How To Look At Those Quarterly Earnings Announcements Before Making Your Decisions???

October 12, 2015

|

It is the start of October and very soon, the Q2 earnings will start to trickle in day after day. This will in turn cause a significant increase in the action in the stock market with all the analysts pouring in their views and estimates on the stock prices of the companies they follow. So as an investor, how much should you worry about this earnings season rollercoaster and eventually make your decisions? Let’s go deeper…

Kitex Garments Ltd., Jenburkt Pharmaceuticals Ltd., Astec Lifesciences Ltd., Atul Auto Ltd., MPS Ltd., Natco Pharma Ltd., etc – why, amongst the thousands of stocks that are listed in NSE and BSE, did these recommendations from StockAxis perform so well during the last 24 months? What was the key trait common amongst these stocks that made them rise a whopping 470% on average? Well, the answer to this would unlock the secret to making money in the stock market and our studies have shown (and proved as well) that percentage increase in revenues coupled with EPS (Earnings Per Share) play the role of a kingmaker in the cause.

- Kitex Garments Ltd.’s sales rose by 42% Q-o-Q with a towering increase of a 172% in the net profit (and the EPS) before its price surge from Rs. 118 to Rs. 1070 during April’14 to July’15.

- Jenburkt Pharma Ltd.’s net profit increased by ‘just’ 58% as against the 13% increase in sales Q-o-Q just before it was recommended by us at Rs. 220 and it went on to touch Rs. 540 in just 11 months.

This goes on and on for all our market winners. In fact, if you take a look at our recommendations, you will observe a direct connection between the booming profits and booming stock prices. Usually, analysts take multiple Q-o-Q numbers into consideration for deeper insights. Note that you should always compare these numbers to the same quarter of the earlier year and not the prior quarter to eliminate the seasonality factor from the picture. This will give you a more accurate evaluation!

Also, there are stocks like Astec Lifesciences Ltd., Orbit Exports Ltd., etc which began a move upwards with subsequent accelerations in their earnings.

- Astec Lifesciences Ltd. was recommended as a BUY on 30th July 2014; before which it showed a mere 3% increase in its EPS Q-o-Q. But post that quarter, it showed a phenomenal 92%, 65%, 117% and 28% increase Q-o-Q in its EPS thereby reaching a high of Rs. 304 from a modest Rs. 61.70 that too in just 11 months.

- Orbit Exports Ltd. on the other hand, showed a negligible 0.24% increase in its EPS Q-o-Q and post it being recommended on 28th Oct 2014; the EPS increased 18%, 138% and 36% Q-o-Q. It managed to gain 77% in its value during this period.

Hence, a key takeaway from these examples is that, the quarterly earnings, particularly EPS, is one of the most important factors to consider while fundamentally analyzing a stock!

The next thing that a winning investor must keep in mind is avoiding the trap of being motivated by nonrecurring profits like a real estate sale. They represent a onetime income and should be subtracted from the report. For example, recently, Jaiprakash Power Ventures Ltd. in a move to reduce its debt sold its two hydropower plants to JSW Energy Ltd. for an Enterprise Value (EV) of Rs. 9575 Cr. Note that it is an onetime income and investors should not get excited apart from the fact that the company is trying to clean its balance sheet. But, they should also not ignore the fact that the sale of these plants would affect the topline of the company as well which is going to be the next part of our article.

Strong earnings must be supported by strong sales growth. Sometimes, companies inflate earnings numbers by reducing costs on marketing, research or other constructive activities and hence an intelligent investor must consider the sales growth as well!

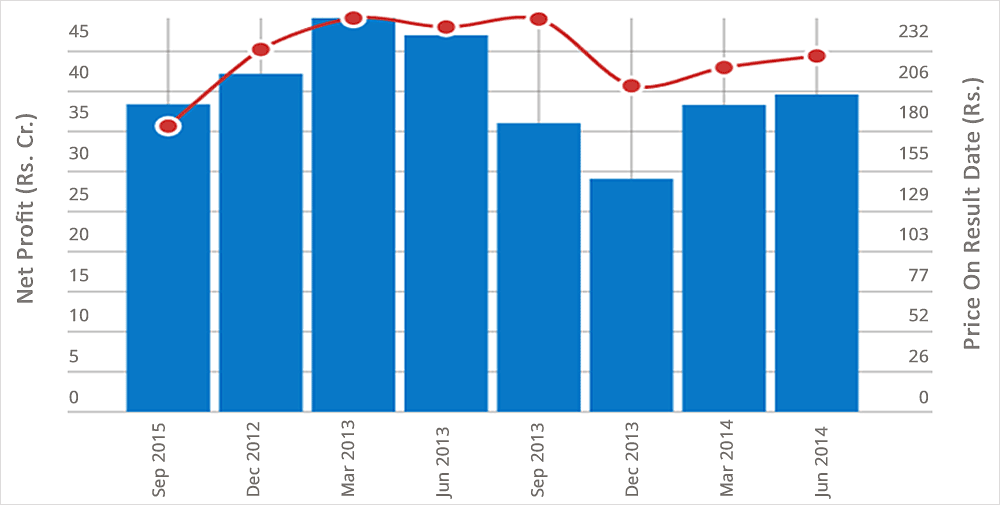

Also, just as it is important to recognize earnings growth, it is equally important to know when your company’s earnings begin to decelerate. Note that even the best of the companies witness a slow quarter so ideally wait for a couple of quarters before you make your call. Consider Bajaj Corp Ltd. for example; it posted TOI worth Rs. 182.11 Cr for its Jun’13 quarter and Rs. 168.37 Cr and Rs. 167.88 Cr for its Sep’13 and Dec’14 quarters showing variations of -7.54% and -0.28% respectively. On the other hand, after every quarterly result announcement, Bajaj Corp traded at Rs. 247.55, Rs. 252.65 and Rs. 209.75 respectively on the BSE.

Bajaj Corp Ltd. - Quarterly Earnings Report

Now, post this slump it made a rebound in its TOI, almost by 15% in the next quarter i.e. Mar’14 thereby helping the stock gain a modest 5.6% at Rs. 221.5 and the story thereafter is known by all. It almost made a then all time high of Rs. 473.8 post its Mar’15 results. So, you should understand and accept the fact the every potential multibagger has a slump period and you should not exit the company based on a couple of not-so-good quarters. Dig deep and understand the reasons behind the slump. It can be anything; off-season, change in management, new policy, etc. Try and interpret whether its effect is permanent and make the call. However, if the results continue to degrade, exit the scrip and find the next cow to be milked!

Remember, stocks trade based on people’s opinions of what the company will be worth in the future. It is a common myth that the price will go up post the good results and vice versa. Sometimes, even though the company posts nearly expected results, its stock price tends to go down as the possible effect of the earnings is already discounted by the market, so analyze those effects properly! But, these already discounted stock prices also make significant movements if the company posts results which is highly deviated from the expectations of the market.

You may find that hardly 1-2% of the stocks in the market show those gains in their numbers. Remember, you’re looking for stocks that are exceptional and not lackluster, so the real game is in finding them and holding them till they are the winners… But, hey don’t worry, they are out there and we do find them regularly.

Continue with Google

Continue with Google