Zensar Technologies Ltd

Quarterly Result - Q1FY25

Zensar Technologies Ltd

IT - Software Services

Current

Previous

Stock Info

Shareholding Pattern

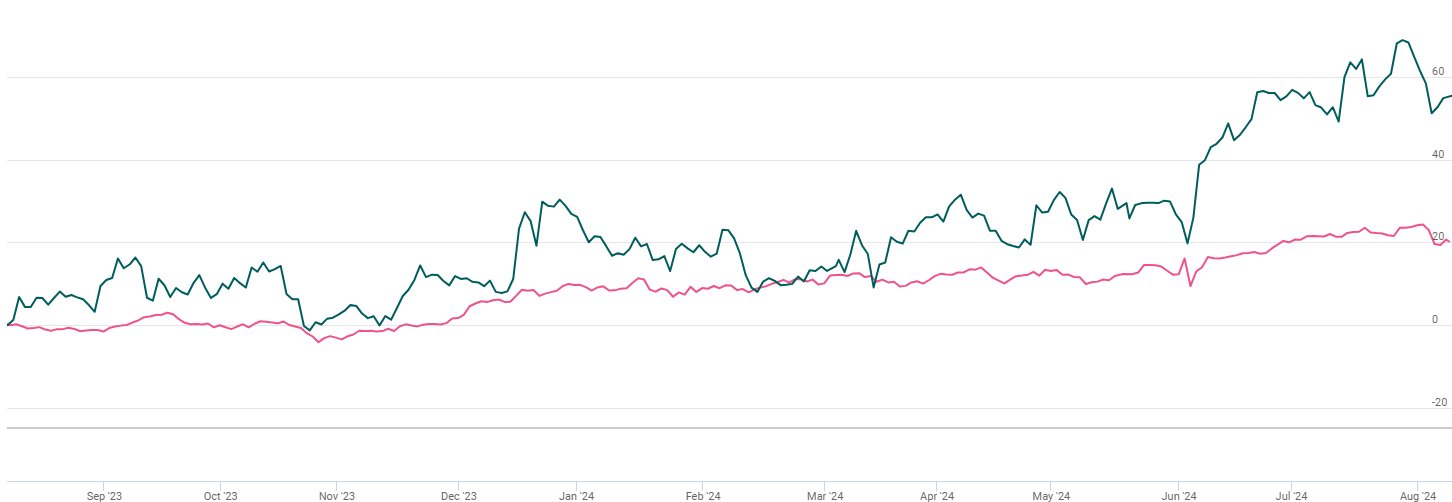

Price performance

Indexed Stock Performance

Financial Highlights:

