Bharat Petroleum Corporation Ltd

Quarterly Result - Q1FY25

Bharat Petroleum Corporation Ltd

Refineries

Current

Previous

Stock Info

Shareholding Pattern

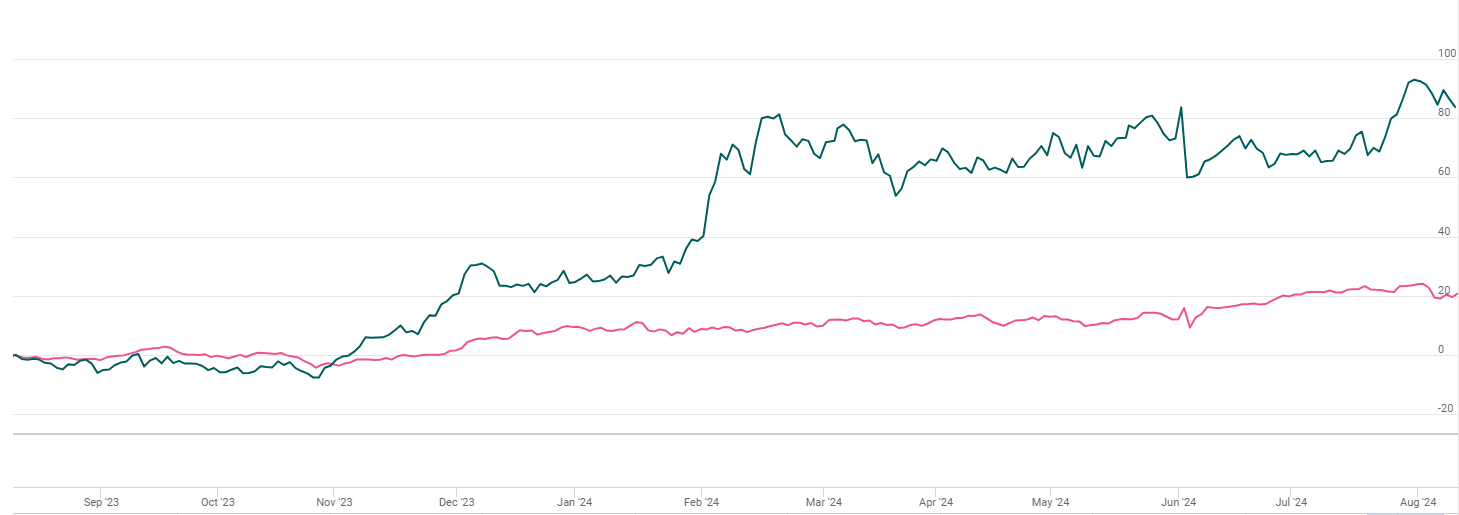

Price performance

Indexed Stock Performance

Financial Highlights:

| Particulars (In Cr.) | Q1FY25 | Q1FY24 | YoY % | Q4FY24 | QoQ % |

|---|---|---|---|---|---|

| Net Sales | 113095.00 | 112985.00 | 0.10% | 116555.00 | -2.97% |

| EBITDA | 5626.00 | 15784.00 | -64.36% | 9158.00 | -38.57% |

| EBITDA Margin% | 4.97% | 13.97% | (900) bps | 7.86% | (289) bps |

| Profit After Tax | 2841.00 | 10644.00 | -73.31% | 4789.00 | -40.68% |

| EPS | 6.65 | 25.00 | -73.40% | 11.23 | -40.78% |

Source: Company Filings; stockaxis Research

Q1FY25 Result Highlights

Bharat Petroleum Corporation Ltd (BPCL) reported lower-than-expected earnings for

the quarter ended Q1FY25 on account of weak refining and gross marketing margins.

Consolidated Revenue stood flat at Rs.1,13,095 cr YoY. BPCL’s operating profit

fell 38.7% QoQ and 64% YoY to Rs.5626 cr on account of weak refining and gross marketing

margins. EBITDA margin contracted by 900 bps and stood at 5%. PAT exhibited a significant

YoY decline of 73% YoY and a 41% sequential decline due to weak gross refining margins

(GRMs) and higher crude oil prices due to geopolitical tensions. The average Gross

Refining Margin (GRM) for the quarter ended Q1FY25, was USD 7.9 per barrel, compared

to USD 12.64 per barrel in the same period last corresponding fiscal. Refining throughput

stood at 10.11 mmt compared to 10.36 MMT last year. Reported GRM came in at US$7.9/bbl.

Singapore GRM continues to remain weak in the current quarter and is averaging at

US$4/bbl.

On the marketing front, BPCL achieved a quarterly sales volume of 13.16 MMT during the June quarter, up from 12.75 MMT last year. The increase in sales was mainly driven by petrol with a growth of 6.38 percent, while sales of LPG and aviation turbine fuel (ATF) increased by 4.45 percent and 14.53 percent, respectively. Implied gross marketing margins came in at Rs4.8/ltr. Marketing inventory gain was Rs4bn in Q1. On a YoY basis, marketing margins fell sharply by 48% owing to higher international petrol and diesel prices. In the current quarter, marketing margins on petrol/diesel are averaging at Rs7.2/2.7/ltr.

Conference Call Highlights

- The company expects annualized growth in petrol to be 5% and diesel to be around 1.5%-2%.

- The current quarter saw a significant fall in international product cracks on a QoQ basis. Despite this, refineries recorded a GRM of USD7.86/bbl which is higher than Singapore's GRM.

- Domestic market sales share grew by 3.2% YoY.

- The company commissioned about 170 plus new retail outlets and 41 CNG retail outlets.

