Newgen Software Technologies Ltd

Quarterly Result - Q1FY25

Newgen Software Technologies Ltd

IT - Software Services

Current

Previous

Stock Info

Shareholding Pattern

Price performance

Indexed Stock Performance

Financial Highlights:

| Particulars (Rs. In Cr) | Q1FY25 | Q1FY24 | YoY (%) | Q4FY24 | QoQ (%) |

|---|---|---|---|---|---|

| Revenue from Operations | 315.00 | 252.00 | 25.00% | 375.00 | -16.00% |

| EBITDA | 48.00 | 32.00 | 49.00% | 123.00 | -61.00% |

| EBITDA Margin | 15.16% | 12.77% | 239 bps | 32.66% | (-1750 bps) |

| EBIT | 40.00 | 25.00 | 58.00% | 115.00 | -65.00% |

| Profit after tax | 48.00 | 30.00 | 57.00% | 105.00 | -55.00% |

| EPS | 3.02 | 1.94 | 56.00% | 7.22 | -58.00% |

Source: Company Filings; stockaxis Research

Q1FY25 Result Highlights

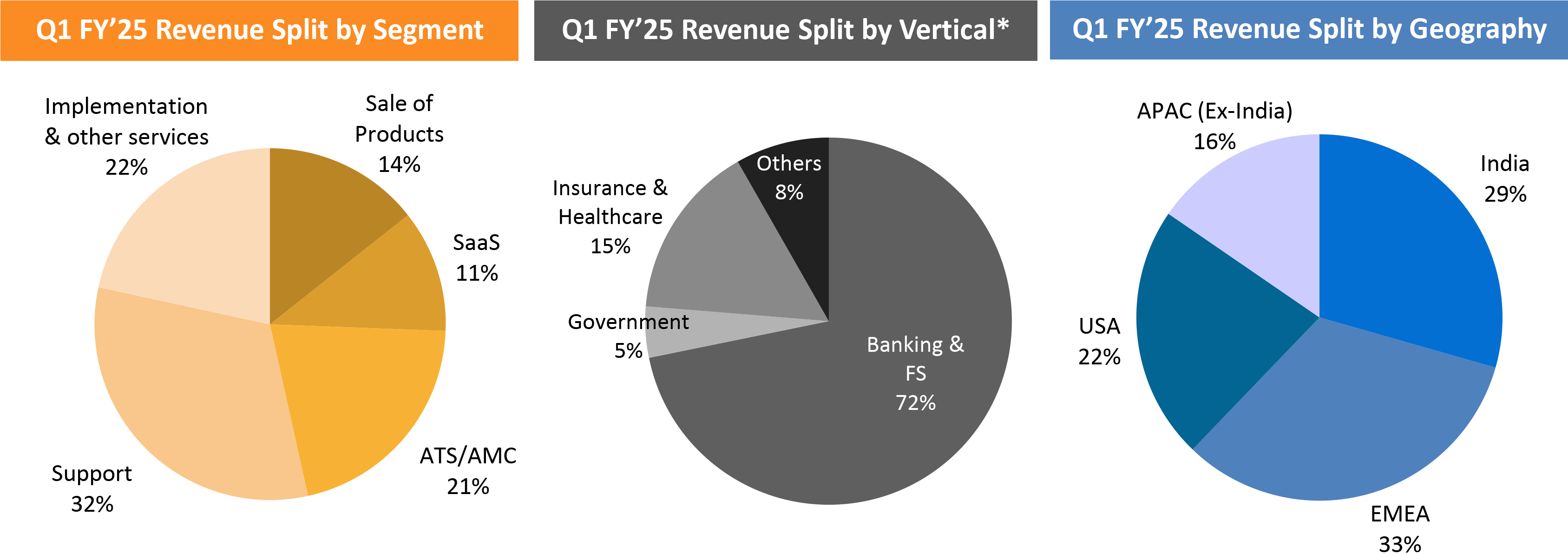

Newgen Software reported steady growth across all its key segments. Consolidated

net sales witnessed a strong growth of 25% YoY to Rs.315 cr as compared to Rs.252

cr registered in the same quarter of the corresponding fiscal driven by growth across

all geographies. Trade, Lending, and Supply Chain Finance solutions receiving good

traction and market acceptance. Annuity revenue streams (ATS/AMC, support, and cloud/SaaS

and Subscription license) stood at Rs.201 crores. Revenue from the sale of products/licenses

was Rs 45 crores. Revenue from Implementation and others were at Rs 68 crores. On

the operating front, consolidated EBITDA experienced a growth of 49% YoY to Rs.48

cr. EBITDA Margin expanded by more than 200 bps at 15%. PAT stood at Rs 48 crores

during the quarter, up 58% YoY compared to Rs 30 crores in Q1 FY24.

