Ipca Laboratories Ltd

Quarterly Result - Q3FY25

Ipca Laboratories Ltd

Pharmaceuticals & Drugs - Global

Current

Previous

Stock Info

Shareholding Pattern

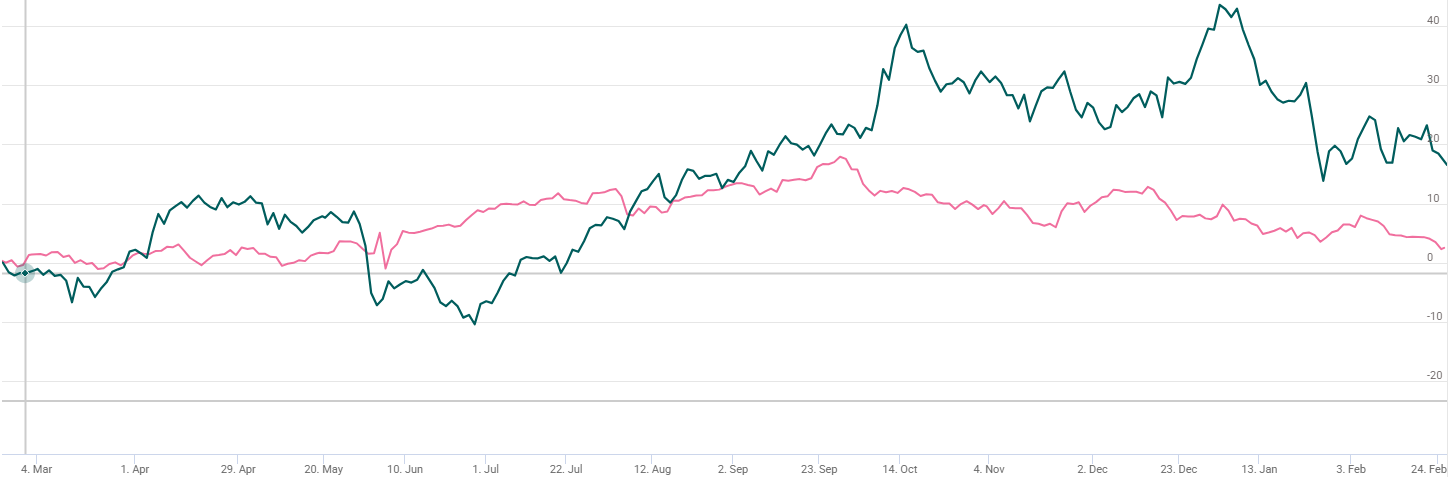

Price performance

Indexed Stock Performance

Financial Highlights:

| Particulars (in Rs. Cr) | Q3FY25 | Q3FY24 | YoY (%) | Q2FY25 | QoQ (%) |

|---|---|---|---|---|---|

| Revenue from Operations | 2245.00 | 2053.00 | 9.00% | 2355.00 | -5.00% |

| EBITDA | 463.00 | 331.00 | 40.00% | 441.00 | 5.00% |

| EBITDA Margin (%) | 20.62% | 16.12% | 450 bps | 18.73% | 189 bps |

| PAT | 277.00 | 223.00 | 25.00% | 245.00 | 13.00% |

| EPS (Rs.) | 9.78 | 7.09 | 38.00% | 9.05 | 8.00% |

Source: Company Filings; stockaxis Research

Q3FY25 Result Highlights

Ipca Labs delivered a strong set of numbers in Q3FY25, comfortably surpassing estimates

on all fronts. Consolidated net sales rose 9% YoY to Rs.2,245 cr as compared to

Rs.2,053 cr in the same quarter of the preceding fiscal. Sales growth was led by

11% YoY growth in domestic branded formulations, surpassing Indian Pharmaceutical

Market (IPM) growth of 8%. API Sales added to the overall growth, growing by 12%

YoY. Subsidiaries, led by Unichem contributed to the growth, growing by 7%. Healthy

sales and raw-material (RM) cost rationalization resulted in a massive increase

in gross margins (419 bps YoY and 245 bps QoQ) at 70.24% in Q3.

