KPIT Technologies Ltd

Quarterly Result - Q1FY25

KPIT Technologies Ltd

IT - Software Services

Current

Previous

Stock Info

Shareholding Pattern

Price performance

Indexed Stock Performance

Financial Highlights:

| Particulars (Rs. cr) | Q1FY25 | Q1FY24 | YoY (%) | Q4FY24 | QoQ (%) |

|---|---|---|---|---|---|

| Revenue from operations | 1365.00 | 1098.00 | 24.00% | 1318.00 | 4.00% |

| EBITDA | 288.00 | 220.00 | 31.00% | 273.00 | 6.00% |

| EBITDA Margin (%) | 21.12% | 20.04% | 108 bps | 20.71% | 41 bps |

| Profit After Tax | 204.00 | 135.00 | 52.00% | 166.00 | 23.00% |

| EPS (Rs.) | 7.53 | 4.95 | 52.00% | 6.06 | 24.00% |

Source: Company Filings; stockaxis Research

Q1FY25 Result Highlights

KPIT Technologies’ industry leading performance continued in Q1FY25, reporting

a 4.7% QoQ and 25% YoY growth in CC terms, the strongest among ER&D players.

Growth was fuelled by passenger cars. The company reported dollar revenue growth

of 23% YoY growth led by Middleware, Powertrain and Asia. Consolidated EBITDA grew

by 31% YoY to Rs.288 cr and EBITDA Margins expanded by 108 bps at 21.12%. EBITDA

margins improved to 21.1% post two months of ESOP cost and quarterly promotions,

mainly due to fixed cost leverage. Sequential EBITDA growth of 5.6%. Other income

was lower as compared to last quarter due to conversion losses Yen denominated assets.

KPIT Tech managed to deliver 16 consecutive quarters of steady revenue and EBITDA

growth. PAT surged 52% YoY to Rs.204 cr which included one-time gain of Rs.40 cr.

Key Conference call takeaways

- Macro environment: Medium term business fundamentals and growth drivers remain unchanged. Management is seeing positive environment for auto ER&D spending across middleware, connected and autonomous domains, especially in SDV, after sales transformation.

- Engineering Research & Development (ER&D): Management mentioned that ER&D spending in new age areas remains robust while clients try to optimize cost in manufacturing and supply chain functions.

- FY25 outlook: Management reiterated guidance of broad based growth in FY25 in the range of 18-22% CC YoY revenue growth.

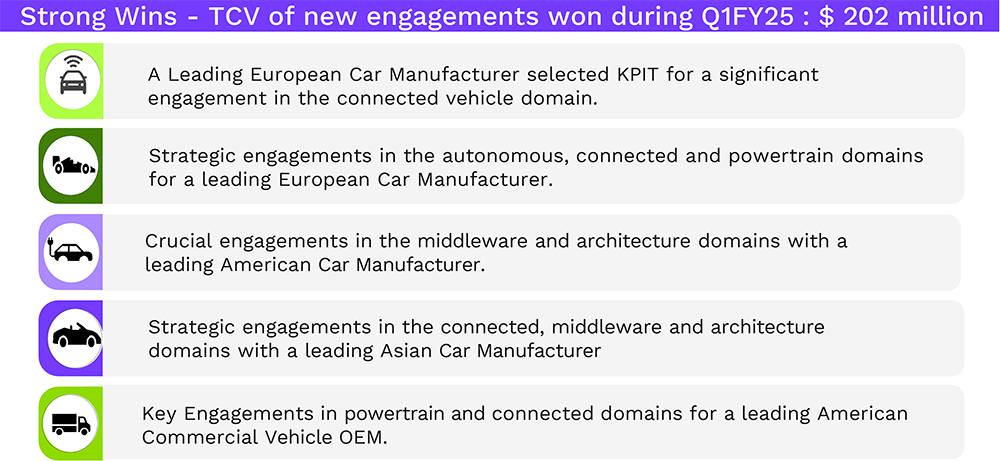

- Total Contract Value (TCV): TCV was modest at $202 mn, up 6% YoY, helped by 5 large deals contributing $120 mn, two each from Europe and US and one in Asia. Wins are in area of power train, connected, autonomous, middleware and architecture.

