Fear & Greed: Don’t Let Emotions Come In The Way Of Your Stock Market Success

August 05, 2016

|

Before we start, just ask yourself these 5 questions:

- Do you still remember the stock market crash of 2008 or the bloodbath that the world markets (including India) witnessed during the Yuan devaluation in 2015 or take the most recent Brexit referendum for that matter, and how it eroded your precious hard earned wealth?

- Do you still curse yourself for waiting that just that little while longer and eventually booking an even bigger loss?

- Do you still prefer to stay on the sidelines by booking losses during turbulences and waiting for the dust to settle down?

- Do you always regret that decision because the market now looks too expensive to re-enter?

- And finally, could this have been avoided?

One thing is for sure, that the panic during a crash on the D-Street is palpable. The newspapers and TV are filled with the aftermath of what happened the day before, warning you, or rather scaring you of a so-called imminent recession that is always on the verge of taking over. But don’t you think, that if you would have timed the market correctly, it would have single-handedly helped you safeguard and eventually appreciate your wealth on an organic basis? NO! Not Necessary At All!

Remember this: even if you have the most terrible timing and happen to jump in just before a market crash, you would still recover your money relatively quickly than you can imagine. This would simply be possible if you just are confident, smart and robust. Yes, robust! This quality can help you sail through the mayhem and most importantly, through the environment of fear which is fueled by none other than our very own media. Now, you might be thinking of how media is the villain here? All they do is report what is going on in the world! Yes, that is true. All they provide you is the access to news which you otherwise wouldn’t have known, whatsoever. But the problem is, that is just ‘news’ and not analysis. Even if it were analysis, you might notice that it will just be in sync with the market conditions. The reason being, they are just news providers and not research houses. They will never go against the market trend and give their own true analysis, because if they happen to be wrong, their news channels or newspapers might just get disregarded! Also, they do not want financial institutions to fail because they implied there was the potential for this to happen. That’s too big a baggage to carry.

So, who would want to take that risk? I wouldn’t, if I were the owner of a financial press house, and neither would you, or anyone for that matter. Therefore, if no one is ready to do the actual analysis and take that risk (mind you, they don’t even have the time to do it), what will help them differentiate their channels or papers from their competition? The answer lies in the magnitude of euphoria that they are able to create in case of a bull market and the despair or misery that they show our economy is in during times of crashes. The more the excitement or fear that they are able to generate, the more the people will follow them and the more their TRPs will rise!

Has it ever occurred to you that why do you hear about crashes only after they have happened or about bubbles only after they have burst? Why do you always hear rosy things only during a rally? Why are you always advised to sell during a crash and buy during a rally, especially when both of them have already taken place? It’s actually quite simple. How? It will be clear from the examples that we have covered in the second half of our article.

Let’s take up some well-known examples:

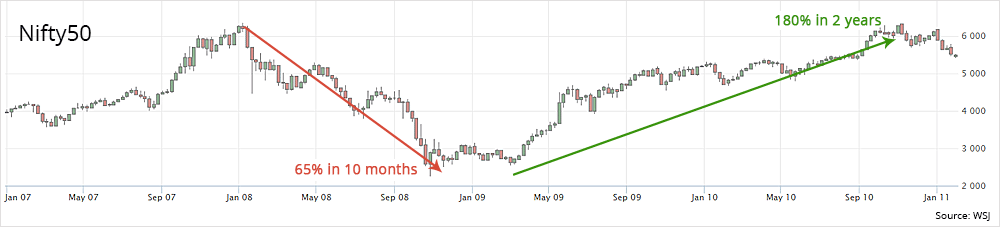

1) 2008 World Market Crash (65% in 10 months):

Who doesn’t remember this year? Many investors still can't shake the memory of that doomed year and it still haunts them, preventing them from making even the simplest of investments. As you might already know, the market was in a freefall for around 10 months from January 2008, falling from around 6300 levels to 2200 levels, owing to the subprime mortgage crisis in the United States. It was terrifying to see the markets plummet by around 65% in just 10 months. Here are some of the news headlines during the time which showed nothing but negativity instead of what was actually going to happen next-

- “Crisis On Wall Street As Lehman Totters, Merrill Seeks Buyer, AIG Hunts For Cash” – WSJ (15th Sept 2008)

