Are ‘Good Times’ Here To Stay For The Indian Beer Industry, Or Will They Get Better?

April 23, 2019

|

Like cricket in India is consumed more during the day-night matches, and obviously outdoor, as more people can enjoy the game after a hard day of work, until only a couple of years ago, maybe a couple more, drinking is slowly swaying away from an outdoor night sport, to well, a complete turnaround.

And surprisingly, a country in which this sport (the latter one) is a big big taboo, boasts one of the highest drinking populations on earth. What’s brewing here? Let us understand, obviously from an informed investors’ perspective.

The first question is, what are Indians drinking? Knowing that, what’s in it for the investors? Two very must-know facts-

-

The alcohol market in India is divided into four categories (with their market values)-

- IMFL (Indian Made Foreign Liquor ie whiskey, rum, vodka, gin, etc): 65%

- Beer: 25%

- Country Liquor: 9%

- Wine: 1%

- United Spirits Ltd., United Breweries Ltd. and Radico Khaitan are the major players serving almost the entire target audience in picture, with the former two having the dragon share in their respective product markets.

Globally, the alcohol market is worth approximately $1.4 Trillion and India occupies just 2% of the share at $30 Billion, inspite being home to nearly 17% of the entire world population. According to a WHO report, in SEAR (South East Asian Region), the percentage of drinkers in the 15+ population as remained almost constant (in line with the population growth) with the number being 33.2% in 2000 and 33.1% in 2017. On the other hand, in Americas Region, the percentage dropped from 63.5% to 54.1% in the same time duration. This drop, coupled with a relatively slower population growth in both, absolute and percentage terms shows that SEAR (especially India, China and Japan) is the next big market for these alcoholic beverage companies.

So how will the market PROSPER in the future and what role will beer play into this prosperity? The following factors we believe will be the facilitators-

1) Demographics & Per Capita Consumption:

Increasing size of the middle-class population and age are the biggest drivers. These two favourable tailwinds are all set to boost demand, complemented income growth, higher savings and ultimately higher spending. 26.2% of the population is in the 15-29 years age bracket & almost 22% is in the 30-44 years age bracket. These two age brackets, here in this analysis are the most important consumers as they are the ones who are hungry for experiences and will drive most of the volumes. These volumes will be aided by the premiumization factor explained in the next point.

Also, the demographics will affect the Total Per Capita Consumption of Alcohol. The figure almost 2.5xed from 2.4 litres in 2005 to ~6 litres in 2017. On the other hand, the global average increased from 5.5 litres to just ~6.7 litres in the same duration. This is the most classic example of how demographics can act as the one of the most underrated weapons in enabling growth. Hence, we can see that the Total Per Capita Consumption of Alcohol in India increased by around 7% CAGR over the last 12-13 years and we don’t see that trend changing negatively. In fact, this CAGR will only be supported by a healthy new addition of consumers in the 30-44 year age bracket.

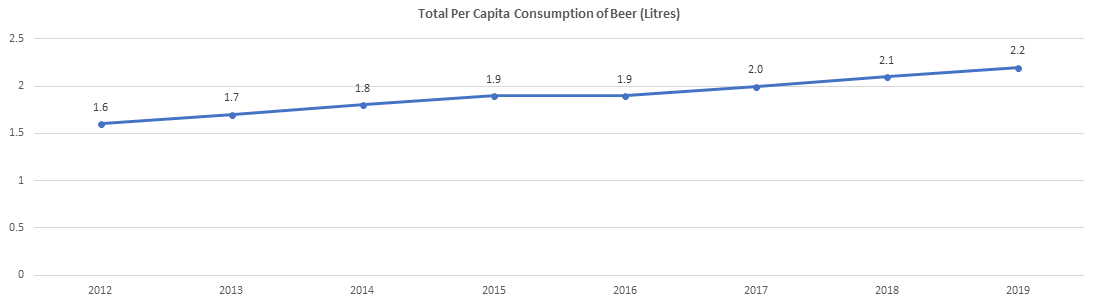

Taking a look at beer consumption growth, which has grown at a CAGR of ~4.6%, ie underperforming compared to the overall alcohol consumption trends:

