Has the recent correction made valuations attractive?

July 02, 2018

|

2017 was an incredible year for midcap stocks. During the year, the BSE MidCap Index, the benchmark for midcap valuations, gained 48%, while the BSE Sensex, the broad market index, gained about 28%. Select midcap stocks saw their valuations double. The flood of domestic funds entering the markets was at the core of the rally. Domestic investments into Indian equities outstripped flows from foreign portfolio investors (FPIs) in a cumulative two-year cycle for the first time in 7 years. Domestic mutual funds poured in Rs 1.15 lakh crore in 2017, the highest ever in a single year. The mutual fund collection in 2017 was 80% of the total collection in the last decade. FPIs invested Rs 48,249 crore ($ 7.3 billion), which was lower than the 10-year average of Rs 58,910 crore.

However, midcap stocks have seen a significant drop in value since the beginning of 2018. The BSE Midcap index, which was trading at a 40% premium to the MSCI India and over a 35% premium to the Nifty, lost about 13% since December 2017. As against this, the broad market represented by the BSE Sensex rose 2.5% during the same period. While a number of investors have exited the midcap space in panic, smart investors are using this fall to accumulate and increase their holdings in robust midcap companies. To understand why midcaps look attractive at current valuations, let’s first review the reasons for the fall in valuations:

Technical correction

The last quarter of the previous calendar year saw midcap stocks spiral to excessive valuations, which increased the valuation gap between large caps and midcaps. The BSE Midcap index was trading at 47 times midcap earnings at the end of the year. A correction was inevitably due.

Macro factors

A number of macro factors including rising oil prices, depreciation of the rupee, US Fed rate hikes, etc. and heightened market volatility has resulted in a shift from the midcap space, which is usually more volatile, to the large cap space (more stable).

SEBI’s recategorisation of mutual fund schemes

SEBI recently initiated recategorisation of mutual fund schemes based on revised market capitalisation of stocks. SEBI has categorised stocks in terms of market capitalisation as follows:

- Large cap stocks: The first 100 companies in terms of full market capitalisation

- Midcap stocks: 101st to 250th company in terms of full market capitalisation

- Small cap stocks: 251st company onwards in terms of full market capitalisation

Companies will be recategorised in this method every 6 months (June and December).

This initiative by SEBI has resulted in mutual funds offloading midcaps to adhere to the new norms by realigning their portfolios.

Additional Surveillance Measures initiated for some stocks

On 4th June 2018, BSE shifted over 100 stocks under additional surveillance measures (ASM) where 100% margins were required to buy those stocks. The move is aimed at checking any abnormal rise in stock prices not in sync with the financial health of these companies. Since this change was initiated at very short notice, investors who had bought these stocks on margin, sold off to close their positions.

Capital gain tax

Budget 2018 re-introduced term capital gains tax at 10% on equity shares and units of equity oriented mutual funds on gains exceeding Rs. 1 lakh. Equity investors will no longer enjoy tax-free gains on their equity investments. This announcement saw some churn in the markets as investors hastened to sell their holdings before the financial year end to avoid paying capital gains tax.

Scams

The markets were hit by a number of scams including the Nirav Modi/Mehul Choksi duo scam on PNB and Karnataka Bank, the Rotomac scam on Bank of Baroda, the Kanishk Gold scam on SBI, etc. Additionally, investors were spooked by a number of audit firms resigning from companies including Vakrangee and Manpasand, which led to suspicion of accounting manipulations by these companies. These developments led to significant market volatility especially in the midcap space with investors exiting in panic.

The way forward

Should you be investing in midcaps now post the drop in valuations? Let’s take some inputs from history.

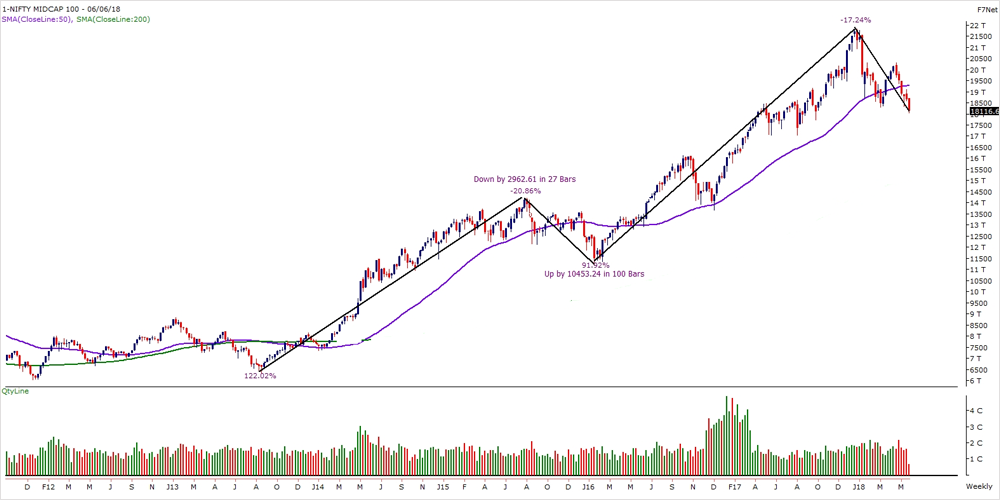

The graph indicating the movement of the Nifty Midcap index is pertinent. In January 2013, the Nifty Midcap index touched a peak of 8859 and fell by 30.75% to 6330.75 in August. This fall was attributed to worsening macro factors. However, by July 2015, it had gained 122% to 14055.5 after which the market started consolidating till March 2016 losing 20.86% to reach 11123.5. However, overall the market gained 91.92% over the next two years till January 2018 to reach 21840.8. It has now lost about 18.44% to touch 17813.7.

Could this be the start of the next rally? Take a look at the Nifty P/E versus Nifty Free Float Midcap – 100 P/E chart. You will observe that a spectacular midcap rally began since the NDA won the elections in May 2014 as a result of investors’ faith in the government’s numerous reform initiatives, which were believed to have an especially positive impact on midcap companies.

The GST advantage

Goods and Services Tax (GST) has been one of the most positive government initiatives for midcap organized players. It is moving business from the unorganized segment of the economy to the organized players, which are primarily midcap companies. This will result in double digit profit growth for these companies, going forward.

Midcap dominant sectors

Certain sectors such as ball bearings, specialty chemicals, farm equipment, automobile ancillaries, etc. are dominated by midcap or small cap companies. These sectors have tremendous growth potential in the India Growth Story.

Lower debt

Being in less capital-intensive businesses, quality midcap companies have much lower debt levels and interest burden, which, in turn, will facilitate these companies giving superior returns on equity with an uptick in demand, going forward.

Strong fundamentals

While midcap valuations have been beaten down, what is pertinent is that midcap companies have retained their fundamental strength. In fact, most healthy midcap companies have reported strong quarterly results along with positive growth outlook.

Midcap companies with healthy corporate earnings, robust outlook and strong management have become attractive ‘buy’ recommendations.

StockAxis uses its incisive fundamental and technical research to spot strong midcap stocks of companies in growing sectors run by honest management and with sound business models.

Continue with Google

Continue with Google