- Pipeline: Pipeline remains healthy and broad based; management mentioned there are 2 significant deals each in US and Europe in pipeline.

- Strategic clients: While bulk of the growth was driven by top 15 clients mgmt. now expects to drive growth from other Top 25 clients as they commit to more meaningful engagements resulting in broad based traction in T25.

- Qorix: The Company is planning to have product ready by end of next calendar year. Management has completed investment and would not need to invest significantly for 12- 18 months.

- Margin Outlook: Management maintained the margin guidance to 20.5%+ for FY25. Management intends to invest into business and technologies to propel growth. For Q2 wage hike impact may not be fully offset by growth.

- Margin levers: Improved rate realization, operational leverage and pyramid optimization will be margin levers.

Outlook & valuation

KPIT Tech delivered steady Q1FY25 earnings owing to healthy deal pipeline and growth led by Middleware, Powertrain and Asia. We believe that KPIT Tech appears to be in a strong position with a clear growth strategy and positive outlook. The company's focus on new technologies, deep client relationships, and successful deal wins has contributed to its consistent revenue growth and profitability. Management's commitment to doubling down on offerings, expanding into new markets, and increasing R&D spending in future-focused areas bodes well for its future growth potential.

Management reiterated guidance of 18-22% revenue growth for FY25 and an EBITDA margin of 20.5% reflects confidence in its ability to capitalize on opportunities in the automotive sector. However, management expressed concerns about industry pressures on demand and profitability, market saturation in china, and competition in the software defined vehicle space. KPIT's plans to invest in new practices, explore adjacencies, and expand its client base in key markets like India and China further support its growth prospects.

We believe that KPIT is well-positioned to capture the immense growth opportunity in the industry considering 1) Accelerated demand for ER&D services, 2) Focus on client retention for long-term sustainable growth, 3) Margin tailwinds driven by cost efficiencies, lower input costs, Robust Investments in newer technologies by the Auto industry, Capitalizing on growing investment in the Automotive vertical, Robust investments in CV segment, strong geographical diversification and strong services mix. The company's consistent industry-leading growth and margins expansion, coupled with positive trends in TCV, pipeline, and net additions, indicate sustained momentum. At a CMP of Rs.1789, the stock is trading at 45x FY26E. We maintain HOLD rating on the stock.

Consolidated Financial statements

Profit & Loss statement

| Particulars (Rs. cr) | Q1FY25 | Q1FY24 | YoY (%) | Q4FY24 | QoQ (%) |

|---|---|---|---|---|---|

| Revenue from operations | 1365.00 | 1098.00 | 24.00% | 1318.00 | 4.00% |

| Other Income | 54.00 | 8.00 | 594.00% | 16.00 | 242.00% |

| Gain on account of Business combinations | 13.00 | -100.00% | |||

| Total Income | 1419.00 | 1119.00 | 27.00% | 1334.00 | 6.00% |

| Operating expenses | 1076.00 | 884.00 | 22.00% | 1045.00 | 3.00% |

| EBITDA | 288.00 | 220.00 | 31.00% | 273.00 | 6.00% |

| EBITDA Margin (%) | 21.12% | 20.04% | 108 bps | 20.71% | 41 bps |

| Depreciation | 53.00 | 45.00 | 17.00% | 53.00 | 0.00% |

| EBIT | 236.00 | 175.00 | 35.00% | 220.00 | 7.00% |

| EBIT Margin (%) | 17.27% | 15.94% | 133 bps | 16.71% | 56 bps |

| Finance costs | 13.00 | 14.00 | -7.00% | 12.00 | 8.00% |

| Change in FMV of Investments | 0.00 | 0.00 | -50.00% | 1.00 | -81.00% |

| Profit before exceptional items | 277.00 | 177.00 | 57.00% | 225.00 | 23.00% |

| Profit/Loss from equity accounted investee | -1.00 | - | -1.00 | 26.00% | |

| Profit before tax | 277.00 | 177.00 | 57.00% | 224.00 | 23.00% |

| Tax | 73.00 | 42.00 | 73.00% | 59.00 | 24.00% |

| Profit After Tax | 204.00 | 135.00 | 52.00% | 166.00 | 23.00% |

| EPS (Rs.) | 7.53 | 4.95 | 52.00% | 6.06 | 24.00% |