360 One Wam Ltd

Quarterly Result - Q2FY25

360 One Wam Ltd

Finance - Asset Management

Current

Previous

Stock Info

Shareholding Pattern

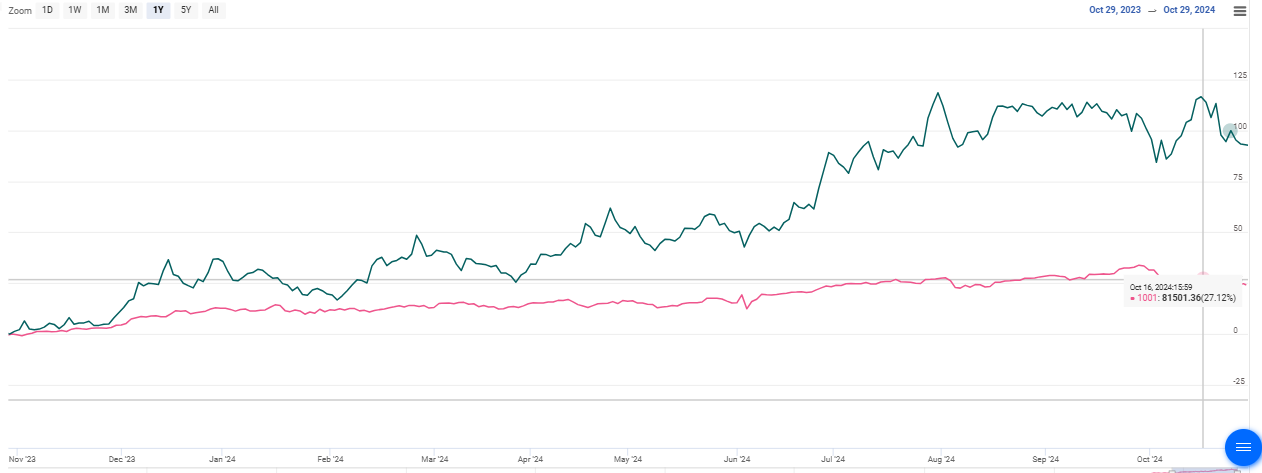

Price performance

Indexed Stock Performance

Financial Highlights:

| Particulars (Rs. in cr) | Q2FY25 | Q2FY24 | YoY (%) | Q1FY25 | QoQ (%) |

|---|---|---|---|---|---|

| Revenue from operations | 589.00 | 427.00 | 38.00% | 600.00 | -2.00% |

| Operating Profit | 289.00 | 213.00 | 36.00% | 335.00 | -14.00% |

| PAT | 247.00 | 185.00 | 34.00% | 243.00 | 2.00% |

| EPS (Rs.) | 6.75 | 5.21 | 30.00% | 6.76 | 0.00% |

Source: Company Filings; stockaxis Research

Q2FY25 Result Highlights

360 One WAM continued its impressive performance in Q2FY25. Consolidated revenue

from operations grew 38% YoY and declined 2% sequentially, driven by robust growth

across the wealth management and asset management divisions.

Operating Profit grew 36% YoY to Rs. 289cr. This was mainly driven by a 39% and 45% YoY expansion in profit margins in the wealth and asset management divisions respectively.

PAT stood at Rs.247cr, up 34% YoY and flat QoQ. PAT Margins stood at 28.5% in Q2FY25 vs 33.8% in Q2FY24 and 28.7% in Q1FY25, impacted by higher finance costs (up 58% YoY) and lower other income.

Cost to income ratio stood at 48.4% in Q2FY25.

