An Investors’ Point of View In This Apparent NBFC Crisis. What To Do Next?

May 29, 2019

|

With our economy reeling under the pressure to perform, well, outperform others as well, there is a fundamental problem brewing with one of the most important catalysts of our growth engine. When we look at the troubled sectors, we always look at real estate, power, metals, etc, which are the primary contributors to our development. But there’s a sector in the sidelines which has kept all of them going and that very sector is now facing the hammer.

Yes, we are talking about India’s recently famed (negatively) so called shadow banking department, the non-banking finance companies (NBFCs), which are facing a colossal task of refinancing themselves that literally enables their basic functionality of lending.

What went wrong?

The first signs were visible when IL&FS, a 30 year old lending giant simply ran out of money. The cracks just widened since then. Banks became cautious on lending money to the NBFCs. This was followed by a fear of redemptions from the mutual funds. And eventually came the downgrades, with Reliance Commercial Finance (Rs. 12,700+ Rs. 5000 Crores) and Reliance Home Finance (Rs. 4890 Crores) downgraded to “default,” implying they faced trouble paying their dues. DHFL and PNB Housing Finance also faced the heat with both of them being put under credit watch. DHFL then just recently not only stopped accepting fresh deposits but allow premature withdrawals. The result? Fundraising became an uphill task for not just these four, but for almost everyone. Again, almost everyone. Mutual Funds, one of the biggest sources of funds for NBFCs have been cutting down on them and that is a big problem.

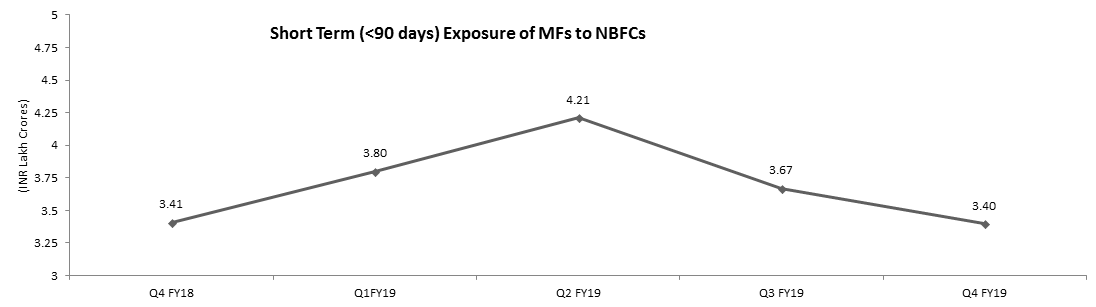

Here’s the data:

Why did we consider Commercial Papers and Debt with less than 90 days of maturity? The answer itself is one of the biggest reasons why NBFCs are in this mess. They are well known for aggressive lending practices, especially for SMEs and MSMEs, home buyers and real estate developers, who have difficulty in borrowing from banks. Credit from the NBFC sector grew by 21% YoY in FY18, when bank credit growth was just around 10%. To fuel this growth, they as usual raised short-term loans of between 3-6 months duration, but the entities they lent to were long-term ones. This causes a maturity mismatch in their assets (loans given) and liabilities (loans taken). To nullify this, they rollover these short term papers that they have issued again and again. The problem arises when the options for enabling this rollover reduce.

What’s the scenario now?

However, following the IL&FS crisis, banks and mutual funds (as shown in the chart above) both have cautious on lending to NBFCs. To add fuel to fire, the cost of funds has also increased. Thus, to sum it up, these lenders are starring down the barrel of a liquidity crunch to repay the ~Rs. 1.2 Lakh Crore of CPs raised by them that are up for redemption by June 2019. The 3-year AAA spreads over Indian government bonds of the same maturity has increased (doubled) from ~75bps in October 2018 to ~150bps in May 2019. This shows that the confidence in even the highest rated debt instrument was under question in just 8 months. This made the roll over process more and more difficult for the NBFCs.

