PI Industries Ltd

Quarterly Result - Q4FY24

PI Industries Ltd

Pesticides & Agrochemicals

Current

Previous

Stock Info

Shareholding Pattern

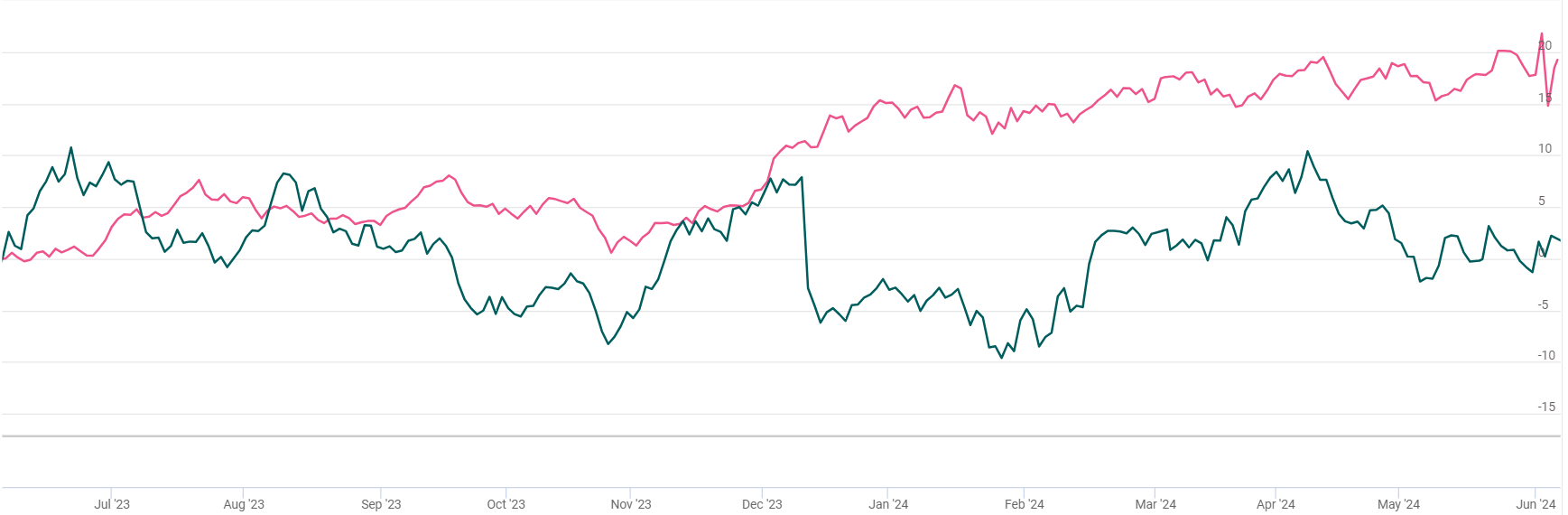

Price performance

Indexed Stock Performance

Financial Highlights:

| Particulars | Q4FY24 | Q4FY23 | YoY % | Q3FY24 | QoQ% |

|---|---|---|---|---|---|

| Total revenue from operations | 1741.00 | 1566.00 | 11.00% | 1898.00 | -8.00% |

| EBIDTA | 444.00 | 344.00 | 29.00% | 555.00 | -20.00% |

| EBIDTA Margin % | 26.00% | 22.00% | 354 bps | 29.00% | (373) bps |

| PAT | 370.00 | 281.00 | 32.00% | 449.00 | -18.00% |

| EPS (Rs.) | 24.36 | 18.49 | 32.00% | 29.59 | -18.00% |

Source: Company Filings; stockaxis Research

Q4FY24 Result Highlights

PI Industries Ltd (PIIND) has demonstrated steady financial performance, marked

by consistent revenue growth and improved profitability. The company reported an

overall 11% YoY revenue growth, to Rs.1741 crores this quarter. Export revenue in

the Agrochemical segment rose by 9%, driven primarily by higher volumes and the

introduction of new products. The Pharma segment contributed Rs. 72 crores to export

revenue, accounting for approximately 5% of the total export revenue growth. Domestic

revenues were subdued with a reductionof about 5% YoY, largely due to a 6% drop

in volume caused by delayed and erratic monsoon patterns. However, a favourable

product mix and improved working capital management helped mitigate the financial

impact. Revenue from biological products increased by around 35% YoY. The gross

margin increased by 903 bps, and EBITDA improved due to a favourable product mix

and operating leverage. EBITDA grew from Rs 344 crores to Rs 444 crores, an increase

of 29%, with EBITDA margins up by 354 bps. Overhead costs rose, with 17% attributable

to newly acquired Pharma businesses and the remaining 21% to the expansion of exports

and promotion expenses for new product launches. Profit after tax (PAT) grew by

32% YoY, rising from Rs 281 crores to Rs 370 crores in Q4FY24. Additionally, cash

flow from operating activities increased by 15%, reaching Rs 880 crores compared

to Rs 762 crores in Q4FY23.

