Coforge Ltd

Quarterly Result - Q4FY25

Coforge Ltd

IT - Software Services

Current

Previous

Stock Info

Shareholding Pattern

Price performance

Indexed Stock Performance

Financial Highlights:

| Particulars (in Rs. Cr) | Q4FY25 | Q4FY24 | YoY (%) | Q3FY25 | QoQ (%) |

|---|---|---|---|---|---|

| Revenues in INR | 3410.00 | 2318.00 | 47.00% | 3258.00 | 5.00% |

| EBITDA | 575.00 | 423.00 | 36.00% | 506.00 | 14.00% |

| EBITDA Margin (%) | 16.90% | 18.30% | (140 bps) | 15.50% | 140 bps |

| Net profit | 307.00 | 229.00 | 34.00% | 256.00 | 20.00% |

| EPS (Rs.) | 38.67 | 36.10 | 7.00% | 31.94 | 21.00% |

Source: Company Filings; stockaxis Research

Q4FY25 Result Highlights

Coforge delivered another resilient financial performance for the quarter ended

Q4FY25. On consolidated basis, Coforge reported revenue of $410.2 million, up 3.4%

QoQ/43.8% y-o-y in constant currency (cc) terms. Revenue in rupee terms stood at

Rs.3,469.1 crores, up 4.5% QoQ/47.1% YoY. Revenue from continuing business stood

at $403.5, up 3.3% QoQ/43.6% YoY. For FY25 revenue from continuing business stood

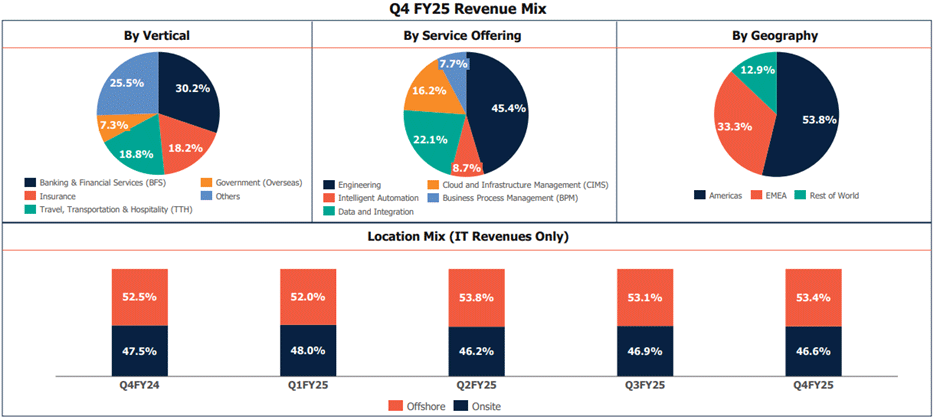

at $ 1,445.2 million, up 31.5% YoY. Sequential growth was led by BFS, TTH and Government

verticals. EBITDA margins from continuing business improved ~134 bps QoQ to 16.9%

while Adj. EBITDA Margin improved ~100 bps QoQ to 18.7%. ESOP costs have come down

by 33 basis point and now stands at 1.8% and is expected to come down to a level

of 100 basis point from H2FY26. Adjusted PAT stood at Rs 287.3 crores, up 24.1%

QoQ/22.2% YoY.

The company reported the highest fresh order intake of $2.1 billion compared to $501 million in Q3FY25 and signed five large deals during the quarter. Executable order book over next 12 months stood at $1,505 million, up 10.3% QoQ/47.7% YoY. Net headcount increased by 403 QoQ, taking the total headcount to 33,497. LTM attrition stood at 10.9%, down 100 bps QoQ. Utilisation (including Trainees) improved 70bps QoQ to 82%.

The number of clients in $ 5-10 million category increased by 4, while the number of clients in $ 1-5 million category declined by 3. Revenue from Top 5 and Top 10 client declined 6.1% and 4.6% QoQ, respectively.

The BFS, TTH and Government grew 13.4%/ 7.5% and 8.5% QoQ respectively while Other emerging vertical declined 8.3% QoQ, respectively, in US Dollar terms. The Sabre $1.56 billion deal has seen an impeccable transition and ramp-up is on track. Management does not see any margin dilution due to the deal.

Coforge signed a definitive agreement to sell its entire stake in the Advantage Go business for GBP 43 million. Advantage Go generated $23 million in revenue, a $5 million EBIT loss, and an $8.5 million cash burn in FY25.

Q4 FY25 - Key Business Highlights

- Order Intake: US$2.1 Bn for the Quarter.

