The Anup Engineering Ltd

Quarterly Result - Q3FY25

The Anup Engineering Ltd

Engineering

Current

Previous

Stock Info

Shareholding Pattern

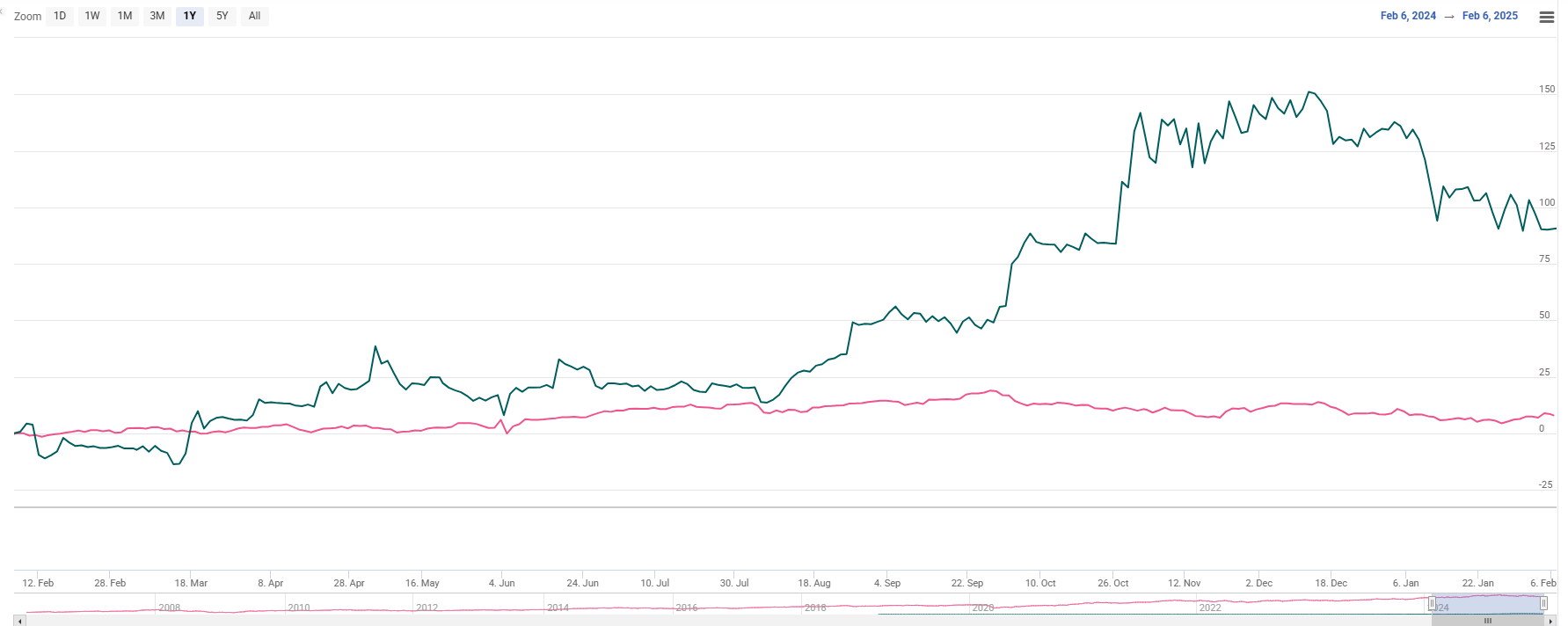

Price performance

Indexed Stock Performance

Financial Highlights:

| Particulars (Rs. in cr) | Q3FY25 | Q3FY24 | YoY (%) | Q2FY25 | QoQ (%) |

|---|---|---|---|---|---|

| Revenue from operations | 171.00 | 128.00 | 34.00% | 188.00 | -9.00% |

| EBITDA | 40.00 | 30.00 | 33.00% | 43.00 | -7.00% |

| EBITDA Margin (%) | 23.39% | 23.44% | (5 bps) | 22.87% | 52 bps |

| PAT | 31.00 | 20.00 | 55.00% | 32.00 | -3.00% |

| EPS (Rs.) | 15.69 | 10.18 | 54.00% | 16.21 | -3.00% |

Source: Company Filings; stockaxis Research

Q3FY25 Result Highlights

The Anup Engineering reported good earnings growth for the quarter ended Q3FY25.

Standalone net sales rose 34% YoY to Rs.171 cr compared to Rs.128 cr in the same

quarter of the preceding fiscal year. EBITDA grew by 33% YoY to Rs.40 cr while margins

stood at 23.39%. PAT surged to Rs.31 cr; and recorded a growth of 55% YoY led by

healthy topline growth. The pure exports have seen good growth for the period at

51% and they should be closing the year with exports of over 50%. The working capital

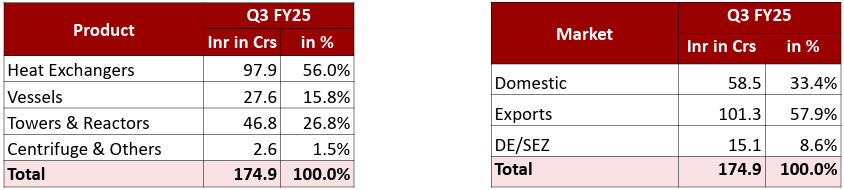

was healthy at 3.9 tonnes and net cash closed at Rs. 35.6 crores. The sectoral revenue

across industries for quarter three was quite interesting. The oil and gas at 17%,

petrochemicals at 20%, hydrogen at 45% and fertilizers at 14%. The exchanges are

at 57%, mostly coming from the Ahmedabad plant, and 42% for vessels and reactors

from the new Kheda facility.