Key Conference call takeaways

- 13 new customer logo additions during the quarter with 51 new logo additions during FY24 with average deal size growing significantly in FY24.

- Launch of a new product named Newgen LumYn - a Gen AI-powered hyper-personalization platform designed specifically for the banking sector.

- 45 patent filings, 24 granted till date.

- Investment of 9% of revenues in R&D initiatives in FY24.

- Newgen recognized in Gartner® Market Guide for State and Local Government Grant Management Solutions.

- The company has reaffirmed the short-term rating of CRISIL A1 for its debt instruments.

- Significant orders - In the APAC market, a large Indonesian state bank partnered with Newgen for the Retail Loan Origination Solution, with an order value of Rs.11 cr.

- Providing Business Financing Solutions to a leading Malaysian government-owned bank, with an order value of Rs 10.6 cr.

- In the Americas market, entered into an agreement with a mid-sized commercial and retail bank for the Digital Account Opening solution for Rs.10 cr.

- Providing Fintech onboarding solution to a large bank in Qatar, order value of Rs.9.8 cr.

- Newgen is focused on horizontal product expansion, vertical offerings and geographical offerings.

- Newgen is gradually shifting to annuity based revenue model.

- The impact of seasonality on revenue is slowly diminishing. US growth is still at an early stage.

- Guidance – Management has guided for a 20% PAT Margin and 23-24% EBITDA Margin.

Outlook & valuation

Newgen Software posted steady earnings growth for the quarter ended Q1FY25. The company is keenly focusing on the innovation of its products which will contribute to more accurate and deep analysis of data. It has launched the Newgen ONE platform which is backed with a cloud-native, AI-based platform which facilitates better real-time extraction of data. Overall growth in customer base and diversity in revenue model will help the company to grow faster and more efficiently. With growing use and dependence on data in sectors like banking & financial services, insurance, etc, the company’s growth trajectory looks promising. We expect traction in the traditional market to continue. We believe that the growth momentum is likely to sustain given its strong deal bookings and pipeline, reinvestments in sales and marketing, product launches, traction in Gen AI, healthy annuity growth, partnership with insurance platform companies, and progress in establishing a GSI ecosystem. At a CMP of Rs.1004, the stock is trading at 35x FY26E. We maintain a HOLD rating on the stock.

Consolidated Financial statements

Profit & Loss statement

| Particulars (Rs. In Cr) | Q1FY25 | Q1FY24 | YoY (%) | Q4FY24 | QoQ (%) |

|---|---|---|---|---|---|

| Revenue from Operations | 315.00 | 252.00 | 25.00% | 375.00 | -16.00% |

| Total Income | 315.00 | 252.00 | 25.00% | 375.00 | -16.00% |

| Employee benefits expenses | 174.00 | 144.00 | 21.00% | 169.00 | 3.00% |

| Other Expenses | 93.00 | 75.00 | 24.00% | 84.00 | 11.00% |

| EBITDA | 48.00 | 32.00 | 49.00% | 123.00 | -61.00% |

| EBITDA Margin | 15.16% | 12.77% | 239 bps | 32.66% | (-1750 bps) |

| Depreciation & Amortization | 8.00 | 7.00 | 13.00% | 7.00 | 5.00% |

| EBIT | 40.00 | 25.00 | 58.00% | 115.00 | -65.00% |

| EBIT Margin | 12.70% | 10.06% | 264 bps | 30.69% | (-1799 bps) |

| Other Income | 23.00 | 13.00 | 80.00% | 15.00 | 50.00% |

| Finance cost | 1.00 | 1.00 | -17.00% | 1.00 | -16.00% |

| Profit before tax | 62.00 | 37.00 | 68.00% | 129.00 | -52.00% |

| Current Tax | 14.00 | 9.00 | 46.00% | 22.00 | -37.00% |

| Deferred Tax | 0.00 | -3.00 | -109.00% | 2.00 | -87.00% |

| Profit after tax | 48.00 | 30.00 | 57.00% | 105.00 | -55.00% |

| PAT Margin | 15.11% | 12.00% | 311 bps | 28.06% | (-1295 bps) |