Radico Khaitan Ltd

Rs. 2576.40

Date: May 06, 2025

-

Rating: Hold

-

Previous Rating: Hold

-

BSE Code: 532497

-

NSE Symbol: RADICO

Stock Info

- Bloomberg RDCK:IN

- Reuters RADC.NS

- Face Value (Rs) 2

- Equity Capital (Rs cr) 27

- Mkt Cap (Rs cr) 34634.90

- 52w H/L (Rs) 2637.70 - 1429.85

- Avg Daily Vol (BSE+NSE) 30,955

Shareholding Pattern

- (as on 31-Mar) %

- Promoter 40.23

- FIIs 16.95

- DIIs 26.77

- Public & Others 16.04

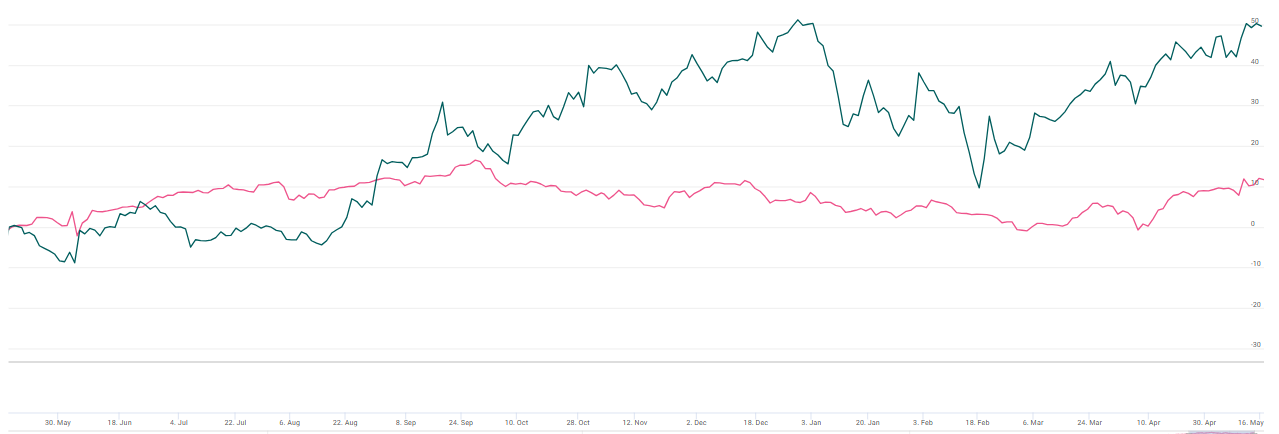

Price Performance

- Return (%) 1m 3m 12m

- Absolute 12.86 12.27 44.90

- Sensex 10.26 3.31 9.13

Indexed Stock Performance

RADICO Sensex

Data Source: Ace equity, stockaxis Research

Radico Khaitan Ltd

Financial Highlights:

| Particulars (Rs. in cr) | Q4FY25 | Q4FY24 | YoY (%) | Q3FY25 | QoQ (%) |

|---|---|---|---|---|---|

| Revenue from operations | 4485.00 | 3895.00 | 15.00% | 4441.00 | 1.00% |

| EBITDA | 178.00 | 123.00 | 45.00% | 184.00 | -3.52% |

| EBITDA Margin (%) | 13.65% | 11.40% | 225 bps | 14.22% | (57 bps) |

| PAT | 91.00 | 54.00 | 69.00% | 96.00 | -3.08% |

| EPS (Rs.) | 6.88 | 4.03 | 71.00% | 7.14 | -3.64% |

Source: Company Filings; stockaxis Research

Q4FY25 Result Highlights Radico Khaitan delivered a healthy set of numbers for the quarter ended Q4FY25. Revenue increased by 21% to Rs.1,304 crores. Gross Margin during the quarter was 43.5% compared to 41.0% in Q4 FY2024 and 43.0% in Q3 FY2025. Gross Margin improved both on Yo-Y and Q-o-Q basis due to the ongoing premiumization in the IMFL business and a relatively stable raw material scenario. After 9 quarters of degrowth, Regular volumes returned to a sharp growth trajectory in Q3 FY25. The momentum continued in Q4 FY25. This was due to a lower base, coupled with a normalization of state-specific industry issues to a large extent. Change in the route-to-market in Andhra Pradesh also contributed to the regular volume growth. Prestige & Above net revenue growth was 22% compared to Q4 FY2024. Non-IMFL revenue growth was muted due to lower bulk-alcohol sales. EBITDA grew by 39% to Rs.178 crores, and PAT grew 71% YoY to 91cr. In Q4FY25, IMFL volume grew 28% year-on-year to 9.15 million cases, marking the highest-ever volume in a single quarter. The Prestige & Above (P&A) segment saw a volume growth of 17% YoY to 3.4 million cases, while its value grew by 22%. IMFL realization also improved, rising 4.6% YoY. Advertising and promotion (A&P) expenses were higher this quarter due to a new celebrity endorsement by Kriti Sanon and brand campaigns, but remained within the targeted range of 7–8% of sales. In Andhra Pradesh (AP), the company’s market share rose significantly from 10% in H1 to 23% in Q4, the highest in the industry, driven by route-to-market changes and a shift in consumer preference from local to national brands. Prestige & Above brands' contribution to the IMFL volumes of 39.1% (vs. 49.6%). Prestige & Above brands' contribution to the Total IMFL sales value of 63.4% (vs. 73.2%).

