How To Pick Best Industry Groups While Selecting Stocks?

August 25, 2016

|

After all our articles in which we’ve covered factors that are to be considered while selecting a stock, like quarterly and annual earnings, stock price relevancy, P/E ratios, portfolio diversification, new products, management changes, supply & demand, correct time to enter, etc., we now move on to the a relatively ignored parameter, the ‘Industry Group’ of a stock.

Remember, more than 50% of the market winners usually belong to leading industries. Roughly half of stock price movement is driven by the strength of its respective industry. Hence you can realize how important and worthwhile is it to consider the industry of a stock before you go any further. By this, we are encouraging our subscribers to follow a strategy which is based on determining the health of the economy (i.e. whether is it a good idea to be investing at that time), the strength of different industries leading that particular market cycle and then picking the strongest stocks within those industries to maximize returns.

If your analysis on the market determines that it is in an uptrend mode, which is likely to continue, you would want to buy stocks which will make the most of the remainder of that uptrend. (Since we are a long-only advisory, we will focus only on uptrends in the entire article; but the same rules apply for a downtrend too) Also, just because an industry is moving in a positive direction, it does not mean that all stocks will perform well, it is just those few gems that will lead the trend! In this article, we will discuss on how to make the job of finding those gems easier using sector analysis. There are two parts to be looked upon-

PART 1: How to determine if an industry is in an uptrend?

The answer to this question is actually quite simple, even if you are not into analyzing stocks in depth or crunching numbers for that matter. It is a very well-known fact that there are always three types of companies in an industry; 1. Leaders, 2. Followers, 3. Laggards. Also, extensive analysis over the years have shown that it is the leaders, who not only determine price of goods and services, but are also the ones who start the change in trend of an industry. They witness huge waves of buying, with every mutual fund or hedge funds wanting to own them during the uptrend and vice versa during a downtrend.

So what exactly is a leader?It is not always the largest company with the most recognized brand name. It is simply the one with the best earnings growth and who is taking away the market share from its maybe older or less innovative peers. Constantly entering into newly emerging leaders at the start of an industry uptrend will give you a real shot at unbelievable price appreciations.For example, back in April 2014, when Eicher Motors Ltd. was trading at 38.23x with a price of around Rs. 6150, no one wanted to enter at those levels as it ‘looked’ overpriced when compared to its peers. But 30 months down the line, it is clear that the one giving better earnings has turned out to be the best performer and not the one having the most known brand name Have a look:

| Stock Name | Price (Apr 1, 2014) | P/E Ratio (Apr 1, 2014) | Price (Aug 18, 2016) | P/E Ratio (Aug 18, 2016) | % Price Change |

|---|---|---|---|---|---|

| Eicher Motors | 6153.85 | 38.23 | 21777.3 | 46.88 | 254% |

| Hero Motocorp | 2250.15 | 21.31 | 3359.25 | NA | 49% |

| Tata Motors | 409.17 | 9.41 | 510 | 15.71 | 25% |

Also, never shy away from buying leader stocks that are making new highs, as buying their laggard and not-so-well-performing peers will mostly make you lose your money because there is a reason why they fall into that category and you should not mistake of thinking their beaten down prices as a bargain.

Also, when the industry changes its direction from an uptrend to a downtrend, none but the leaders are able to absorb the beating. The result? This negativesentiment takes the Followers and Laggards down, at an even faster rate than they had surged with (if they had surged). This is why you should be refraining yourself from taking heavy positions in them. To know more about what stocks to look into for leaders, you can refer to the StockAxis “Stock Trend / Rating Finder”. A stock with a rating of over 70 can be considered for further research to finally find that leader you were looking for. You can also visit the StockAxis “Top 10 Industries” section to know about the industries that are leading the market cycle and click on a particular industry to find the stocks above the 70-rating mark, all together. In this article, we will understand how industries are chosen to be the best performing of the lot.

Remember, industries that emerge as leaders in the market during a new bull-run can be found out by observing unusual strength in one or more of the best performers in that category during the previous bear-run. Then, when the rally starts, you will also observe signs of strength in their not-so-well-performing peers too, but it will most probably be the “wash-over effect”and you should not fall in the trap. Instead, concentrate on the leaders in the industry group. Let us understand this with an example of the famous Indian Banking Industry.

