Axis Bank Ltd

Quarterly Result - Q4FY24

Axis Bank Ltd

Bank - Private

Current

Previous

Stock Info

Shareholding Pattern

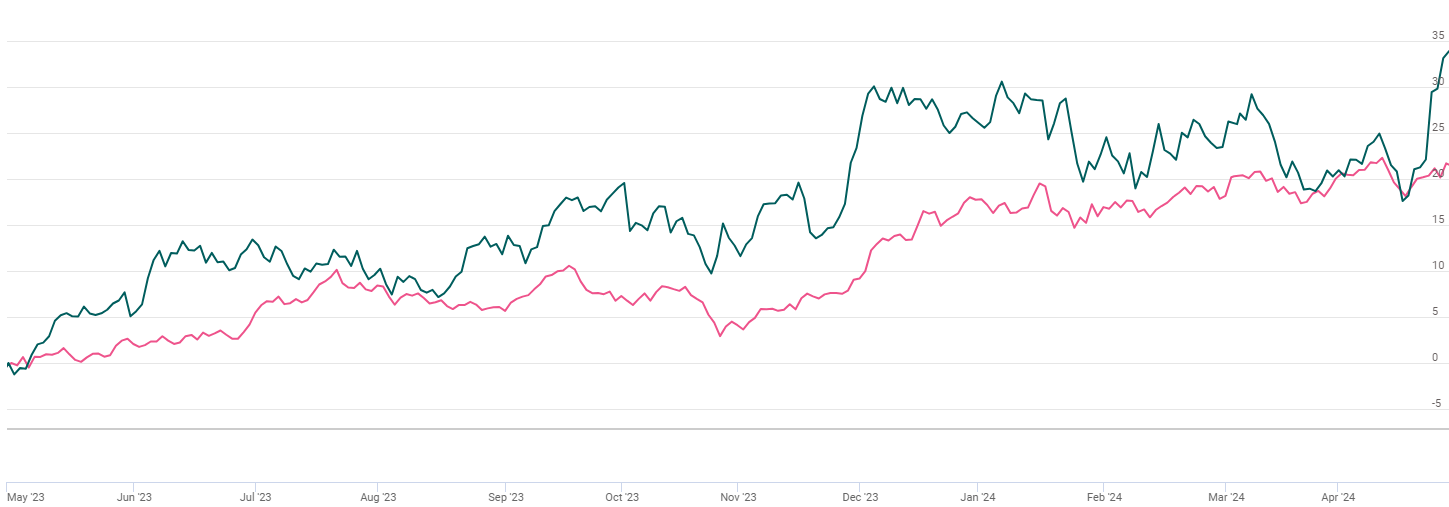

Price performance

Indexed Stock Performance

Financial Highlights:

| Particulars (Rs. In cr) | Q4FY24 | Q4FY23 | YoY (%) | Q3FY24 | QoQ (%) |

|---|---|---|---|---|---|

| Net Interest Income | 13089.00 | 11742.00 | 11.00% | 12532.00 | 4.00% |

| NIM (%) | 4.06% | 4.22% | -4.00% | 4.01% | 1.00% |

| Cost To Income Ratio (%) | 47.00% | 45.00% | 5.00% | 49.00% | -5.00% |

| Pre-Provisioning operating Profit | 10534.00 | 9167.00 | 15.00% | 9142.00 | 15.00% |

| Profit Before Tax | 9350.00 | 8861.00 | 6.00% | 8114.00 | 15.00% |

| PAT | 7129.00 | 6625.00 | 8.00% | 6072.00 | 17.00% |

Source: Company Filings; stockaxis Research

Q4FY24 Result Highlights

Axis Bank’s (AXSB) Q4FY24 earnings surpassed street expectations across all its key parameters. In the fourth quarter of FY24, AXSB saw a 17.4% increase in its Profit After Tax (PAT) compared to the previous quarter, reaching Rs.7,130 Crores. This growth was supported by strong other income and margin improvement, although it was partially offset by higher provisions. Net Interest Income (NII) grew by 11% year-on-year (YoY) and 4% (QoQ) to Rs.13,089 Crores. The Bank’s operating profit for the quarter stood at Rs.10,536 crores, grew 15% YoY and 15% QOQ. Core Operating profit for Q4FY24 at Rs.9,515 crores, grew 5% YOY and 8% QOQ. NIMs increased by 5 bps q-o-q led by continued loan mix change and reduction in the RIDF book. Yield on IEA improved by 11 bps q-o-q offsetting an increase in COF by 8 bps q-o-q. Loan growth grew by 14% YoY and 4% QoQ to Rs.9,651 cr.

Regarding asset quality, new slippages decreased to Rs.34.7 billion compared to INR 37.2 billion in the previous quarter. The Gross Non-Performing Assets (GNPA) ratio improved by 15 bps QoQ to 1.43%, while the Net NPA ratio declined to 0.31%. The Provision Coverage Ratio (PCR) improved to 78.5%. Annualized slippages were lower at 1.6% vs 1.8% q-o-q. The restructured book stood at 0.16% of advances versus 0.18% q-o-q. The ‘BB and below’ rated book increased marginally to Rs.5,131 crore vs Rs.5,034 crore q-o-q. Gross slippages were reported at Rs. 3,471 crores versus Rs.3,715 crore q-o-q. Recoveries and upgrades stood at Rs.2,155 crores versus Rs.2598 crore q-o-q. Write-offs were at Rs.2,082 crores versus Rs.1981 crore q-o-q. Operating expenses grew by 25% YoY and 4% QoQ to Rs.9,319 cr due to higher staff expenses offset by lower other opex.