- Executable Order Book over next twelve months: at $1.5 billion, a 47.7% YoY increase and a 10.3% QoQ increase.

- Large Deal Momentum: 5 large deals signed this quarter across North America, UK, and APAC

- Headcount: stood at 33, 497; net addition of 403 sequentially. Headcount has increased 35.5% since the beginning of the year.

- Attrition Rate: Maintained at 10.9%, improved by 60 bps YoY and among the lowest in the industry.

- Launched a GenAI Center of Excellence in collaboration with Service Now to develop Agentic AI solutions for financial services and travel industries.

- FY25 was an exceptional year where the firm grew 32.0% in CC terms —driven by 14 large deals and broad-based growth in all of our verticals and geo-based businesses.

- The $1.56 Bn TCV deal signed in Q4, a 47.7% YoY increase in the order executable book for next twelve months, and a growing large deals pipeline positions us well for strong growth in FY26.

Recognitions

- NelsonHall recognized Coforge as a Leader within the IT Infrastructure Transformation: Cognitive & Self Healing NEAT in 3 market segments - Overall, AI Capabilities, Server-Centric Services Capability.

- Everest recognized Coforge as a Leader in BFS in Everest Group's Banking, Financial Services, and Insurance (BFSI) IT Services Specialists PEAK Matrix® Assessment 2025.

- Everest recognized Coforge as a Leader in Insurance in Everest Group's Banking, Financial Services, and Insurance (BFSI) IT Services Specialists PEAK Matrix® Assessment 2025.

- ISG recognized Coforge as a Leader in the ISG Provider Lens™ Quadrant study on 'Sales force Ecosystem Partners 2025’ for Implementation Services for Core Clouds and AI Agents — Midmarket quadrant in the US and UK regions, and in Managed Application Services – Midmarket quadrant in the US region.

- ISG recognized Coforge as a Product Challenger in GCC Design & Setup and Optimization & Enhancement quadrants in the ISG Provider Lens™ Global Capability Center (GCC) Services 2025.

Partnerships

- Coforge achieved Pega Global Elite Partner status for 2025 for the second year in a row. This prestigious recognition underscores our exceptional capabilities in delivering Pega-led solutions.

- Coforge launched a GenAI Center of Excellence in collaboration with Service Now to develop Agentic AI solutions for financial services and travel industries. The CoE will serve as the foundation for Coforge to accelerate clients’ journey with Service Now platform, especially in the areas of payment, fraud detection, dispute management and digital operations resiliency

Key Conference call takeaways

FY25 Highlights

- Coforge closes an exceptional FY25 with 32.0% CC growth

- EBITDA up 31.7% for the year in INR terms

- Record large deal closure in Q4 with 5 large deals signed during the quarter

- $1.56 Bn TCV deal signed during the quarter

- Q4 revenue surges 47.1% YoY

- Order Executable at $1.5 Bn, up 47.7% YoY

Demand Outlook

- Coforge enters FY26 with highest-ever order intake, and the large deal pipeline remains robust.

- Growth in FY25 has been broad-based across geographies, service lines, and industry verticals.

- Digital transformation and legacy modernization continue to drive demand.

- The management indicated that the outlook on travel is still a mixed bag, with recent change in geopolitics impacting the travel industry and leading to a more cautious approach by clients, particularly in the US and Europe, while APAC and the Middle East are doing well.

Guidance

- Coforge remains confident in reaching its USD2b revenue target by or before FY27. Organic growth in FY26 is expected to surpass FY25.

Deal Pipeline and orderbook

- Coforge signed 5 large deals in Q4 which include the Sabre deal (TCV of USD 1.56bn; 13-year tenure), GPU as a service at scale deal, deal with a large bank for AI-led QE services and QE for AI, Sales force-led win with a bank, and a deal with one of the top-3 clients of Cigniti (TCV of USD62mn TC; 3-year tenure).

- FY25 deal TCV reached USD3.5b, with USD2.1b booked in Q4 alone. Five large deals were signed in Q4, ensuring a strong start to FY26. The 12-month executable order book grew 47.4% YoY to USD1.5b.

- FY25 adjusted EBITDA margin was 18%. 4QFY25 EBIT margin was 13.2%; the company aims to raise this to 14% by FY27, with visible improvements in FY26. Reported EBIT will expand materially in FY26.

- The Sabre USD1.5b deal has ramped up strongly and will continue over the next three quarters. It is not expected to dilute margins. Sabre's financial situation poses no risk, as they are deleveraging, and COFORGE has a credit insurance policy in place.