Being in the list of one of the important and backbone industries, the Indian banks have had their share of doom and gloom. Apart from a 2-3 serious plunges in the past10 years, the industry has always been everyone’s favorite, but also a victim of the collateral damage from the world policies. But the part that should interest you is in knowing how could you have (in the past) and will you (in the future) try and maximize those rallies. Also, further to the “wash-over effect”mentioned in the previous paragraph, it is always less riskyas well as worthy to invest in leaders if you are taking the sectoral approach (only) to investing in the stock market. (The other approach, which is the ideal one, comprises of analyzing earnings, products, etc. along with taking the sectoral approach too. In this case, even if you ignore the sectoral approach, and if your stock is fundamentally strong, it will still survive the bear markets moving sideways, and then give you desired results when its industry starts an uptrend, but mostly after the uptrend). Understand how:

After the carnage of 2008, during which the Nifty Bank index fell by over 67% in close to 10 months, it again started its merry run, not only surpassing its previous highs, but making new peaks altogether, gaining more than 280% in the next 21 odd months. With such a rally, one can expect some consolidation and even a near term fall, which is exactly what happened. In the mid 2011period, markets across the world started plunging due to fears of contagion of the European sovereign debt crisis to Spain and Italy, as well as concerns over France's then AAA rating, concerns over the slow economic growth of the US and its credit rating being downgraded by S&P. This again sent the world markets into turmoil, with India as always being the victim of collateral damage. Also, Indian banks then had limited exposure to their European peers as most of their business in Europe was via trade finance or through short-term lending in the money market. Hence this impact was limited. But since Indian banks had lent to companies like Tata Steel, Suzlon Energy, Hindalco Industries, Tata Motors, etc., fears of their businesses in and from Europe getting affected resulting into possible debt repayment defaults had caused the Indian banks to fall too.

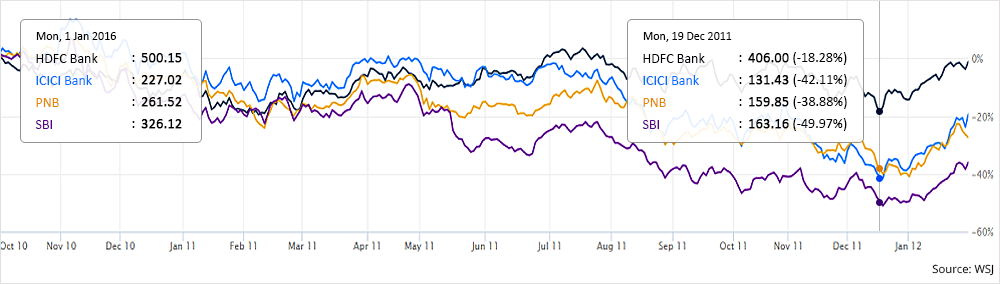

But coming back to our claim of leaders being able to absorb panic efficiently and then grow quickly then their laggard peers, following are the charts of India’s ‘Biggest Banks’ and ‘Leader Banks’ during the time:

As you can see, after making highs in October 2010, the Indian Banks started falling on account of the above mentioned reasons. But, what’s interesting to see, is HDFC Bank Ltd. falling by just 19% compared to its peers like ICICI Bank Ltd., Punjab National Bank Ltd. and the biggest, State Bank of India Ltd. which fell by a colossal 42%, 39% and 50% respectively. Why? Not only was HDFC one of the biggest banks during the time, but was also the best performer in the lot, with relatively lower NPAs, but a healthy loan too, making itself a very strong contender for the market leader position. Also, just for your information, from these fallen levels, in the next 15 odd months, HDFC Bank Ltd. and ICICI Bank Ltd. gained a handsome 50% each, with State Bank of India gaining a modest 24% and Punjab National Bank Ltd. losing more 15%. This clearly proves that the leaders i.e. HDFC Bank Ltd. and ICICI Bank Ltd. (to some extent), gain the most during the respective industry uptrend.

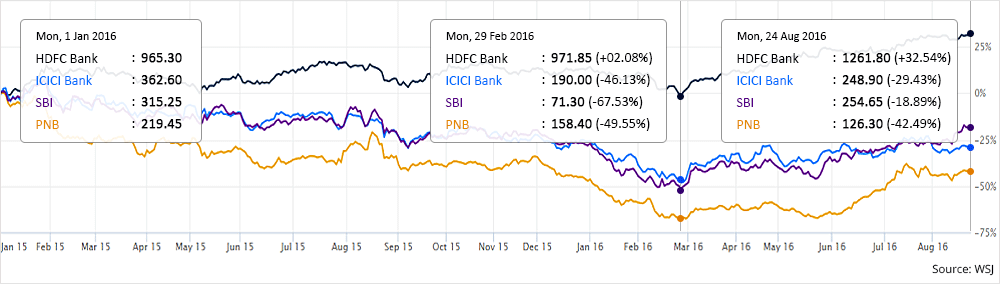

Again, during another banking downfall, in fact during the most recent one, which commenced right from the start of the year 2015 and continued till the next year’s Budget i.e. till February 2016. This bear run of the Indian banks was mainly due to the uncovering of their mounting NPAs, a much-required and a determined process led the current RBI Governor RaghuramRajan, apart from the overall dampened investor sentiments. Have a look at the charts of the same banks during this particular fall:

Again, with the banks falling in the range of 47-68%, HDFC Bank Ltd., like true leader, not only sustained this downfall in the industry with its superior balance sheets and an all-time healthy and growing loan book, but was also on the green side; although by a very small margin, but huge when compared to the numbers of its peers.