Other Key Highlights (FY25)

- In FY25, Radico Khaitan delivered its best-ever annual performance, achieving a record revenue of Rs 4,851 crores, the highest ever, with EBITDA of Rs 668 crores and PAT of Rs 341 crores.

- Magic Moments Vodka crossed 7 million cases sold during the year, reflecting strong brand momentum.

- Net debt was reduced by Rs 114 crores in FY25, bringing the current net debt to around Rs 600 crores, with a target to reduce it by 35–40% in FY26 and to become net debt-free within two years.

- The company’s strategy continues to focus on premiumization, innovation, brand building, and market expansion.

- Exports in FY25 surpassed the record levels of FY24 and now contribute 5% of the company’s total volume and 9% of its total value.

- Radico Khaitan expects bulk Scotch imports to be worth Rs.250 crores in FY26, benefiting from reduced duties under the UK-India FTA (from 150% to 75%).

- Management remains confident that premium brands like Rampur (priced at Rs.8,500) will retain their pricing and focus on quality despite cost savings.

- The company has no plans to reduce prices for its premium products, aiming to preserve brand positioning and equity.

- Two new luxury products are planned for launch in FY26, as part of a strategy to drive 30% growth in the luxury spirits segment.

- Sales volumes surged in FY25, fuelled by both premium and mass-market offerings.

- While optimistic about cost advantages from the FTA, Radico remains cautious and awaits final details, noting potential competitive pressures.

Key Conference Call Takeaways

Performance Highlights & Strategic Outlook

- Radico Khaitan delivered its outstanding annual performance in FY25, driven by the strong execution of its premiumization and innovation strategy.

- Exports exceeded FY24’s record levels, now contributing 5% of total volume and 9% of total value.

- EBITDA margin improved by 150 bps YoY in FY25, and the company expects at least 100 bps margin improvement going forward.

- Margin expansion is supported by growth in the premium P&A segment and a three-year focus on a margin-driven business model.

- The company remains confident in maintaining pricing power even after the UK-India FTA, and believes reputed foreign brands will also avoid price cuts to preserve brand equity.

- Despite the FTA with Australia, non-tariff barriers like aging and maturation norms restrict Indian whiskey growth there.

- Radico is a founding member of the Indian Single Malt Association, aiming to establish global credibility by setting standards and preventing manipulation.

- The regular segment rebounded after nine weak quarters, aided by favourable policy changes in Andhra Pradesh, and is expected to grow 10–13% in FY26.

- Royal Ranthambore, priced Rs 100 higher than the top Scotch brand, is growing 50% YoY and is a key growth driver in the BIO/BII segment.

Raw Materials, Cost Trends & Capex Plans

- Extra Neutral Alcohol (ENA) prices remained stable, with broken rice prices falling to Rs 25,000/ton from Rs 27,500–Rs 28,000, and maize prices down by Rs 2,000/ton.

- Glass prices corrected 3–4% last year and are expected to stay stable.

- Backward integration benefits, which once offered a Rs 12–13/litre cost advantage, have normalized to a steady Rs 7–8/litre in FY26.

- Scotch procurement has no significant stockpiles, so cost benefits from lower import duties will reflect immediately upon implementation.

- No major new capex is planned over the next 3–4 years due to recent capacity expansion at the Sitapur unit, one of Asia’s largest.

- Capex discipline supports the company’s target to become debt-free by FY27, with a 30–40% debt reduction expected in FY26 and the remainder in FY27.

Market Expansion, FTAs & State-Level Developments

- Under the UK FTA, import duty on Scotch has been reduced from 150% to 75%, expected to lower consumer prices by only 6–8%.

- Despite importing Rs. 250 crores worth of blended malt Scotch in FY26, Radico will not reduce prices to preserve its premium brand positioning.

- Two luxury whiskey brands developed over the last two years will launch in Q1FY26, along with a super-premium whiskey in H1FY26, targeting the 18 million case segment growing at double-digit rates.

- Magic Moments Vodka has been rebranded with celebrity ambassador Kriti Sanon, while 8 PM Premium Black has been relaunched with a refreshed packaging and brand story.

- In Andhra Pradesh, market share jumped from 10% in H1 to 23% in Q4—the highest in the industry—driven by route-to-market changes and a consumer shift toward national brands.

- Delhi has extended its current policy by 3 months, with a new policy expected in July, which is seen as favourable for national brands.

- Bihar is being closely monitored due to upcoming elections, though no regulatory changes have been observed yet.