At Mabel Engineers, most projects under manufacturing are planned for Quarter 4 delivery, and hence no sizable revenue is noticed in Q3. For the period ending December, the total revenue build is about Rs. 26 crores. And with delivery planned for Q4, they should be on plan for around Rs. 50 crores revenue that has been planned for Mabel Engineers.

The orderbook stood at Rs 770 Crores as on 31st December 2024 and Rs.811 Crore as on 31st January 2025. Including Mabel, the order book is at 831 Crore as on 31st January 2025.

Key Conference call takeaways

Operational performance

- Exports – Impressive 51% growth over nine months. Exports are expected to make up over 50% of the year’s revenue.

- Kheda Plant – The new facility accounted for 42% of revenue from vessels and reactors over nine months, showing a promising beginning.

- Mabel Engineers – Limited Q3 revenue recognition due to planned Q4 deliveries, totalling Rs.26 cr over nine months. Aimed for Rs.50 cr revenue by year’s end.

- Capacity utilisation - Standing at 70-75% with Kheda’s addition, with 10% capacity conserved for short-term, higher-margin projects.

Future Outlook

- FY25 Guidance – Management is optimistic about achieving 30% revenue growth with an EBITDA margin of around 23%.

- FY26 Guidance – Anticipated revenue growth of 25-30% and EBITDA Margin over 20%. Export contribution is expected between 50-55%.

- Orderbook – Current orders valued at Rs.831 cr (including Mabel), with Rs.600 cr set for execution in FY26. Exports form 70% of the orderbook.

- Now Phase-2(A) construction at Kheda is in progress with capex of Rs.50 Crore, which will have TWO Bays (1 complete bay and 1 open bay) and likely to commission in Oct-25.

- Working capital usage has been at encouraging level of 3.90 times.

Key Growth Drivers

- Hydrogen projects from the US and Canada, expected to constitute 30-32% of revenue in FY25.

- Gas projects originating from the Middle East.

- Domestic petrochemical projects spearheaded by private enterprises.

Outlook & valuation

Anup Engineering exhibited good earnings growth for the quarter ended Q3FY25. Incorporated in 1962, Anup is engaged in the design and fabrication of process equipment, which mainly includes heat exchangers, pressure vessels, centrifuges, columns/towers, and small reactors that find application in refineries, petrochemicals, chemicals, pharmaceuticals, fertilizers, and other allied industries. ANUP is a derivative play on the robust capex upcycle in refining and petrochemicals, renewables, and hydrogen initiatives. It has ample headroom to sustain growth ahead, with the addition of new capacity at the Kheda plant, a gradual shift towards complex metallurgy products, and a robust export market, backed by strong execution (with an impeccable record of on-time delivery).

ANUP’s technical expertise and specialized products offer significant benefits over conventional heat exchangers which are expected to support its profitability; its core strength lies in project execution, handling complicated equipment, and on-time delivery record. Anup has been maintaining a healthy EBITDA margin of over 20% over the past many years despite volatility in commodity prices backed by strict control over its overheads coupled with efficient management of the order book and product mix. Given the promising outlook, strong order book, and impressive on-time delivery record of over 95%, makes the solid reputation of the company among its user industries. Management has guided for a 25-30% YoY revenue growth with EBITDA margins of over 20% over the next 2-3 years. Exports will be in the range of 50% to 55%. At a CMP of Rs.2866, the stock is trading at 37x FY26E. We maintain a HOLD rating on the stock.

Standalone Financial statements

Profit & Loss statement

| Particulars (Rs. in cr) | Q3FY25 | Q3FY24 | YoY (%) | Q2FY25 | QoQ (%) |

|---|---|---|---|---|---|

| Revenue from operations | 171.00 | 128.00 | 34.00% | 188.00 | -9.00% |

| COGS | 87.00 | 67.00 | 30.00% | 103.00 | -16.00% |

| Gross Profit | 84.00 | 61.00 | 38.00% | 85.00 | -1.00% |

| Gross Margin (%) | 49.12% | 47.66% | 146 bps | 45.21% | 391 bps |

| Employee Benefit expenses | 9.00 | 7.00 | 29.00% | 9.00 | 0.00% |

| Other expenses | 34.00 | 24.00 | 42.00% | 32.00 | 6.00% |

| EBITDA | 40.00 | 30.00 | 33.00% | 43.00 | -7.00% |

| EBITDA Margin (%) | 23.39% | 23.44% | (5 bps) | 22.87% | 52 bps |

| Depreciation expenses | 6.00 | 5.00 | 20.00% | 6.00 | 0.00% |

| EBIT | 34.00 | 25.00 | 36.00% | 37.00 | -8.00% |

| Finance cost | 0.68 | 1.00 | -32.00% | 0.93 | -27.00% |

| Other Income | 0.68 | 3.00 | -77.00% | 1.00 | -32.00% |

| PBT | 34.00 | 26.00 | 31.00% | 38.00 | -11.00% |

| Tax expenses | 3.00 | 6.00 | -50.00% | 5.00 | -40.00% |

| PAT | 31.00 | 20.00 | 55.00% | 32.00 | -3.00% |

| EPS (Rs.) | 15.69 | 10.18 | 54.00% | 16.21 | -3.00% |