Inox India Ltd

Quarterly Result - Q4FY24

Inox India Ltd

Engineering - Industrial Equipments

Current

Previous

Stock Info

Shareholding Pattern

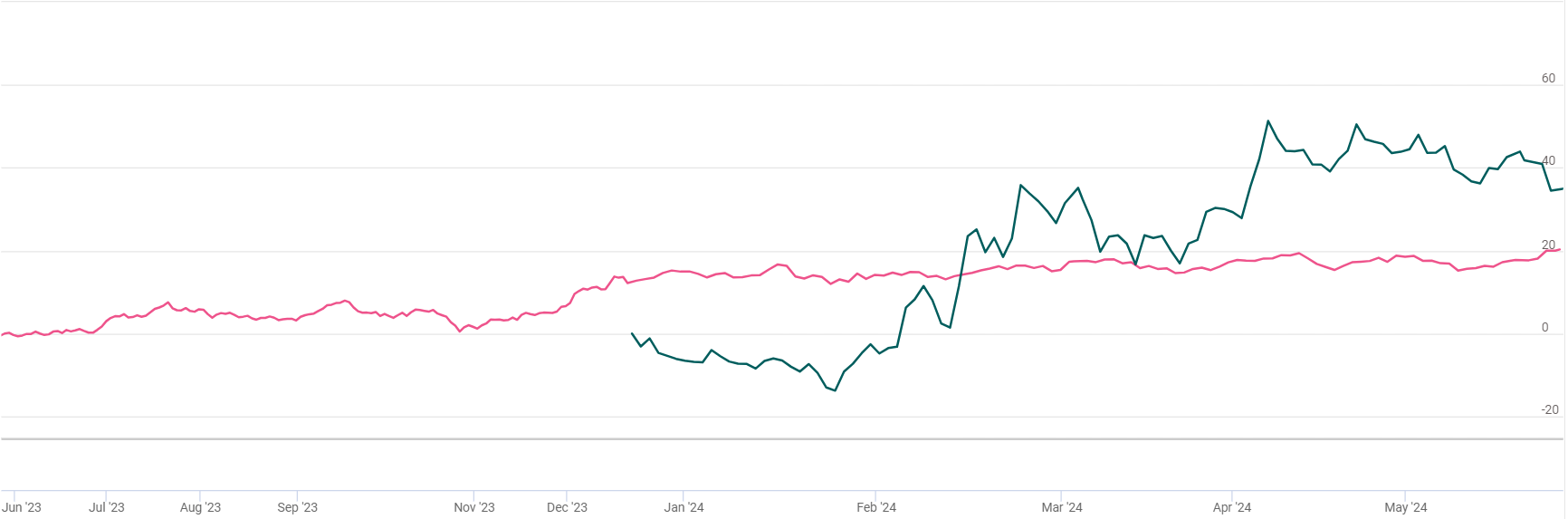

Price performance

Indexed Stock Performance

Financial Highlights:

| Particulars | Q4FY24 | Q4FY23 | YoY % | Q3FY24 | QoQ% |

|---|---|---|---|---|---|

| Total revenue from operations | 276.00 | 235.00 | 17.00% | 290.00 | -4.90% |

| EBIDTA | 53.00 | 40.00 | 33.00% | 67.00 | -20.00% |

| EBIDTA Margin % | 19.00% | 17.00% | 224 bps | 23.00% | (369) bps |

| PAT | 44.00 | 31.00 | 44.00% | 49.00 | -9.00% |

| EPS (Rs.) | 5.00 | 3.00 | 44.00% | 5.00 | -9.00% |

Source: Company Filings; stockaxis Research

Q4FY24 Result Highlights

Inox India Ltd delivered steady growth for the quarter ended Q4FY24. Inox India

had witnessed robust growth driven by strategic partnerships, expanding market presence

in LNG and hydrogen sectors, and maintaining strong EBITDA margins, supported by

a solid order backlog and efficient execution of new projects. Inox India’s

Consolidated revenue registered a growth of 17% YoY at Rs. 276 cr YoY in Q4FY24

as compared to Rs.235 cr in the same quarter of the corresponding fiscal. Consolidated

