5 Rules to deal with a volatile market

June 21, 2018

|

The stock markets have become increasingly volatile over the recent past due to rising US and domestic interest rates, mixed corporate results, bank NPAs, corporate governance issues and many other factors.

Volatility makes investors jittery and unsure about their investments. This often results in selling fundamentally strong stocks impulsively or shifting away from long-term holdings to very short term trading calls. As a result, the investor usually faces losses and often decides to exit from the stock markets completely. This is when a discerning investor sees opportunity by remaining invested and even adding to his holdings during dips.

Volatility is an integral part of the stock markets. In fact, it provides opportunities to perceptive investors to play on market sentiment and invest at attractive valuations. Volatility should be viewed in a positive manner without allowing your emotions to enter your investment decisions. And always keep in mind – holding your investments for the long term not only reduces investment risk with passing time, but also helps you build serious wealth.

Here are 5 factors that you should bear in mind during volatile periods:

1. Volatility is ever-present

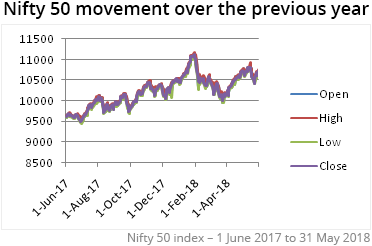

Consider the NSE Nifty movement over the previous year (1 June 2017 to 31May 2018). The Nifty peaked at 11171.55 (on 29 January 2018) and hit the bottom at 9448.75 (on 30 June 2017) during the year, which is a difference of 1722.8 points between the highest and lowest levels. Additionally, the visual shows the spikes (volatility) the Nifty experienced during the year.

Volatility is even more pronounced in case of individual stocks. Consider Bajaj Finserv Ltd., a fundamentally strong stock, which experienced significant volatility during the previous year. However, investors who held on to this stock have seen it significantly bounce back to a new 52-high on 11 June 2018 (at Rs 6156.90).

Takeaway: Market declines and panics will impact nearly all stocks – some more, some less; you must deal with it to succeed as an investor.

2. In the long term, there is only one way - up

The stock markets have historically proven that eventually, the direction is up. The truth is – while markets can be unpredictable in the short term, they are surprising predictable in the long term. Consider the NSE Nifty over the last 18 years. From 1349 points on 1 June 2000, 18 years later, it stands at 10736.15 points, having risen about 8 times.

In case of fundamentally strong stocks, the impact is even more pronounced. For instance, if you have invested in MRF Ltd. on 1 June 2000 when the stock was quoting at Rs 1378.80, you would today have a 54.9 bagger in your portfolio.

Takeaway: Being a successful investor requires you to be disciplined and patient with the ability to keep emotions away from your investment decisions.

3. A correction provides an attractive investment opportunity

Let’s say the market corrected by 200 points on the Nifty… it would in all likelihood be traumatic. In fact, you may consider quitting the markets right away. Don’t!

Remember, corrections and panics are truly the best opportunities. In fact, the famous investor Warren Buffett once stated that if the market was at near-bottom, he would use the opportunity to increase his positions. Take the case of Dewan Housing Finance Corporation Ltd. (DHFL) which hit rock bottom on 22 November 2016 quoting at Rs 226.95 having fallen from its peak of Rs 330. Investors who had entered the stock then would have now had a 3 bagger in their portfolio.

Takeaway: Market corrections provide you with an attractive opportunity to buy at great valuations, which, in turn, increases your stock appreciation potential.

4. Stay liquid to some extent

A correction is only useful if you have the funds available to increase your positions. In other words, don’t be 100% invested at all times. At the same time, it would not be wise to hold cash beyond 5-10% of your total portfolio. Use this cash to take advantage of opportunities. Additionally, it’s not advisable to borrow to invest in stocks (margin investing). This is dangerous especially in times of volatility. Any short term dips will put you in an uncomfortable position of having to square up your margin positions at a loss.

Takeaway: Maintain some liquidity to take advantage of market dips. In fact, greater the volatile, higher the chances of getting attractive entry opportunities.

5. Avoid over-trading and following the crowd

Most investors tend to get influenced by news, rumours, trading recommendations, stock tips… and the short term noise. This results in frequent buying and selling based on ‘the latest update’. A successful investor has the temperament to stay invested and ignore this noise. Once he is convinced on the fundamentals of a stock, he invests and then gives the company time to perform.

Takeaway: Build the right temperament to be a successful investor. Buy based on the stock’s strength and not on rumours, tips, etc.

To conclude, making an investment decision based on extensive research, deep knowledge of the business and sector the company belongs to, sound assessment of future growth prospects, assessment of the management, etc. is what makes an investor successful. Volatility is the icing on the cake offering attractive entry points for fundamentally strong stocks.

Happy investing!

StockAxis applies more than 3 decades of the collective knowledge and experience of its team of research analysts to locate companies run by honest and competent management with attractive growth prospects and available at reasonable valuations.

Continue with Google

Continue with Google