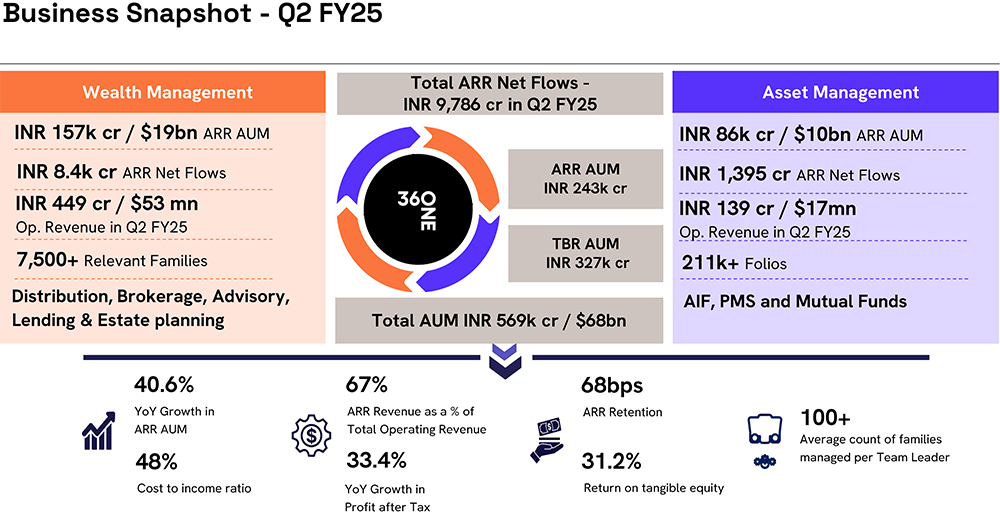

Assets under Management for 360 ONE stood at Rs 5,69,372 Crs, consisting of ARR AUM of Rs 2,42,619 Crs and Transactional / Brokerage AUM of Rs 3,26,753 Crs.

Fundraise: 360 ONE Asset raised Rs. 5000 Crs in commitments through their private equity funds and private credit funds. Also, $350mn was raised from a marquee global investor under the Institutional mandates segment.

Segmental highlights:

Wealth Management: ARR AUM rose to Rs 1,56,849 Crs (+45% YoY) supported

by robust growth across segments. 360 ONE Plus proposition saw growth of 72% YoY,

while Distribution and Lending businesses grew by 34% YoY and 28% YoY respectively

Client Acquisition: In Q2 FY25, 360 ONE Wealth successfully onboarded 160+ clients (with more than Rs 10 Crs ARR AUM). During this period, clients having ARR AUM above Rs 50 Crs, increased by 70+. Overall, the segment manages assets for 7,500+ relevant clients.

Asset Management: ARR AUM increased to Rs 85,770 Crs (+33% YoY) mainly driven by growth in Listed Equity (+54% YoY), Credit (+23% YoY) and Private Equity (+12% YoY) segments.

Key Conference call takeaways

Guidance: 1) Flows for the full year FY25 should exceed the initial guidance of Rs. 25000-30000cr, but the management is waiting to see how the market performs. 2) Shifting to a more conservative approach, potentially paying out 30-50% of overall profits (vs 65-80% previously) due to reinvestment needs in lending and alternative businesses; 3) Cost to income should settle around 46-47% in FY25 and 45-46% in FY26. Over the longer term, the aim is to settle in the range of 43-45%

Segment Mix: The wealth management AUM comprises of ~85% of the total AUM of 360ONE.

It also accounts for 84.4% of the total revenue and 68.12% of the total PBT in Q2FY25.

Other Takeaways:

Q2FY25 Financial Performance

- The total Assets Under Management (AUM) reached Rs 5,69,372 crores in Q2FY25.

Annual Recurring Revenue (ARR) AUM stood at Rs 2,42,619 crores, reflecting a 40.6% increase YoY and a 9.6% increase QoQ. Transactional/Brokerage AUM amounted to Rs 3,26,753 crores.

- Total revenue for the period was Rs 618 crores, up 40.1% YoY, while revenue from operations was Rs 589 crore, marking a 37.7% year-over-year increase.

- ARR revenue grew by 28% YoY to Rs 397 crores.

- The combined ARR retention rate was 68 basis points, with Wealth Management at 68 bps and Asset Management at 67 bps.

- Profit After Tax (PAT) reached Rs 247 crores, representing a 33% increase YoY, and marking the highest quarterly PAT to date.

- The cost-to-income ratio stood at 48.4% for Q2 and 42.9% for H1 FY25.

- Wealth Management

The wealth management division demonstrated impressive growth across various segments, with 360 ONE Plus soaring by 72% year-over-year, Distribution increased by 34% year-over-year, and Lending rising by 28% year-over-year.

- Asset Management

The Asset Management division saw significant activity, with Listed Equity growing by 54% year-over-year, Credit up by 23% year-over-year, and Private Equity increasing by 12% year-over-year.

- Private Equity/AIFs

The firm is nearing the completion of planned distributions from its first set of alternative funds raised in 2016-17 and has secured its sixth institutional mandate, which includes a $350 million investment from a prominent global investor.

- Flows

The company experienced substantial net inflows of Rs 9,786 crores for Q2 and Rs 15,335 crores for the first half of FY25, a significant increase from Rs 4,323 crores during the same period in FY24.

