PCBL Ltd

Quarterly Result - Q1FY25

PCBL Ltd

Chemicals

Current

Previous

Stock Info

Shareholding Pattern

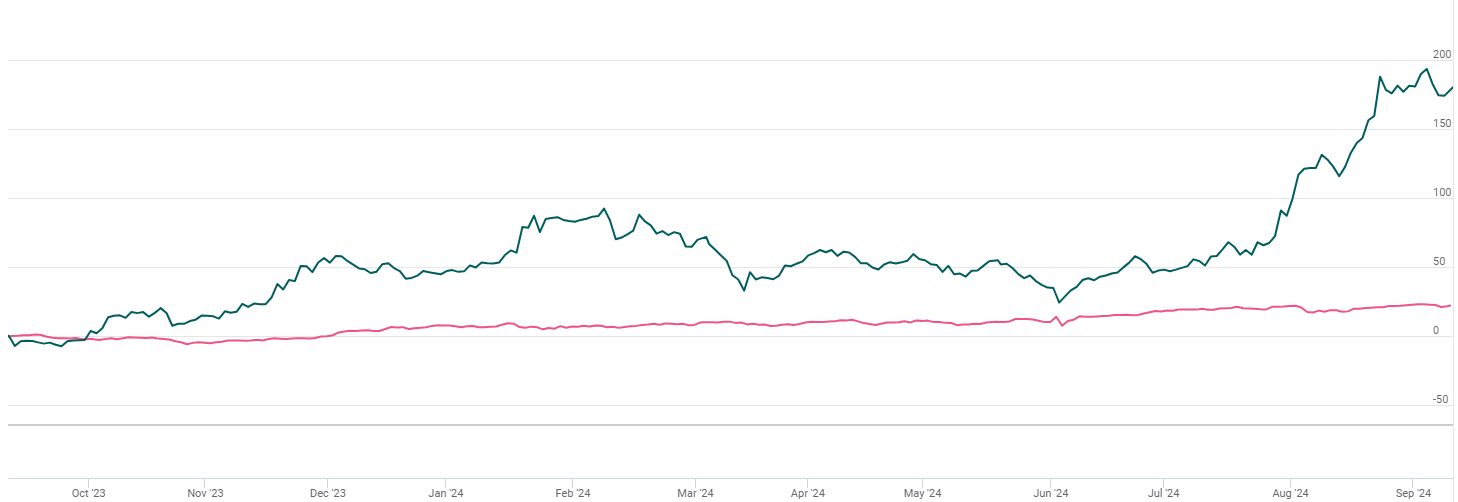

Price performance

Indexed Stock Performance

Financial Highlights:

| Particulars (Rs. in cr) | Q1FY25 | Q1FY24 | YoY (%) | Q4FY24 | QoQ (%) |

|---|---|---|---|---|---|

| Revenue from operations | 2144.00 | 1348.00 | 59.00% | 1929.00 | 11.00% |

| EBITDA | 359.00 | 212.00 | 69.00% | 309.00 | 16.00% |

| EBITDA Margin (%) | 16.74% | 15.73% | 101 bps | 16.02% | 72 bps |

| PAT | 118.00 | 109.00 | 8.00% | 111.00 | 6.00% |

| EPS (Rs.) | 3.13 | 2.89 | 8.00% | 2.95 | 6.00% |

Source: Company Filings; stockaxis Research

Q1FY25 Result Highlights

PCBL delivered impressive earnings growth for the quarter ended Q1FY25. Consolidated

revenue from operations surged 59% YoY to Rs.2144 cr as compared to Rs.1348 cr registered

in the same quarter of the corresponding fiscal. Revenue growth is driven by better

realization, higher sales volumes in the carbon black segment (rubber & specialty

blacks), and consolidation of aquafarm. During the quarter, the company posted its

highest-ever carbon black production volumes of 153,918 tonnes, which increased

25% YoY/ 8% QoQ. Gross margin expanded 178 bps YoY to 32.4% because of lower raw

material prices. Higher growth was seen from the specialty black and performance

segment, which grew by 33% YoY while tyre volumes grew marginally by 6%. Consolidated

EBITDA witnessed a robust growth of 69% YoY to Rs.359 cr. PBT stood at Rs.164 crores

while PAT increased by 8% year-on-year to Rs.118 crores.

