Lumax Auto Technologies Ltd

Quarterly Result - Q2FY25

Lumax Auto Technologies Ltd

Auto Ancillary

Current

Previous

Stock Info

Shareholding Pattern

Price performance

Indexed Stock Performance

Financial Highlights:

| Particulars (Rs. in cr) | Q2FY25 | Q2FY24 | YoY (%) | Q1FY25 | QoQ (%) |

|---|---|---|---|---|---|

| Revenue from operations | 842.00 | 700.00 | 20.00% | 756.00 | 11.00% |

| EBITDA | 102.00 | 90.00 | 13.00% | 88.00 | 16.00% |

| EBITDA Margin (%) | 12.11% | 12.86% | (60 bps) | 11.64% | 47 bps |

| PAT | 52.00 | 37.00 | 41.00% | 42.00 | 24.00% |

| EPS (Rs.) | 6.29 | 4.02 | 56.00% | 4.65 | 35.00% |

Source: Company Filings; stockaxis Research

Q2FY25 Result Highlights

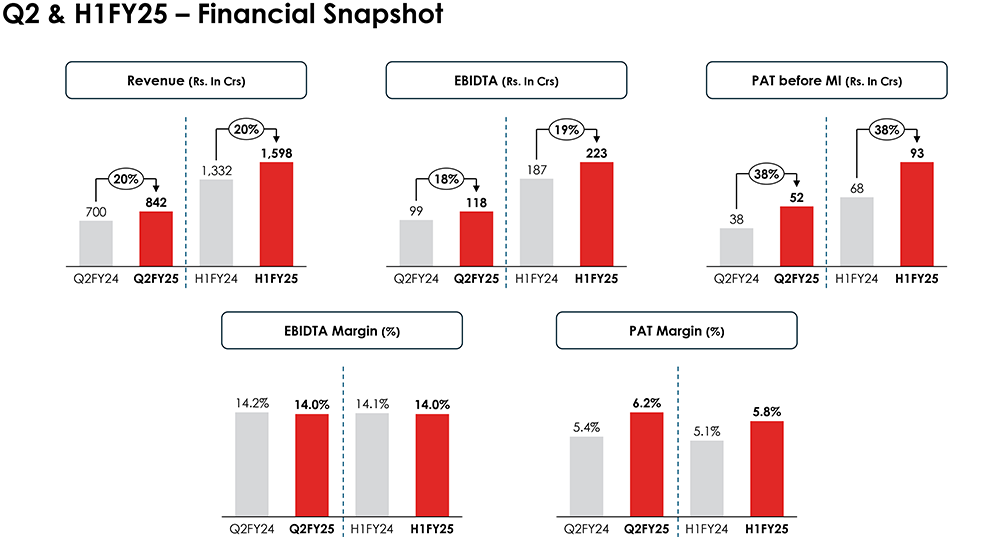

Lumax Auto reported steady financial performance for the quarter ended Q2FY25. Consolidated

revenues grew 20% YoY to Rs.842 cr, which has been the highest ever single quarter

revenue in the history of the company on the back of 29.4% YoY growth in IACI’s

business and 16% YoY growth in Ex IACI’s business. EBITDA increased by 13%

YoY to Rs 102 cr. EBITDA margin contracted by 60 bps YoY to 12.11% on 94 bps contraction

in gross margin. IACI business has reported a 650 bps contraction in EBITDA margin

to 14.2%, while Ex IACI’s business has reported a 170 bps YoY improvement

in EBITDA margin. With this operating performance, PAT increased by 41% YoY to Rs.52

cr. In H1FY25 Advance plastic models contributed 57% to the overall revenue, followed

by the aftermarket at 12%, Structures & Control Systems at 21%, Mechatronics

at 3%, and others at 7%.

This quarter saw a subdued performance mainly in the Passenger Vehicle segment, due to elections, heatwaves, and an uneven monsoon across the country. Inventory levels for passenger vehicles remained elevated during the quarter.

Key Conference call takeaways

Revenue breakup in H1FY25:

Passenger vehicles contributed 50% to overall

revenue, two and three-wheelers at 25%, aftermarket at 12%, CV at 9%, and others

at 4%.