Clients

- The total client roster has now exceeded 7,500, with existing clients contributing between 25-40% of net inflows and new clients making up 55-65%.

- In Q2, more than 160 clients with annual recurring AUM exceeding Rs 10 crores were added, along with over 70 new clients boasting more than Rs 50 crores in ARR AUM.

- Among new client inflows, 60% came from fresh liquidity events, while 40% were transferred from other accounts.

HNI Segment

- Continued focus on acquiring new clients in the HNI segment and expanding geographically, alongside a successful platform launch with initial bankers and clients onboarded.

- Positive initial feedback from the HNI segment, with efforts to refine offerings based on insights and learnings.

Growth Initiatives

- Global business: About $160mn of new flows was recorded. Plans for ramping up this business are in place.

- Continued investment in data and analytics to enable superior business insights and decisions.

- ET Money: The recent acquisition of ET Money is completing the ecosystem of offerings by 360 ONE WAM, and will contribute to the overall growth.

Near-term concerns and Outlook

- Securities market sentiment and volatility: A change in market sentiments towards the negative, or a sustained correction in the markets can play spoilsport for investor sentiments

- Anil Taparia’s resignation as CEO: The resignation of CEO Anil Taparia is expected to have a 2-3% impact on the Wealth Management division revenues. More members of Mr. Taparia’s team are expected to resign.

Outlook & valuation

360 One WAM delivered healthy earnings growth for the quarter ended Q2FY25. The firm is optimistic about the significant growth opportunity beyond Tier-1 cities and has outlined an expansion plan for domestic coverage. Leveraging the strength of their core platform and innovative competencies, they aim to achieve higher growth in the High Net worth Individual (HNI) segment and position themselves as a preferred manager for global capital seeking access to India. The unique combination of macroeconomic tailwinds and their distinctive proposition continues to solidify their position as one of the leading players in India.

The company is looking to diversify its presence in terms of the mass-affluent client segment and geography (lower tier cities + international regions). The resultant investments in team building have kept costs at elevated levels. The benefits of these investments, however, are likely to be back ended in nature. Retaining a niche positioning in the wealth management business, the firm boasts a track record of innovative products and operates on a strong team leader-driven model, resulting in low attrition at both the client and senior banker levels. Management's strategic decision to expand into new domestic geographies and target the HNI category, alongside global markets, is expected to drive the next phase of growth.

360 One Wealth is best positioned to benefit from the structural growth in wealth business. Its core segment consisting of UHNI (ultra-high net worth individuals with assets above Rs.25 cr) is expected to see highest growth among the different sub-segments based on the income/wealth level, mainly because of K-shaped recovery after the pandemic. The market opportunity in wealth business is huge and is likely to grow in sync with India’s economic growth and rising income/wealth levels in the economy which makes 360 One’s business on a sustained growth path. At CMP of Rs.1011, the stock is trading at 34x FY26E. We maintain HOLD rating on the stock.

Consolidated Financial statements

Profit & Loss statement

| Particulars (Rs. in cr) | Q2FY25 | Q2FY24 | YoY (%) | Q1FY25 | QoQ (%) |

|---|---|---|---|---|---|

| Revenue from operations | 589.00 | 427.00 | 38.00% | 600.00 | -2.00% |

| Annual Recurring revenue | 397.00 | 311.00 | 28.00% | 376.00 | 6.00% |

| Transactional/brokerage income | 191.00 | 117.00 | 63.00% | 225.00 | -15.00% |

| Other Income | 30.00 | 14.00 | 114.00% | 97.00 | -69.00% |

| Total Revenue | 618.00 | 441.00 | 40.00% | 698.00 | -11.00% |

| Total Expenses | 299.00 | 214.00 | 40.00% | 265.00 | 13.00% |

| Operating Profit | 289.00 | 213.00 | 36.00% | 335.00 | -14.00% |

| PBT | 319.00 | 227.00 | 41.00% | 315.00 | 1.00% |

| Exceptional Item (net of taxes) | 74.00 | 41.00 | 80.00% | 88.00 | -16.00% |

| PAT | 247.00 | 185.00 | 34.00% | 243.00 | 2.00% |

| EPS (Rs.) | 6.75 | 5.21 | 30.00% | 6.76 | 0.00% |

| Net flows (ARR assets) | 9786.00 | 5743.00 | 70.00% | 5549.00 | 76.00% |