Annual Earnings: Look For Big Growth...

October 14, 2015

|

Once in a while, every other company is likely to have a good quarter, but that doesn’t mean that it is the start of its uptrend. If you were to invest your money into that company, well, you need more proof of its potential. A blend of strong earnings in the last several quarters plus a solid growth in the recent years makes it potential multibagger. You wouldn’t want to bet on a stock which has shown a good couple of quarters but had a shabby last year or some flat years on the trot. Let us understand why…

Consider Cera Sanitaryware Ltd.; having a market cap of above to 2600 Cr, and a stock P/E of 37.83, it is currently trading close to Rs. 2000. So what’s so special about this company, obviously in our context?

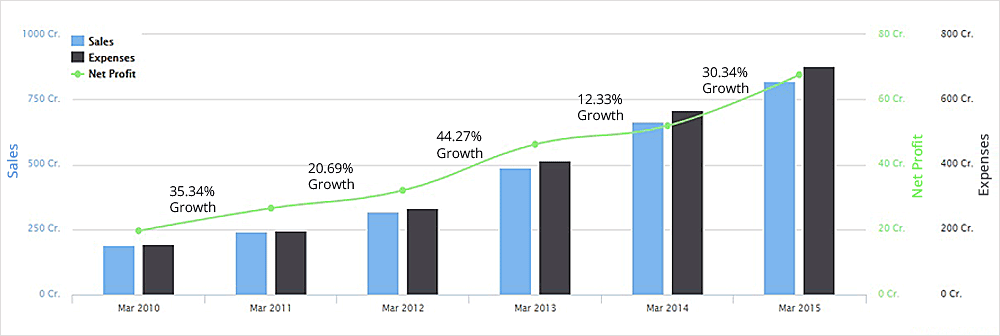

Above given is the annual growth chart of Cera Sanitaryware Ltd.. The company was recommended as a BUY on 21st Oct, 2013 by us at Rs. 603 and made an all time high of Rs. 2952 thereby giving a pleasing 390% return. It had a P/E Ratio of 4.02 during the time. So, apart from the hundreds of other factors that caused this rally, we’ll concentrate on the earnings part, especiazlly the annuals. As you can see, before its BUY call in Oct 2013 i.e. before the Mar 2014 annual results, the sales of the company grew consistently with the likes of 26.96%, 31.46% and 52.75% and the net profit grew 35.34%, 20.68% and 44.27%. On the other hand, quarterly earnings before the recommendation grew 36.24%, -25.60% and 22.96% in terms of sales. You have to discount the seasonal factor in this example as you can clearly see the sales slump in the Jun quarters every year results followed by steady gains in the Sept and Dec quarters.

| Jun 2013 | Sep 2013 | Dec 2013 | Mar 2014 | Jun 2014 | Sep 2014 | Dec 2014 | Mar 2015 | |

|---|---|---|---|---|---|---|---|---|

| Sales | 126.59 | 158.76 | 160.15 | 218.19 | 162.33 | 199.6 | 209.29 | 250.44 |

| %Var | - | 25.41 | 0.88 | 36.24 | -25.60 | 22.96 | 4.85 | 19.66 |

| Expenses | 106.68 | 139.51 | 139.54 | 183.02 | 138.19 | 171.96 | 179.63 | 214.36 |

| %Var | - | 30.77 | 0.02 | 31.16 | -24.49 | 24.44 | 4.46 | 19.33 |

| Net Profit | 11.18 | 10.62 | 10.76 | 19.34 | 13.63 | 15.75 | 16.16 | 22.12 |

| %Var | - | -5.01 | 1.32 | 79.74 | -29.52 | 15.55 | 2.60 | 36.88 |

Thus, we can conclude that Cera Sanitaryware Ltd. not only showed solid annual earnings, but also consistent quarterly earnings which made it a winner. Hence keep in mind that every three out of four stocks that make histories with their rallies show positive growths of 25% - 40% or even higher, over three years and in some cases five. But sometimes, you also have to discount a down year as long as the following year’s earnings move back to a new high. Remember that the bigger picture here is stability. On the other hand, let’s take a look at Unitech Ltd..

Above given is the annual performance of Unitech Ltd. over the past five years. As you can see, post Mar 2011, sales have been on the flatter side showing marginal signs of improvement every year. The company witnessed some not so good years before showing improvement in the sales in Mar 2015. So let’s see what happened during those quarters and why you shouldn’t have invested:

| Dec 2013 | Mar 2014 | Jun 2014 | Sep 2014 | Dec 2014 | Mar 2015 | Jun 2015 | |

|---|---|---|---|---|---|---|---|

| DOA | 14 Feb 2014 | 28 May 2014 | 13 Aug 2014 | 12 Nov 2014 | 13 Feb 2015 | 29 May 2015 | 13 Aug 2015 |

| Share Price | 12.66 | 27 | 21.75 | 21.05 | 16.7 | 14.35 | 6.99 |

| %Var | - | 113.27 | -19.44 | -3.22 | -20.67 | -14.07 | -51.29 |

| Sales | 731.68 | 1,033.31 | 1,524.94 | 383.73 | 706.81 | 813.23 | 417.55 |

| %Var | - | 41.22 | 47.58 | -74.84 | 84.19 | 15.06 | -48.66 |

| Expenses | 703.81 | 995.18 | 489.43 | 396.97 | 653.55 | 1,131.79 | 693.48 |

| %Var | - | 41.40 | -50.82 | -18.89 | 64.63 | 73.18 | -38.73 |

| Tax | 20.91 | -0.37 | 49.53 | 12.31 | 22.5 | 27.51 | 10.6 |

| Net Profit | 32.83 | -51.55 | 5.56 | -14.7 | 43.34 | -162.54 | -281.29 |

| %Var | - | -257.02 | -110.79 | -364.39 | -394.83 | -475.03 | 73.06 |

After an ordinary Dec 2013 quarter, Unitech Ltd. showed signs of improvement in its sales worth 41.22% and 47.58% in the Mar and Jun 2014 quarters respectively. The profits took a beating in Mar 2014 as the company created a provision of over Rs. 103 Cr for its non-performing assets, which is a good sign and hence the 113% increase in its stock price (Note that there were other factors as well which contributed to this rally). Further in Jun 2014, the sales continued to flourish, almost by 50% accompanied by a similar drop in expenses. Well, for an investor this is a superficially great reason to invest in Unitech Ltd., but the prices tanked by 20%. When we do deeper, we find that the company had experienced a loss of close to Rs. 1000 Cr as the underlying investment of Simpson Unitech Wireless Private Limited in Unitech Wireless (Taminadu) Private Limited had diminished significantly due to the cancellation of Unified Access Services Licenses pursuant to the judgment of the Honorable Supreme Court of India which contributed to a negative sentiment.

So the bottom line is, the company might have shown a couple of good quarters, but you have to take your position of the long run based on its annual performance over the years. Make sure that you don’t put your hard earned money into a company whose recent results are just a flash in the pan! Always insist on more proof and the best way to get them if you are in the game for a long run is by the annual performances of the company. Every three out of four winners recommended by us have always shown positive growth in their annuals which have enabled them to negate the bears and outperform the bulls. So do your diligence properly. Happy Investing…

Continue with Google

Continue with Google