| Particulars | Q1FY25 | Q1FY24 | YoY % | Q4FY24 | QoQ % |

|---|---|---|---|---|---|

| Revenue from operations | 1288.00 | 1227.00 | 5.00% | 1230.00 | 5.00% |

| EBITDA | 196.00 | 230.00 | -15.00% | 203.00 | -3.00% |

| EBITDA Margin | 15.25% | 18.77% | (352) bps | 16.50% | (125) bps |

| EBIT | 172.00 | 188.00 | -8.86% | 179.00 | -4.02% |

| Profit after tax | 158.00 | 157.00 | 0.83% | 173.00 | -8.51% |

Source: Company Filings; stockaxis Research

Q1FY25 Result Highlights

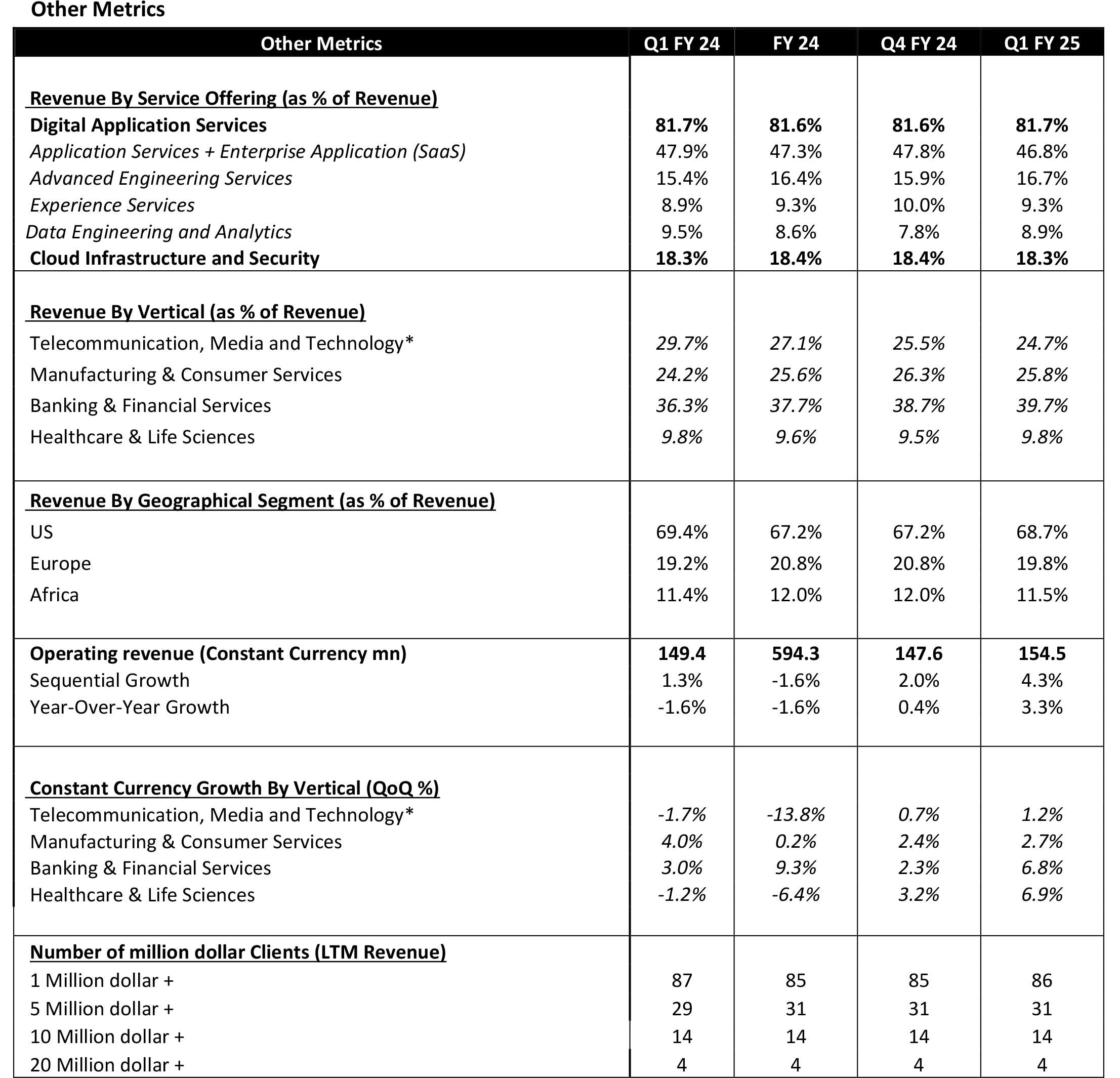

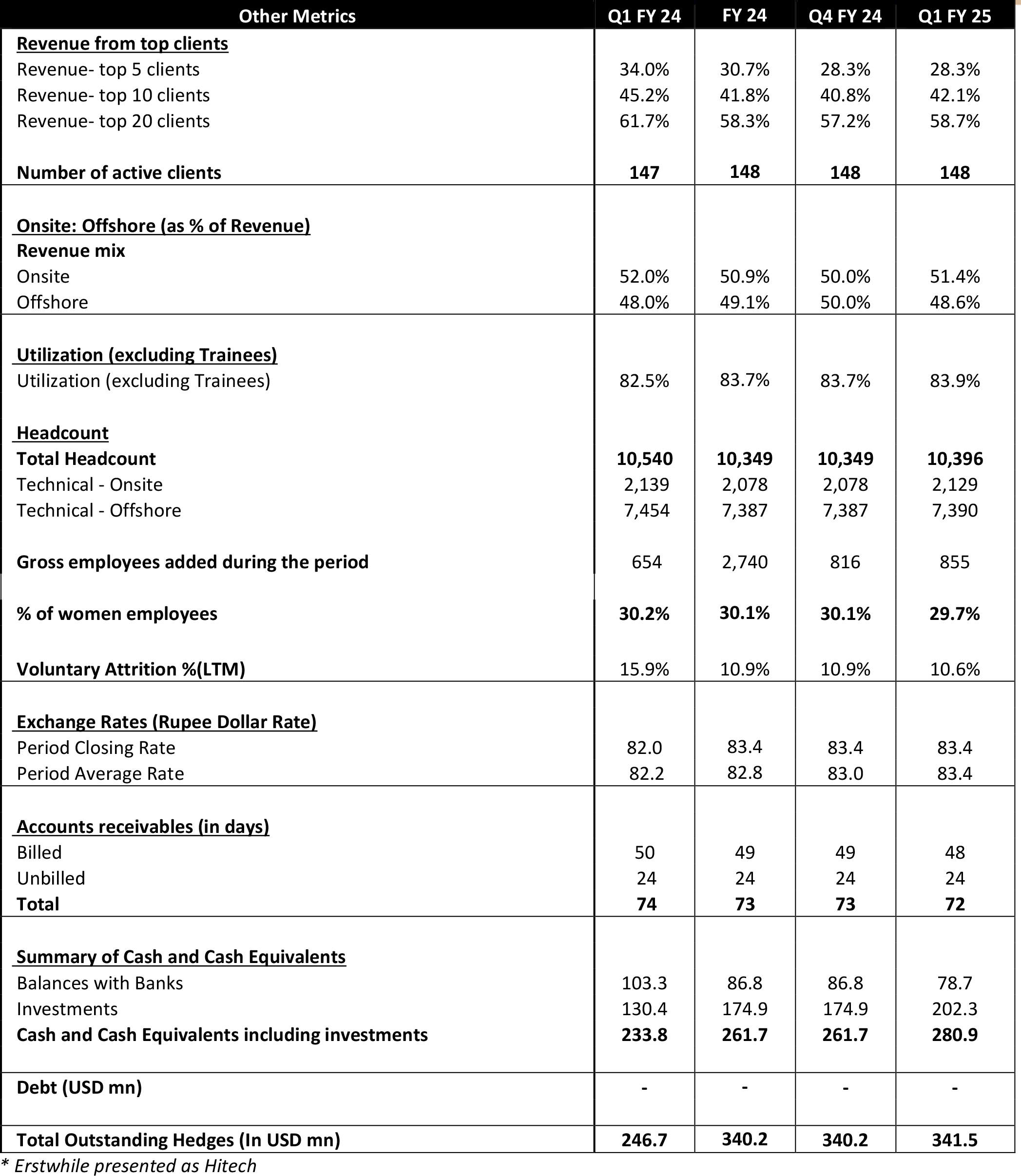

Zensar Technologies reported steady growth across all the key segments. In Q1FY25,

the company reported revenue of $154.4M, sequential QoQ growth of 4.2% in reported

currency and 4.3% in constant currency. EBITDA declined 3.9% QoQ/16.0% YoY to INR1,962m

and EBITDA margin came in at 15.2%. Deal TCV came in at USD154m (-15% QoQ/flat YoY).

EBIT declined 4% QoQ/ 9% YoY to INR1,714m and EBIT margin was down 130bp at 13.3%.

Margins were impacted due to higher SG&A )110 bp QoQ), one-off due to bad debt

provisions) and higher cost of delivery. PAT declined 8.5% QoQ to Rs.158 cr.

For the second consecutive quarters, they have witnessed growth across all the verticals. Banking and Financial Services reported a sequential QoQ revenue growth of 6.8% in both reported and constant currency.

Manufacturing and Consumer Services reported a sequential QoQ revenue growth of 2.4% in reported currency and 2.7% in constant currency.

Telecommunication, Media, and Technology reported a sequential QoQ revenue growth of 1.2% in both reported and constant currency.

Healthcare and Life Sciences reported a sequential QoQ revenue growth of 6.9% in both reported and constant currency.

The US region reported a sequential QoQ revenue growth of 6.5% in reported currency and 6.6% in constant currency.

On July 17, 2024, Zensar has entered into definitive agreement for acquisition of 100% stake in Bridge View Life Sciences, a Pennsylvania-based technology and consulting solutions company in the Life Sciences industry. This move reinforces our focus on the Healthcare and Life Sciences vertical.