We hope that you will now be able to set a seal on the claim that leaders suffer the least during bearish cycles due to their superior performances over the time, and also gain sizably during new uptrends in their respective industries. As you can see below, HDFC Bank Ltd.(a current StockAxis recommendation) still grew by a pleasing 28% and ICICI Bank Ltd. too showing similar growth. Yes, one can argue that the remainder banks soared by 50-70%, but you should also consider the fact that they were beaten down at the fullest and thereby had a low base effect coming into the picture. They are still not considered to be near their previous highs, even though programmes like project “Indradhanush” has been started to recapitalize them.

Still not convinced? No problem!!!

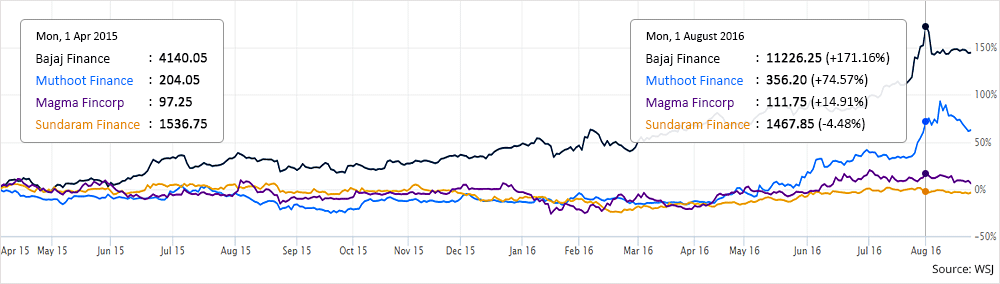

We can also consider another example of the Non-Banking Financial Services (NBFC) bull-run that has been slowly gaining steam since the last 15-18 months, to put the final nail in the coffin. As most of you’ll might be aware that, owing to above average monsoons and a recent uptick in the real estate sector, theNBFCs has been on a roll. Keep in mind that you should not compare the rallies witnessed in the Bankingindustry with the one currently witnessed in NBFCs as they are two different industries, even though they kind of do the same thing i.e. lending, but operationally are totally different.

As you can see, post Q1 FY16, Bajaj Finance Ltd., which is considered to be the leader of the NBFC segment for quite some time now, in spite of negative market sentiments for almost 10-12 months, soaredagainst all odds, thereby giving returns worth more than 170% in 17-18 odd months. Whereas, in the same duration, its non-performing peers grew by a meager 15-20%, with Muthoot Finance picking up steam just recently. Have a look:

Also, like everyone is aware of, we had recommended Mahindra & Mahindra Financial Services Ltd. to our clients from back in November 2015 when it was trading at Rs. 220 levels. We also advised them to add more at Rs. 180 levels as we were certain of the growth expected in the industry, if not in this monsoon, then in the next one or the one after that. What happened next is known to all. The stock, even though it being a large cap company with around Rs. 13000 crores of market capitalization, has already given close to 60% returns in just 10 months, with our paid subscribers still holding the company. Coming back to our point on the importance of leaders in an industry, with Bajaj Finance Ltd. placed at the top of the list for almost 4-5 years now, and it rising consistently unlike its peers shows the true traits of an actual performer company. This also clearly indicated that a change in trend in the NBFC industry was set to happen. And voila, all Non-Banking Financial Services companies started their merry run, with a significant chunk of the lot now trading near their 52 week highs. And finally let’s move on to the second part of the article.

PART 2: What is a “follow-on effect”?

The first term i.e. the “follow-on effect” simply means, that a development leading to a bull-run in one industry is usually followed by a bull-run in an industry related to the first one. The easiest example to consider here is the effect of the announcement in April 2016 regarding the above average monsoons. As the announcement took place that India was set to witness an above average rainfall in 2016, not only the seed making companies like Advanta Ltd. (rallied by close to 38%), but irrigation companies like Jain Irrigation Ltd. (rallied by close to 36%) as well as automobile companies like Maruti Suzuki India Ltd. (rallied by close to 36%), apart from the rally in Sugar companies and NBFCs gained steam.

