Natco Pharma Ltd

Quarterly Result - Q4FY24

Natco Pharma Ltd

Pharmaceuticals & Drugs - Global

Current

Previous

Stock Info

Shareholding Pattern

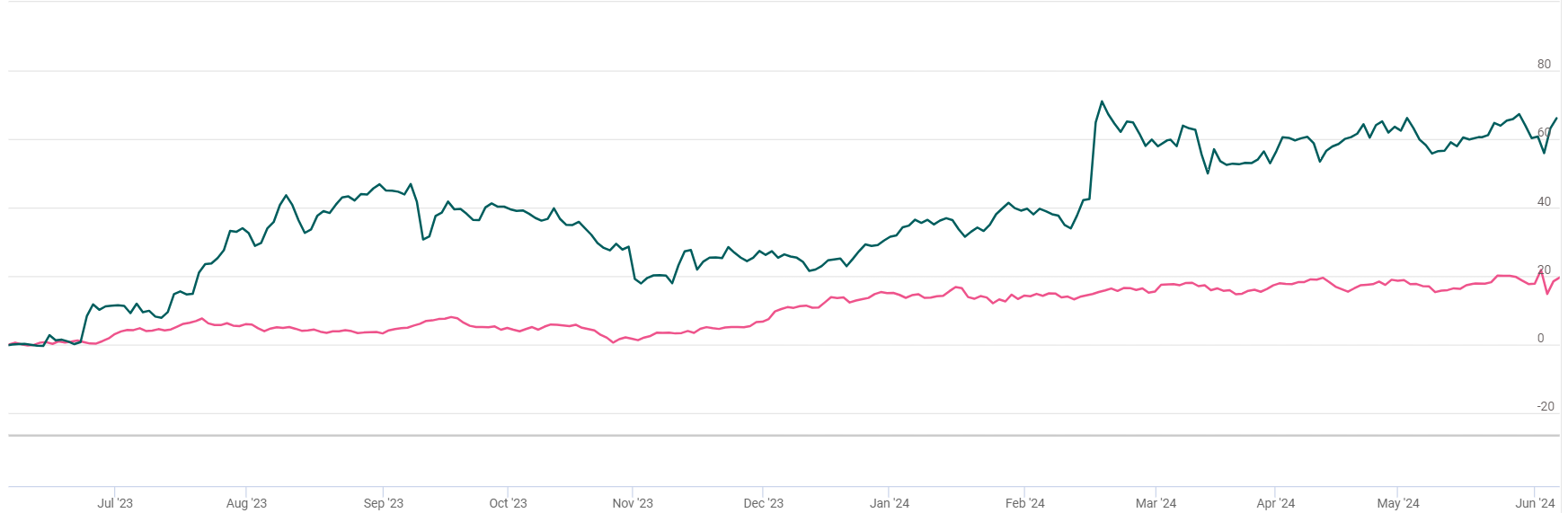

Price performance

Indexed Stock Performance

Financial Highlights:

| Particulars | Q4FY24 | Q4FY23 | YoY % | Q3FY24 | QoQ% |

|---|---|---|---|---|---|

| Total revenue from operations | 1068.00 | 898.00 | 19.00% | 759.00 | 41.00% |

| EBIDTA | 497.00 | 339.00 | 47.00% | 268.00 | 85.00% |

| EBIDTA Margin % | 47.00% | 38.00% | 877 bps | 35.00% | 1119 bps |

| PAT | 386.00 | 276.00 | 40.00% | 213.00 | 82.00% |

| EPS (Rs.) | 21.56 | 15.11 | 43.00% | 11.88 | 81.00% |

Source: Company Filings; stockaxis Research

Q4FY24 Result Highlights

Natco Pharma Ltd (NPL) experienced a strong Q4FY24, largely due to significant traction

from the anti-cancer drug gRevlimid. Revenues increased by ~19% YoY to Rs 1068 crore,

with export formulations rising by 35% to Rs 955 crore, primarily driven by gRevlimid.

Typically, sales of gRevlimid are higher in Q4 and Q1. Other segments, however,

remained weak, with API segmentdeclining by 31% to Rs 50 crore and domestic formulations

registered a degrowth by 43% to Rs 52.4 crore. EBITDA grew by 47% YoY to Rs 449

crore, with margins improving by 877 basis points, mainly due to Revlimid sales.

The improvement in gross profit margins up 1541 bps YoY to 86.5% also contributed

to the EBITDA growth. Consequently, PAT increased by 40% year-on-year to Rs 213

crore.

The company’s Total Formulations business saw a 25.8% YoY growth to Rs 1007 crores, driven by a low base in the export sector. The management anticipates a 15-18% growth in Domestic Pharma for FY25. Crop Protection sales increased to Rs 25 crores bolstered by a ramp-up in CTPR sales. Additionally, they plan to launch 2-3 unique products over the next 12-18 months. The Export Formulations business grew by 34.6% YoY to Rs 950 crores, primarily due to Revlimid. The Rest of World (RoW) markets, including Brazil and Canada, performed well, generating revenues of Rs 2.6 crores and CAD 40 million, respectively.

Conference Call Highlights

Financial

- Revenue is expected to comfortably grow by 15-20%, with PAT projected to increase by 20% in FY25.

- Management anticipates achieving Rs 300 crore in sales for crop protection within three years.

- The Red Sea crisis is not expected to have a significant impact, as most shipments are sent via air route.

- Natco Pharma Ltd is focusing on strengthening its base business through inorganic growth, primarily targeting Rest of World (RoW) markets. These markets are similar to the domestic market, featuring established brands, large and consistent distribution networks, stable earnings, and favourable valuations.