Significant Wins in Q1FY25

Providing migration of the data and configuration to the latest cloud-based instance for customers specialized in water analytics, and packaging services worldwide.

Partnered with a leading US based manufacturer and distributor of analytical instruments to implement a centralized and standardized Service Desk.

Multi-year Partner in Infrastructure Support, End User Computing, and Dispatch for a Global Mobility Solution Provider.

Helping Global Insurance clients with core data engineering activities and cost reduction by building semantic data models and working on Advanced Analytics

End to End application modernization for one of the largest banking vendors in South Africa.

Conference Call Highlights

Operational Highlights

- Strong demand and a robust pipeline across all verticals, the company experienced high demand and has a strong pipeline of projects across all business segments.

- Successful execution of strategic initiatives and projects, Zensar Technologies effectively executed its strategic plants and projects, driving growth and improvement.

- The company maintained its emphasis on innovation and research & development to drive long-term growth.

- Traction in large deals is increasing. It witnessed good momentum across the portfolio. Growth in overall company revenue was driven by sequential growth across all verticals.

- Zensar Technologies is expanding its customer base and strengthening its relationship which its existing client.

- Zensar Technologies is implementing an automated process to increase effective efficiency by 25% and also complete digital transformation initiatives to enhance customer experience.

- Zensar Technologies was able to save 15% of their operational cost by improving the process, and also launched an innovative incubator developing new revenue streams.

- Zensar Technologies is planning to enhance customer engagement through personalized solutions and the company also formed a strategic partnership with a leading industry player, expanding its market reach by 30% and enabling access to new customer segments and geographies.