Advances displayed impressive growth of 14%/4% to Rs.9,65,068 cr. Deposit growth was also healthy at 13% to Rs.10,68,641 cr. The growth was mainly paced due to the traction in the term deposits as the non-recurring term deposits increased by 13.3% QoQ/34.2% YoY while recurring term deposits grew by 3.4% QoQ/16.1% YoY. The bank’s CASA ratio was 43%, improving marginally on a sequential basis by 85bps QoQ while declining on a YoY basis by 417bps. ROA stood at 2%. Retail loans and SME books grew by 20% y-o-y / 17% y-o-y, respectively. In the retail segment, home loans, LAP, personal loans, credit cards, and rural loans grew 5%, 25%, 31%, 30%, and 30%, respectively, on a y-o-y basis. Within retail, growth was stronger in segments such as small business banking, personal loans, rural loans, and LAP. Corporate loans grew 3% y-o-y. 89% of the corporate book is now rated ‘A and above’ with 88% of incremental sanctions being to corporates rated A- and above. Average LCR was ~120% stable q-o-q.

Other Income Fee income for Q4FY24 grew 23% YOY and 9% QOQ to Rs. 5,637 crores. Retail fees grew 33% YoY and 12% QoQ and constituted 74% of the Bank’s total fee income. Retail cards and payment fees grew 39% YoY and 4% QOQ. Retail Assets (excluding cards and payments) fee grew 20% YoY. Fees from Third Party Products grew 59% YoY and 44% QoQ. The Corporate & Commercial banking fees together grew 2% YoY to Rs.1,478 crores. The trading income gain for the quarter stood at Rs. 1,021 crores; miscellaneous income in Q4FY24 stood at Rs. 107 crores. Overall, non-interest income (comprising of fee, trading, and miscellaneous income) for Q4FY24 grew 41% YoY and 22% QoQ to Rs. 6,766 crores.

Provision and contingencies for Q4FY24 stood at Rs.1,185 crores. Specific loan loss provisions for Q4FY24 stood at Rs. 832 crores. The Bank has not utilized Covid provisions during the quarter and these are reclassified to other provisions. The Bank holds cumulative provisions (standard + additional other than NPA) of Rs.12,134 crores at the end of Q4FY24. Credit cost for the quarter ended 31st March 2024 stood at 0.32%.

Conference Call Highlights:

Stability in Net Interest Margin (NIM) and Net Interest Income (NII):

The call highlighted that there were no one-off items affecting NIM and NII, reflecting

a disciplined strategy. The bank assured stakeholders that various mechanisms are

in place to uphold margins, with no intention of erosion. NIM has improved due to

certain factors including better loan mix and better execution.

Trading Gains and Margin Maintenance:

Trading gains were attributed to Debt Capital Markets (DCM), treasury activities,

and the reversal of Mark-to-Market (MTM) losses from the previous quarter. The bank

emphasized its commitment to maintaining the cost-to-assets ratio of Return on Equity

(RoE) stays above 18%.

Deposit Growth Strategy:

The call discussed the bank's continued success in deposit mobilization, with

momentum expected to carry into the next fiscal year. It noted strong growth in

retail deposits, contributing to improved Liquidity Coverage Ratio (LCR) outflow

rates.

Fee Income and Fintech Partnerships:

Significant fee income was reported, mainly derived from granular retail and transaction

banking. The bank highlighted its partnerships with fintech firms to enhance customer

experience and leverage new-age tech platforms.

Operational Performance:

The bank reported a strong operating performance in the fourth quarter, with NIM

reaching 4.07% and the Cost-to-Income (C/I) ratio declining by 229 basis points

(bp) quarter-on-quarter. It also mentioned significant branch network expansion,

surpassing 5,000 branches.

Asset Quality and Portfolio Metrics:

There was a positive trend in asset quality, with Gross Non-Performing Assets (GNPA)

improving by 15bp quarter-on-quarter (QoQ) to 1.43%, while the net NPA remained

stable at 0.3%. The successful completion of the migration from Citi systems was

highlighted, with portfolio metrics aligning with projections.

Loan Book Management and Trading Gains:

The bank acknowledged that deposit growth might temporarily constrain loan book

expansion in the near term. It also mentioned trading gains sourced from DCM, treasury

activities, and reversal of MTM losses from the previous quarter.

Cost Management and Strategic Outlook:

Continued investment in the franchise was assured if RoE targets were met. The bank

anticipated outpacing industry growth in deposits by 300-400bp in the medium to

long term.

Overall Assessment:

The bank emphasized its commitment to sustainable growth while maintaining flexibility

in upcoming quarters. It expects alignment and convergence between credit and deposits

to drive future expansion.

