Goldiam International Ltd

Quarterly Result - Q2FY25

Goldiam International Ltd

Diamond & Jewellery

Current

Previous

Stock Info

Shareholding Pattern

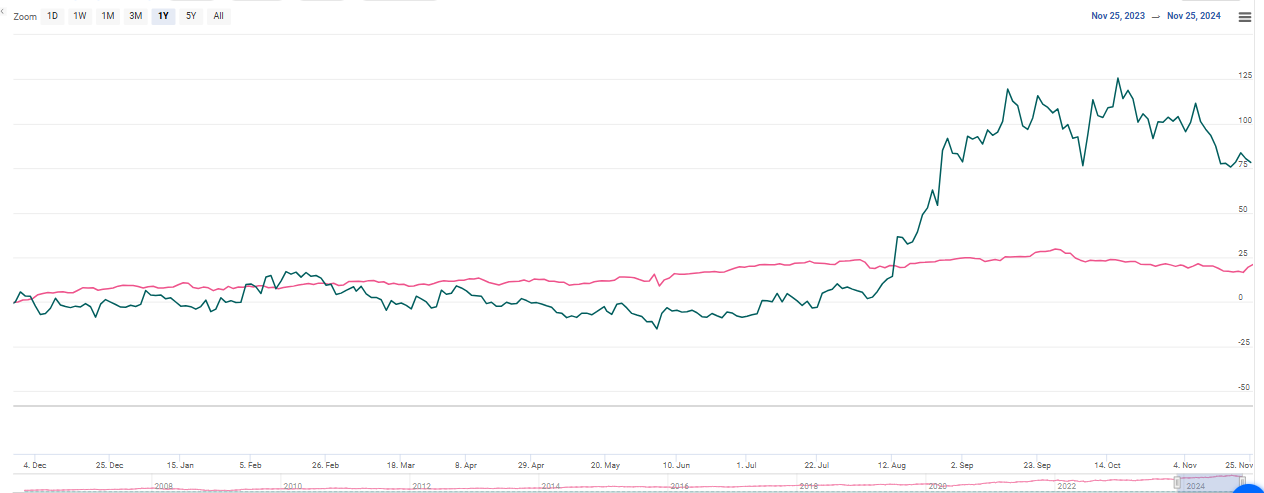

Price performance

Indexed Stock Performance

Financial Highlights:

| Particulars (Rs .In cr) | Q2FY25 | Q2FY24 | YoY (%) | Q1FY25 | QoQ (%) |

|---|---|---|---|---|---|

| Revenue from operations | 137.00 | 133.00 | 3.00% | 166.00 | -17.00% |

| EBITDA | 34.00 | 33.00 | 3.00% | 34.00 | 0.00% |

| EBITDA Margin (%) | 24.50% | 23.74% | 68 bps | 20.00% | 450 bps |

| PAT | 22.00 | 24.00 | -6.00% | 22.00 | 0.00% |

| EPS (Rs.) | 2.07 | 2.20 | -6.00% | 2.06 | 0.00% |

Source: Company Filings; stockaxis Research

Q2FY25 Result Highlights

Goldiam International delivered muted set of numbers in Q2FY25 primarily due to

shipment delays caused by flight alterations / cancellations to the US, impacting

consolidated sales. Consolidated net sales saw a marginal increase to Rs.141 cr

due to shipment delays caused by flight alterations /cancellations to the US.

These sales have since been recorded subsequently in October, 2024. Excluding, the shipment delays, the company would have posted a significant 38% revenue growth for Q2. Consolidated EBITDA saw a mere growth of 3% YoY to Rs.34 cr while margins expanded 68 bps at 24.5%.

During Q2 FY25, Lab Grown Diamond jewellery exports contributed 77%; as compared to 34% in Q2FY24to the overall sales mix. Online revenue accounted for 21% of the revenue during Q2 FY25. About 63% of the inventory (jewellery) as on September 30, 2024 is with customers as finished stock of jewellery to be sold in subsequent months to their customers. With news orders received during Q2 2025, Goldiam’s order book position as on September 30, 2024 stands at about Rs.270cr. This order book will be fulfilled within 3‐4 months.

Key Conference call takeaways

Launch of ORIGEM stores

- During the Dhanteras festive season, Goldiam achieved a significant milestone with the opening of its first retail store under the brand “ORIGEM” in Borivali West, Mumbai. The initial response has exceeded expectations, with sales reaching approximately Rs.25 cr within the first 10 days.