PV Segment:

Inventory levels were higher in anticipation of new model

launches but have started to decline due to strong sales during the festive season

and attractive OEM discounts. LATL expects low single-digit growth in the PV segment

for FY25.

Two-Wheeler Segment:

Continued to experience strong growth, particularly

in rural areas. This growth was fueled by the launch of high-end models and strong

festive season demand. The company anticipates continued upward momentum, driven

by a robust rural economy, premium model introductions, and shifting consumer preferences.

CV segment – Hopeful for a rebound in demand in the second half of the year as government spending resumes and infra projects regain momentum.

Key Strategies:

The company is focused on several strategic initiatives

to ensure continued growth: (1) Increasing Content per Vehicle: Lumax aims to enhance

its product offerings across all vehicle segments. (2) Inorganic Growth:

The company is pursuing joint ventures and acquisitions to introduce fuel-agnostic

product categories, bolstering both top-line and bottom-line growth. (3) OEM Partnerships:

Lumax continues to strengthen its relationships with major OEMs, positioning itself

as a trusted single-source supplier while leveraging global joint venture expertise

to deliver cutting-edge technologies. (4) R&D Focus: The company is increasing

investments in in-house R&D, focusing on advanced technologies such as autonomous

driving assistance (ADA), electronics integration, Human-Machine Interface (HMI),

and software.

IAC India (IACI):

IACI continued to show strong growth, driven by solid

performance from its key customers. The company is planning brownfield expansions

in H2 FY25. A major highlight is the win of a full-service supplier business for

Tata Motors, including a new lighting product line, with a start of production (SOP)

expected in 2026.

Lumax Cornaglia:

The division experienced flat growth in H1FY25, primarily

due to degrowth in Tata Motors’ business. However, single-digit growth is

expected in H2FY25, with higher momentum anticipated next year. The plastic fuel

tank business has faced delays due to Tata Motors shifting back to metal fuel tanks,

but LATL is exploring new opportunities in roto-molding technology.

EV Strategy:

While LATL is not yet focusing on developing EV-specific

components, it is concentrating on developing EV-agnostic products that can be used

in both traditional and electric vehicle platforms. Currently, 40% of its order

book is dedicated to EV models across passenger cars and two-wheelers.

Key Growth drivers:

- Strong growth in the Mechatronics segment (76% YoY in H1FY25) driven by cross-selling opportunities and new product additions.

- Advance Plastics segment grew 17% YoY in H1FY25, fueled by premiumization trends and new product lines.

- Continued strong performance in standalone business, particularly for OEMs like Bajaj Auto and Honda Motorcycle and Scooter India (HMSI).

Key Growth Initiatives:

- Increasing content per vehicle across segments.

- Introducing EV-agnostic product categories through joint ventures and acquisitions.

- Maintaining position as a single-source partner for major OEMs.

- Enhancing in-house R&D capabilities focused on technologies like ADAS, electronics integration, HMI, and software.

Green Fuel Acquisition:

- Expected to be finalized in Q3 FY25 with revenue contribution starting in Q3 or Q4 FY25.

- Anticipate Rs.300-350 crores of revenue with a stronger EBITDA margin than current subsidiaries.

- Annualized revenue guidance is for FY26.

Lumax Alps Alpine:

- Expect revenue to double in H2 FY25, leading to 50% YoY growth for the full year.

- Aim to cross the Rs.100 crore revenue mark in FY26.

Other Important Points:

- The company maintains a strong cash position, exceeding long-term debt.

- Focus on inorganic growth opportunities to further accelerate growth rate.

- Exploring opportunities in alternate fuels like CNG and hydrogen, particularly in the CV space.

- Committed to ESG initiatives, including plant carbon neutrality and promoting gender diversity.

- Continued focus on operational efficiency and scaling up newer subsidiaries.

- Expect organic growth to be at least 50% higher than the industry growth rate in the next 3-4 years.