The global beer market is estimated to be in excess of 2000 Million Hecto Litre and India’s share in the pie is fairly insignificant at around 2%. Comparing India with China (as always), the number is shocking this time. China’s contribution is in excess of 25% and its Per Capita Beer Consumption in is almost 16x of India at ~35 Litres/Capita, increasing from 2 Litres/ Capita, only 25 years ago. Other Asian countries cumulatively average more than 24 Litres/ Capita which is still more than 10x of the Indian average.

| Country | Per Capita Consumption |

|---|---|

| India | Just 2.2L |

| China | 35.9L |

| Brazil | 65.5L |

| Russia | 76.1L |

This shows how underpenetrated the domestic market has been. The reasons for this include ‘moral’ conflicts (spending that money for more righteous uses), religion, politics, desi cheap liquor and a very complex state-wise regulatory structure. All these are clearly fading off, slowly but steadily, primarily due to increasing disposable income in the hands of a young and growing India, which makes them one of the most aspirational population in the world.

2) Premiumization + Upgradation & Increased spending:

Although being one of the most crude indicator of a nation’s prosperity, Per Capita Income of India has grown at a CAGR of 4.2% in the past 7 years (on a constant rate basis). This, coupled by an increasing fad of non-occasion based drinking and a alcohol-content conscious audience has set the floor for a turnaround in the beer segment.

But why are Indians upgrading, or maybe ‘forced’ to do so?

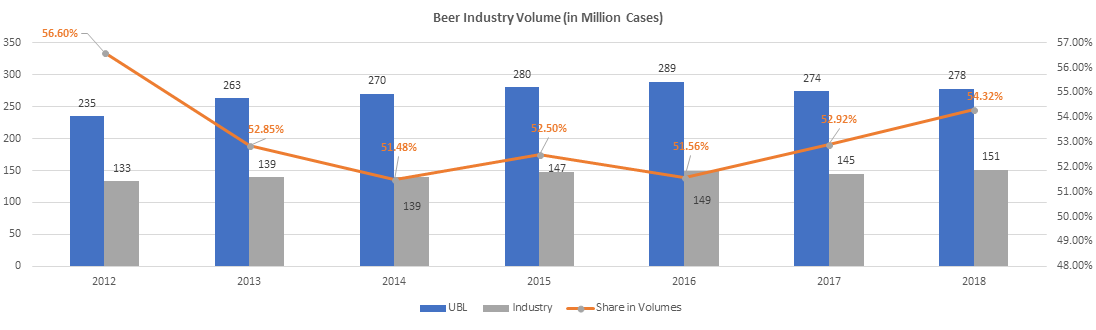

UBL, which has a mammoth ~53% share had been ceding its hold. The premium beer segment which forms 80% of the market has grown at just 4% compared to the super premium segment which has a share of just 10% but is growing at an eye-catching 30-40%. Now, focussing on these segments, via the recent launch of, say Amstel by UBL as a premium beer and entry into craft beer by many players (which has witnessed growth in consumption fairly quickly), it wouldn’t be surprising if beer could witness premiumisation at a much faster pace and eventually become a lifestyle drink for the audience. Also, brewers have expanded their presence in the non-alcoholic beverage space as well. It is an attractive option for non-drinkers and is helping drinking to foray into lunch time or sports events as well. It also has great appeal to women who are potentially the largest expected entrants into the drinking population.

United Breweries Ltd., Carlsberg and AbInBev are the three major players in the Indian beer industry. The following chart shows that instead of a transition (from the traditional offering to a newly constructed portfolio), UBL after losing share, bounced back handsomely:

3) Stability of regulations and taxation complemented by innovative marketing:

In the last couple of years, growth has been hindered due to multiple incidents like demonetisation, ban on sale of liquor in the vicinity of 500 metres of any highway in the country from March 2017 (and eventually backtracking to a great extent), onset of GST leading to price hikes as not liquor but its ingredients like malt/barley were excluded from claims of input credit.

Prohibition risk in states has so far not been the election narrative except for Chhattisgarh where the Congress stated a possibility of a ban. This, alongside Maharashtra Government’s rollback on excise duty on strong beer 235% of manufacturing cost again to 175% shows that the onslaught on beer is not fierce. On the other hand, the same government increased the excise duty on IMFL by another 20% making it 300% of the manufacturing cost declared by the producer. Although we have not seen pricing controls directly, states have eventually turned progressive towards alcohol as too steep a taxation regime will only encourage smuggling and an overall drop in consumption, eventually hurting their coffers.