Further, Essel Group’s solvency is also in question. Mutual funds have an exposure of ~Rs. 5700 crores to the group. These mutual funds are also the de-facto bankers to our troubled NBFCs, which have in all borrowed more than Rs. 3.2 Lakh Crores from them. But debt mutual fund outflows shot up to Rs. 1.25 Lakh Crores in FY19 as against Rs. 9,128 Crores registered a year ago. The result? Share of debt schemes has dropped from 34.9% in April 2018 to 29.3% in April 2019. This shows clear signs of the start of some serious redemption pressure. If even one piece falls out of the puzzle, this pressure on the NBFCs will surpass the liquidity crunch that they’re facing and the whole financial market will go for a toss.

Summarizing it all- huge upcoming repayments which seem very difficult to honor & regular downgrades by rating agencies leading to costly funds are making life very difficult for the NBFCs.

How are the Q4FY19 results of top NBFCs?

Bajaj Finance and M&M Financial have spectacular NIMs of 11.50% and 7.79% respectively. This shows that, they have not only provided healthy loan book growth, but at good yields as well. Have a look at their loan growth as well:

| NBFC/HFC Name | Y-o-Y Loan Book ↑ | Q-o-Q Loan Book ↑ |

|---|---|---|

| Bajaj Finance | 37.91% | 8.41% |

| M&M Financial | 27.73% | 6.41% |

| HDFC | 13.40% | 5.69% |

This shows nothing but clear leadership and outperformance.

Are the worries addressed?

NBFCs are trying to improve their liquidity in an unconventional manner. The level of securitization (conversion of loans into debt instruments) reached a 10-year high of Rs 1.9 Lakh Crores in FY19 (total loans being ~17.5 Lakh Crores). This amounts to ~12% of their total advances, which shows how slippery their liquidity situation is. But they are devoid of options as well. The bond market in India for investing in say, a 15-year project, there is way too underdeveloped.

The RBI mandated NBFCs with assets greater than Rs. 5000 Crores to appoint a chief risk officer (CRO). A special borrowing window from the RBI (although the Central Bank itself is not in favor of it) on the lines of the one our banks already have could be among the likely measures to ease the liquidity crunch. Last year, a co-origination scheme for priority sector lending was started, with a partnership dynamic between the two sets of lenders (banks and NBFCs) would be such that loans would be originated by NBFC with a minimum exposure of 20% and banks would fund the rest of the loan with pre-agreed rates of lending by the two players. This is too is being explored by the non bank lenders and can pick up pace in the coming quarters (approximately 5-10k Crores has already been sanctioned since its inception).

Just recently, NBFCs will need to maintain LCR of 60% net cash outflows from April 2020, by means of investments in government bonds. This will lead to less cash to lend and eventually affect profitability. This could force them to increase lending rates to maintain that profitability, which will lead them to lose share to leaders who can sustain low rates.

What should investors do?

The market share that had moved to NBFCs may go back to banks, which have since raised capital, adequately. But, as we have always said, true leaders always sustain. Smart money usually looks for market leaders that have seen and survived a booms and busts and still have their fundamentals in place. Examples in this troubled sector include Bajaj Finance, HDFC, M&M Financial, etc, which have not only maintained their NIM above most of their peers, but have been perfectly cautious as well as aggressive in stealing the market where the banks couldn’t capitalize. But given the resistance faced by low rated NBFCs in raising funds, the aforementioned leaders (who are adequately cushioned when it comes to liquidity and repayment schedules) are all set to further grab share from their own peers and eventually strengthen their foothold even more. Furthermore, with the norm to maintain LCR at 60%, leader NBFCs with strong credit ratings and stronger parentage or ALM profiles, like the ones mentioned above, will further take in the share on offer.

This is how leaders become bigger, better and even more bigger; and the NBFC leaders have this opportunity presented to them on a silver platter. Will they be able to capitalize and exploit the current brunt faced by their peers to their favor, or will they be too late to the party. Only time will tell, but yes, given the ingredients and given the perfect opportunity, we don’t see any reason why someone like a Bajaj Finance or a HDFC making themselves, not virtually, but literally unbeatable. As an informed investor, you should keep an eye on the sector, which might be troubled, but not down and out. One should also keep an eye on the banks which are set to benefit big time from this current fiasco. We at StockAxis are extremely bullish on select leader NBFCs and banks (both, private and PSUs). All in all, the next 2-3 quarters will define the positioning of the financial services sector of our nation and our goal is to make sure that you ride the winners in this scenario till the end.

Continue with Google

Continue with Google