Wipro Ltd

IT - Software Services

Wipro Ltd

IT - Software Services

Stock Info

Shareholding Pattern

Price performance

Indexed Stock Performance

Huge beneficiary of structural changes in IT industry

Company Profile

Incorporated in 1945, Wipro is one of the leading global IT, consulting and business

process services companies. It is the fourth largest Indian player in the global

IT services industry, in terms of revenue. Wipro was as Western India Vegetables

Product limited and was majorly a consumer care product manufacturer till 1980 after

which it diversified into the IT services business. The company demerged its consumer

care division into a separate company called Wipro Enterprises Limited (WEL) in

April 2013, to enhance its focus and allow both businesses to pursue their individual

growth strategies. The company’s operations can be broadly classified into

IT Services, IT Products and India state run enterprise and it derived 96.8% of

its revenue from the IT Services segment in FY20. IT services include digital strategy

advisory, customer-centric design, technology consulting, IT consulting, custom

application design, development, re-engineering and maintenance, systems integration,

package implementation, cloud infrastructure services, analytics services, business

process services, research and development and hardware and software design.

Consolidated Financial Statements

| Rs in Crores | Revenue | EBITDA | EBITDA% | PAT | EPS | ROE% |

|---|---|---|---|---|---|---|

| FY18 | 54487.00 | 10376.00 | 19.00% | 8002.00 | 13.00 | 17.00% |

| FY19 | 59019.00 | 11617.00 | 20.00% | 9022.00 | 15.00 | 16.00% |

| FY20 | 61138.00 | 12342.00 | 20.00% | 9769.00 | 17.00 | 18.00% |

| FY21 | 61935.00 | 14772.00 | 24.00% | 10855.00 | 20.00 | 20.00% |

| FY22E | 73021.00 | 16038.00 | 22.00% | 11427.00 | 21.00 | 17.00% |

| FY23E | 85289.00 | 18572.00 | 22.00% | 13382.00 | 24.00 | 19.00% |

Rationale for Investment

Continous deal wins shall bolster growth

The company has managed to win large deals in the past two quarters and the demand

environment is currently robust coupled with overall deal pipeline remaining healthy.

The company’s focus continues to remain on midsized deals especially in areas

like cybersecurity, application modernization and customer experience to drive growth

in the medium term. The company closed 12 large deals resulting in a TCVs of $1.4

billion during Q4FY21, out of which the company’s mega deal in American market

is expected to lead to revenues over $1 billion of the deal duration. The company’s

focus is on account mining of existing clients, which will be done by empowering

global account executives for faster decision-making. The company is witnessing

strong deal wins and strengthening of market presence through acquisitions.

Inorganic expansion to provide impetus to growth

Recently, the company announced the Capco acquisition for a cash consideration of

$ 1.45 billion. Capco is a global technology and management consultancy specialising

in driving digital transformation in the financial services industry. The acquisition

will strengthen Wipro’s position as a consulting and IT services provider

(more comprehensive end-to-end solutions and offerings) in the BFSI space and shall

provide following benefits such as: i) widening customer reach in BFSI segment,

which was hard for the company to penetrate in the past (Capco’s 80% of revenues

is generated from the top 30 customers, thus the company intends to increase its

wallet share in these accounts by cross-selling IT services) and ii) strengthening

its capability to participate in large transformation deals using Capco’s

consulting solutions. The company emphasized that they have received encouraging

response up till now and their major focus will be on driving growth through joint

go-to-market efforts. Capco will continue to function as a separate brand and hence

the company expects limited cost synergies from the acquisition.

New organizational structure showing early signs of success

The company adopted a new organizational structure designed to simplify its go-to-market

execution and ensure sector focus and growth in non-US markets. The previous structure

of multiple delivery units has been replaced by a simplified model designed to bring

the best of the company closer to its customers. This model consists of four strategic

market units (“SMUs”) and two global business lines (“GBLs”).

The four SMUs are Americas 1, Americas 2, Europe, and Asia Pacific Middle East Africa

(“APMEA”). This new model reduces the total number of P&L

units from 20+ to 4, aligns the company geographically to be closer to the customer

and eliminates red tape to facilitate faster decision-making. In the previous vertical

structure, business heads were primarily based in the US, whereas in the new structure

leadership teams are closer to customers. Further, the company is not focused across

all verticals in a particular geography, and instead focus is on select verticals

in select markets depending on the company’s strength and relative size. This

shall aid in increasing focus on priority investments and free up resources.