Thus, keep in mind that if an industry is doing well, find out about related industries and as well as about the suppliers of raw materials of the industry in uptrend. In most cases, industries move only when the government makes substantial changes or simply when the overall economy is doing great.It also pays to understand the volatility of particular industries like chemicals or sugar or any commodity based groups, as the pace with which they rally is the same pace at which they plummet, maybe even faster, in cases of bear markets taking over. So allocate your portfolio accordingly.

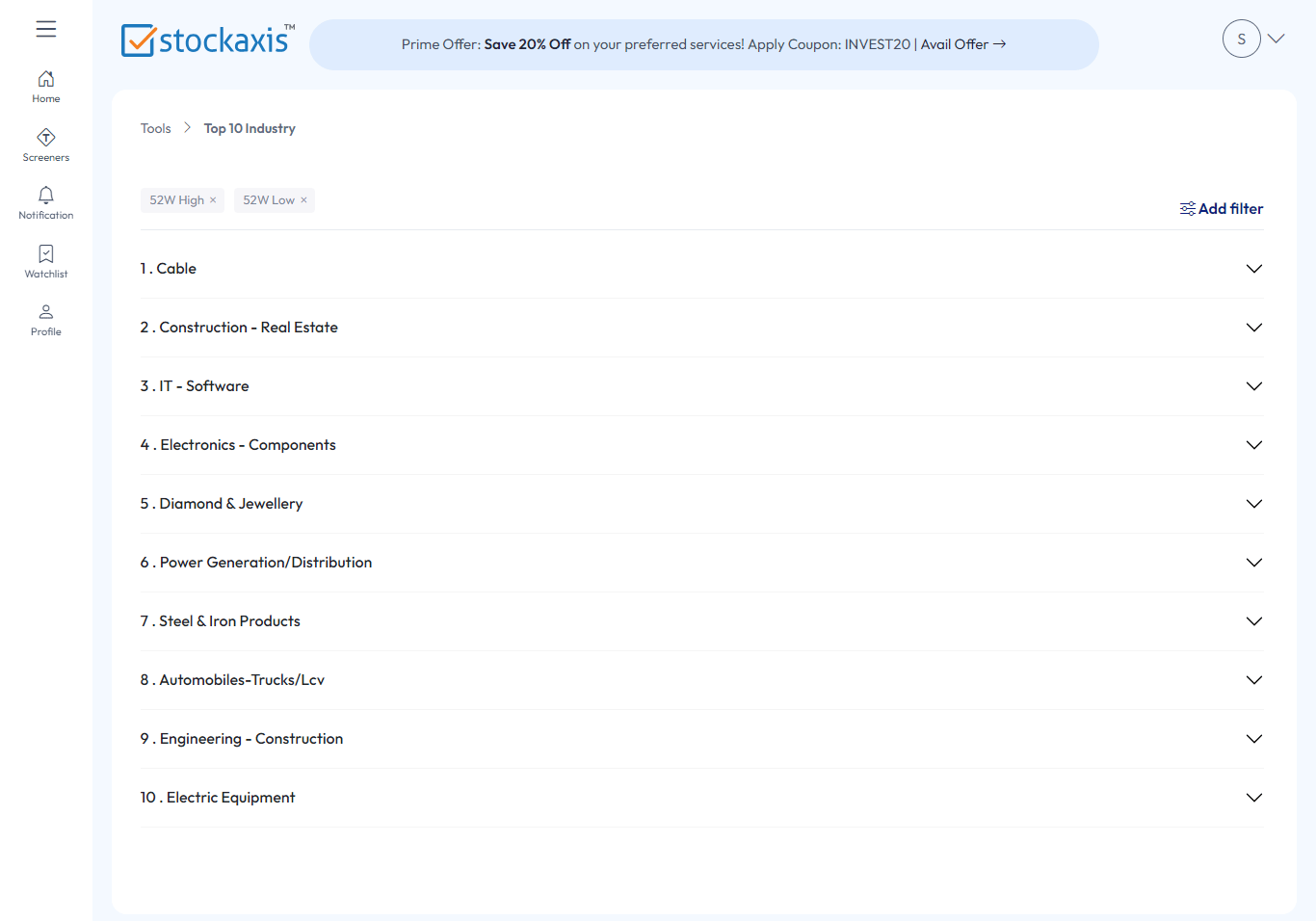

We’re sure that you now understand the importance of being aware of the “leader movements” in your favorite sector, and by doing so, you can now ride those deserving winners like never before. So, what are you waiting for? Visit our Top 10 Industries page now and find out the NEXT BIG SECTOR!!!We at StockAxis have made our Top 10 Industries section LIVE to all the retail investors of the Indian equity market. Here is the sneak-peak of the page:

But what’s so special about it? Find out by yourself (click here).

Continue with Google

Continue with Google