Vinati Organics Ltd

Chemicals

Vinati Organics Ltd

Chemicals

Stock Info

Shareholding Pattern

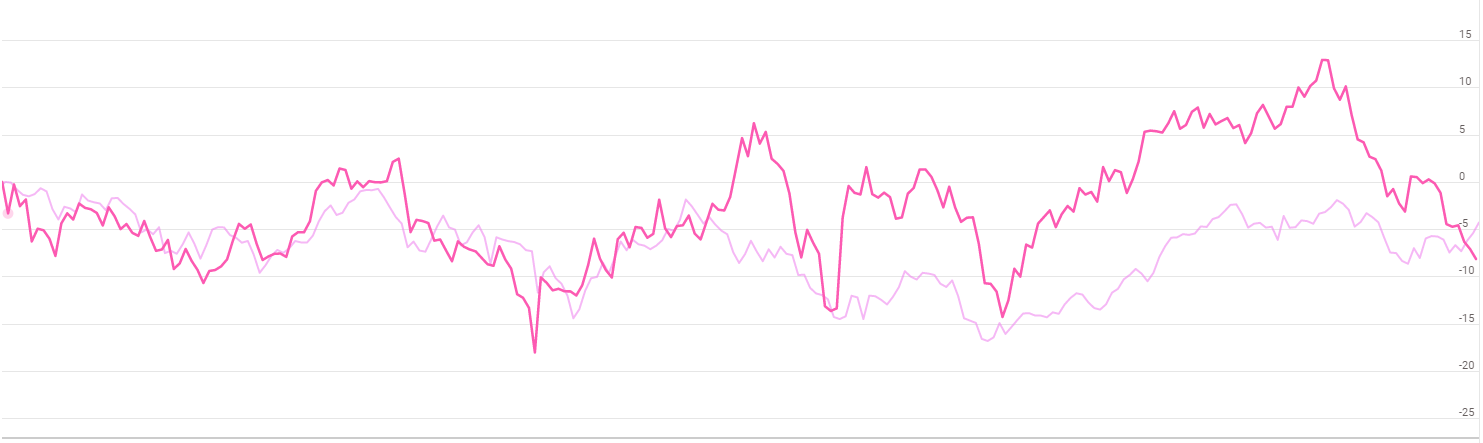

Price performance

Indexed Stock Performance

Vinati Organics Limited (VOL), is one of India’s leading manufacturers and exporters of specialty organic intermediaries, monomers, and polymers. With two manufacturing units in Maharashtra, the company is the world’s largest manufacturer of Isobutyl Benzene (IBB) (70% of Global market share) and 2-Acrylamido 2 Methylpropane Sulfonic Acid (ATBS) (80% of Global market share), and India’s largest manufacturer IsoButylene (IB) and Butyl Phenols. VOL produces IB, one of the major components needed in the production of ATBS. In addition, VOL also produces Normal Butylbenzene (NBB), Hexenes, Tertiary Butyl Acrylamide (TBA), high purity methyl tertiary butyl amine (HP-MTBE), and other industrial monomers.

Investment Rationale

Integrated Manufacturing

Vinati’s concentration on product integration ensures its market share’s

long-term viability while also building hurdles to entrance for potential competitors.

Controlling waste products generated during core product synthesis and converting

them into commercially useful products, continuously

backward and forward integrating into new related products to reduce costs and developing new products with the same RM to improve scale for raw material sourcing are some of Vinati’s salient features of product integration. The company has demonstrated its commitment to the environment by developing new methods or utilizing the plants residuals. For example, the co-products generated during ATBS manufacturing are used to make TBA.

Long-standing relationship with reputed clients with diversified presence in domestic

and export markets:

VOL has been able to maintain long-term relationship with its clients over the years

with its client list including reputed companies such as Chemtall Inc, BASF Corporation,

Mitsubishi Corporation, SNF, and Dow Europe GMBH among others. VOL enters into long-term

supply contracts with its customers, for its two primary products IBB and ATBS.

It is an export-oriented company with around 70% of its revenues from exports. It

supplies to around 40 countries across the world with majority exports to USA, Europe,

Japan and China.

New products and Capex to drive growth

The company started India’s largest Butyl Phenols plant about a year back

and is currently witnessing good demand in the domestic and the export markets.