Consolidated EBITDA per metric ton in the Carbon Black segment stood at Rs.20,861 as against an average of Rs.20,018 per metric ton during FY '24. During this quarter, PCBL Tamil Nadu achieved a sales volume of 28,228 tons. The state-of-the-art plant in Chennai has received approvals from all major tyre manufacturers in India and locked the capex utilization of 85% plus during the quarter.

Of the total Carbon Black sales volume, domestic sales volume stood at 90,438 metric ton, while international sales volume stood at 63,480 tons. Export sales volume registered a strong growth on a year-on-year basis of 56% in Q1FY25.

Segmental Performance

Tyre accounted for 87,945 tons. Performance chemicals reported a sales volume of

50,302 tons. The company also achieved a specialty sales volume of 15,671 tons,

which is again the highest ever in history. And company continues to expand our

product portfolio and customer base. The company achieved highest ever power generation

and sales volume during the quarter. Power generation increased by 24% from 156

million units in Q1 FY 24 to 194 million units during the quarter with external

sales volume of 116 million units as against 98 million units in Q1FY24. PCBL's

average realization stood at Rs.4.16 per kilowatt hour.

Aquapharm business update

In Q1FY25, revenue of Aquapharm stood at Rs.359 crores and operational EBITDA at

Rs.55 crores. The quarterly sales volume was 24,402 tons. The capacity utilization

witnessed a steep improvement and stood at around 75% during Q1 FY25. Currently,

Aquapharm has approximately 24% of global market share, excluding China, in Phosphonate.

Key Conference call takeaways

Power Generation for Q1FY25: Power generation increased to 194mn units in Q1FY25 vs. 156mn units in 1QFY24. The average power realization was Rs.4.16/kwh in the quarter.

Aquapharm: The management has said that its Aquapharm business has a market share of 24% globally (ex-China) in the phosponate segment and it aims to further increase that with additional capacities and value-added products planned in the future. The company is also focusing on expanding its green chelates portfolio with the growing trend of substitution of older chelating agents in the USA, Europe, China, and India. It is currently making MGDA and GLDA liquids; MGDA granules will also be introduced. The management has indicated that its strategy is to increase capacity and utilisation, improve supply chain capabilities and expand the customer base across geographies. More than 55% of their revenue comes from North America followed by Europe and India, which resonate around 18% and 14% of the revenue. Around 51% of revenue comes from phosphonates followed by oil and gas chemicals and polymers.

The management indicated that the Aquapharm business is currently going through a low cycle and is at the bottom. By FY25-end, the company expects to achieve INR 850mn-900mn quarterly EBITDA run-rate at Aquapharm. Aquafarm capacity stood at 130,000 tons and it plans to expand this capacity by more 38,000 tons in the next 6-8 months. Capacity utilisation in Aquafarm increased to 75% and sales volume stood at 24,402MT.

Carbon black EBITDA/MT could go up by INR 4,000/MT-5,000/MT in the next 5 years: EBITDA/MT in the carbon black segment stood at INR 20,861/MT in 1QFY25. Over the next 4-5 years, the company expects EBITDA/MT to go up by INR 4,500-5,000/MT driven by yield improvement, favourable product mix, and positive operating leverage. The company has launched multiple high-margin grades in the tyre segment with margins comparable to the specialty grades and this is currently contributing to increasing margins.

Targeting an addition of 400KTPA carbon black capacity: The management indicated that its 20KTPA specialty line and 90KTPA rubber black line were under implementation currently. With this, the total CB capacity will reach 880KTPA by FY26 from the current 770KTPA and will include a specialty capacity of 112KTPA. Power capacity will be at 134MW.

Capex: The management has informed that it has planned a capex of Rs.2500 cr over the next 5 years in the carbon black segment with Rs.60,000-65,000/MT capex. The company has already spent Rs.165 cr for the additional 38KTPA Aquapharm capacity while the balance Rs.500 mn is expected to be spent in FY25. It expects to spend Rs.4-5bn for the additional 100KTPA Aquapharm capacity in the future. Further, it plans to spend Rs.4.5-5bn capex for battery chemicals capacity.

Roadmap to 5x PAT by 2029: The company highlighted that it is looking at i) Rs.25,000/MT EBITDA from 900-920KTPA carbon black volume, translating to Rs.22bn EBITDA from the carbon black business, ii) Rs.700 cr EBITDA from Aquapharm from 2x capacity from current levels, and iii) Rs.10-12bn EBITDA from battery chemicals. Further, it expects to generate INR 100 bn of OCF, which, it believes, will take care of the capex and debt reduction.

