Lupin Ltd

Quarterly Result - Q3FY25

Lupin Ltd

Pharmaceuticals & Drugs - Global

Current

Previous

Stock Info

Shareholding Pattern

Price performance

Indexed Stock Performance

Financial Highlights:

| Particulars (in Rs. Cr) | Q3FY25 | Q3FY24 | YoY (%) | Q2FY25 | QoQ (%) |

|---|---|---|---|---|---|

| Revenue from Operations | 5768.00 | 5197.00 | 11.00% | 5673.00 | 2.00% |

| EBITDA | 1356.00 | 1038.00 | 31.00% | 1340.00 | 1.00% |

| EBITDA Margin (%) | 23.51% | 19.97% | 354 bps | 23.62% | (12) bps |

| PAT | 859.00 | 619.00 | 39.00% | 859.00 | 0.00% |

| EPS | 18.69 | 13.41 | 39.00% | 18.64 | 0.00% |

Source: Company Filings; stockaxis Research

Q3FY25 Result Highlights

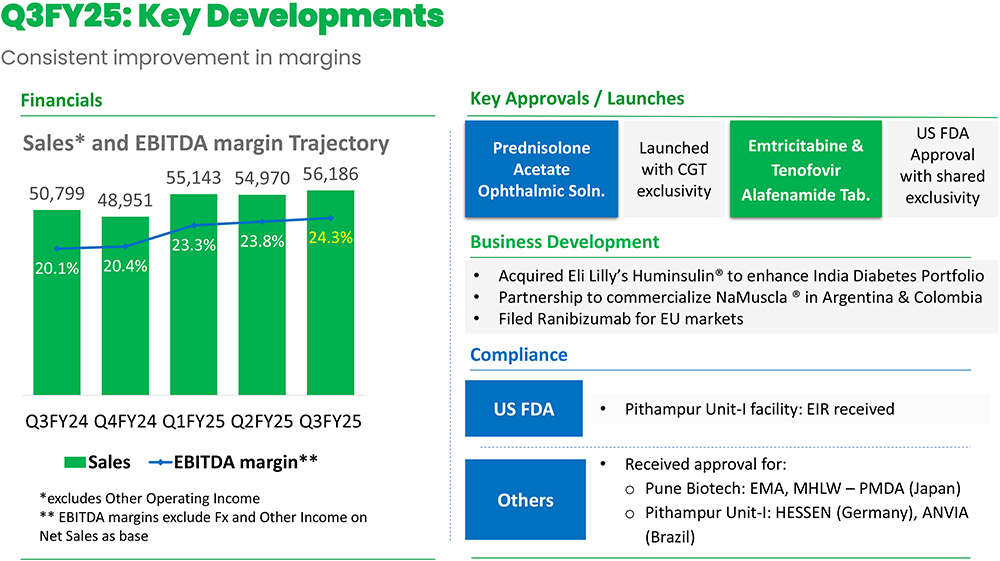

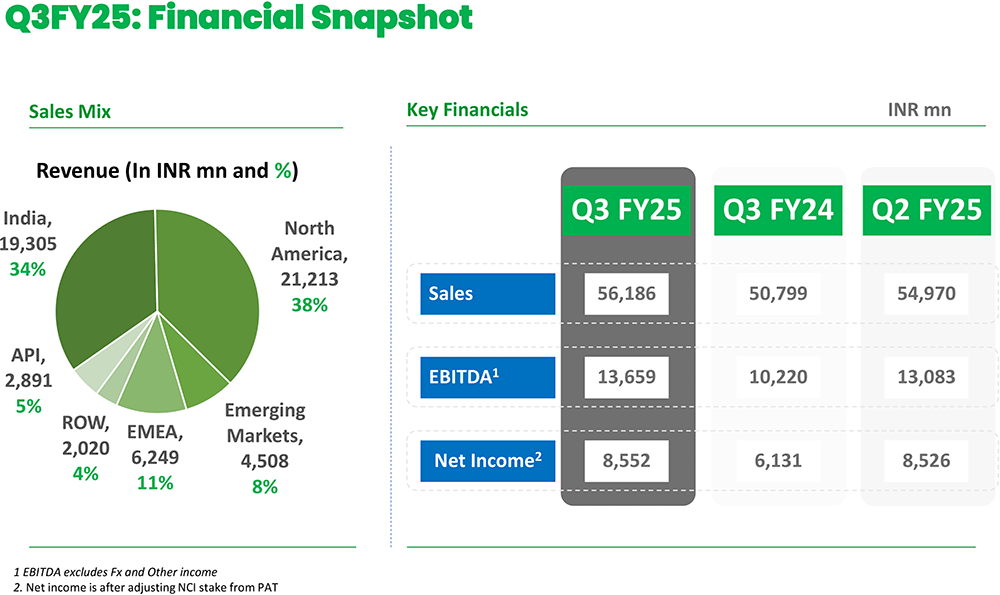

Lupin Q3FY25 earnings managed to beat estimates driven by new product launches,

and strong growth in North America, India, South Africa, and other markets. Consolidated

net sales rose 11% YoY to Rs.5,768 cr. Lupin saw a remarkable turnaround in profitability

with ~2x jump in EBITDA over FY23-24 aided by better product mix, continued niche

launches in the US, clearance from USFDA for facilities, domestic formulations regaining

momentum and cost optimization measures. Consolidated EBITDA exhibited robust growth

of 31% YoY to Rs.1,356cr driven by higher operating leverage while margins for the

quarter expanded by 354 bps at 23.51% YoY. Gross Margins came in 336 bps higher

at 70.15% driven by product mix, lower input costs, operational efficiencies, and

also cost improvements. PAT soared to Rs.859cr, registering a growth of 39% YoY.

For 9MFY25, Rx business grew 1.1 times the IPM, driven by key therapies like Diabetes, Cardiac, GI, AI & VMS which delivered above market performance.During the quarter, Rx business grew 9.1% while In-licensed products contributed 12% of revenue for 9MFY25.Key segments - Diabetes, Cardiology, GI, AI& VMS grew faster than market. Notably, the diabetes segment grew by approximately 10.9%, significantly outperforming IPM growth of 8.5%. The chronic segment, accounted for around 65% of sales vs 62% of sales in Q2FY25.The anti-diabetes segment provided market beating growth of 10.9% (vs 8.5% for IPM) during 9MFY25. The tender business aided growth during the quarter; however it is likely to stay flat next year.