Management Guidance

- Revenue growth is expected to continue in the next quarter, driven by strong demand for digital solutions and cloud services.

- Margin expansion is anticipated through operational efficiencies and cost optimization initiatives. Strategic investments are planned to enhance innovation and drive long-term growth. The margin outlook for FY25 remains unchanged at mid-teens EBITDA margins.

- There was an impact of furloughs in the Hi-tech vertical (impact of 1-2 weeks in Jul’24); Q2 will also see furloughs.

- The guidance reflects confidence in the company's ability to execute on its strategic priorities and deliver value to shareholders.

Future Outlook

- Q2 Expectations

Cautious Optimism: Zensar Technologies remains cautiously optimistic about the upcoming quarter. The company acknowledges the potential for continued growth but is aware of the volatile market conditions that may impact performance. - Challenges

Wage Increases: One significant challenge anticipated in Q2 is the potential rise in wage costs. This increase could affect the company’s overall cost structure and margins, necessitating careful management and strategic planning to mitigate the impact.

Strategic Initiatives

- Acquisitions

Bridge View Life Sciences: Zensar has acquired Bridge View Life Sciences to strengthen its presence and capabilities in the life sciences sector. This strategic move is expected to enhance the company's offerings and market position in this growing industry.

Market Position and Strategy:

- Digital Transformation

Service Expansion: Zensar is focused on expanding its digital transformation services, aiming to offer innovative solutions that cater to the evolving needs of its clients. This strategic focus is intended to drive growth and enhance the company's competitive edge in the market.

Key Highlights

- Investment in Technology:

Emerging Technologies: Zensar continues to invest in emerging technologies to stay ahead in the competitive market. This commitment ensures the company remains innovative and relevant in delivering cutting-edge solutions.

Geographic Expansion:

New Regions: The company is exploring opportunities in new geographic

regions to diversify its revenue streams. This strategy aims to reduce dependency

on existing markets and drive growth through regional diversification.

Outlook & valuation

Zensar Technologies’s strong deal pipeline and successful execution of strategic initiatives are likely to sustain this growth trajectory. Operational efficiencies and cost optimization initiatives are anticipated to expand margins. The company is focused on improving processes, increasing automation, and completing digital transformation projects to enhance customer experience and operational efficiency. Zensar Technologies plans to make strategic investments to drive long-term growth, emphasizing innovation and R&D. This includes continued investment in emerging technologies to maintain a competitive edge and exploring new geographic regions to diversify revenue streams.

Zensar has demonstrated growth across all verticals for the second consecutive quarter. Key segments such as Banking and Financial Services, Manufacturing and Consumer Services, Telecommunication Media and Technology, and Healthcare and Life Sciences have all shown positive revenue growth. Zensar’s focus on digital transformation and expanding its customer base, along with strategic partnerships and acquisitions, enhances its market position. We expect Zensar Tech’s revenue growth to improve in the long term, which will be led by healthy deal wins, restructure of the organization, incentivisation of sales, and cross selling, and diversified presence across various service lines and verticals. At a CMP of Rs.762, the stock is trading at 23x FY26E. We maintain a HOLD rating on the stock.

Consolidated Financial statements

Profit & Loss statement

| Particulars | Q1FY25 | Q1FY24 | YoY % | Q4FY24 | QoQ % |

|---|---|---|---|---|---|

| Revenue from operations | 1288.00 | 1227.00 | 5.00% | 1230.00 | 5.00% |

| Total Revenue | 1288.00 | 1227.00 | 5.00% | 1230.00 | 5.00% |

| Employee Cost | 815.70 | 766.00 | 7.00% | 780.00 | 5.00% |

| Other exp | 276.00 | 231.00 | 19.00% | 247.00 | 12.00% |

| EBITDA | 196.00 | 230.00 | -15.00% | 203.00 | -3.00% |

| EBITDA Margin | 15.25% | 18.77% | (352) bps | 16.50% | (125) bps |

| Depreciation and Amortisation | 24.70 | 42.00 | -41.19% | 24.00 | 2.92% |

| EBIT | 172.00 | 188.00 | -8.86% | 179.00 | -4.02% |

| Finance Cost | 4.20 | 6.00 | -30.00% | 2.80 | 50.00% |

| Other Income | 42.40 | 28.40 | 49.30% | 52.00 | -18.46% |

| Profit before tax | 210.00 | 211.00 | -0.43% | 228.00 | -7.98% |

| Tax | 52.00 | 54.00 | -4.07% | 55.30 | -6.33% |

| Profit after tax | 158.00 | 157.00 | 0.83% | 173.00 | -8.51% |

| EPS | 6.96 | 6.90 | 0.87% | 7.65 | -9.02% |