Other Key Highlights

- During the quarter, its Tamil Nadu plant received a sales volume of 28,228MT and has reached full capacity utilization in 12 months.

- Brownfield expansion of TN facility by 90,000 MTPA Carbon Black and 12 MW Green Power is being expedited. First phase of 30,000 MTPA to be commissioned by Q3FY25 and 2nd phase of 60,000 MTPA by H1FY24.

- Guidance- Current capacity stood at 770,000 MTPA and management mentioned that they are fast tracking the specialty project of 20,000 MTPA capacity in Mundra and 90,000 MTPA carbon black facility in PCBL (TN).

- They expect carbon black capacity to reach 880,000 tonnes/1mt by FY27/FY28.

- They have received approval from all major tyre manufacturers in India and clocked a capacity utilisation of 85% + during the quarter.

- Their Joint venture with kinaltek has started work on large scale pilot plant in India which will develop Nano-Silicon additives to be used in anodes of Li-Ion batteries.

- Management mentioned the ban on carbon black from Russia into China. The European tyre manufacturers have started increasing sourcing from India.

Outlook & valuation

PCBL demonstrated resilient financial performance in Q4FY24, showcasing strong revenue growth and record sales volumes, particularly in specialty black and performance segments. The company's strategic focus on diversifying its product portfolio and entering the specialty chemicals segment through acquisitions and joint ventures bolsters long term growth prospects for the company. The joint venture with Kinaltek for EV battery materials and the successful integration of Aquapharm positions PCBL well within high-growth markets, enhancing its long-term growth prospects. The expansion projects in Tamil Nadu and Mundra, along with the anticipated increase in capacity utilization, reflect PCBL's commitment to scaling operations efficiently. The company's proactive steps to mitigate freight cost challenges and capitalize on the European ban on Russian carbon black further underscore its adaptive and resilient business model.

We believe that PCBL Ltd is well placed to capitalize on several structural tailwinds such as i) elevated feedstock price for Chinese players due to higher use of coal tar towards synthetic graphite for EV batteries, ii) lower availability of coal tar due to the shift towards electric arc furnace, and iii) limited capacity additions in developed nations due to higher compliance costs. Further, we believe European sanctions on Russian imports starting Jul’24 would further create an export opportunity for Asian players. Further, we also feel that PCBL has scope for margin expansion due to a change in mix towards specialty and performance blacks, positive operating leverage as utilization in its existing plants kicks in, and the introduction of key high conductive and superconductive products). Healthy demand outlook for end-user segments, majorly the domestic tyre industry, will drive revenue growth over the medium term. At a CMP of Rs.478, the stock is trading at 24x FY26. We maintain a HOLD rating on the stock.

Consolidated Financial statements

Profit & Loss statement

| Particulars (Rs. in cr) | Q1FY25 | Q1FY24 | YoY (%) | Q4FY24 | QoQ (%) |

|---|---|---|---|---|---|

| Revenue from operations | 2144.00 | 1348.00 | 59.00% | 1929.00 | 11.00% |

| COGS | 1449.00 | 935.00 | 55.00% | 1318.00 | 10.00% |

| Gross Profit | 695.00 | 413.00 | 68.00% | 611.00 | 14.00% |

| Gross Margin (%) | 32.42% | 30.64% | 178 bps | 31.67% | 75 bps |

| Employee Benefit expenses | 100.00 | 52.00 | 92.00% | 81.00 | 23.00% |

| Other expenses | 236.00 | 149.00 | 58.00% | 221.00 | 7.00% |

| EBITDA | 359.00 | 212.00 | 69.00% | 309.00 | 16.00% |

| EBITDA Margin (%) | 16.74% | 15.73% | 101 bps | 16.02% | 72 bps |

| Depreciation and amortization expenses | 84.00 | 41.00 | 105.00% | 75.00 | 12.00% |

| EBIT | 275.00 | 171.00 | 61.00% | 234.00 | 18.00% |

| Finance cost | 121.00 | 19.00 | 537.00% | 108.00 | 12.00% |

| Other Income | 11.00 | 4.00 | 175.00% | 23.00 | -52.00% |

| PBT | 164.00 | 154.00 | 6.00% | 149.00 | 10.00% |

| Tax expenses | 46.00 | 45.00 | 2.00% | 38.00 | 21.00% |

| PAT | 118.00 | 109.00 | 8.00% | 111.00 | 6.00% |

| EPS (Rs.) | 3.13 | 2.89 | 8.00% | 2.95 | 6.00% |