- Telangana payments are currently regular and on time, and the backlog of outstanding dues, now under Rs 100 crore, has begun to be cleared over the past month.

FY26 Guidance & Management Focus

- Radico is targeting over Rs.500 crores in revenue from its luxury portfolio in FY26, up from Rs. 340 crores in FY25, which grew 32% YoY.

- The company is aiming for double-digit growth in the P&A category, supported by continued premiumization and brand investments.

- Management is focused on sustained volume growth in the prestige and luxury segments, while leveraging plant efficiency to generate cash and repay debt.

- The company's strategy is firmly anchored in premiumization, innovation, brand building, and geographical expansion.

- Management emphasized that future launches will focus on upscale price points and premium segments, reflecting its aspiration to lead the luxury spirits category.

- The long-term goal remains to maintain leadership in luxury spirits, achieve zero net debt by FY27, and deliver consistent value to shareholders.

Outlook & valuation

Radico Khaitan delivered yet another quarter of impressive earnings growth in Q4, driven by the recovery in the regular segment. We believe that with consumers shifting to premium IMFL brands, RKL’s focus on improving the presence of each brand in key markets and the emergence of favourable liquor policies in key states would aid faster growth of branded liquor products in the near to medium term. The company expects double-digit volume growth in the P&A segment to sustain in the medium term due to strong traction for its premium brands. With the Indian spirits industry witnessing an increasing shift toward premium and luxury brands, Radico is well-positioned to capitalize on long-term opportunities in this evolving market.

Focus on premiumisation, enhanced distribution capabilities, a strong innovation pipeline, and impactful consumer engagement and support of backward integration will drive consistent, strong double-digit earnings growth in the coming years. We like the company’s focus on launching products in brown and white spirits, targeting the premium/luxury segment to consistently gain market share in key markets and outpace the industry. Margins have bottomed out, and we should expect consistent improvement in margins on moderation in grain prices. The management is targeting Rs 500 cr revenue from its luxury portfolio in FY26, and aims to maintain leadership in luxury spirits. The company aims to become debt-free by FY27, with 30-40% debt reduction planned in FY26, driven by strong cashflow generation. Market-share gains were significant— from 10% in H1 to 23% in Q4 (industry-high) in Andhra Pradesh, and from 23% to 29% in Uttar Pradesh. Management anticipates further market-share gains through product launches (especially in luxury and super-premium whisky segments) and expanded distribution. Looking ahead, it expects the demand environment in the spirits industry to remain robust, led by continued premiumization. Guided by strategic vision, it remains focused on leveraging strong business fundamentals to drive competitive and profitable growth. At CMP of Rs.2,460, the stock is trading at 50x FY27E. We maintain a HOLD rating on the stock.

Consolidated Financial statements

Profit & Loss statement

| Particulars (Rs. in cr) | Q4FY25 | Q4FY24 | YoY (%) | Q3FY25 | QoQ (%) |

|---|---|---|---|---|---|

| Revenue from operations | 4485.00 | 3895.00 | 15.00% | 4441.00 | 1.00% |

| Excise duty on sales | 3181.00 | 2816.00 | 13.00% | 3147.00 | 1.09% |

| Net revenues | 1304.00 | 1079.00 | 21.00% | 1294.00 | 0.78% |

| COGS | 737.00 | 637.00 | 16.00% | 737.00 | 0.02% |

| Gross Profit | 567.00 | 442.00 | 28.00% | 557.00 | 1.78% |

| Gross Margin (%) | 43.48% | 40.96% | 252 bps | 43.04% | 44 bps |

| Employee Benefit expense | 52.00 | 47.00 | 11.00% | 63.00 | -16.97% |

| Other expenses | 337.00 | 273.00 | 23.00% | 310.00 | 8.74% |

| EBITDA | 178.00 | 123.00 | 45.00% | 184.00 | -3.52% |

| EBITDA Margin (%) | 13.65% | 11.40% | 225 bps | 14.22% | (57 bps) |

| Depreciation and amortization expenses | 36.00 | 32.00 | 13.00% | 36.00 | -0.05% |

| EBIT | 142.00 | 91.00 | 56.00% | 147.00 | -3.71% |

| Finance cost | 22.00 | 17.00 | 29.00% | 20.00 | 7.51% |

| Other Income | 1.00 | 2.00 | -50.00% | 1.00 | 37.98% |

| Profit before share of profit/loss of JV | 121.00 | 77.00 | 57.00% | 130.00 | -6.60% |

| Share of Profit/(loss) of JV | 1.00 | -3.00 | - | -0.47 | |

| PBT | 123.00 | 74.00 | 66.00% | 130.00 | -5.49% |

| Tax expenses | 31.00 | 20.00 | 55.00% | 34.00 | -9.44% |

| PAT | 91.00 | 54.00 | 69.00% | 96.00 | -3.08% |

| EPS (Rs.) | 6.88 | 4.03 | 71.00% | 7.14 | -3.64% |