- The company plans to open 2 more stores in Kharghar and Bandra, with a total of 10-12 new stores planned in the next 6 months.

Market Strategy

- Focus on retailing lab-grown diamond jewellery, which contributed 77% of Q2 revenue.

- Aiming for a strong presence in the retail sector, leveraging expertise in jewellery manufacturing.

US Market demand

- Increased demand or lab-grown diamonds, with consumers favoring them over natural diamonds due to cost and quality equivalence.

- Management reassured that concerns about declining lab-grown diamond prices are overstated.

Competition in India

- Recognized increasing competition in the retail space but expressed confidence in ORIGEM’s offerings and strategic positioning.

- Emphasis on the large untapped market for lab-grown diamond jewellery in India.

Growth projections and outlook

- Management remains confident that Q3 will be one of the best quarters to date, driven by strong order fulfillment and retail expansion.

- Positive outlook for the lab grown diamond market, with expectations of continued consumer preference growth.

Capex

- Estimated capex per store between Rs.55 lakhs to Rs.65 lakhs with additional working capital requirements for inventory.

Other important points

- Long-Term B2B Growth: Anticipates double-digit sales growth in the 10-12% range from B2B business, even without adding new retailers. Continued growth is expected from increased penetration with existing clients.

Outlook & valuation

Goldiam International posted tepid earnings for the quarter ended Q2FY25. However, we believe that with in-house manufacturing capability, innovative designs, and established relationships with key jewellery retail clients in the US, Goldiam is expected to outperform in the fast-growing LGD space. The scope of market share gains in the US is huge, given the large market size and Goldiam’s low single digit market share for key clients. The commencement of LGD jewellery retail operations in India from Q3FY25 is an important trigger for Goldiam. The risk-reward is extremely favorable for the India business, given that the company is among the early movers in the Indian market. Goldiam plans to be among the largest LGD jewellery companies in India, and the India operations would be largely funded by internal accruals and the company’s strong cash reserves. With the LGD market picking up, Goldiam would immensely benefit from the trend.

Goldiam International is among the few jewellery companies with experienced management, established track record, increasing orderbook, presence in export markets, robust balance sheet and return ratios, and prudent capital allocation Management exhibits strong optimism regarding future growth, driven by robust demand for lab-grown diamonds, successful retail, initiatives, and strategic inventory management. The company is navigating operational challenges while planning significant retail expansion and maintaining healthy margins. We maintain HOLD rating on the stock.

Consolidated Financial statements

Profit & Loss statement

| Particulars (Rs .In cr) | Q2FY25 | Q2FY24 | YoY (%) | Q1FY25 | QoQ (%) |

|---|---|---|---|---|---|

| Revenue from operations | 137.00 | 133.00 | 3.00% | 166.00 | -17.00% |

| Other Income | 4.00 | 6.00 | -33.00% | 4.00 | 0.00% |

| Total Income | 141.00 | 139.00 | 1.00% | 170.00 | -17.00% |

| COGS | 79.00 | 88.00 | -10.00% | 112.00 | -29.00% |

| Gross Profit | 62.00 | 51.00 | 22.00% | 58.00 | 7.00% |

| Gross Margin (%) | 44.20% | 36.69% | 741 bps | 34.12% | 1008 bps |

| Employee benefit expenses | 9.00 | 6.00 | 50.00% | 7.00 | 29.00% |

| Other expenses | 19.00 | 12.00 | 58.00% | 17.00 | 12.00% |

| EBITDA | 34.00 | 33.00 | 3.00% | 34.00 | 0.00% |

| EBITDA Margin (%) | 24.50% | 23.74% | 68 bps | 20.00% | 450 bps |

| Depreciation | 2.00 | 2.00 | 0.00 | 1.00 | 50.00% |

| Finance cost | 0.00 | 0.00 | - | - | -� |

| PBT | 33.00 | 32.00 | 5.00% | 33.00 | 0.00% |

| Tax expenses | 11.00 | 8.00 | 38.00% | 11.00 | 0.00% |

| PAT | 22.00 | 24.00 | -6.00% | 22.00 | 0.00% |

| EPS (Rs.) | 2.07 | 2.20 | -6.00% | 2.06 | 0.00% |