- The base business PAT is between Rs 300-350 crores, showing slight improvement, alongside other R&D expenditures.

- As of May, the company holds Rs 2000 crores in cash and Rs 116 crores in debt.

- A decision on a buyback has not yet been made.

- Other income includes Rs 30 crores from interest on deposits.

- Capex is projected at Rs 300-350 crores, primarily for maintenance and expanding capacities in existing plants.

- Despite a Q4 setback, the company believes crop protection remains viable, with FY24 sales estimated at ₹140-150 crore.

- The management will continue to explore opportunities in oligopeptides, difficult-to-manufacture generics, and Para IVs.

- The distribution and profit-sharing agreement with Teva for gRevlimid will continue beyond FY26.

Business

- Rest of World (RoW) markets are performing well, with Brazil (direct and through subsidiaries) generating USD 25-26 million in FY24, and Canada contributing USD 40 million. The company is expanding its presence in Egypt and Saudi Arabia this year.

- In the agrochemical segment, the company aimed for Rs 140-150 crore in sales but experienced sales returns due to the price sensitivity of the Indian market. Specific guidance will be provided in June 2024, with expectations for improved performance driven by new launches, including first-time generics. It is anticipated that this business will take two to three years to establish.

- Internally, there is a target to triple the agrochemical segment's performance in the next two to three years, aiming to reach Rs 300 crores.

- Future drug development is focused on innovative areas. For instance, Cellogen was acquired due to the lack of in-house expertise in CAR-T therapy, an area believed to see significant growth in oncology treatment. The company is also exploring opportunities in oligopeptides.

- The company has one New Chemical Entity (NCE) in phase 2 trials in the US, targeting a type of oral cancer, but it's still early days for this project.

- The company aims to continue finding new opportunities, focusing on niches with fewer competitors. It plans to build on products like Semaglutide, Yondelis, Olaparib, Carfilzomib, and Imbruvica, and may acquire to strengthen its base business, aiming for two First-to-File (FTF) filings in FY25.

- A migraine drug has been filed, although there were seven to eight other filers on day one, which may affect market dynamics. The company plans to file additional products this year.

- In the domestic market, there was a one-time charge, but FY24 saw Rs 400 crore in sales. The business is expected to grow 15-20% and is considered consistent without major challenges.

- Copaxone's market share remains consistent, but there has been a shift in multiple sclerosis treatment towards oral medications, leading to a decline in prescriptions.

- To de-risk operations, the company files from Vizag and occasionally uses Contract Manufacturing Organizations (CMOs). The top products are manufactured at two sites.

Outlook & valuation

Outlook & ValuationTop of Form

Natco Pharma Ltd has achieved robust revenue and PAT growth in FY24, The company is focusing on expanding its presence in both domestic and international markets. Natco’s focus on strengthening the core business is bearing fruit, evident from steady India and Agrochem ramp-up (25% growth potential). gRevlimid opportunity is turning out well, and increased investment in R&D has led to a robust US pipeline—semaglutide, olaparib, erdafitinib, etc. Agrochem is starting to show traction and domestic business is complemented by new launches. We welcome the R&D ramp-up (from 8% to 10% of revenue) given Natco’s strength in complex generics. The strong Balance Sheet provides ample scope to pursue inorganic opportunities. With base business recovering and Natco pursuing complex opportunities with gRevlimid, long term outlook appears promising. Management also sounds confident and has guided for 15-20% sales growth and 20% PAT growth in FY25 thus, reaffirms its bullish stance. At a CMP of Rs. 1010, the stock is trading at 12x FY26E. We recommend a HOLD rating on the stock.

Consolidated Financial statements

Profit & Loss statement

| Particulars | Q4FY24 | Q4FY23 | YoY % | Q3FY24 | QoQ% |

|---|---|---|---|---|---|

| Total revenue from operations | 1068.00 | 898.00 | 19.00% | 759.00 | 41.00% |

| COGS | 143.00 | 258.00 | -45.00% | 162.00 | -12.00% |

| Gross profit | 926.00 | 640.00 | 45.00% | 596.00 | 55.00% |

| Gross profit margin | 87.00% | 71.00% | 1541 bps | 79.00% | 801 bps |

| Employee cost | 143.00 | 119.00 | 20.00% | 122.00 | 17.00% |

| Other exp | 286.00 | 182.00 | 58.00% | 206.00 | 39.00% |

| EBIDTA | 497.00 | 339.00 | 47.00% | 268.00 | 85.00% |

| EBIDTA Margin % | 47.00% | 38.00% | 877 bps | 35.00% | 1119 bps |

| Depreciation exp | 56.00 | 41.00 | 35.00% | 44.00 | 26.00% |

| EBIT | 442.00 | 298.00 | 48.00% | 224.00 | 97.00% |

| Finance cost | 6.00 | 3.00 | 130.00% | 5.00 | 35.00% |

| Other income | 42.00 | 29.00 | 45.00% | 37.00 | 14.00% |

| PBT | 477.00 | 324.00 | 47.00% | 256.00 | 86.00% |

| Tax | 91.00 | 49.00 | 88.00% | 44.00 | 109.00% |

| PAT | 386.00 | 276.00 | 40.00% | 213.00 | 82.00% |

| PAT Margin | 36.00% | 31.00% | 543 bps | 28.00% | 810 bps |

| EPS (Rs.) | 21.56 | 15.11 | 43.00% | 11.88 | 81.00% |