EBITDA surged by 33% YoY to Rs.53 cr YoY. EBITDA margin was 19%, a sharp 224 bps

increase from 17% in Q4FY23 due to a decrease in COGS of 801 bps. Overall, the impact

was partially offset by an increase in employees and other expenses. Higher other

expenses in Q4 FY24 were primarily due to a book provision for debtors, as required

by Indian guidelines, amounting to ~1 crore rupees. During the quarter, the PAT

was at Rs. 44 crores, a growth of 44% from Rs. 31 crores in Q4FY23. Export revenue

in Q4 was Rs. 74 crores.

The company's other expenses increased by 30%, mainly due to one-off expenses related to the Savli project. Going forward, it is estimated that these expenses will stabilize at around Rs. 70 to Rs. 75 crores.

Robust Performance Across Business Divisions

Record Order Booking: In Q4 FY24, the company recorded its highest-ever

order booking of Rs. 1,193 Crores, marking a 14% YoY increase. Order inflow stood

at Rs. 309 Crores, up by 84% YoY.

Order Backlog: As of FY24, the company achieved its highest-ever order backlog of Rs. 1,087 Crores, with a distribution as follows:

- 55% from Industrial Gas

- 20% from LNG

- 25% from the Cryo Scientific Division

Geographical Distribution:

- Domestic: 48%

- Export: 52%

Growing Total Income: Over the years, total income has grown significantly, with the following contributions:

- Industrial Gas: 63%

- LNG: 28%

- Cryo Scientific Division: 7%

- Others: 2%

Key developments in each of the business divisions

- Industrial Gas (IG) registered quarterly revenue of Rs. 161 crore and full year revenue of Rs.732 crore, contributing ~63% of the total income.

- The LNG division registered quarterly revenue of ₹ 74 crore and full year revenue of ₹ 320 crore, contributing ~28% of the total income.

- Cryo Scientific (CSD) registered quarterly revenue of ₹ 42 crore and full year revenue of ₹ 79 crore, contributing ~7% of the revenue.

Other Key Highlights during the financial year

- Join hands with Adani Total Gas to strengthen the LNG ecosystem in India.

- Inauguration of a new plant at Savli for manufacturing of Stainless-Steel Keg.

- Signs MOU with IUAC for Development of Superconducting Magnet based Systems.

- Order received from Adani Total Gas for 5 LNG Fueling stations.

- High-Value order received for LIN Storage & Vaporiser system from Petrochemical industry for Gulf country.

- First dispatch of UN Portable T21 Storage tank for aluminium alkyl

Key Conference Call Takeaways

Key Developments in FY24

- Commissioned a new plant at Savli, Gujarat within 6 months.

- Received revalidation and approvals from ASME, DOT-US, EN, NSF Certification.

- Developed new products for Hydrogen, Helium, and LNG markets.

- Received several engineering system projects for IG and LNG business.

- Actively participating in various public sector tenders and engaging with private customers for LNG infrastructure.

LNG

- Growth Drivers: LNG growth is primarily driven by increasing demand from Asian countries such as China, India, South Korea, Pakistan, and Bangladesh, these are transitioning from energy sources like coal and crude oil to nuclear and gas.

- Market Expansion: Commissioning several LNG stations for CGD companies, winning key orders, and signing MOUs to strengthen the LNG ecosystem in India, highlighting a growing market for LNG fuelling stations and tanks. With the stabilization of the LNG prices, the market for LNG Fuelling Stations, LCNG Stations & LNG Fuel Tanks for vehicles would continue to grow in India.

- Enabling Growth: Significant orders have been received from major companies such as IOCL, BPCL, and HPCL. Notably, over 60% of the tanks supplied for stationary and trailer-mounted mobile LNG applications in India have been provided, demonstrating a strong market presence and capability in this sector.

