Don't Miss The 98% Of The Story!!!

May 06, 2015

|

Before investing in any stocks several questions pops up into the investor’s mind and one of the top most question is “IS THIS A GOOD MARKET?” Well after much analysis I find this question to be the most horrifying mistake you make before investing. For some reasons I feel you already know why is it so, still let me take you through this.

Every year I talk to the executives of a hundred companies and I can’t avoid hearing from the various gold bugs, interest rates disciples and fiscal mystics quoted in the newspapers. Thousand of experts study overbought indicators, oversold indicators, Put-call ratios, RBI policy, foreign investment, the movement of constellations through the heavens and they can’t predict market with any useful consistency, any more than the gizzard squeezers could tell the Roman emperors when the Huns would attack.

Although in some way the stock market is related to the general economy, one way that people try to outguess the market is to predict inflation and recessions, booms and busts, and the direction of interest rates. True, there might be a correlation between interest rates and the stock market but who can tell interest rate with any bankable regularity?

So we come to the same question again when to buy stocks? The answer to this is ANYTIME, you find a good company with growth potential and strong fundamentals. Let me take you to an analysis where if you have not thought market to be overvalued, you would have been a millionaire by now.

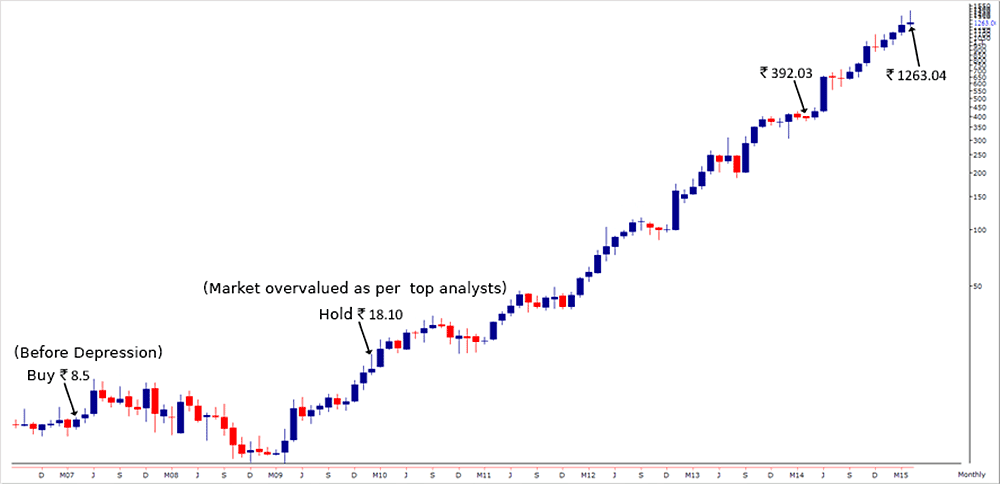

Look at the chart below of Ajanta Pharma Ltd. If you would have invested in the stock before the depression and hold it till the market recovered it would have turned out to be 2 bagger for you within 2 years.

Even if you would have invested in the stock when almost all analyst in Dalal Street thinking Nifty to be overvalued 6800 it would have turned out to be 3 bagger for you within a years time.

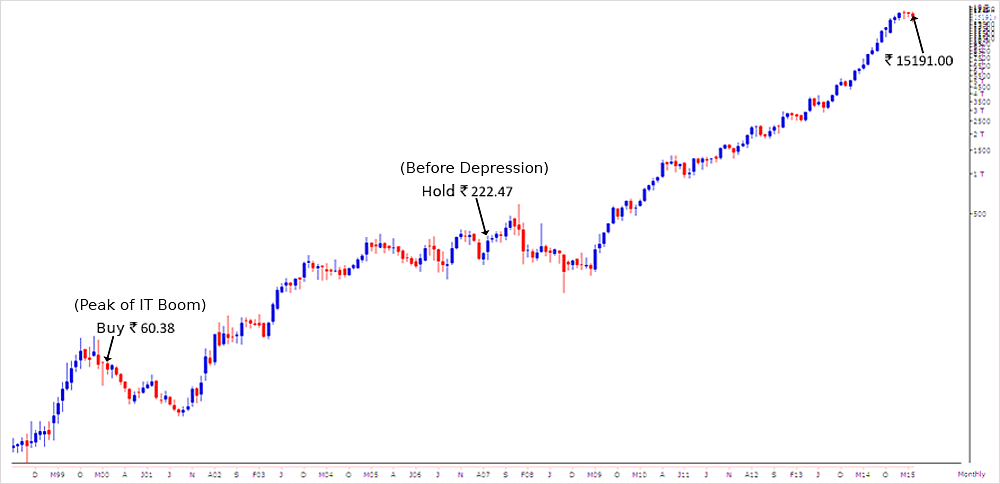

Let’s look into another stock Eicher Motors Ltd. Where if you would have invested in April 2007 it would have turned out to be a 67 bagger by now an investment of 1 lakh would have given you 68.67 Lakhs in just 7 years and if you would have invested in the idea at the peak price of Yr’2000 when there was an IT boom an investment of 1 lakh would have given you 2.5 Crores in just 15 years.

The bottom line is investing in stocks should be specific to a company fundamentals irrespective of the market situation because you will never know when the bubble will bust and there will be another great depression. So, DON’T you miss the 98% of the story.

A Smarter Way to Build Your

Equity Portfolio

Balanced investing across market caps.

Flat ₹1,000 OFF on Annual Subscriptions. + Extra 10% OFF on 2+ Services | Use Code: INVEST

Avail offer

Welcome to stockaxis

Access Your Research Dashboard

Yes, send me important updates on WhatsApp.

Verify Your Mobile

Enter the 4-digit OTP sent to +91 98*****745

Secure Verification. No Spam.

Complete Your Registration

Email Id is required for real-time alerts.

Secure Registartion. No Spam.

Complete Your Registration

Mobile number is required for real-time alerts.

Yes, send me important updates on WhatsApp.

Secure Registartion. No Spam.

Continue with Google

Continue with Google