- “Why aren’t we seeing any suicides on the Wall Street?” – Slate.com (22nd Sept 2008)

- “Debt Market Distress Spreads” – WSJ (26th Sept 2008)

- “Bailout Plan Rejected, Markets Plunge, Forcing New Scramble to Solve Crisis” – WSJ (30th Sept 2008)

But, then came the turnaround. Keeping the worse behind, the US market started to stabilize, thereby reducing the panic in emerging economies like ours too, taking the Nifty back to its original levels of 6300 in close to 2 years. But, what should interest you as an investor is the 180% recovery against the 60% fall. Yes, you read that right. Have a look at the charts during the time:

If you would have been a wise ‘investor’, with at least some credibility in understanding just the mood of the market, not only would you have recovered your initial investment amount, but investing in between would have gained you at least 50-70% (worst case) on your fresh investment.

Also, here is what the media had to say after the rally:

- “Another Stock Market Bubble?” – The Hindu (23rd Sept 2009)

- “Stock market recovery: too fast, too soon” – Live Mint (23rd Nov 2009)

Isn’t it ironic? Where were they during the recovery or why did they not predict the rebound after the crash? Think about it! Just for the record, Nifty gained a pleasing 27% in over 1 year from the above mentioned ‘media speculations’.

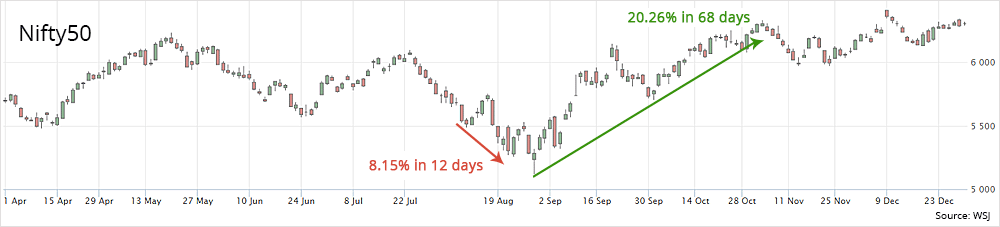

2) Crash Of August 2013 (8.15% in 12 days):

Another noticeable crash after the 2008 crisis was witnessed in August 2013. On two separate occasions i.e. on the 16th and the 27th, Nifty plummeted by a sizeable 4.28% and 3.69% respectively, making an overall fall of around 8.15% in less than 2 weeks. The first fall was attributed to continuing concerns over the then depreciating rupee, weak global cues and the speculation that US Federal Reserve might roll back monetary stimulus after jobless claims in US declined to the lowest level since 2007. Whereas, the second fall, which was relatively less heavy than the previous one was due to the passage of the food bill in Lok Sabha which raised fears that the government might face even more subsidy burden thereby dampening investor sentiment. Have a look at the chart during the time.

Again, while speculators and institutional investors worked out their strategies, retail investors got carried away with the bloodbath on the street, thereby missing out on the great bull-run which helped the Nifty gain 20.26% in just a bit over two months.

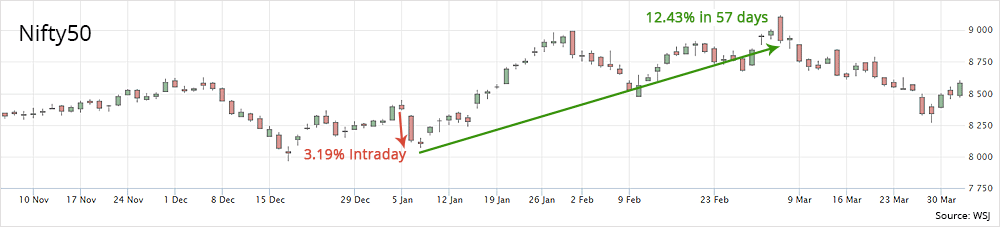

3) Grexit Fears and Falling Crude Prices in January 2015 (3.19% Intraday):

Marking the start to a terrible year in the Indian stock market, Nifty fell by over 3.19% on 6th January 2015 on account of the political turmoil over Grexit and falling of oil prices below the $50/barrel. Here are the headlines during the time which show how negative and naïve are they:

- “Bloodbath: Sensex tanks 855 pts on Greece woes, oil gloom” – The Financial Express (6th Jan 2015)

- “Stocks should fall further. Here's why” – CNN (6th Jan 2015)

Have a look at the chart during the time:

But, like it has always happened, the market bounced back strongly in the next 2 months, surging close to 12.43% in just 57 days, and as always, it was the patient and the smart that benefitted from our herd mentality.