Other Highlights

In FY24, The company saw strong performance in its CSM business, with overall revenue

growth of 18% YoY. This growth was primarily driven by a 19% YoY increase in CSM

revenue, attributed to the scale-up of existing products and the introduction of

six new products. However, domestic agrochemical sales declined by 6% YoY. Gross

margins remained high in Q4 at 54% (FY24 at 50%), with a guidance of 49-50% for

FY25. EBITDA increased by approximately 30% YoY to Rs 2000 crores, and PAT grew

by around 37% YoY, supported by a lower tax rate of 14.9% compared to 11.3% in the

previous year. Management expects the tax rate to increase to around 24% due to

reduced benefits from SEZs like Jambusar.

The domestic and pharmaceutical segments are expected to take time to recover. The domestic segment faced challenges due to erratic monsoons, leading to reduced insecticide and herbicide sales in certain regions. However, revenue from biological products increased by approximately 29% YoY. Management anticipates a strong first quarter in FY25 due to expectations of a better monsoon, although industry-wide elevated inventory levels and price pressure from generics are likely to persist until the end of CY24. The company plans to focus on biologicals and an integrated crop solution approach, along with improved working capital management. The pharmaceutical business achieved a 12% EBITDA margin (excluding development spends) in FY24. Management expects 25% growth in the pharmaceutical segment in FY25, with continued investment in development for the next 1-1.5 years.

CRO segment

- The Hyderabad facility is nearing completion and will feature 8 labs with 65 fume hoods.

- It will include fully integrated analytical labs and a Process Safety lab.

- The facility will have a team of 65+ scientists.

- The services suite will include Medicinal Chemistry Services, Lead Optimization, Analytical Services, Process Development and Safety Studies, Toxicology, Preclinical and Clinical supplies, and Technology Transfer.

CMO segment

- Facilities at Lodi are being upgraded.

- The construction of a Kilolab is currently in progress.

- A global business development team has been established to enhance lead generation efforts.

Key Conference Call Takeaways

CSM business

- The current order book size of USD 1.75 billion provides growth visibility for the CSM business for the next 4-5 years.

- PI Industries plans to launch 80-100 new products in FY25, with a third of the product pipeline coming from non-agrochemicals, including electronic chemicals, semiconductors, advanced polymers for various applications, and intermediates.

- The contribution of new products to revenue is expected to increase to 30%-35% over the next 2-3 years from the current 20%-25%, with new products expected to grow at 30%.

- The company does not anticipate any significant impact from the expiration of the patent for Pyroxasulfone technical in the US in FY25.

Capex and Revenue Growth Guidance

- The company has guided for a capital expenditure of Rs. 800 - Rs. 900 crore for the current fiscal year, which will include setting up one dedicated plant and a multiproduct plant for new molecules. This investment is aimed at aggressive commercialization of 8-10 new products in the CSM business. The capex will be allocated towards adding 2 dedicated plants and 2 multi-purpose plants.

- Despite global challenges, the company aims for a 15% revenue growth this year, considering industry sentiment, demand, and the impact of erratic monsoons. Post FY25, it expects a return to 18%-20% revenue growth as the industry cycle stabilizes, driven by an expanded base from FY24 and factors like industry sentiment, demand, and monsoon patterns.

New Product Revenue Share

- The revenue share from new products was around 17%-18% last year.

- With a 17% growth in this segment, the revenue share from new products is expected to be around 23%-25% in FY24.

Pharma Business

- The Pharma business experienced a 37% growth in FY24.

- Revenue growth was impacted by deferred supplies for some products, which are expected to be fulfilled in the coming financial year.

- The segment is expected to grow by 25% in FY25, with margins expected to normalize at +20% levels over the next two years.

- Revenue is expected to double in the next 2-3 years, with development costs to continue for the next 1-1.5 years.

Gross Margin Improvement

- Gross margin improvement is attributed to factors such as a favourable product mix, business mix, and the addition of the higher-margin Pharma business.