- 200 Klpd bioethanol plant at Bargarh, Orissa is nearing completion and should be commissioned soon.

- Capex guidance for FY25 is Rs164bn (refinery/petchem-Rs43bn, E&P-Rs22.5bn, marketing infrastructure-Rs71bn, CGD-Rs28bn) and capex incurred in Q1 was Rs26bn.

- Announced plans will take refining capacity to 45 MMT, however, the company is exploring additional capacity beyond 45 MMT.

- Total debt is Rs.427 bn on the group level and surplus cash is Rs.150 bn

- Mozambique cost escalation due to delay is USD 3-4 bn. Therefore, the total capex is expected to be USD 19 bn.

- Refining margins are still at good levels as they are better than the 10-year average. Cracks will improve in the coming quarters.

- By FY28-29, after all projects are completed, profits should see a substantial growth.

- A cumulative investment to date in BPRL is around Rs.370 bn.

- For Bina expansion, the expected capex is Rs.490 bn. It is an integrated project. Capex in the current year will only be Rs.20 bn and is expected to be commissioned by FY28-29, but major milestones have been achieved.

- Freight rates are comparatively better.

- BPCL added 171 new ROs in Q1 and achieved ethanol blending of 14.13%.

- Russian crude accounted for 39% of the throughput with a discount of US$3.5-4/bbl.

- Kochi refinery will go for a planned turnaround for 45 days in Sept-Oct. Similarly, the Bina refinery is to go for 15 days turnaround in Aug-Sept.

Outlook & valuation

BPCL delivered Q1 earnings below estimates due to weak gross refining margins (GRMs) and higher crude oil prices. BPCL’s focus on expanding its retail network, particularly in the LPG segment, and its strategic investments in refining, petrochemicals, and clean energy indicate a positive outlook for future growth. BPCL’s capex plans under Project Aspire, targeting Net Zero Scope 1 & 2 emissions by 2040, demonstrate its commitment to sustainability and future readiness. The company’s focus on expanding its refining capacity, diversifying its gas sourcing, and investing in renewable energy projects aligns well with global trends toward cleaner energy sources. This strategic direction positions BPCL to capitalize on future opportunities in the energy transition. Overall, BPCL’s strong market position, diversified business portfolio, and strategic investments in growth areas make it an attractive proposition.

We remain constructive on BPCL as a steady marketing outlook, stable crude oil prices, and a healthy refining environment is likely to augur well for the company. BPCL’s GRM has been at a premium to Singapore GRM on account of continuous optimization of refinery production, product distribution, and crude procurement. The advanced processing capabilities of Bina and Kochi refineries allow for the processing of 100% of high Sulphur crude and 50% Russian crude. GRMs have marginally improved after a setback in the previous quarter. We feel that the weakness in the Singapore GRM is only temporary and should normalize to its long term average of USD 5-6/bbl. BPCL’s refining performance continues to be superior relative to its peers. At a CMP of Rs 313, the stock is trading at an EV/EBITDA of 6.24x FY26E. We maintain HOLD rating on the stock.

Consolidated Financial statements

Profit & Loss statement

| Particulars (In Cr.) | Q1FY25 | Q1FY24 | YoY % | Q4FY24 | QoQ % |

|---|---|---|---|---|---|

| Revenue from Operations | 128106.00 | 128264.00 | -0.12% | 132087.00 | -3.01% |

| Excise Duty | 15011.00 | 15279.00 | -1.75% | 15532.00 | -3.35% |

| Net Sales | 113095.00 | 112985.00 | 0.10% | 116555.00 | -2.97% |

| COGS | 100610.00 | 90889.00 | 10.70% | 99543.00 | 1.07% |

| Gross Profit | 12485.00 | 22096.00 | -43.50% | 17012.00 | -26.61% |

| Gross Profit Margin | 11.04% | 19.56% | (850)bps | 14.60% | (356) bps |

| Employee Cost | 786.00 | 888.00 | -11.49% | 855.00 | -8.07% |

| Other exp | 6073.00 | 5424.00 | 11.97% | 6999.00 | -13.23% |

| EBITDA | 5626.00 | 15784.00 | -64.36% | 9158.00 | -38.57% |

| EBITDA Margin% | 4.97% | 13.97% | (900) bps | 7.86% | (289) bps |

| Depreciation and Amortization Expenses | 1686.00 | 1614.00 | 4.46% | 1722.00 | -2.09% |

| EBIT | 3940.00 | 14170.00 | -72.19% | 7436.00 | -47.01% |

| EBIT Margin % | 3.48% | 12.54% | (906) bps | 6.38% | (290) bps |

| Finance Costs | 889.00 | 1071.00 | -16.99% | 967.00 | -8.07% |

| Other Income | 570.00 | 562.00 | 1.42% | 507.00 | 12.43% |

| Profit from continuing operations before share of profit of equity accounted investees and income tax | 3621.00 | 13661.00 | -73.49% | 6976.00 | -48.09% |

| Share of profit/(loss) of equity accounted investees | 379.00 | 477.00 | -20.55% | -203.00 | - |

| Exceptional Items | 142.00 | 36.00 | 294.44% | 104.00 | 36.54% |

| Profit Before Tax | 3858.00 | 14102.00 | -72.64% | 6669.00 | -42.15% |

| Tax | 1017.00 | 3458.00 | -70.59% | 1880.00 | -45.90% |

| Profit After Tax | 2841.00 | 10644.00 | -73.31% | 4789.00 | -40.68% |

| PAT Margin | 2.51% | 9.42% | (691) bps | 4.11% | (160) bps |

| EPS | 6.65 | 25.00 | -73.40% | 11.23 | -40.78% |