- During the year, the company has installed and commissioned large LNG Satellite Stations for key industry players.

- During the year, the company has successfully increased its footprint in Central America and Caribbean area substantially by commissioning several LNG Satellite Stations to meet the clean fuel.

Hydrogen

- Growth Drivers: The need for large-scale movement of liquid hydrogen is driving growth in this sector. Additionally, the proposed launch of the National Hydrogen Mission is set to further stimulate demand. Key industries benefiting from hydrogen include refining, ammonia, and methanol production.

- Enabling Growth: As the first Indian company to manufacture trailer-mounted hydrogen transport tanks, designed in collaboration with ISRO, the company has achieved a significant milestone. Additionally, liquid hydrogen tanks have been produced and supplied to two customers in South Korea, showcasing a growing international footprint.

Orderbook position: Order backlog of Rs. 1,087 crores as of March 2024, with 55% orders from IG, 20% from LNG, and 25% from CSD division, and a comfortable cash position of Rs. 253 crores after incurring a capex of Rs. 100 crores. During FY24, the order inflow was at ₹. 1,193 Cr, up by 14% YoY.

Order Book Targets: Achieved a 14% growth in order bookings, with a strong focus on LNG market opportunities, expecting projects delayed from Q4 to materialize in Q1/Q2 of the current year.

Top-line Growth for FY25 and Outlook: Expect to see mid-teen or high-teen growth, driven by new orders and swift execution, particularly for products with short lead times like disposable cylinders and new stainless steel container lines. Confidence in achieving 20% growth remains high, driven by strong growth in LNG, cryo-synthetic, and hydrogen divisions.

Export Order Book: Despite a 13% decrease, the export market remains strong. Variations in order size contribute to fluctuations, but the annual average export percentage remains around 55%.

Capex Plans: Planning a total Capex of 100 crores for the next year, with 80 crores allocated to expanding the Savli plant and the remainder for maintenance and other plant-related expenditures. All Capex to be funded internally. Capex for other plants is around Rs. 20-25 Crores.

Beverage Kegs Revenue and Scale-up: Sold 16 crores worth of kegs last year, with plans to dispatch 200,000 cylinders this year, translating to an expected revenue of Rs. 80 to 100 crores.

Disposable Cylinders Sales: Sales in FY24 were Rs. 98 crores, with a positive outlook for FY25 due to winning the anti-dumping case, expecting sales to reach around Rs. 150-160 crores, driven by increased demand for refrigerant gases and helium cylinders.

Working Capital Increase: The increase in working capital in FY24 was attributed to large orders from entities like Eater and government companies, which had minimal or delayed advances compared to private customers. Advances from customers are reduced as a result.

Zero Anti-Dumping Duties

Inox India has been granted a zero percent anti-dumping duty by the U.S. DOC, compared

to competitors who face an 8 percent plus duty, giving Inox India a competitive

advantage in the U.S. market. Expecting an increase in orders from the U.S. market,

enhancing Inox India's revenue potential in the disposable cylinders segment.

Strategic Partnership with Adani for LNG and Hydrogen

- MoU with Adani: Secures preferential treatment for all LNG and hydrogen needs.

- Adani's Plans: Establishing numerous LNG fuelling and LCNG stations; converting cement and mining trucks to LNG; implementing hydrogen fuel tanks and stations.

- Initial Projects: Five fuelling stations to be installed along the Golden Quadrilateral.

- Market Expansion: Over 50 LNG stations to become operational in the next 2-3 months.

- Growth Potential: Strong market growth driven by strategic partnership and infrastructure expansion.

- Signs MOU with IUAC for Development of Superconducting Magnet based Systems

- High Value order received for LIN Storage & Vaporiser system from the Petrochemical industry for Gulf country.

- First dispatch of UN Portable T21 Storage tank for aluminium alkyl.

Future Outlook

- Expecting growth in LNG market with projects coming up and growth in the export market.