4) China Currency Devaluation in August 2015 (6.39% Intraday):

Making one of the biggest falls since 2009, Nifty, after a couple of small scale selloff sessions (1-1.5%), sank by 6.39% on 24th August 2015, the carnage being attributed to the ongoing Yuan devaluation which was cratering the Chinese equities, with India as always, being the victim of collateral damage. Movement towards safe-haven government bonds and an exodus from riskier emerging economies spread unrest in the financial markets across the world. Also, the following rupee depreciation, which diminishes the returns of FIIs forced them to pull out their money and thereby adding fuel to fire. The media again, did not miss this opportunity throwing out speculations like:

- “A Global Recession May Be Brewing in China” – WSJ (16th Aug 2015)

- “Is China About to Plunge the World into Recession?” – Foreignpolicy.com (18th Aug 2015)

- “Has Chinese Yuan devaluation led world towards depression?” – BharatNiti (25th Aug 2015)

Also have a look at the chart during the time:

After coming to terms with the mayhem, the markets rallied again, reaching its previous levels of 8300 in less than 2 months i.e. 7.30% in just 2 months. Missed out on another rally, right?

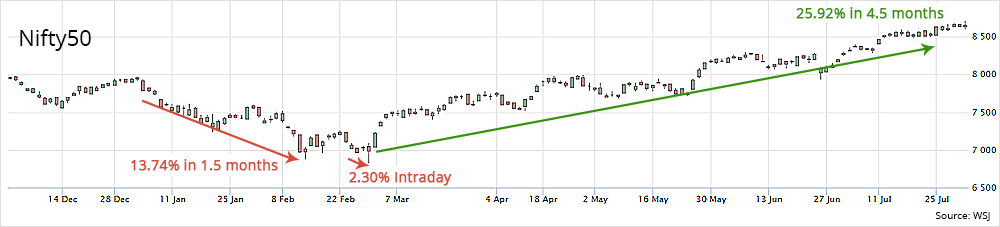

5) A Selloff At Start of 2016 Followed By Dovish Union Budget (13.74% in 1.5months & 2.30% Intraday resp.):

After a very unpleasing two months at the start of 2016, followed by a budget which failed to cheer the D-Street, the Nifty sank 13.74% in the first 1.5 months of the year and 2.3% intraday in a volatile Budget-day trading session. What surprised everyone was the rally which started immediately after the event, in which the index gained a hefty 25.92% in slightly over 4.5 months. Have a look at the chart:

Hence, you can clearly see the change in the trend and mood of the market. On the other hand, let’s have a look at what well known financial media houses had to offer:

- “George Soros Sees Crisis in Global Markets That Echoes 2008” – Bloomberg (7th Jan 2016)

- “A recession worse than 2008 is coming” – CNBC (15th Jan 2016)

- “Market Crash: Is This Like 2008 All Over Again?” – Investing.com (19th Jan 2016)

Result: ~16%-17% Rally from 19th Jan – 28th July 2016

And many many more…

Still believe every word that they say? Have a look at our final example and decide for yourself.

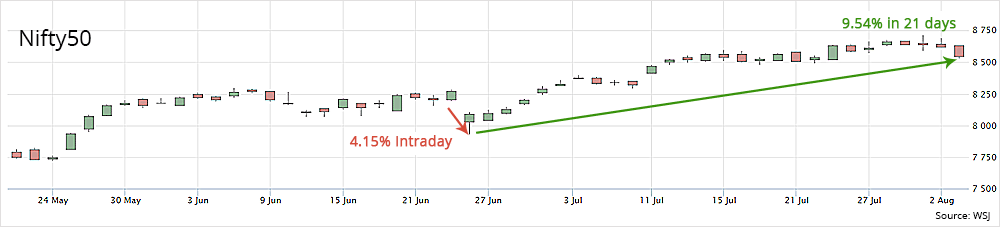

6) Outcome of Brexit Referendum (4.15% Intraday):

Just recently, The United Kingdom held the referendum for whether to remain in or leave the 28-nation European Union (EU), the outcome of which sent ripples across the global financial markets. It was termed as the most important global event of 2016 and was expected to have profound implications on various economies across the world, including India. The result, our benchmark index Nifty50 fell by a colossal 4.15% intraday, a fall which was again ought to mark the start of a new bear run. This time too, the markets stuck to its basics and came back even stronger.