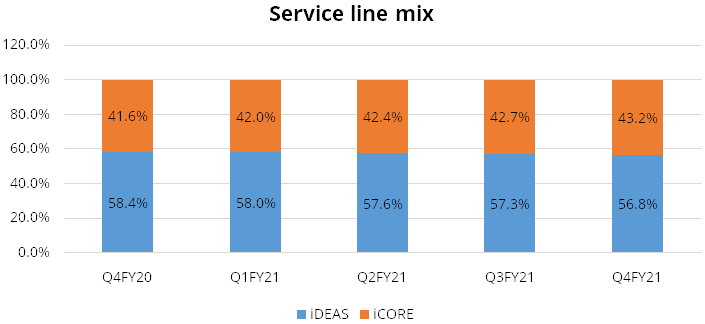

Streamlined its business to facilitate faster decision-making

The company has consolidated its delivery organization into two global service lines

(instead of 15 delivery hubs earlier) constituting i) iCORE: which includes service

lines cloud infrastructure, digital operations, risk & enterprise cyber security

services (43% of revenue) and ii) iDEAS: integrated digital, engineering & application

services (57%). Due to changes in service line structure, now each market has its

own delivery engine and this enables geographic heads to invest in creating its

own talent pool and simplify the delivery organization. The company is going to

follow global account executive (GAE) model whereby they intend to appoint a GAE

from among the senior leaders who will be supported by a dedicated team of tech

specialists and industry experts, delivery teams and decide on investments to grow

these client accounts. The company has raised the role of account executives to

be closer to the CEO and decrease hindrance around decision-making. The company

is also setting-up a large deal team which includes a team of industry veterans

to improve participation.

Structural changes in the IT industry

We believe that to navigate businesses through the current crisis, digitization

and use of technology will be of prime importance. There is high demand for services

like i) digital transformation, ii) cyber security, iii) cloud. It is evident that

companies that have previously digitized their operations have been more resilient.

The pandemic has positively impacted the IT industry, with more and more organizations

globally having realized the importance of technology and increased their spending

on digital transformation. Consequently, in the medium to long term, it is

very likely that businesses will continue to spend on technology related initiatives

with a greater focus on automation, remote working, cloud-based applications, optimization

of legacy technology costs, etc. Several sectors are also seeking technology-based

solutions immediately to tackle the health and economic crises – notably in

healthcare, life sciences, banking, telecommunications and essential retail.

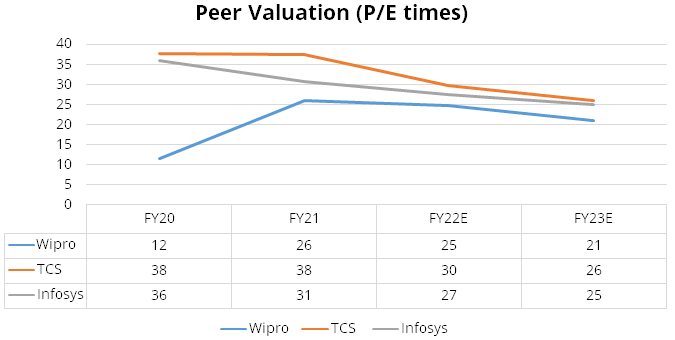

Peer Comparison:

In comparison to its peers like TCS & Infosys which is trading at PE of 26x/25x

on FY23E basis, Wipro currently trades at 21.1x FY23E EPS which looks attractive.

The company is well positioned to decrease the gap in growth rate with large peers

in FY22E.

Outlook & valuation

We believe the company has multiple growth drivers such as i) healthy deal pipeline largely driven by mid-sized deals ii) early success visible from its change to a new organization structure iii) ramping up investments in senior hires in key focus markets, iv) focus on higher client mining v) beefing up capabilities in consulting through the Capco acquisition and lastly investing in setting up a large deal team. We believe strong demand for cloud infrastructure services, higher usage of specialised software and increase in online adoption across verticals should augur well for the company. The stock currently trades at 21.1x FY23E EPS and we initiate our coverage on “Wipro ltd” with a Buy rating.

