A Winning Stock Portfolio: Get These Two Things Right!

April 29, 2022

One of the most infamous sayings on Dalal Street is - ‘Let your winners Run’. However, many investors still appear to sell the stocks after merely a small gain & only to watch them head higher.

Another important rule to follow when investing in the stock market is ‘Damage Control’ - by maintaining a Stop Loss on your positions. This means selling a stock when it's down by a set percentage from your purchase price. Sounds simple right? but no one wants to sell for a loss.

In our experience curating a winning portfolio boils down to these 2 simple things. Namely,

1. Cutting your losers

2. Riding your Winners

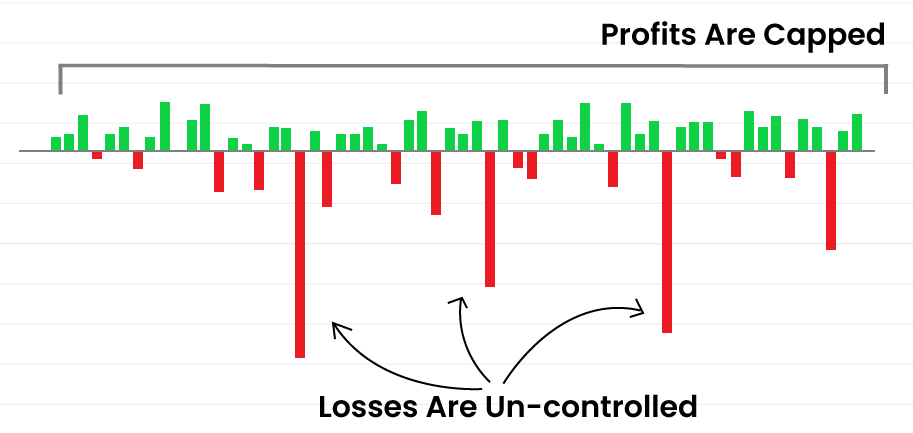

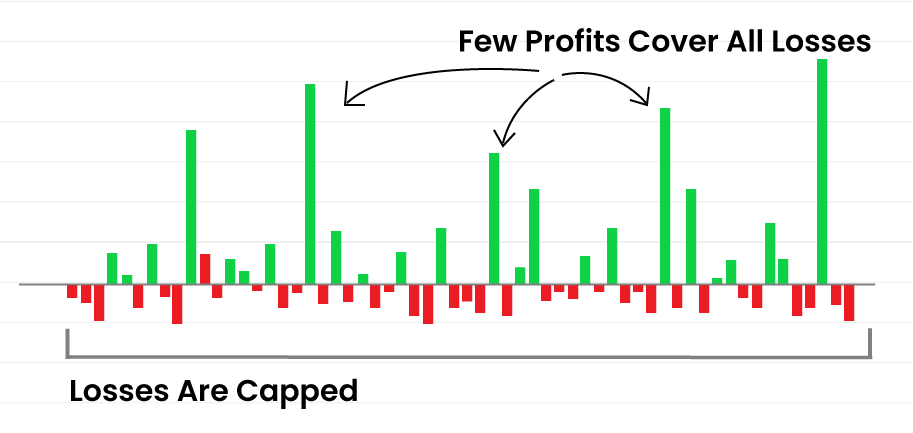

It is advisable that one should not stay in a losing position too long and, on the other hand, not close a winning position too soon. The key is to be quick with losses and patient with profits. Observe the two illustrations of P&L statements below & decide for yourself which one would you rather have for yourself.

Illustration 1: When you book profits early but let your losers run free.

Illustration 2: When you cut losses short but let your winners run free.

Any sensible investor would surely pick Illustration no 2. These rules look simple and seem obvious, however, it is exactly the opposite of what most investors do. There is a common affliction that hits most new investors that causes them to do the exact opposite— they can’t admit that they were wrong.

At first glance, it may appear sensible to sell your winners & book the profits to take your money home while you wait for the losing stocks to perform or at least reach break-even. However, We would disagree with your plan & think that it would be a mistake. The reason is something that we like to call ‘The rule of the percentage’.

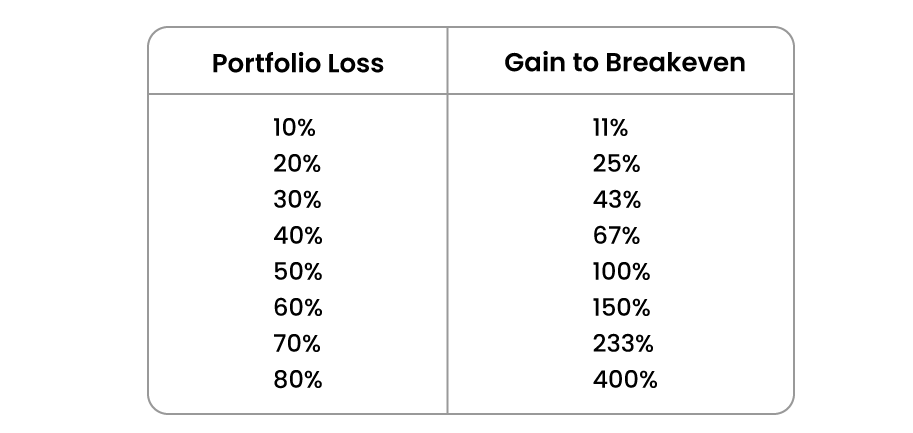

Due to the way percentages work, it is bound to take a much larger percentage gain to recover your losses. For instance, a stock that has lost 15% of its value will require an upside rally of 18% just for you to break even. These calculations get worse the more your stock goes down. Take a look:

Illustration 3: How the rule of percentage works.

