Lupin Ltd

Rs. 2576.40

Date: May 14, 2025

-

Rating: Hold

-

Previous Rating: Hold

-

BSE Code: 500257

-

NSE Symbol: LUPIN

Stock Info

- Bloomberg LPC:IN

- Reuters LUPN.NS

- Face Value (Rs) 2

- Equity Capital (Rs cr) 91

- Mkt Cap (Rs cr) 92638.36

- 52w H/L (Rs) 2402.90 - 1493.30

- Avg Daily Vol (BSE+NSE) 1,598,135

Shareholding Pattern

- (as on 31-Mar) %

- Promoter 46.91

- FIIs 21.46

- DIIs 25.41

- Public & Others 6.22

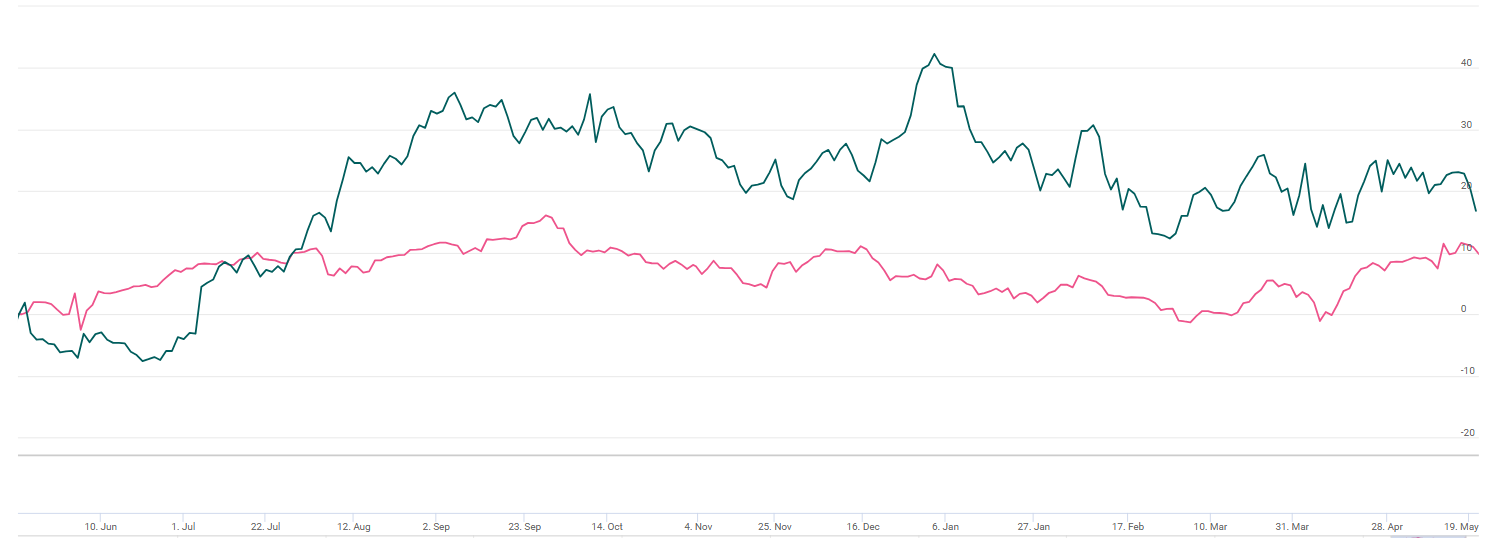

Price Performance

- Return (%) 1m 3m 12m

- Absolute 2.98 5.26 26.63

- Sensex 5.99 7.10 11.25

Indexed Stock Performance

LUPIN Sensex

Data Source: Ace equity, stockaxis Research

Lupin Ltd

Financial Highlights:

| Particulars (in Rs. Cr) | Q4FY25 | Q4FY24 | YoY (%) | Q3FY25 | QoQ (%) |

|---|---|---|---|---|---|

| Revenue from Operations | 5667.00 | 4961.00 | 14.24% | 5768.00 | -1.75% |

| EBITDA | 1321.00 | 997.00 | 32.54% | 1356.00 | -2.57% |

| EBITDA Margin (%) | 23.31% | 20.09% | 322 bps | 23.51% | (20) bps |

| PAT | 782.00 | 368.00 | 112.49% | 859.00 | -8.93% |

| EPS | 16.92 | 7.89 | 114.45% | 18.74 | -9.71% |

Source: Company Filings; stockaxis Research

Q4FY25 Result Highlights Lupin reported good numbers in Q4FY25, with revenues up 14.23% YoY to 5667 crs. EBITDA grew 32% YoY to Rs 1,321 crs on account of higher gross profit and operating leverage benefits. PAT grew 108% YoY to Rs 768 crs led by lower tax expenses. Earnings were primarily driven by higher sales in the US and Europe, along with improved gross margins. The company's ambition to achieve double-digit growth in the domestic market in FY26, despite a high base in FY25, coupled with its guidance of a 100bps margin expansion and continued R&D investments in complex generics, stood out as key positives—especially at a time when some peers may be forced to scale back R&D to preserve margins.

Key Conference Call Takeaways

US Business, Domestic Portfolio, and Growth Strategy

- MDI and DPI products contribute around one-third of Lupin’s US revenue, with the overall respiratory portfolio making up ~25% of total sales.

- Mirabegron continues to be sold and will remain a meaningful revenue driver through FY26.

- The share of complex generics and specialty products in US sales is expected to grow to ~55% by FY30, from ~34% currently.

- In India, erosion in the in-licensed portfolio over the past three years has largely stabilized.

- Chronic therapies are projected to form ~70% of domestic sales by FY30 (vs ~64% now).

Expansion Initiatives, Diagnostics Outlook, and Biosimilar Strategy

- Lupin's pilot launch of an extra-urban division in India succeeded, prompting expansion of its salesforce in tier 2/3 markets.

- Lupin Diagnostics is expected to turn EBITDA positive by FY27, while Lupin Life (OTC business) topline could double in 3–4 years.

- The company holds ~18% domestic market share in human insulin and may gain 6–7% more after Novo Nordisk’s exit.

- DPI and MDI products in the pipeline have been filed from Indian and US (Coral Springs) facilities.

- Lupin will pursue biosimilars selectively, aiming for first-wave entry; despite price erosion, development and access costs have declined.

- Lupin Manufacturing Solutions, with a dedicated CRDMO team, is building a strong pipeline and may scale significantly over the next two years.

Guidance

- The company aims to achieve double-digit growth in the domestic market in FY26, despite a high base in FY25.

- Lupin has guided for a 100 basis points margin expansion in FY26.

- Continued R&D investments in complex generics are expected to support future growth, particularly as some peers may reduce R&D to maintain margins.

- FY29 is expected to benefit from meaningful launches from the Respimat and Ellipta platforms.

- Its positive outlook is underpinned by the conviction that Jynarque will remain a meaningful earnings contributor through FY27.

- Mirabegron will remain a meaningful revenue driver through FY26.

- The share of complex generics and specialty products in US sales is expected to increase to ~55% by FY30 (from ~34% currently).

- Chronic therapies are projected to constitute ~70% of domestic sales by FY30 (vs ~64% currently).

- Lupin will expand its salesforce in tier 2/3 markets following the successful pilot of its extra-urban division.

- Lupin Diagnostics is expected to turn EBITDA positive by FY27.

- The topline of Lupin Life (OTC business) could double in the next 3–4 years.

- Lupin may gain 6–7% domestic market share in human insulin following Novo Nordisk’s exit.

- Lupin will pursue biosimilars selectively and aims to be in the first wave, benefiting from reduced development and market access costs.