Lupin registered robust growth across most key geographies. North America has grown by 12% YoY. India's business has grown at a healthy 11.9% YoY, whereas EMEA grew at 20.9% YoY. Growth markets saw a degrowth of -4.7%YoY and API business has grown 4% YoY.

North America

- Sales of $235 million, a 10.5% increase YoY in dollar terms.

- Growth driven by volume growth and new product introductions, balanced out by price declines and new competition for products like Albuterol and Suprep.Base products experienced low single-digit price erosion. Strong performance was witnessed in the respiratory portfolio with a high market share.

- The growth was aided by volume growth in base portfolio and new products such as Mirabegron which offset the expected competition in Albuterol and gSuprep.

- Expanding in the US through acquisitions or in-licensing late-stage assets.

- Focus on enhancing US profitability through a refined product mix and operational efficiencies.

- Complex generics now contribute 35% of revenues.

- Respiratory market share: gAlbuterol at 23%, gSpiriva steady at ~30%.

- The management cited about investing in respiratory platforms such as Ellipta and Respimat and focusing on MDI, DPI and nebulization technologies

India Business

- Sales growth of 11.9% YoY.

- Prescription business grew 9.1% in the nine months of FY25, outperforming the 8.2% market growth.

- Growth observed in chronic therapy segments like diabetes and cardiology.

- Respiratory segment growth was muted during the quarter.

- Strong YoY growth in both formulation and institutional segments.

- Therapy-wise performance:

- Key therapy areas (Diabetes, Cardiology, GI, Anti-infective, and VMS) outperformed the IPM.

- Chronic portfolio share increased to 65% of total revenues

- Rx business grew 9.1% while In-licensed products contributed 12% of revenue for 9MFY25.

- The management stated that it is strengthening the diabetes portfolio with the acquisition of the human insulin range from Eli Lilly. It also acquired 3 trademarks from BoehringerIngelheim for the Indian market. MR strength stood at 7,700 and 11 brands launched across various therapies in 9MFY25.

EMEA

- EMEA region posted a strong growth of 20.9% YoY, led by growth in the UK and Germany.

Growth Markets

- Sales in emerging markets declined 4.7% YoY, affected by currency impacts in Latin America.