- Positive outlook for hydrogen market with the National Green Hydrogen Mission.

- Focus on green energy initiatives to reduce carbon footprint.

- Strong order book and potential for mid-to-high-teens top-line growth in FY25.

- Expecting growth in industrial gas, LNG, and Cryo Scientific divisions.

- Confident about maintaining EBITDA levels in the range of 21% to 24%.

- Engaged in discussions with major conglomerates for hydrogen and LNG requirements.

- Expresses confidence in surpassing current sales targets and aiming for higher growth over the next three years, indicating ambitious growth aspirations for the company.

Outlook & valuation

Inox India has over 30 years of experience offering solutions across design, engineering, manufacturing, and installation of equipment and systems for cryogenic conditions. The demand for cryogenic equipment across geographies is expected to be driven by the increased demand for cleaner fuels such as LNG and hydrogen due to the global focus on reducing carbon emissions from conventional energy sources. Citing strong growth prospects, marquee relationship with its customers, superior return ratios, strong financial performance, healthy demand, robust order book, strong product portfolio catering to different segments, diversified customer base, no competition, and attractive valuations, Inox India is well positioned to capture this global market growth with in-house technology as well as LNG product range that includes the entire value chain. In hydrogen, its engineering teams are developing products and systems in complex industry environments like hydrogen storage, transportation, and distribution to address the need for large-scale movements of liquid hydrogen.

INOX India experienced a decrease in margins due to initial expenses incurred at its recently established facility. This new facility is expected to double the company's production capacity. In the future, we anticipate that margins will revert back to their usual levels. Additionally, we anticipate that revenues will receive a significant boost from the elimination of custom duty on disposable cylinders; and the commencement of beverage keg business. Going forward, Inox India anticipates mid-to-high-teens top-line growth in FY25, driven by a strong order book and traction in its industrial gas, LNG, and Cryo Scientific divisions. The company's focus on green energy initiatives, along with its optimistic outlook for the LNG and hydrogen markets, positions it well for future growth. At a CMP of Rs.1333, the stock is trading at 40x FY26E. We recommend a HOLD rating on the stock.

Consolidated Financial statements

Profit & Loss statement

| Particulars | Q4FY24 | Q4FY23 | YoY % | Q3FY24 | QoQ% |

|---|---|---|---|---|---|

| Total revenue from operations | 276.00 | 235.00 | 17.00% | 290.00 | -4.90% |

| COGS | 99.00 | 103.00 | -4.00% | 128.00 | -23.00% |

| Gross profit | 177.00 | 132.00 | 34.00% | 162.00 | 9.00% |

| Gross profit margin | 64.00% | 56.00% | 801 bps | 56.00% | 834 bps |

| Employee cost | 32.00 | 21.00 | 54.00% | 25.00 | 28.00% |

| Other exp | 92.00 | 71.00 | 29.00% | 70.00 | 30.00% |

| EBIDTA | 53.00 | 40.00 | 33.00% | 67.00 | -20.00% |

| EBIDTA Margin % | 19.00% | 17.00% | 224 bps | 23.00% | (369) bps |

| Depreciation exp | 5.00 | 3.00 | 49.00% | 5.00 | -1.00% |

| EBIT | 48.00 | 37.00 | 31.00% | 61.00 | -22.00% |

| Finance cost | 2.00 | 2.00 | -26.00% | 2.00 | -33.00% |

| Other income | 11.00 | 6.00 | 73.00% | 5.00 | 137.00% |

| PBT | 58.00 | 41.00 | 41.00% | 64.00 | -10.00% |

| Tax | 14.00 | 10.00 | 31.00% | 15.00 | -11.00% |

| PAT | 44.00 | 31.00 | 44.00% | 49.00 | -9.00% |

| PAT Margin | 16.00% | 13.00% | 295 bps | 17.00% | (77) bps |

| EPS (Rs.) | 5.00 | 3.00 | 44.00% | 5.00 | -9.00% |