Financial Statement

Profit & Loss statement

| Yr End March (Rs Cr) | 2018 | 2019 | 2020 | 2021 | 2022E | 2023E |

|---|---|---|---|---|---|---|

| Net Sales | 54487.00 | 59019.00 | 61138.00 | 61935.00 | 73021.00 | 85289.00 |

| Growth % | -2.00% | 8.00% | 4.00% | 1.00% | 18.00% | 17.00% |

| Material Cost | 1843.00 | 1407.00 | 936.00 | 696.00 | 986.00 | 1194.00 |

| Employee Cost | 27222.00 | 29977.00 | 32657.00 | 33237.00 | 39787.00 | 46503.00 |

| Other Expenses | 15045.00 | 16017.00 | 15202.00 | 13231.00 | 16211.00 | 19019.00 |

| EBITDA | 10376.00 | 11617.00 | 12342.00 | 14772.00 | 16038.00 | 18572.00 |

| Growth % | -8.00% | 12.00% | 6.00% | 20.00% | 9.00% | 16.00% |

| EBITDA Margin | 19.00% | 20.00% | 20.00% | 24.00% | 22.00% | 22.00% |

| Depreciation & Amortization | 2112.00 | 1947.00 | 2086.00 | 2763.00 | 3285.00 | 3728.00 |

| EBIT | 8265.00 | 9670.00 | 10257.00 | 12008.00 | 12753.00 | 14844.00 |

| Other Income | 2559.00 | 2614.00 | 2725.00 | 2391.00 | 2439.00 | 2835.00 |

| Interest & Finance Charges | 583.00 | 738.00 | 733.00 | 509.00 | 447.00 | 413.00 |

| Profit Before Tax - Before Exceptional | 10241.00 | 11547.00 | 12249.00 | 13890.00 | 14745.00 | 17267.00 |

| Profit Before Tax | 10241.00 | 11547.00 | 12249.00 | 13890.00 | 14745.00 | 17267.00 |

| Tax Expense | 2239.00 | 2524.00 | 2480.00 | 3035.00 | 3318.00 | 3885.00 |

| Effective Tax rate | 22.00% | 22.00% | 20.00% | 22.00% | 23.00% | 23.00% |

| Net Profit | 8002.00 | 9022.00 | 9769.00 | 10855.00 | 11427.00 | 13382.00 |

| Growth % | -6.00% | 13.00% | 8.00% | 11.00% | 5.00% | 17.00% |

| Net Profit Margin | 15.00% | 15.00% | 16.00% | 18.00% | 16.00% | 16.00% |

Balance Sheet

| Yr End March (Rs Cr) | 2018 | 2019 | 2020 | 2021 | 2022E | 2023E |

|---|---|---|---|---|---|---|

| Share Capital | 905.00 | 1207.00 | 1143.00 | 1096.00 | 1096.00 | 1096.00 |

| Total Reserves | 46844.00 | 54954.00 | 54024.00 | 53650.00 | 64278.00 | 76723.00 |

| Shareholders' Funds | 48167.00 | 56686.00 | 55509.00 | 55051.00 | 65678.00 | 78123.00 |

| Minority Interest | 241.00 | 264.00 | 188.00 | 150.00 | 150.00 | 150.00 |

| Long Term Burrowing | 4527.00 | 2837.00 | 484.00 | 746.00 | 582.00 | 332.00 |

| Deferred Tax Assets / Liabilities | -388.00 | -222.00 | -321.00 | 294.00 | 294.00 | 294.00 |

| Long Term Provisions | 1101.00 | 1311.00 | 1697.00 | 1413.00 | 1413.00 | 1413.00 |

| Short Term Borrowings | 7960.00 | 6809.00 | 5402.00 | 6036.00 | 5400.00 | 5150.00 |

| Trade Payables | 5120.00 | 6266.00 | 5840.00 | 5417.00 | 6101.00 | 7373.00 |

| Other Current Liabilities | 6359.00 | 6301.00 | 7888.00 | 8271.00 | 8271.00 | 8271.00 |

| Short Term Provisions | 1912.00 | 2060.00 | 2509.00 | 3280.00 | 3280.00 | 3280.00 |

| Total Equity & Liabilities | 75003.00 | 82364.00 | 80678.00 | 82566.00 | 93077.00 | 106294.00 |

| Assets | ||||||

| Net Block | 18127.00 | 17465.00 | 22062.00 | 23040.00 | 24755.00 | 26027.00 |

| Non Current Investments | 887.00 | 815.00 | 1069.00 | 1204.00 | 1204.00 | 1204.00 |

| Long Term Loans & Advances | 3010.00 | 2854.00 | 2138.00 | 2646.00 | 2646.00 | 2646.00 |

| Current Assets | ||||||

| Currents Investments | 24909.00 | 22072.00 | 18964.00 | 17571.00 | 17571.00 | 17571.00 |

| Inventories | 337.00 | 395.00 | 187.00 | 106.00 | 277.00 | 325.00 |

| Sundry Debtors | 10099.00 | 10049.00 | 10447.00 | 9429.00 | 10538.00 | 12578.00 |

| Cash and Bank | 4493.00 | 15853.00 | 14450.00 | 16966.00 | 24483.00 | 34340.00 |

| Short Term Loans and Advances | 6627.00 | 6784.00 | 6250.00 | 6250.00 | 6250.00 | 6250.00 |

| Total Assets | 75003.00 | 82364.00 | 80678.00 | 82566.00 | 93077.00 | 106294.00 |