After the outcome of the referendum, Nifty, against all odds, in the next one month, soared by a handsome 9.06%, making our initially mentioned claim even stronger. Still, have a look at what the media headlines:

- “Summer crash of 2016 is about more than the Brexit” – MarketWatch (29th June 2016)

- “Brexit Could Bring the S&P 500 Down 40% in 2016” – Profit Confidential (24th June 2016)

- “Why Brexit could be a bigger risk for India than a jump in oil prices and a Fed rate hike" – The Economic Times (14th June 2016)

- “Brexit’s impact on India: when elephants fight, the grass suffers” – Live Mint (25th June 2016)

- “This is how 'Brexit' is going to hit our stocks, rupee and the economy” – The Economic Times (21st June 2016)

- “Brexit impact on India: Stock markets may face more mayhem” – Financial Express (27th June 2016)

Result of all: ~9%-9.5% Rally after Brexit

Remember, it may be tempting to stay on the sidelines and holding cash in fear of a market crash, but it will almost certainly cause you to miss the periods of rally thereafter. Of course, this analysis not does state that you should stay put no matter what the market scenario is, and hold your investments blindly; but instead it just shows how you can outperform your fellow peers by acting smart and not following the herd mentality. You should always stick to understanding the fundamental impact of such global and domestic events and BUY accordingly.

Media headlines like those given below are nothing but hindsight trying to create a sense panic:

- “Stock Market Crash? It's Coming, and This Chart Shows How It Will Unfold” – The Street (20th March 2016)

- “Buckle up: Stocks could drop 25% or more” – CNBC (19th April 2016)

- “CALM BEFORE THE STORM: Investors told to brace themselves for impending stock market crash” – Express Newspapers (6th May, 2016)

- “80% Stock Market Crash To Strike in 2016, Economist Warns” – The Sovereign Investor Daily (22nd July 2016)

- “Will the 7-year Cycle of Economic Crash Come Again?” – Econmatters.com (28th July 2016)

In fact, according to the last two headlines, a bear market should have taken grip over the Wall Street, but wait, did that happen? Did anything even close to that happened? NO! Contradictorily, the markets have not only recovered from the temporary Brexit hiccup, but are in the green, and that too by a pleasing margin.

Like we said in our analysis on the Brexit outcome and how it was set to affect India, global events should be nothing but noise to you if you are confident enough on your research, which is why we advised our clients to use it as an opportunity to enter into businesses, which they had missed out on earlier, at comparatively lower valuations, as the markets were definitely set to bounce back when the dust was to settle. Keep in mind that, these events will just cause temporary hiccups, but the bottom line is, they are in most cases not going to change the fundamentals of the companies, and the growth stories that they had charted, will be continued upon no matter what happens.

The media can do all the if and buts, all the calculations, all the speculations they want, but we hope you now understand and accept the fact that smart investors BUY at correct times in a bear market when no one is interested in going long and SELL when there is a massive euphoria where everyone, I mean everyone tries to become a stock market guru. Think about it, now that the Nifty is rallying like it did in the 2014, which media house do you see is talking of Brexit impacts on stocks, Yuan devaluation impacts and sliding oil prices impacts? Everyone now is just the corporate results, which is actually what matters.

So, what are you now going to do, God forbid if we are to witness another fall? Will you get played by the ‘noise’ created by news channels or will you spend that time studying the company fundamentals? The choice is yours! Keep this in mind that:

“News Follow The Market, The Market Does Not Follow The News!”

And like Jesse Livermore rightly says, Markets are never wrong, Opinions often are! All you can do is play smart and capitalize on other investors’ sentiments which were driven by the media coverage around future events, and who knows, you might actually make some serious money.

Happy Investing!