- Growth markets showed healthy growth, on back of strong contribution from Luforbec and NaMuscla from UK and Germany markets. Focus remains on launching it in Spain and few other countries.

Other Markets

- Strong double digit growth in Germany and the UK.

- South Africa – revenues up 4% YoY (8th largest generics player)

- Brazil grew 19% YoY, generating over BRL 64mn of sales in Q3FY25.

- Mexico – Sales were up 11% YoY, driven by higher Ophthalmic and Antiallergic sales.

- In markets of Australia and Phillipines, Lupin is the No. 4 generics player and No. 2 Branded Gx player respectively.

Key Conference call takeaways

Guidance

- US business – Anticipating double-digit growth in FY25.

- India business – Aiming to deliver above - market growth in formulations.

- EBITDA Margin – Projected at 22.5% to 23.5% for FY25.

The company expects to retain US Dollar sales at $220-230 million on a quarterly basis higher than $ 200 million run rate driven by gSpiriva, gMirabigron, gAlbuterol, etc. gSpiriva market share is at 30%.

In FY26, the company is planning to cross a USD 1bn run rate in the US market.

For the full year, R&D is expected to be around Rs.1,800 crores.

Gross margins to sustain at current levels around 68-69%.

US business

- Lupin launched two new products in the US during Q3FY25. The company received six ANDA (Abbreviated New Drug Application) approvals from the USFDA, increasing its total approvals to 334.

- Lupin’s complex generics portfolio accounts for ~35.0% of North American sales. The company plans to file 30+ ANDAs in the next two years, with over 50.0% being complex products.

- Products like Albuterol (23.0% market share), Tiotropium (29.6% share), and Arformoterol (30.3% share) continue to drive sales.

- Low single-digit price declines in base products partially offset the volume growth from existing products and contributions from new product launches in the U.S. market.

- The generic version of Pred Forte (Prednisolone Acetate Ophthalmic Solution) was launched with Competitive Generic Therapy (CGT) exclusivity, which boosted revenue.

- The company acquired the Huminsulin range of products from Eli Lilly and three trademarks from Boehringer Ingelheim for the Indian market, strengthening its diabetes portfolio. R&D as a percentage of sales was 7.7% during Q3FY25 and R&D expenses are expected to be around Rs. 18,000 Mn for FY25E, which will mean a significant increase in R&D spending in Q4FY25E.

- A significant portion of the R&D spend is attributed to the company's complex generics portfolio, specifically five nasal sprays expected to be filed in Q4FY25E.

- Base products experienced low single-digit price erosion. Complex generics now contribute 35% of revenues.

- Management cited about investing in respiratory platforms such as Ellipta and Respimat and focusing on MDI, DPI and nebulization technologies.

- The company anticipates its US business to deliver double-digit growth in FY25E, ahead of its earlier guidance of high single-digit growth in the segment.

- Lupin expects Tolvaptan to have a stronger revenue tailwind due to its speciality nature, REMS (Risk Evaluation and Mitigation Strategy) restrictions, which will lead to slower price erosion even after competition enters. This ensures a meaningful contribution in H2FY26E and into FY27E.

- The company has a strong pipeline with over 20 respiratory products and 40 injectable products in development. The company believes its strong pipeline will help drive growth in the US market despite losing exclusivity on certain products.

Growth Markets

- Growth markets showed healthy growth, on back of strong contribution from Luforbec and NaMuscla from UK and Germany markets. Focus remains on launching it in Spain and few other countries. Intends to launch Semaglutide in first wave of launch in FY27 for Canadian markets.

India market

- In India, growth was led by Diabetes, Cardiology, Gastrointestinal (GI), Anti-infectives (AI), and Vitamins, Minerals & Supplements (VMS), all of which grew faster than the market.

- In domestic business, 11 new brands launched in Q3FY25.

- Strong YoY growth in both formulation and institutional segments. Key therapy areas (Diabetes, Cardiology, GI, Anti-infective, and VMS) outperformed the IPM.

- Chronic portfolio share increased to 65% of total revenues. Rx business grew 9.1% while In-licensed products contributed 12% of revenue for 9MFY25.