It had expanded its current capacity of Butyl Phenols from 35,000 TPA to 50,000

TPA and this additional capacity of 15,000 TPA got completed in Q4FY22. VOL is also

planning to undertake a capex of Rs. 65 crores in a new Butyl Phenols plant, which

is expected to be used in the agrochemical sector.

The company had made a capital expenditure of Rs. 300 crores in Veeral Additives Pvt. Ltd. [one of the largest manufacturers of Antioxidants (AO) for Polymer and Plastic Industry]. Veeral additives had set up a plant to manufacture three types of AOs and as per the management, this plant was completed at the end of Q4FY22. In Feb. 2021, the board of the VOL had approved the scheme of amalgamation of Veeral Additives with VOL, and as per the recent updates, the company has received the SEBI approval for the same and the application has been filed with NCLT. The company expects revenue of Rs. 700 crores (at the full capacity) from this expansion. Veeral Organics (a subsidiary) is foraying into specialised chemical production with a total expenditure of Rs. 250 crores. It consists of five innovative products that are used in diverse industries and have a total market size of Rs. 2,500 crores. VOL is aiming for a 10% market share. The capex is now ongoing and should be completed by March 2023.

Global Leadership in IBB and ATBS

VOL is a global leader in the production of isobutyl benzene (IBB) and 2-Acrylamido

2-Methylpropane Sulfonic Acid (ATBS), with the capacity of 25,000 TPA and 40,000

TPA, respectively. The ATBS capacity is to be expanded to 60,000 MT. Veeral Organics

Private Limited, 100% subsidiary of VOL, will be investing in new products catering

to niche industries. IBB is used in the production of ibuprofen (a non-steroidal

anti-inflammatory drug), whereas ATBS is a specialty monomer used in a variety of

processes, including industrial water treatment, oil field recovery, construction

chemicals, medical hydrogels, personal care products, emulsion polymers, detergents,

textile print pastes, adhesives and sealants, thickeners, and paper coatings. As

per the latest annual report, the global market share of the company in IBB and

ATBS was more than 65%. Because of its market leadership in these two key products,

the company has been able to post consistently strong operating profits in the past.

Because manufacturing techniques are difficult to imitate and serve as an entry

barrier for new competitors, the competitive advantage in both products is likely

to continue in future too.

Financials

Financial performance for last 3 years

VOL registered a Sales CAGR growth of 13% at Rs.1616 crores in FY22 as compared

to Rs.1128 crores in FY19. PAT witnessed a decent CAGR growth of 7% at Rs.347

crores against Rs.282 crores it clocked in FY19. On the operational front,

EBITDA saw a flat growth of 1% at Rs.435 crores in FY22.

Risks & Concerns

Raw Material Risk: IBB and ATBS are made from crude derivatives as a starting material. If the company is unable to pass on the higher raw material price to its customers, it may encounter margin pressure.

Foreign Currency Risk: Almost 70%-75% of the company’s revenue is generated via exports. Therefore, company remains exposed to any adverse movement in the foreign exchange.

Outlook & valuation

VOL is one of India’s leading manufacturers and exporters of specialty organic intermediaries, monomers, and polymers. VOL is the world’s largest manufacturer of IBB & ATBS. We believe that competitive advantage of VOL in both its product segments is expected to sustain in the medium term as the manufacturing processes are not easy to replicate and the same acts as entry barrier for new entrants. The ongoing capex in Butyl Phenols, long established relationship with its reputed clients, diversified presence in domestic and export markets, backward integrated manufacturing of ATBS and Butyl Phenols and stable demand from other products will act as key growth drivers for VOL.

At CMP of Rs 1994, currently, the stock trades at 25x of FY25E earnings. We initiate coverage on VOL with BUY rating and target price of Rs.2370; valuing a 30x to FY25E earnings.

| Financial Year (Rs. In crores) | Sales | EBITDA | PAT | EPS |

|---|---|---|---|---|

| FY2021 | 954 | 353 | 269 | 26 |

| FY2022 | 1616 | 436 | 347 | 34 |

| FY2023E | 2072 | 574 | 453 | 44 |

| FY2024E | 2568 | 763 | 586 | 57 |

| FY2025E | 3421 | 1052 | 817 | 79 |