Subsequently, EBITDA grew 40% YoY to Rs.463 crores. EBITDA Margins expanded by 451 bps YoY and 188 bps QoQ, at 20.62%, mainly driven by a flow-through from gross margin benefit and relatively lower employee costs. Healthy operations, a 50% YoY decline in finance cost to Rs. 17 crores, and flattish depreciation resulted in PAT growth of 25% YoY to Rs. 277 crores.

Formulation sales grew 10% YoY to Rs.1335.32cr (73.4% of sales). Domestic Formulations (DF) sales rose 13% YoY to Rs.877.17cr (65.7% of formulation sales). Generics formulation exports saw a degrowth of 11% YoY to Rs. 224cr (48.9% of formulation export sales). Branded formulation exports grew by a robust 53% YoY to Rs.160.01cr (34.9% of export sales). Institutional sales exports saw muted growth at -3% YoY to Rs.74.14cr (16.2% of formulation export sales). API sales were strong growing at 12% YoY to Rs.317.92cr (19.1% of sales). Domestic API sales grew 22% YoY to Rs.95.16 cr (30.5% of API sales). API exports grew by 7% YoY to Rs.222.76 cr (70.1% of API sales). Revenue from subsidiaries grew 7% YoY to Rs.582.69 cr (23.1% of sales), largely led by Unichem.

Key Conference Call Takeaways

Guidance: (i) FY25 Revenue guidance for Unichem is revised to Rs. 1850-1900 crores for FY25, (ii) Consolidated revenue growth guided at 10-11% and standalone guidance revised to 9-10% for FY25, (iii) Consolidated EBITDA Margin guidance raised to 23-24%, (v) Capex guided for FY2025E is around Rs.3-3.5 billion, (v) Consolidated R&D spending is expected to increase to 4% of sales in the near future.

Market Share

- The company's market share improved by 11 basis points to 2.05% in Q3 FY25 from 1.95% in December 2023.

- Ipca ranks among the top 300 brands in the country with six of its brands, according to IQVIA.

- Both acute and chronic market segments are exhibiting growth surpassing the market average.

API Business

- The API business anticipates growth around 8-10%. Significant utilization of the Ratlam API capacity is planned for the US market, while the newly expanded Dewas API facility is functioning at 35-40% capacity, with improvements expected as regulatory approvals and inspections progress.

Generics

- The generics business witnessed a decline in the South Africa segment by about Rs.75-80 crore compared to last year, attributed to lost tender orders.

- The generics business is expected to see notable enhancements in the South Africa segment next year, driven by new tender orders.

Product Portfolio and Market Performance

- Six brands in chronic medication contributed significantly to growth, with the overall market in the acute segment growing by 7.4%.

- The chronic segment's growth was recorded at around 9.7%, while the acute segment grew by approximately 6%.

- Ipca's performance in the U.S. market is gradually improving, with several products in the pipeline.

Unichem Laboratories

- The Unichem acquisition has seen Unichem's EBITDA margin improve from about 5% last year to 12% currently, adding to the consolidated margin enhancement.

- In the US business, four Ipca products have been shipped via Unichem with 7-8 products in the pipeline. Meaningful numbers are anticipated in the upcoming quarters as bids are won and market presence is established.

- Long-term Unichem growth will result from new product launches and market expansion, with expected margin improvements due to operational efficiencies and synergy benefits.

Gross Margin Improvement

- There was a noteworthy reduction in material costs, boosting gross margins, with the material cost ratio improving from approximately 32% for the previous year's first 9 months to 28.73% this year.

- An enhanced product mix, particularly within the chronic portfolio, contributed positively to growth and margin improvement.

New Therapy Areas

- The company is concentrating efforts on building its standing in high-growth therapy areas such as pain management, cardiovascular, dermatology, and urology.

- The company plans to continue to make strategic investments in the above mentioned areas, which are expected to fuel continued growth and margin enhancement.

R&D

- R&D expenditures for Ipca and Unichem combined are around 3-3.25% of revenue, projected to increase to approximately 4% in the future.

Institutional business

No order cancellation as of now antimalarials. USAID quantum of business for IPCA at ~Rs 40 cr.

Future Outlook

- Management remains optimistic about sustaining growth, particularly in the chronic segment and pain management therapies.