- GCC-driven revenue contributes ~10% of revenue, with a strong pipeline in place.

Other Key Highlights

- FY25 revenue stood at USD1.5b, a ~31% YoY increase, including 15% organic CC growth. The quality of growth remains high, led by large deals and strong deal momentum. The company’s top client cohort remains stable and resilient.

- The travel industry remains cautious due to geopolitical issues. Recovery is being driven by low-cost carriers and digital-first models, especially in Europe.

- The Cigniti merger share swap process is expected to be completed within the Dec-25 to Jan-26 timeframe.

- The Advantage Go divestment alone had a 50 bps margin impact. ESOP costs declined 33 bps QoQ and currently stand at 1.8%. This is expected to reduce to ~1.0% by 2HFY26.

- Reported EBITDA margin is expected to approach 18% by FY27.

- No margin pressure is expected in Q1FY26, except for visa-related costs.

- Coforge Accelerates AI-powered Service Now Dispute Management in the Financial Services Industry.

Outlook & valuation

Coforge reported steady financial performance for the quarter ended Q4FY25. We believe the company is well placed to see robust and sustained growth in the quarters ahead given the strengthening of order book, strong large deal pipeline, and consecutive quarters of significant net headcount additions and on account of synergies with Cigniti picking up momentum. The management stated that the merger with Cigniti would help the company to drive operational margin improvement as EBITDA margin of Cigniti has improved from 12%. Further, a strategic focus on diversifying the business into emerging verticals, improvement in client metrics, strong executable orders, and sharp recovery in the travel segment would aid growth. The 12 month executable order book and fresh order intake witnessed a sharp jump during the quarter and provides strong visibility for the quarters ahead. Strong leadership, deep domain capability in select verticals, improved capability, and a marquee client base would help the company sustain growth momentum.

Strong growth, better digital mix, and operating efficiencies should drive margin expansion in the next two years. We believe the organic business is robust and is likely to regain its strong growth trajectory in coming quarters driven by recovery in key verticals especially BFS, ramp up of deal wins, and recovery of pent-up demand triggered by a better macro environment. The management remains optimistic on growth momentum sustaining in FY26, with reported EBIT margin expansion backed by broad-based growth, Sabre deal ramp up, integration of Rythmos/TMLabs, healthy deal pipeline. The company is confident of achieving USD 2 bn revenue by FY27, with 18% EBITDAM/~14% EBITM. At CMP of Rs.7460, the stock is trading at 30x FY27E. We maintain HOLD rating on the stock.

Consolidated Financial statements

Profit & Loss statement

| Particulars (in Rs. Cr) | Q4FY25 | Q4FY24 | YoY (%) | Q3FY25 | QoQ (%) |

|---|---|---|---|---|---|

| Revenues ($ mn) | 404.00 | 287.00 | 41.00% | 390.50 | 3.00% |

| Revenues in INR | 3410.00 | 2318.00 | 47.00% | 3258.00 | 5.00% |

| Expenses | 1996.00 | 1344.00 | 49.00% | 1957.00 | 2.00% |

| Gross Profit | 1414.00 | 974.00 | 45.00% | 1301.00 | 9.00% |

| Selling/G&A | 1352.00 | 529.00 | 156.00% | 726.00 | 86.00% |

| Acquisition related to costs/ESOPs | 62.00 | 22.00 | 182.00% | 69.00 | -10.00% |

| EBITDA | 575.00 | 423.00 | 36.00% | 506.00 | 14.00% |

| EBITDA Margin (%) | 16.90% | 18.30% | (140 bps) | 15.50% | 140 bps |

| Depreciation | 125.00 | 79.00 | 58.00% | 117.00 | 7.00% |

| EBIT | 449.00 | 344.00 | 31.00% | 389.00 | 15.00% |

| EBIT Margin (%) | 13.20% | 14.80% | (160 bps) | 11.90% | 130 bps |

| Other Income | -30.00 | -45.00 | - | -33.00 | - |

| PBT | 393.00 | 289.00 | 36.00% | 340.00 | 16.00% |

| Tax provision | 87.00 | 59.00 | 47.00% | 87.00 | 0.00% |

| Minority interest | 45.00 | 7.00 | 543.00% | 38.00 | 18.00% |

| Net profit | 307.00 | 229.00 | 34.00% | 256.00 | 20.00% |

| EPS (Rs.) | 38.67 | 36.10 | 7.00% | 31.94 | 21.00% |