Outlook & valuation

Lupin reported a beat in Q3FY25 driven by a superior show in all key markets (North America, India, Europe, and South Africa), new product launches, lower R&D spending, and a low tax rate. In the U.S, new launches, complex generics, and strong respiratory sales, including Albuterol, Tiotropium, and Arformoterol, drove momentum. The company is focused on complex generics such as inhalers in the respiratory segment and injectables to spur growth. The company has a healthy product pipeline of complex generics and specialty products, which constitute 70% of the product pipeline. The company envisages US cc sales to increase from $230mn in FY25E and inch up to a $250 million quarterly run rate from FY2026E, driven by - 1) No immediate competition expected in Spiriva, 2) Expected launch of Mirabegron, 3) Launch of peptide-based products like Liraglutide, 4) Launch of ophthalmic products like Glucagon, and 5) High-value low competitors products like Tolvaptan, Slynd, and Loteprednol and Risperdal Consta. The new product pipeline is expected to aid in increasing the EBITDA margin to 23-24%, in line with peers. India's business is also expected to sustain double-digit growth, led by 1) Increasing productivity through 7,700 medical representatives (MRs), 2) a healthy chronic portfolio of 65%, and 3) Venturing into newer segments like respiratory, cardiology, and diabetes therapy areas.

The launch of generic Pred Forte with CGT exclusivity further boosted revenue. In India, growth in diabetes, cardiology, and gastrointestinal therapies was supported by new launches and acquisitions. Profitability improved significantly due to a better product mix with a greater contribution from complex generics and operating leverage. The U.S. market is expected to sustain double-digit growth, driven by a robust pipeline of complex generics, injectables, and respiratory therapies. Additionally, the India Formulations business is poised to outperform the market, supported by new product launches, strategic acquisitions, and a growing focus on chronic therapies.

The U.S. is a key market for Lupin where it is grappling with issues surrounding the high intensity of competition in the Oral Solid Dosage (OSD) segment in the U.S. The company has been trying to restructure or optimize the U.S. business and enhance it with the help of launching complex generics and specialty products in respiratory, injectables, and biosimilar segments. With improvement in U.S. profitability post restructuring and key product a launch lined up, including gSpiriva, and as it has added sales representatives in India, we expect a sustained improvement in profitability on an operating and net basis. Lupin is expected to sustain strong earnings growth momentum in FY25/FY26 on account of improved traction in USA, better margin and compliance. It has seen improved traction across its key markets, resulting in better operating leverage. The company continues to invest in the ANDA pipeline, comprising injectables, inhalation and biosimilars. At CMP of Rs.1970, the stock is trading at 32x FY26E. We maintain HOLD rating on the stock.

Consolidated Financial statements

Profit & Loss statement

| Particulars (in Rs. Cr) | Q3FY25 | Q3FY24 | YoY (%) | Q2FY25 | QoQ (%) |

|---|---|---|---|---|---|

| Revenue from Operations | 5768.00 | 5197.00 | 11.00% | 5673.00 | 2.00% |

| Cost of Goods Sold | 1722.00 | 1726.00 | 0.00% | 1690.00 | 2.00% |

| Gross Profit | 4046.00 | 3471.00 | 17.00% | 3983.00 | 2.00% |

| Gross Profit Margin (%) | 70.15% | 66.79% | 336 bps | 70.21% | (6) bps |

| Employee Benefit Expenses | 984.00 | 889.00 | 11.00% | 1008.00 | -2.00% |

| Other Expenses | 1706.00 | 1544.00 | 10.00% | 1635.00 | 4.00% |

| EBITDA | 1356.00 | 1038.00 | 31.00% | 1340.00 | 1.00% |

| EBITDA Margin (%) | 23.51% | 19.97% | 354 bps | 23.62% | (12) bps |

| Depreciation | 271.00 | 257.00 | 6.00% | 257.00 | 6.00% |

| EBIT | 1085.00 | 781.00 | 39.00% | 1083.00 | 0.00% |

| Finance Cost | 67.00 | 74.00 | -10.00% | 71.00 | -6.00% |

| Other Income | 54.00 | 29.00 | 83.00% | 42.00 | 27.00% |

| Profit Before Tax | 1071.00 | 736.00 | 46.00% | 1055.00 | 2.00% |

| Taxes | 212.00 | 117.00 | 81.00% | 195.00 | 9.00% |

| PAT | 859.00 | 619.00 | 39.00% | 859.00 | 0.00% |

| EPS | 18.69 | 13.41 | 39.00% | 18.64 | 0.00% |