- Internal target to expand EBITDA margins to 15%, driven by top-line growth, operational efficiency, and scaling up of subsidiaries.

- Significant CAPEX planned for FY25 (Rs.120-140 crores), primarily focused on IAC and metallics for Bajaj business.

- Expect Rs.400 crores of additional revenue in FY25 from this CAPEX, resulting in an asset turnover of 1:7.

- The total order book, considering the value of all product and domain categories is Rs.1,050 crores, out of which 90% is new business. 15% of the order value will mature in the current financial year FY25, 40% in FY26, 30% in FY27, and the remaining residual 15% in FY28. EV contribution is approximately 40% of the total order book.

- The Capex outlay during H1FY25 has been Rs.32 crores. The Capex outlay for the whole year is estimated to be around Rs.120 crores to Rs.140 crores. The company is sitting on a healthy free cash of Rs.387 crores as of 30th September, which is more than the long-term debt of Rs.363 crores.

Outlook & valuation

Lumax Auto tech delivered a steady set of numbers in Q2FY25. We believe that Lumax Auto Tech could emerge as a key beneficiary of the revival in automotive demand and is expected to benefit from strong underlying demand from its clients in the 2W, PV, and CV space, driven by an expected recovery in the automotive segment and expansion of the product portfolio. We believe that the company is well poised to benefit from its strong relationship with leading OEMs, rich product mix, and robust order book from its existing clients providing strong earnings visibility. On the 2-wheeler side, management said that the recent launch of high-end models by OEMs has driven substantial demand with festive season sales providing an additional boost. It anticipates an upward trend to persist, fueled by a stronger rural economy, the continued introduction of premium models, and evolving consumer preferences.

Management has indicated a healthy uptick in the demand scenario in H2FY25 in support of the festive season and new product launches. We anticipate increasing content per vehicle from the growing four-wheeler (4W) segment and the probable rise in premiumisation in its order book for the 2W segment will support sustained profitability. Post the successful integration of IACI with itself, going forward management continues to look for inorganic growth opportunities to derisk its business model and diversify its revenue mix. With higher content per vehicle, increased wallet shares with existing customers, and the potential to expand its customer base, we remain positive about the company’s growth prospects. At a CMP of Rs.503, the stock is trading at 15x FY26E. We maintain a HOLD rating on the stock.

Consolidated Financial statements

Profit & Loss statement

| Particulars (Rs. in cr) | Q2FY25 | Q2FY24 | YoY (%) | Q1FY25 | QoQ (%) |

|---|---|---|---|---|---|

| Revenue from operations | 842.00 | 700.00 | 20.00% | 756.00 | 11.00% |

| COGS | 542.00 | 444.00 | 22.00% | 481.00 | 13.00% |

| Gross Profit | 300.00 | 256.00 | 17.00% | 275.00 | 9.00% |

| Gross Margin (%) | 35.63% | 36.57% | (94 bps) | 36.38% | (75 bps) |

| Employee Benefit Expenses | 114.00 | 94.00 | 21.00% | 108.00 | 6.00% |

| Other expenses | 84.00 | 73.00 | 15.00% | 80.00 | 5.00% |

| EBITDA | 102.00 | 90.00 | 13.00% | 88.00 | 16.00% |

| EBITDA Margin (%) | 12.11% | 12.86% | (60 bps) | 11.64% | 47 bps |

| Depreciation expenses | 29.00 | 30.00 | -3.00% | 30.00 | -3.00% |

| EBIT | 73.00 | 60.00 | 22.00% | 58.00 | 26.00% |

| Finance cost | 19.00 | 16.00 | 19.00% | 19.00 | 0.00% |

| Other Income | 15.00 | 9.00 | 67.00% | 17.00 | -12.00% |

| PBT | 70.00 | 53.00 | 32.00% | 56.00 | 25.00% |

| Tax expenses | 18.00 | 16.00 | 13.00% | 15.00 | 20.00% |

| PAT | 52.00 | 37.00 | 41.00% | 42.00 | 24.00% |

| EPS (Rs.) | 6.29 | 4.02 | 56.00% | 4.65 | 35.00% |