PG Electroplast Ltd

Quarterly Result - Q1FY25

PG Electroplast Ltd

Consumer Durables - Domestic Appliances

Current

Previous

Stock Info

Shareholding Pattern

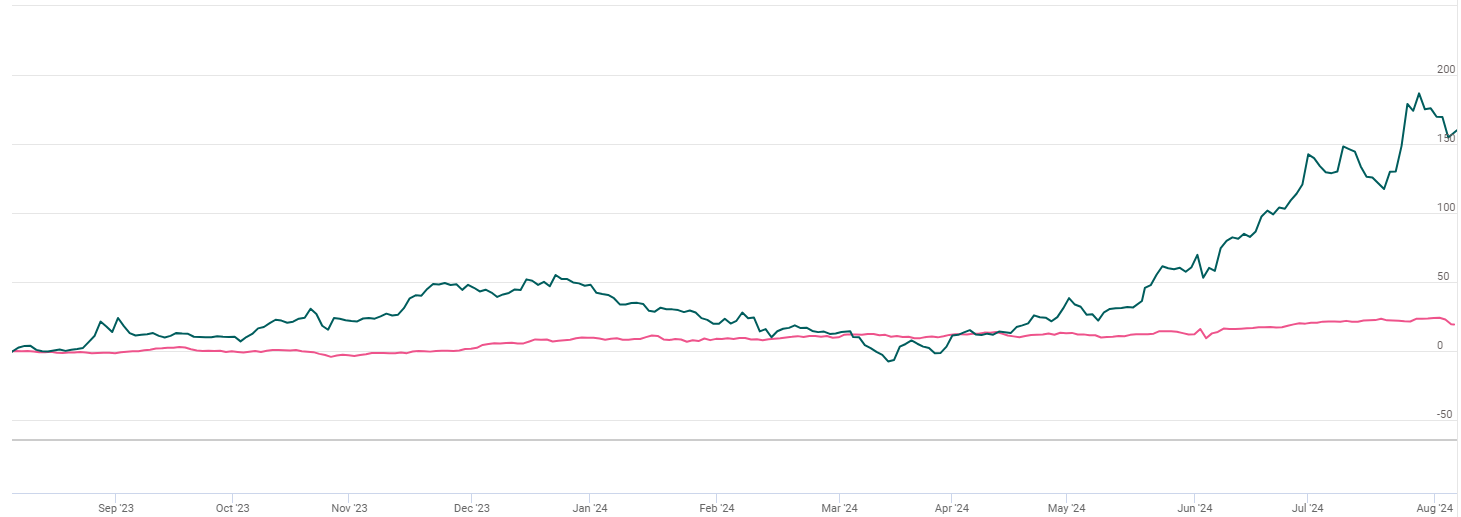

Price performance

Indexed Stock Performance

Financial Highlights:

| Particulars (Rs. In cr) | Q1FY25 | Q1FY24 | YoY (%) | Q4FY24 | QoQ (%) |

|---|---|---|---|---|---|

| Revenue from operations | 1321.00 | 678.00 | 95.00% | 1077.00 | 23.00% |

| EBITDA | 135.00 | 68.00 | 99.00% | 120.00 | 12.00% |

| EBITDA Margin (%) | 10.20% | 10.00% | - | 11.14% | -94 bps |

| PAT | 85.00 | 34.00 | 149.00% | 72.00 | 19.00% |

| EPS (Rs.) | 3.21 | 1.49 | 115.00% | 2.77 | 16.00% |

Source: Company Filings; stockaxis Research

Q1FY25 Result Highlights

PG Electroplast (PGEL) delivered remarkable earnings growth in Q1FY25 with revenue

and operating profits surging nearly 2-fold YoY. The business continues to exhibit

strength on most fronts on the back of secular tailwinds in the AC industry. Consolidated

net sales exhibited robust growth of 95% YoY to Rs.1321 cr as rising temperatures

in India fueled the volumes of room Acs (RACs), air coolers, and cooling solutions

in the quarter gone by. However, average sales realizations declined on account

of lower commodity prices. Operating profits doubled to Rs.135 cr while operating

margins improved YoY due to cost control and operating leverage. PAT more than doubled

to Rs.85 cr on the back of healthy revenue growth and solid operational performance.

The Product business contributed 75.2% of the total revenues in 1QFY2025. Room AC business at INR 882 crores grew 130% during the period while the Washing Machines business had a growth of 72% YoY. Other business verticals like Plastics, Electronics, and Moulds also exhibited steady growth.

Major Highlights of Q1FY25

- Q1FY25 has been a robust quarter for PGEL despite the ASPs being down sharply YoY across the board for all our product categories.

- PGEL’s 100% subsidiary, PG Technoplast, crossed INR 984 crores in revenue in 1QFY2025. The company’s Bhiwadi AC Unit ramped up during the quarter.