Cash Flow Statement

| Yr End March (Rs Cr) | 2018 | 2019 | 2020 | 2021 | 2022E | 2023E |

|---|---|---|---|---|---|---|

| Profit After Tax | 8002.00 | 9022.00 | 9769.00 | 10855.00 | 11427.00 | 13382.00 |

| Depreciation | 2112.00 | 1947.00 | 2086.00 | 2763.00 | 3285.00 | 3728.00 |

| Others | 219.00 | 1579.00 | -1770.00 | 0.00 | 0.00 | 0.00 |

| Changes in Working Capital | -88.00 | 2717.00 | -2386.00 | 676.00 | -596.00 | -816.00 |

| Cash From Operating Activities | 8423.00 | 11632.00 | 10064.00 | 14755.00 | 14116.00 | 16294.00 |

| Purchase of Fixed Assets | -2187.00 | -2278.00 | -2350.00 | -3741.00 | -5000.00 | -5000.00 |

| Free Cash Flows | 6236.00 | 9354.00 | 7715.00 | 11014.00 | 9116.00 | 11294.00 |

| Others | 5628.00 | 7097.00 | 5624.00 | 4515.00 | 0.00 | 0.00 |

| Cash Flow from Investing Activities | 3558.00 | 5013.00 | 3401.00 | 774.00 | -5000.00 | -5000.00 |

| Increase / (Decrease) in Loan Funds | -1098.00 | -3888.00 | -2604.00 | -1022.00 | -800.00 | -500.00 |

| Equity Dividend Paid | -450.00 | -450.00 | -569.00 | -760.00 | -800.00 | -937.00 |

| Others | -11358.00 | -506.00 | -11810.00 | -11102.00 | 0.00 | 0.00 |

| Cash from Financing Activities | -12998.00 | -4937.00 | -15100.00 | -12884.00 | -1600.00 | -1437.00 |

| Net Cash Inflow / Outflow | -1017.00 | 11707.00 | -1634.00 | 2645.00 | 7516.00 | 9857.00 |

| Opening Cash & Cash Equivalents | 5072.00 | 4093.00 | 15853.00 | 14410.00 | 16966.00 | 24483.00 |

| Closing Cash & Cash Equivalent | 4093.00 | 15853.00 | 14410.00 | 16966.00 | 24483.00 | 34340.00 |

Key Ratios

| Yr End March | 2018 | 2019 | 2020 | 2021 | 2022E | 2023E |

|---|---|---|---|---|---|---|

| Basic EPS | 13.00 | 15.00 | 17.00 | 20.00 | 21.00 | 24.00 |

| Diluted EPS | 13.00 | 15.00 | 17.00 | 20.00 | 21.00 | 24.00 |

| Cash EPS (Rs) | 17.00 | 18.00 | 21.00 | 25.00 | 27.00 | 31.00 |

| DPS | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 2.00 |

| Book value (Rs/share) | 80.00 | 94.00 | 97.00 | 100.00 | 120.00 | 143.00 |

| ROCE (%) Post Tax | 13.00% | 15.00% | 16.00% | 18.00% | 18.00% | 18.00% |

| ROE (%) | 17.00% | 16.00% | 18.00% | 20.00% | 17.00% | 19.00% |

| Inventory Days | 2.00 | 2.00 | 2.00 | 1.00 | 1.00 | 1.00 |

| Receivable Days | 66.00 | 62.00 | 61.00 | 59.00 | 50.00 | 49.00 |

| Payable Days | 33.00 | 35.00 | 36.00 | 33.00 | 29.00 | 29.00 |

| PE | 16.00 | 17.00 | 12.00 | 26.00 | 25.00 | 21.00 |

| P/BV | 3.00 | 3.00 | 2.00 | 5.00 | 4.00 | 4.00 |

| EV/EBITDA | 11.00 | 11.00 | 7.00 | 18.00 | 16.00 | 13.00 |

| Dividend Yield (%) | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| P/Sales | 2.00 | 3.00 | 2.00 | 5.00 | 4.00 | 3.00 |

| Net debt/Equity | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Net Debt/ EBITDA | -1.00 | -2.00 | -2.00 | -1.00 | -1.00 | -2.00 |

| Sales/Net FA (x) | 3.00 | 3.00 | 3.00 | 3.00 | 3.00 | 3.00 |