- An increase in the share of CSM exports in revenues also contributed to the improvement.

Order Book Execution

- The order book includes long-term agreements and contracts spread over 2-5 years.

- Annual purchase orders also contribute to revenue growth alongside the order book.

Domestic Market Outlook

- The domestic market outlook was challenging due to extreme weather conditions.

- Optimism is high for the first quarter based on IMD forecasts and climate predictions, with growth expected on an annual basis, focusing on the second quarter for major consumption.

Inorganic Opportunities

- The company is actively evaluating inorganic opportunities in various business areas.

- There is a strong focus on long-term strategic direction and growth aspirations backed by science and technological capabilities.

Other highlights

- Total capital expenditure (capex) for FY24 amounted to Rs 1080 crores, which includes the acquisition of Pharma assets worth approximately Rs.500 crores. Excluding this addition, the capex was around Rs580 cr, compared to Rs 340 crores in FY23.

- In FY24, PI launched 7 innovative brands, including 2 insecticides, 2 fungicides, 1 herbicide, 1 biological, and 1 nematicide.

- PI filed for 21 patents in FY24, bringing the total to over 165. Additionally, six new products were commercialized in FY24. The company expects to launch over 4 innovative products in FY25, with a robust pipeline of over 20 products under registration and development.

Outlook & valuation

The company's strategic initiatives, including aggressive commercialization of new products and expansion of its CSM business, have contributed to its growth trajectory. Despite challenges such as erratic monsoon patterns impacting domestic sales, PIIND has managed to maintain a positive outlook, targeting a 15% revenue growth for the year. Looking ahead, PIIND expects to capitalize on its diverse product portfolio and strong order book to drive future growth. Additionally, PIIND's prudent cost management and focus on enhancing operational efficiencies bode well for its profitability. The company's strategic focus on expanding its presence in the CSM business and the pharmaceutical segment, along with its commitment to sustainable business practices, further strengthens its long-term growth prospects. PI has forecasted a 15% year-on-year increase in topline growth for FY25 (vs. 18-20% earlier), while maintaining the EBITDA margin at the FY24 level of 26%. FY25 guidance for tax-rate increases to 24% (vs. 11.3% in FY24). Additionally, the company has indicated that there is no substantial competitive pressure in its primary product, Pyroxasulfone, and anticipates a growth rate of 30% and 25% for new molecules/pharma over the next three years. Overall, PIIND's strong financial position, coupled with its strategic initiatives and focus on innovation, underpin its positive outlook for the future. At a CMP of Rs. 3540, the stock is trading at 30x FY26E. We recommend a HOLD rating on the stock.

Consolidated Financial statements

Profit & Loss statement

| Particulars | Q4FY24 | Q4FY23 | YoY % | Q3FY24 | QoQ% |

|---|---|---|---|---|---|

| Total revenue from operations | 1741.00 | 1566.00 | 11.00% | 1898.00 | -8.00% |

| COGS | 803.00 | 864.00 | -7.00% | 881.00 | -9.00% |

| Gross profit | 938.00 | 702.00 | 34.00% | 1016.00 | -8.00% |

| Gross profit margin | 54.00% | 45.00% | 903.00 | 54.00% | 30.00 |

| Employee cost | 178.00 | 135.00 | 33.00% | 186.00 | -4.00% |

| Other exp | 316.00 | 227.00 | 39.00% | 274.00 | 15.00% |

| EBIDTA | 444.00 | 344.00 | 29.00% | 555.00 | -20.00% |

| EBIDTA Margin % | 26.00% | 22.00% | 354 bps | 29.00% | (373) bps |

| Depreciation exp | 80.00 | 58.00 | 38.00% | 78.00 | 2.00% |

| EBIT | 364.00 | 286.00 | 27.00% | 477.00 | -24.00% |

| Finance cost | 11.00 | 3.00 | 230.00% | 7.00 | 56.00% |

| Other income | 58.00 | 50.00 | 17.00% | 56.00 | 3.00% |

| PBT | 411.00 | 333.00 | 24.00% | 526.00 | -22.00% |

| Tax | 42.00 | 52.00 | -19.00% | 77.00 | -46.00% |

| PAT | 370.00 | 281.00 | 32.00% | 449.00 | -18.00% |

| PAT Margin | 21.00% | 18.00% | 330.00 | 24.00% | -242.00 |

| EPS (Rs.) | 24.36 | 18.49 | 32.00% | 29.59 | -18.00% |