- Order book for product business remains robust and the company hopes to scale product business significantly in FY2025.

- During the quarter operating margins have improved YoY due to cost control and operating leverage.

- Net debt has decreased by almost INR 103 crores during the quarter. The operating cash flow during the period has been strong and working capital optimization remains a key focus area for the company.

- For FY25, creating building blocks for the next level of growth and improving capital efficiency will be the major priorities. R&D, New Product Development, and Capacity Enhancement are the focus areas for future across product businesses. The company plans to strengthen its product offerings further in both AC and WMs.

- The company is seeing increased opportunities for business from new and existing clients, and we remain very confident about the future growth prospects of the business.

Key Conference call takeaways

- For PGEL Consolidated Revenue guidance is of at least INR 3650 crores which is a growth of 32.9% over FY2024 Revenues of INR 2746 crores despite TV business revenues shifting to JV company Goodworth Electronics Ltd.

- For Goodworth, they expect revenues at INR 600 crores.

- Implying Group Revenues to be around 4250 crores.

- PGEL Net profit guidance of INR 216 crores which is a growth of 57.7% over FY2024 Net profit of INR 137 crores.

- In FY2025, Management expects EBITDA margins to have slight upward bias.

- The growth in product business i.e., WM, RAC and Coolers is expected to be around 58.8% to over INR 2650 crores from INR 1668 crores in FY2024.

- Capex for FY2024 will be in the range of 350-380 crores. New Integrated Unit for Manufacturing RAC in Rajasthan, New Building in Greater Noida and new building along with further AC capacity expansion in Supa is being planned.

Outlook & valuation

PG Electroplast reported a beat in Q1FY25 across all its key metrics driven by strong growth across all its business segments. PGEL reported strong growth in the product business driven by RAC and strong margins due to operating leverage. PGEL is receiving significant enquiries and commitment for new business across business segments. New customers are shifting from China to India. The company is uniquely positioned in the consumer durable & plastics space in India and would derive higher revenue growth by growing its market share in the customer outsourcing wallet. Management foresees large opportunities in plastic moulding in consumer durables in appliances like a) Washing machines b) Room Air Conditioners c) Refrigerators d) Ceiling Fans and e) Sanitaryware products and opportunities in the ODM space for products like a) Air coolers, b) Washing Machines and Room Air conditioners. PGEL will sustain its growth momentum aided by the emerging opportunities in the EMS space like Strong industry tailwinds, Capital expenditure, strong execution capabilities, new product launches, encouraging guidance from the management, improving operational efficiencies leading to better profitability & higher cash flows, established client relationships and diversified product profile.

Over the long run, PGEL’s business has multiple tailwinds in the form of low penetration of electronics (RACs, WMs) in the country. The company is pursuing an organic growth strategy by ramping up its existing capacity and capabilities in each of its product verticals to achieve higher value addition, and better economies of scale on the back of backward integration. At a CMP of Rs.434, the stock is trading at 42x FY26E. We maintain a HOLD rating on the stock.

Consolidated Financial statements

Profit & Loss statement

| Particulars (Rs. In cr) | Q1FY25 | Q1FY24 | YoY (%) | Q4FY24 | QoQ (%) |

|---|---|---|---|---|---|

| Revenue from operations | 1321.00 | 678.00 | 95.00% | 1077.00 | 23.00% |

| COGS | 1082.00 | 555.00 | 95.00% | 862.00 | 26.00% |

| Gross Profit | 239.00 | 123.00 | 94.00% | 215.00 | 11.00% |

| Gross Margin (%) | 18.08% | 18.00% | - | 19.93% | -185 bps |

| Employee Benefit exps | 62.00 | 36.00 | 74.00% | 55.00 | 13.00% |

| Other expenses | 46.00 | 21.00 | 119.00% | 43.00 | 7.00% |

| Other Income | 4.00 | 1.00 | 202.00% | 3.39 | 15.00% |

| EBITDA | 135.00 | 68.00 | 99.00% | 120.00 | 12.00% |

| EBITDA Margin (%) | 10.20% | 10.00% | - | 11.14% | -94 bps |

| Depreciation and amort | 15.00 | 11.00 | 36.00% | 14.00 | 11.00% |

| EBIT | 120.00 | 57.00 | 111.00% | 106.00 | 12.00% |

| EBIT Margin (%) | 9.06% | 8.36% | 70 bps | 9.88% | -82 bps |

| Finance cost | 18.00 | 14.00 | 31.00% | 16.00 | 16.00% |

| PBT | 101.00 | 43.00 | 137.00% | 91.00 | 12.00% |

| Tax expenses | 16.00 | 9.00 | 89.00% | 19.00 | -14.00% |

| PAT | 85.00 | 34.00 | 149.00% | 72.00 | 19.00% |

| EPS (Rs.) | 3.21 | 1.49 | 115.00% | 2.77 | 16.00% |