Sansera Engineering Ltd

Quarterly Result - Q2FY25

Sansera Engineering Ltd

Auto Ancillary

Current

Previous

Stock Info

Shareholding Pattern

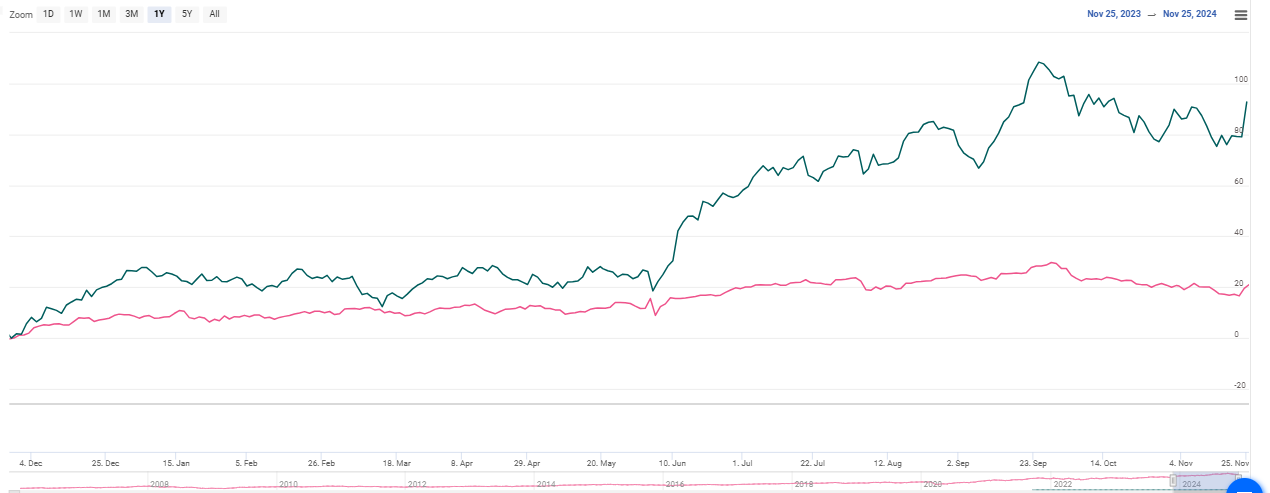

Price performance

Indexed Stock Performance

Financial Highlights:

| Particulars (Rs. In cr) | Q2FY25 | Q2FY24 | YoY (%) | Q1FY25 | QoQ (%) |

|---|---|---|---|---|---|

| Revenue From Operation | 763.00 | 693.00 | 10.00% | 744.00 | 3.00% |

| EBITDA | 133.00 | 118.00 | 13.00% | 128.00 | 4.00% |

| EBITDA Margin | 17.43% | 17.03% | 40 bps | 17.20% | 23 bps |

| Profit After Tax | 52.00 | 48.00 | 8.00% | 50.00 | 4.00% |

| EPS (Rs.) | 9.38 | 8.81 | 6.00% | 9.24 | 2.00% |

Source: Company Filings; stockaxis Research

Q2FY25 Result Highlights

Despite a challenging macro environment, Sansera delivered its highest ever quarterly

revenue, achieving a topline of Rs. 763 cr, a YoY growth of 10% on account of healthy

order execution. Auto ICE grew by 9% YoY, with healthy growth in 2W business of

21% YoY. Auto Tech-agnostic & xEV grew by 53% YoY, primarily driven by ramped

up order execution for a large EV customer. Non-Auto business de-grew by 20% YoY,

mainly on account of subdued performance of off-road and Agriculture business. Consolidated

EBITDA witnessed a growth of 13% YoY to Rs.133 cr. With an evolved product mix prudent

cost control measures and operating leverage along with benign RM prices, the company

was able to improve its EBITDA margins to 17.4%. PAT grew by 8% YoY to Rs.52 cr.

The company continues to strengthen domestic business, and delivered highest ever revenue of Rs. 502 cr with a growth of 8% on a YoY basis. International revenues saw a faster growth of 15% on a YoY basis. Contribution of top 5 customers has reduced from 48.0% in H1FY24 to 46.1% in H1FY25.

In H1FY25, the company invested Rs. 294 cr towards capex.

Net debt as on Sept-24 stood at Rs.879 cr.

Key Conference call takeaways

Market Overview

- Domestic 2-wheeler market showed double-digit volume growth, while PV volumes experienced a slight dip.

- Export volumes for 2-wheelers followed a similar trajectory.

- Festive sales in October were strong, but there is softness in demand.

Auto ICE business

- Achieved 9% YoY growth, with revenue reaching Rs.537 cr, the highest ever quarterly revenue.

