Demonetization: Are Stock Prices Attractive Enough Now?

December 20, 2016

|

Last week, the Finance Minister of India - Mr. Arun Jaitley announced a host of discounts and concessions to encourage people throughout the country to opt for digital payments. Some of the highlights of the same being (a) 0.75% discount on petrol and diesel, (b) no service tax on digital transaction charges/MDR of up to Rs. 2000, (c) 10% discount on buying general or life insurance policies of public sector insurance companies among many others. The message is quite clear:

“To encourage people to go digital and transform India into a ‘cashless’ economy.”

Well, one can definitely say that moves like these are rolled out to somewhat calm the chaos in the lives of the common man, but for investors like us, the question of whether to invest now or wait for the dust to settle poses as the biggest dilemma ever. We have also been receiving all sorts of queries related to this, with our clients asking us whether they should change their stance towards equities; whether to increase their allocations or exit and sit on cash till the demand picks up again. Being a long only advisory, we always look forward to and relish such chaos, as it not only brings great businesses at attractive valuations, but also corroborates our theory, that, smart investors BUY at correct times in a bear market when no one is interested in going long and SELL when there is a massive euphoria where everyone, I mean everyone tries to become a stock market guru.

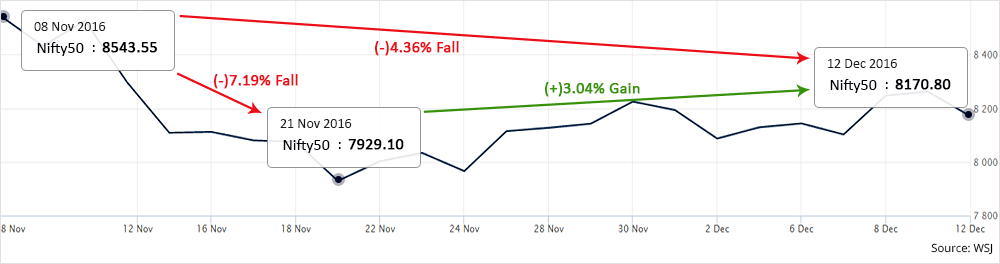

The logic is actually very simple: There is no arguing to the fact that the shortage of cash in the economy has led to a slowdown in the buying and selling of goods, and this will lead to a number of companies taking a beating on their toplines, thereby posting muted growth or potentially no growth at all in their Q3/Q4 FY2017 P/L statements. Now, everyone knows this. And this in itself has resulted in the selling pressure that we’ve been witnessing for the past 25-30 days. Have a look:

After being in a freefall for 2 weeks and plummeting by over 7%, the market finally changed its trend and has gained 4% in the next 2.5 weeks. Everyone follows this trend. But a smart and an informed investor could, and should have used that fall for buying stocks, at heavy discounts. As a matter of fact, we increased the number of recommendations given by us to our clients by almost 2.5x in the 30 days post monetization than we did in the 30 days prior to it. With concentrating majorly on banks, chemicals, financial services, food processing, pharmaceutical, sugar among other sectors, we bring to you a brief on impact and future outlook on each of these sectors. Have a look:

1) Banks:

Impact- There has been a big surge in low-cost deposits, which will help banks in the short-term. It basically means lower cost of funds, and therefore better margins. On the negative side, loan disbursements are declining as the manufacturing and production capacity has stagnated, and hence the need for working capital has reduced too. Also, this being a festive season, which is one of the most prosperous times for lenders, they are still pressing hard to find opportunities to deploy the cash that they are plush with. A slowdown in the economy could also contribute to worsening the asset quality even further

Outlook- Out of the Rs. 15 lakh crores that is expected to enter the system in the form of junk notes, even if only 10% remains with the banks due to a disproportionate share of savings than earlier, it means an incremental Rs. 1.5 lakh crores of current and savings account ratio (CASA). This will certainly lead to system-wide interest rate declines as banks’ cost of funds will now decline. And this is exactly what’s happened and will continue to do so. Major lenders, including ICICI and HDFC Bank, lowered FD rates by up to 0.25% in view of surge in deposits, which is eventually lead to decline in lending rate as well. Also, this money left with the banks will have a multiplier effect when compared to it sitting in cash. This should facilitate enough liquidity in the system. Banks are also expected to see a greater income in the form of fee from electronic payments and transaction charges once the system stabilizes. This will be complimented by the government’s push to make India a ‘cashless’ economy.

2) Microfinance:

Impact- There are a large number of microfinance companies in India, catering to the financing needs of rural and semi-urban Indian population. These customers mainly operate on a cash basis due to informal and trifling nature of the amounts involved in their transactions. And since the whole country is facing a shortage of cash, the recovery schedules have been relaxed. Loan installments from such customers are usually on a weekly and sometimes on a daily basis. But, the demonetization has halted, though temporarily, business transactions which are now running on a daily credit basis, and more importantly has led to a domino effect on daily wage workers like farmers and unskilled laborers and other customers whose livelihood is based on cash payments. On top of this, no new lending has been taking place. Also, not having the permission to recover loans in the junked currency like its banking peers has only worsened the matters. They also cannot default on the borrowings that they have made from banks for further lending as it would impair their rating.

Outlook- The Reserve Bank of India (RBI) has allowed both individuals and companies with loans up to Rs 1 crore, an additional grace period of 60 days to repay their loans. This is applicable for ongoing loans where the dues are payable between 1st November and 31st December 2016. This will positively affect the almost 15% of all loans, and will enable the NBFCs (as well as banks) to not classify them as NPAs, which otherwise would have made matters worse. Also, allowing farmers to use the notes to buy seeds for the crucial rabi season for which sowing is overdue, will help them in the long term as loans will be easier to recover in the future when the farmers cash in on the produce from the current sowing. One thing is for sure, this is just a temporary slowdown and that the underpenetrated banking markets will definitely require microfinance in the years to come.

3) Pharmaceuticals:

Impact- Sales are fell by around 8-10% Q-o-Q in November, as the sales of medicines for acute diseases declined sharply. On the other hand, sales of medicines for chronic diseases rose in the first fortnight, as patients stocked up medicines by using old notes at pharmacies, which were among the few outlets accepting the junked currency.

Outlook- Owing to advanced buying of medicines for chronic diseases and a seasonally weak December-March period for the industry, sales of drugs are expected to remain subdued for this period (subdued than the usual low sales). The impact of demonetization on the sector is likely to be temporary as demand for drugs is largely inelastic but the rate of growth in the coming months may be slower than that witnessed in the first 6-7 months of FY2016.

Remember, even after this historic demonetization decision, India still remains the brightest spot of growth in the world. Also, no matter what happens, people will not stop travelling or stop eating at restaurants; nor will they stop buying medicines or manufacture goods. They will also not stop buying electronics or automobiles. No event can stop those. In fact, all these sectors are poised for pleasing growth in the future. It’s just that, the process has been paused in its tracks for now. As soon as the currency starts flowing into the system, the common mass will again resume their demand for goods and services, but with the exception (likely possibility) of more digital transactions.

No one likes to lose money. But isn’t it great if you could earn some more by capitalizing on other investors’ fear/greed. These kind of macro events only defer the growth stories, and not destroy them. The short term might look unpleasing, but always keep in mind what Robert Arnott quoted: “In investing, what is comfortable is rarely profitable.”

The current volatility in the market could enable you find good businesses at attractive prices, but only if you are ready to leave the herd mentality and start thinking like a smart investor. Now that you’ve been presented with one more opportunity, wouldn’t it be wise if you’d make the most of it?

Do let us know if you feel otherwise!

Continue with Google

Continue with Google