Outlook & valuation

Lupin reported a beat in Q4FY25 driven by a superior show in North America, Europe, new product launches, lower R&D spending, and a low tax rate. The Company is focused on complex generics such as inhalers in the respiratory segment and injectables to spur growth. The company has a healthy product pipeline of complex generics and specialty products, which constitute 70% of the product pipeline. The company envisages US cc sales to increase from $245mn in FY25 and inch up to a $250 million quarterly run rate from FY2026E, driven by - 1) No immediate competition expected in Spiriva, 2) Expected launch of Mirabegron, 3) Launch of peptide-based products like Liraglutide, 4) Launch of ophthalmic products like Glucagon, and 5) High-value low competitors products like Tolvaptan, Slynd, and Loteprednol and Risperdal Consta. The new product pipeline is expected to aid in increasing the EBITDA margin to 23-24%, in line with peers. India's business is also expected to sustain double-digit growth, led by 1) increasing productivity through 7,700 medical representatives (MRs), 2) a healthy chronic portfolio of 70%, and 3) venturing into newer segments like respiratory, cardiology, and diabetes therapy areas.

The launch of generic Pred Forte with CGT exclusivity further boosted revenue. In India, growth in diabetes, cardiology, and gastrointestinal therapies was supported by new launches and acquisitions. Profitability improved significantly due to a better product mix with a greater contribution from complex generics and operating leverage. The U.S. market is expected to sustain double-digit growth, driven by a robust pipeline of complex generics, injectables, and respiratory therapies. Additionally, the India Formulations business is poised to outperform the market, supported by new product launches, strategic acquisitions, and a growing focus on chronic therapies.

The U.S. is a key market for Lupin, where it is grappling with issues surrounding intense competition in the Oral Solid Dosage (OSD) segment in the U.S. The company has been trying to restructure or optimize the U.S. business and enhance it with the help of launching complex generics and specialty products in the respiratory, injectables, and biosimilar segments. With improvement in U.S. profitability post restructuring and key product launches lined up, including gSpiriva, and as it has added sales representatives in India, we expect a sustained improvement in profitability on an operating and net basis. Lupin is expected to sustain strong earnings growth momentum in FY25/FY26 on account of improved traction in the USA, better margins, and compliance. It has seen improved traction across its key markets, resulting in better operating leverage. The company continues to invest in the ANDA pipeline, comprising injectables, inhalation, and biosimilars. At CMP of Rs. 1965, the stock is trading at 23x FY27E. We maintain a HOLD rating on the stock.

Consolidated Financial statements

Profit & Loss statement

| Particulars (in Rs. Cr) | Q4FY25 | Q4FY24 | YoY (%) | Q3FY25 | QoQ (%) |

|---|---|---|---|---|---|

| Revenue from Operations | 5667.00 | 4961.00 | 14.24% | 5768.00 | -1.75% |

| Cost of Goods Sold | 1686.00 | 1574.00 | 7.14% | 1722.00 | -2.08% |

| Gross Profit | 3981.00 | 3387.00 | 17.54% | 4046.00 | -1.61% |

| Gross Profit Margin (%) | 70.25% | 68.28% | 197 bps | 70.15% | 10 bps |

| Employee Benefit Expenses | 1001.00 | 900.00 | 11.22% | 984.00 | 1.75% |

| Other Expenses | 1659.00 | 1490.00 | 11.31% | 1706.00 | -2.78% |

| EBITDA | 1321.00 | 997.00 | 32.54% | 1356.00 | -2.57% |

| EBITDA Margin (%) | 23.31% | 20.09% | 322 bps | 23.51% | (20) bps |

| Depreciation | 393.00 | 457.00 | -13.98% | 271.00 | 45.08% |

| EBIT | 928.00 | 540.00 | 71.94% | 1085.00 | -14.48% |

| Finance Cost | 89.00 | 71.00 | 24.98% | 67.00 | 32.99% |

| Other Income | 57.00 | 29.00 | 94.70% | 54.00 | 5.46% |

| Profit Before Tax | 896.00 | 498.00 | 80.00% | 1071.00 | -16.36% |

| Taxes | 113.00 | 129.00 | -12.38% | 212.00 | -46.48% |

| PAT | 782.00 | 368.00 | 112.49% | 859.00 | -8.93% |

| EPS | 16.92 | 7.89 | 114.45% | 18.74 | -9.71% |