- 2-wheeler business growth of approx 21% YoY.

- PV segment degrew by 8% YoY, aligning with industry trends.

Emerging business

- Tech-agnostic and xEV sectors grew by 53% YoY, driven by large North American EV customer orders.

- Non-Auto segment saw a 20% YoY degrowth, primarily due to weak-off road and agricultural performance.

- Off-road segment revenue was Rs.17 cr, agricultural sales stood at Rs.10 cr.

Aerospace business

- Faced pressure due to delays from a large customer; however demand remains robust with a significant backlog.

- Entered a strategic MoU with Dynamatic Tech for high friction parts in Airbus A220 door assemblies.

Orderbook

- Order book as of September 2024 stood at over Rs.2000 cr, with 60% from international markets.

- Secured Rs.320 cr in new orders during the quarter, with contributions from both auto and non-auto sectors.

- Future Outlook :

Outlook

- Management remains optimistic about growth prospects despite current headwinds in certain sectors.

- Anticipates recovery in the aerospace and off-road sectors, projecting 40%-50% CAGR in aerospace and defense over the next 2-3 years.

- Plans for a small assembly plant in the U.S. and potential investments in aluminium forging and hot-forged components.

Other Key Highlights

- The company plans to reduce interest expenses by around Rs.55 cr annually by repaying Rs.700 cr in debt by March 2025, using proceeds from the QIP.

- The company successfully raised Rs.1200 cr through a Qualified Institutional Placement (QIP). The funds will be used for debt repayment, capacity expansion, and strategic initiatives.

- The company aims to maintain EBITDA margins, with potential for growth through product diversification, cost improvements, increased volume, and higher capacity utilization in the long term.

Outlook & valuation

Sansera delivered steady earnings growth for the quarter ended Q2FY25. The Indian automotive industry is propelling manufacturing growth and emerging as a significant exporter, creating heightened opportunities for the auto-component sector. The management expects to grow an additional 8-10% to the average industry on the Auto side of business in the coming years while 35-40% yoy growth in Non-Auto as diversification remains the key to success of Sansera.

The company has been consistently growing ahead of the industry led by new client additions, product addition, and increasing kit value. It is also diversifying into tech agnostic auto components and non-auto segments, which should help mitigate the risk of EV transition. Furthermore, the company is poised to benefit from the China + 1 theme and consolidation in EU suppliers as there is limited capacity addition in the EU. We remain constructive on the growth prospects of the company considering leadership position in the domestic auto component industry, long standing relationship with marquee customers, strong technological capabilities, healthy order backlog, diversified product portfolio, focus on EV penetration, reasonable valuations and superior return ratios. The factors cited above makes Sansera a compelling bet for the long term. At CMP of Rs.1510, the stock is trading at 25x FY26E. We maintain a HOLD rating on the stock.

Consolidated Financial statements

Profit & Loss statement

| Particulars (Rs. In cr) | Q2FY25 | Q2FY24 | YoY (%) | Q1FY25 | QoQ (%) |

|---|---|---|---|---|---|

| Revenue From Operation | 763.00 | 693.00 | 10.00% | 744.00 | 3.00% |

| Cost of goods sold | 448.00 | 415.00 | 8.00% | 304.00 | 47.00% |

| Gross Profit | 315.00 | 278.00 | 13.00% | 440.00 | -28.00% |

| Gross Profit Margin | 41.28% | 40.12% | 116 bps | 59.14% | (1786 bps) |

| Employee benefit expenses | 110.00 | 93.00 | 18.00% | 107.00 | 3.00% |

| Other Expenses | 72.00 | 66.00 | 9.00% | 205.00 | -65.00% |

| EBITDA | 133.00 | 118.00 | 13.00% | 128.00 | 4.00% |

| EBITDA Margin | 17.43% | 17.03% | 40 bps | 17.20% | 23 bps |

| Other Income | 4.00 | 1.00 | 300.00% | 0.40 | 900.00% |

| Depreciation expenses | 43.00 | 37.00 | 16.00% | 40.00 | 8.00% |

| EBIT | 94.00 | 82.00 | 15.00% | 88.00 | 6.00% |

| EBIT Margin | 12.32% | 11.83% | 4.00% | 11.88% | 4.00% |

| Finance Cost | 23.00 | 18.00 | 28.00% | 19.00 | 21.00% |

| Profit before Tax | 71.00 | 64.00 | 11.00% | 69.00 | 2.00% |

| Tax | 20.00 | 16.00 | 25.00% | 18.00 | 11.00% |

| Profit After Tax | 52.00 | 48.00 | 8.00% | 50.00 | 4.00% |

| EPS (Rs.) | 9.38 | 8.81 | 6.00% | 9.24 | 2.00% |