Citi Integration:

Citi integration is on track, and the bank is inching towards the final milestone

in the next six months.

Advances:

Foresee system credit growth to converge with system deposit growth at 13% for FY25.

In the medium to long term (3-5 years), the bank’s advances are likely to

grow by 300-400bps higher than the system (earlier, the bank had guidance of 400-600bps

higher than the system). In the short term, deposit growth will drive advanced growth

for the system.

Outlook & valuation

In the fourth quarter of FY24, AXSB exceeded earnings expectations, buoyed by robust other income and margin improvement. Net Interest Margins (NIMs) saw a 5 basis points (bp) improvement quarter-on-quarter (QoQ), aided by a favorable asset mix and the controlled uptick in funding costs. Despite elevated provisions dedicated to bolstering the Provision Coverage Ratio (PCR), asset quality remained robust. The bank has reaffirmed its guidance of outpacing system growth by 300-400 basis points (bp) over the medium term. It intends to persist in business investments, leveraging controlled credit costs, which is expected to maintain the cost-to-assets ratio at around 2.5% by the end of FY25. However, the key monitorable should be the constrained credit growth due to an elevated Credit Deposit (CD) ratio and the potential impact on margins from ongoing deposit repricing. Despite maintaining a healthy Liquidity Coverage Ratio (LCR) of 120% with industry-leading outflow rates, the influence of a surge in non-retail deposits warrants monitoring in subsequent quarters. Overall, AXSB's resilient performance, coupled with its strategic focus on retail expansion and prudent cost management, underscores a positive outlook for the company's valuation and prospects.

The bank has made structural changes in the loan mix, funding franchise, and asset optimization, suggesting improved ‘through the cycle’ NIM. With a sharper focus on better yielding products and term deposits re-pricing mostly done, Axis appears relatively better positioned to cushion NIM. While the reported CET 1 (13.74%) is reasonably strong and internal accruals remain robust, we believe additional capital buffer would enhance future growth trajectory. Axis Bank is looking for a sustainable growth path with granularity in the balance sheet mix. The investment thesis remains strong for Axis Bank, led by sustained improvement in the business franchise. The balance sheet mix has significantly improved for the bank, which we believe is positive for its profitability and sustainable growth going forward. At CMP of Rs.1130, the stock is trading at 1.7x P/BV of FY26E. We maintain a Hold rating on the stock.

Standalone Financial statements

Profit & Loss statement

| Particulars (Rs. In cr) | Q4FY24 | Q4FY23 | YoY (%) | Q3FY24 | QoQ (%) |

|---|---|---|---|---|---|

| Interest Income | 29225.00 | 23970.00 | 22.00% | 27961.00 | 5.00% |

| Interest Expended | 16136.00 | 12228.00 | 32.00% | 15429.00 | 5.00% |

| Net Interest Income | 13089.00 | 11742.00 | 11.00% | 12532.00 | 4.00% |

| NIM (%) | 4.06% | 4.22% | -4.00% | 4.01% | 1.00% |

| Core Fee Income | 5637.00 | 4569.00 | 23.00% | 5170.00 | 9.00% |

| Other Income | 1128.00 | 326.00 | 246.00% | 385.00 | 193.00% |

| Net Income | 19854.00 | 16637.00 | 19.00% | 18087.00 | 10.00% |

| Employee Expenses | 2924.00 | 2164.00 | 35.00% | 2711.00 | 8.00% |

| Other Opex | 6396.00 | 5306.00 | 21.00% | 6234.00 | 3.00% |

| Total Opex | 9320.00 | 7470.00 | 25.00% | 8945.00 | 4.00% |

| Cost To Income Ratio (%) | 47.00% | 45.00% | 5.00% | 49.00% | -5.00% |

| Pre-Provisioning operating Profit | 10534.00 | 9167.00 | 15.00% | 9142.00 | 15.00% |

| Provisions | 1185.00 | 306.00 | 287.00% | 1028.00 | 15.00% |

| Profit before Exceptional items and Tax | 9350.00 | 8861.00 | 6.00% | 8114.00 | 15.00% |

| Exceptional Items | 12490.00 | -100.00% | |||

| Profit Before Tax | 9350.00 | 8861.00 | 6.00% | 8114.00 | 15.00% |

| Tax expenses | 2221.00 | 2100.00 | 6.00% | 2042.00 | 9.00% |

| PAT | 7129.00 | 6625.00 | 8.00% | 6072.00 | 17.00% |

| ROA | 2.00% | - | 1.80% | 11.00% | |

| Advances | 965068.00 | 845303.00 | 932286.00 | ||

| Deposits | 1068641.00 | 946945.00 | 1004900.00 | ||

| Gross NPA | 15127.00 | 18604.00 | 15893.00 | ||

| Gross NPA Ratio (%) | 1.00% | 2.02% | 1.58% | ||

| Net NPA | 3247.00 | 3559.00 | 3527.00 | ||

| Net NPA ratio | 0.31% | 0.39% | 0.36% | ||

| Provision Coverage Ratio (PCR) | 78.50% | 80.90% | 77.80% |