Also, with the advent of heavy smartphone usage in the most suitable target audience bracket, engagement on Instagram and Facebook, alongside making presence felt via events like Sunburn, Oktoberfest, Derby, Web Series, IPL, Bond Campaigns, Lakme Fashion Week, etc, brewers are not feeling the pinch of no TV ads at all.

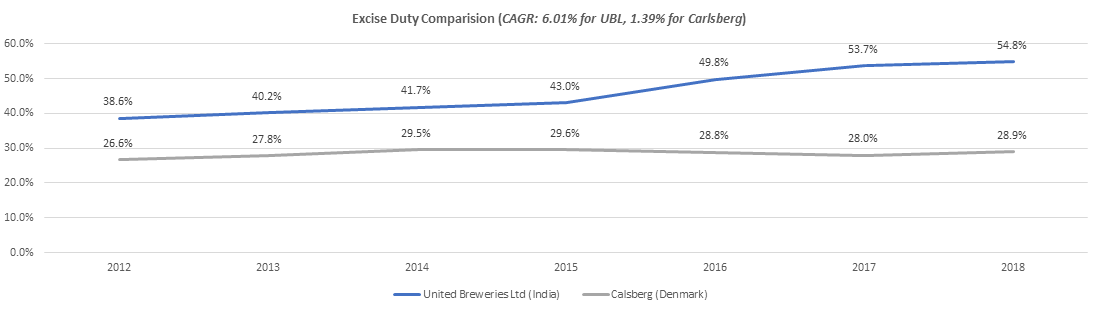

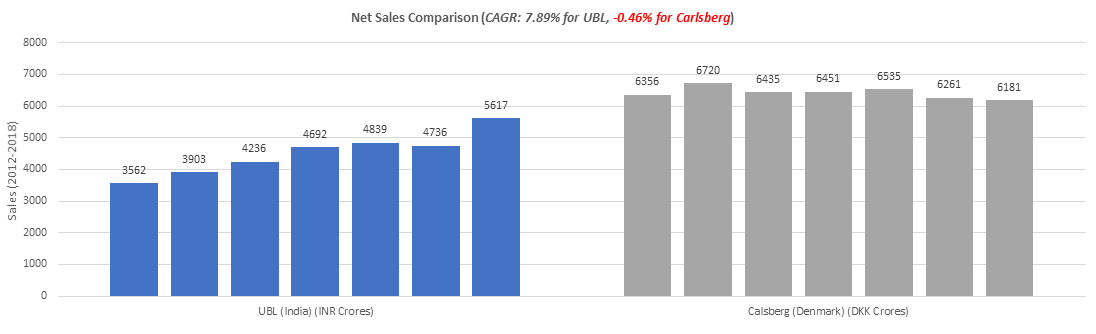

Now that we have seen how the industry can prosper, especially on a low base, let us see the taxation comparison, which troubles the brewer the most. Comparing India’s biggest brewer with one of its most renowned peers, we can clearly see how the Indian government relies so much on alcohol taxation and the worst is already behind.

What can we infer from the data given above? The answer is very pleasing. Net Sales of UBL and Carlsberg (adjusted for Excise Duty) have grown at a CAGR of 7.89% vs -0.46%, which shows that even though excise duty for beer in India grew at a 4x rate than that in Denmark, sales still outperformed its peer by a huge margin. In fact, Carlsberg’s sales showed degrowth in the timeframe.

The sales from premium institutions (bars, restaurants, clubs, pubs, etc) in the past 4 years have been growing at 20-30% (for the industry). This shows that the nature of consumption in India is changing, that many more people are buying more expensive products from more expensive places, which reinforces the whole trend of premium products and this is exactly what United Breweries is banking on. India's thirst for booze, especially beer, is winning out over conservative values.

We at stockaxis are bullish on the beer sector. UBL’s Q3 numbers corroborate our rationale as well, as the company reported a stellar result with its profits jumping more than 2x Y-o-Y, complemented by rigorous cost control measures. Will the favourable dynamics and changing attitudes take this underrated market by storm or will the morals and religion continue to dominate? Time will tell.

Cheers!

Continue with Google

Continue with Google