If you buy Stock XYZ at Rs.100 per share and it drops to ₹50, then you would have lost 50% of your investment. The stock must now double in price & rally 100% on the upside just to get back to ₹100 a share. And that's just break even. That's not an ideal situation at all. It is much better for you to cut your losses early, at 8-12% rather than get into this predicament.

But the positive thing about this law of percentage is that it also works in your favour when you are in profit. The longer you hold onto a winner, the less it needs to move in order for you to make substantial gains. For instance, let’s say you have bought a stock named ABC at ₹1,000 per share. If this stock is trading now at ₹4000/share, every 1 percent rise in the stock produces for you a 4 percent gain. Impressive, Correct? That’s how you get rich: Finding winners and sticking to them as long as they keep rising consistently.

Now, let us take a random portfolio of 8 stocks and see how it performs if we allow our winners to ride. Assume that higher risk/ lower capitalisation stocks have been given lower weights in the portfolio. In this context, we are considering a rising market scenario as has been the case most of the time in the Indian equity market. The period of investment considered is only 3 years although your focus should be for a much longer-term.

Illustration 4: Sample Portfolio of 8 stocks where Initial capital is ₹10,00,000/-.

| Stock | Initial Allocation | Starting Value | Returns in Yr 1 | Value at the end of Yr 1 | Returns in Yr 2 | Value at the end of Yr 2 | Returns in Yr 3 | Value at the end of Yr 3 | No. of times Return | Final Allcation | CAGR |

|---|---|---|---|---|---|---|---|---|---|---|---|

| A | 15% | 150,000 | 75.00% | 262,500 | 50.00% | 393,750 | 25.00% | 492,188 | 3.30 | 24.80% | 48.6% |

| B | 15% | 150,000 | 15.00% | 172,500 | 15.00% | 198,375 | 15.00% | 228,131 | 1.50 | 11.50% | 15% |

| C | 15% | 150,000 | 10.00% | 165,000 | 10.00% | 181,500 | 10.00% | 199,650 | 1.30 | 10.10% | 10% |

| D | 15% | 150,000 | 15.00% | 172,500 | 20.00% | 207,000 | 25.00% | 258,750 | 1.70 | 13.00% | 19.9% |

| W | 10% | 100,000 | 20.00% | 120,000 | 0.00% | 120,000 | −20.00% | 96,000 | 1.00 | 4.80% | −1.4% |

| X | 10% | 100,000 | 200.00% | 300,000 | 50.00% | 450,000 | 20.00% | 540,000 | 5.40 | 27.20% | 75.4% |

| Y | 10% | 100,000 | 10.00% | 110,000 | −10.00% | 99,000 | 10.00% | 108,900 | 1.10 | 5.50% | 2.9% |

| Z | 10% | 100,000 | −30.00% | 70,000 | 0.00% | 70,000 | −15.00% | 59,500 | 0.60 | 3.00% | −15.9% |

| Total | 1,000,000 | 1,372,500 | 1,719,625 | 1,983,119 | 2.00 | ||||||

| Returns | 37.30% | 25.30% | 15.30% | ||||||||

| Portfolio CAGR | 25.60% |

As you can see, holding on to winners can make a big change to the portfolio. Stock A with 15% initial allocation grew to 25% at the end of 3 years as it delivered 3.4 times. Stock Z, on the other hand, automatically reduced from 10% allocation to 3% as it did not deliver. This further shows that underperformers automatically end up with lower weights when the portfolio grows as the winners take up more allocation, for example, stock A.

‘Cut your losses short & let your winners run’ is an inbuilt & predefined selling rule of the stockaxis MILARS strategy. It ensures that our clients are making their investment decisions based on factual information & in-depth research as opposed to random emotions & instincts caused by market volatility. You too can adopt this rule for your portfolio. Here are some of the things that you should remember in order to implement this rule better:

-

Know that stocks don’t always rebound:

While it is seen & believed that the broad market will always end up on the higher side in the long run, it is certainly not the case for individual stocks. Various companies in the past have slid down & never again risen back to their previous highs. Some have even gone bankrupt. -

Accept the Blame:

It is not uncommon for investors to not accept that they have made the wrong choice. They try to hold the stock out of their egos & to prove themselves right. It is an illusion that a loss only occurs when the position is closed. It is wise to accept an error in judgement & put your money to better use as time is precious. -

Set Stoploss:

It is advisable that you utilise the stop loss option & set it at 8-10% maximum. This shall help you turn off your emotions & will protect your capital. -

Would I make a buy now?

Whenever a stock in your portfolio starts spiralling down, ask yourself ‘Will I buy this stock at this stage now?’ The answer to this question will tell you whether to hold on or exit your position.

As famous investor and hedge fund manager George Soros once said-

"It's not whether you're right or wrong, but how much money you make when you're right and how much you lose when you're wrong”.

So get ready to leave your emotions behind as cutting losses with discipline will help you stay out of trouble. This rings true for every successful investor. They calmly take a small loss and look for the next potential winner.

Now the question that arrives is this - How one can know the right technical levels to maintain the stop loss? With stockaxis, you can easily get out of the stock when the Long term Trend turns ‘Down’ from ‘Up’. We'll help you stand out from the crowd and show you how to identify your winners and when to make your move.

Continue with Google

Continue with Google