- Plans to introduce new divisions focusing on orthopedics, cardiology, and dermatology, targeting high-growth areas in the pharmaceutical market.

- The company aims to leverage its existing relationships and product offerings to bolster market presence and increase sales.

Outlook & valuation

Ipca Labs delivered a strong set of results in Q3FY25, led by strong growth in the domestic formulations and the API businesses business, coupled with strong growth in the branded generics segments. Unichem’s business integration further added to the growth during the quarter. A healthy product mix led to the expansion of margins. Ipca is a fully integrated Indian pharmaceutical company, manufacturing a wide array of formulations and APIs for various therapeutic segments. The domestic formulations business is expected to grow at a healthy pace and is likely to be a key growth driver for the company. The company is witnessing strong demand traction in the API segment and is implementing de-bottlenecking to ease capacity constraints. Over the next year, Dewas’s expansion would come on stream and drive the topline. Moreover, the company has set up a new API plant at its Ratlam facility with a 50MT capacity, which is on the verge of commercialization. The expected improvement in the formulation business, and increased opportunities in the API space, and healthy traction from the institutional segment indicate strong earnings potential for the company.

The broad based revenue growth in 9M provides comfort while export API and generic should recover in coming quarters. Domestic formulation business, which now contributes 40% of revenues and ~60% of EBITDA, continued to outperform and grow at healthy levels. Going forward, the company expects growth to be driven by 1) Stable realisation in the API prices, 2) Domestic formulation growth to be driven by pick up in the acute segment, and 3) New product launches in the US region. Additionally, the recent turnaround of Unichem Labs is implementing numerous strategic measures, driven by penetration into newer geographies and improving the process of the APIs increasing EBITDA margins to 15%. We believe The Unichem acquisition will allow IPCA to scale up US formulation. IPCA remains on track to deliver better-than-industry growth in the domestic formulation segment. Its efforts are underway to rebuild the US business from its site, given successful compliance. Increase in share of high margin products, improvement in operating leverage and revival in US business are key growth drivers for the company. At a CMP of Rs.1463, the stock is trading at 30x FY26E. We maintain a HOLD rating on the stock.

Consolidated Financial statements

Profit & Loss statement

| Particulars (in Rs. Cr) | Q3FY25 | Q3FY24 | YoY (%) | Q2FY25 | QoQ (%) |

|---|---|---|---|---|---|

| Revenue from Operations | 2245.00 | 2053.00 | 9.00% | 2355.00 | -5.00% |

| Cost of Goods Sold | 668.00 | 697.00 | -4.00% | 759.00 | -12.00% |

| Gross Profit | 1577.00 | 1356.00 | 16.00% | 1596.00 | -1.00% |

| Gross Profit Margin (%) | 70.24% | 66.05% | 419 bps | 67.77% | 247 bps |

| Employee Benefit Expenses | 485.00 | 459.00 | 6.00% | 510.00 | -5.00% |

| Other Expenses | 629.00 | 566.00 | 11.00% | 645.00 | -2.00% |

| EBITDA | 463.00 | 331.00 | 40.00% | 441.00 | 5.00% |

| EBITDA Margin (%) | 20.62% | 16.12% | 450 bps | 18.73% | 189 bps |

| Depreciation | 98.00 | 100.00 | -2.00% | 100.00 | -2.00% |

| EBIT | 365.00 | 231.00 | 58.00% | 341.00 | 7.00% |

| Finance Cost | 17.00 | 33.00 | -48.00% | 23.00 | -26.00% |

| Other Income | 20.00 | 22.00 | -9.00% | 26.00 | -23.00% |

| Profit before exceptional items and Tax | 368.00 | 220.00 | 67.00% | 345.00 | 7.00% |

| Exceptional Items | 0.00 | -68.00 | - | - | - |

| Profit Before Tax | 368.00 | 289.00 | 27.00% | 345.00 | 7.00% |

| Taxes | 91.00 | 66.00 | 38.00% | 99.00 | -8.00% |

| PAT | 277.00 | 223.00 | 25.00% | 245.00 | 13.00% |

| EPS (Rs.) | 9.78 | 7.09 | 38.00% | 9.05 | 8.00% |