Voltas Ltd

Air Conditioners

Stock Info

Shareholding Pattern

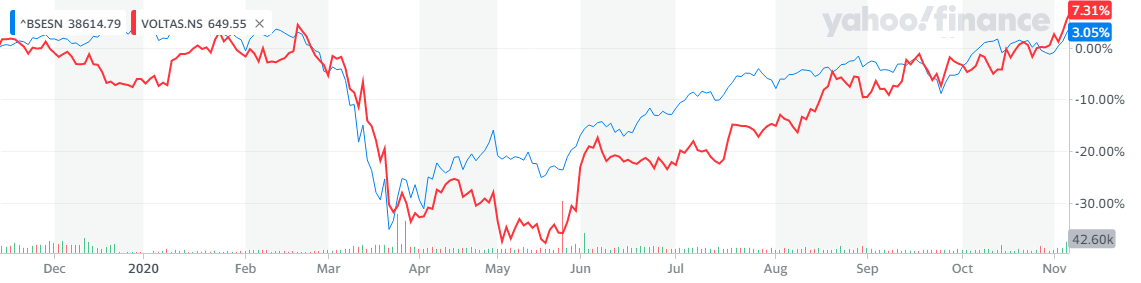

Price performance

Indexed Stock Performance

Muhurat Pick

Company Overview

Voltas is India’s Leading Room Air Conditioner brand and

commands ~24% market share in the domestic AC segment as well as provides air coolers,

water dispensers, water coolers and commercial refrigeration products. It is a part

of the Tata Group, which holds a 30.30% stake in the company. It operates in three

main business segments viz. Unitary Cooling Products (UCP) (53%), Engineering Projects

(EPS) (42.6%), and Engineering Products & Services (4.4%).

Investment Rationale

Strong Presence in Retail and Commercial AC Business in Domestic Market: Leading

market position across the country in room ACs, with presence in both window and

split ACs, has aided the Unitary Products division to grow at a CAGR of ~9% over

the past six years despite facing a few years of short summers during its peak business

season.

Restructure of B2B business: The company has announced to restructure all domestic B2B business into a 100% owned subsidiary (Rohini Industrials). The newly incorporated subsidiary will comprise of the domestic project business and the EPS business. The objective is to provide adequate management bandwidth across both the business EPS and UCP. We expect stock to rerate as it is possibly a precursor to future de-merger.

Diversified Revenue Streams: Voltas is present in the MEP and HVAC projects segments in the domestic and international markets as well as in the AC business in the domestic market, which together account for ~95% of the its revenues. Its revenues are fairly diversified within each of these segments in terms of geographies and products/services offered.

JV to drive growth in future: VoltBek is a 50:50 Joint Venture between Voltas and Arçelik. With this, Voltas entered the home appliances market. It introduced refrigerators and washing machines in 2019 and plans to focus on widening its portfolio, ramp up distribution network and expand manufacturing capacity. In FY 2020, it has achieved ~2% market share in refrigerators and Washing Machines. Further, it targets to achieve 10% market share in categories such as refrigerators, washing machine, microwave and dishwashers by 2025.

Outlook and Valuation: Voltas’s room air conditioning market share has expanded to 26.8%; Voltas’s market share gain is reflection of its strong execution & scale benefits. Moreover, a stronger balance sheet and weaker economic growth are benefiting Voltas in gaining market share from peers. Given high dependence of nearly ~40% on imports in the AC industry, companies are increasingly looking to outsource to domestic players to control costs. Voltas is expected to continue its lead in the industry on the back of its market leadership, strong brand recall ,high operational efficiency and strong distribution reach. Currently the stock trades at PE of 56x39x of FY21/FY22E estimates. We remain positive on the stock for long term.