Tata Steel Ltd

Steel & Iron Products

Tata Steel Ltd

Steel & Iron Products

Stock Info

Shareholding Pattern

Price performance

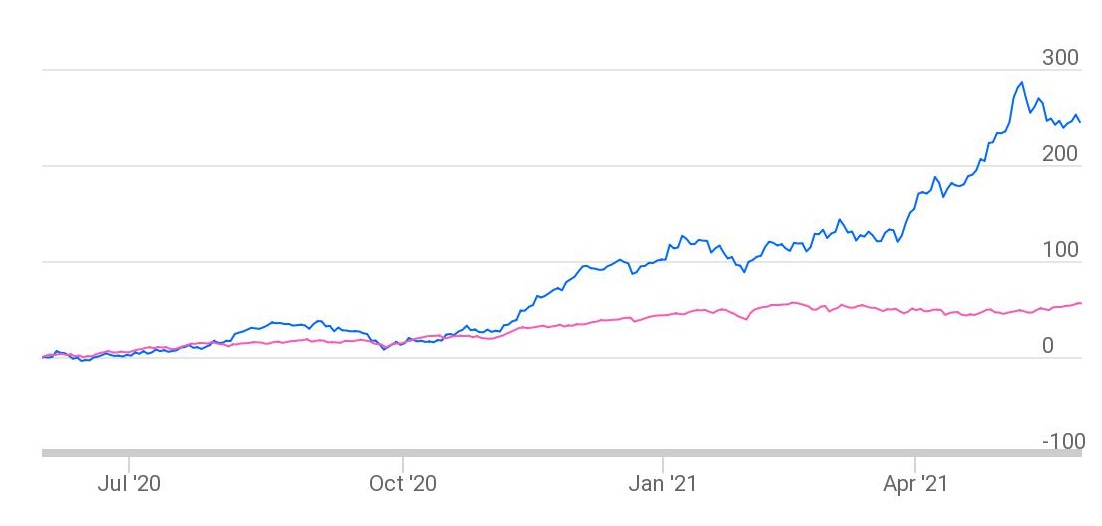

Indexed Stock Performance

Established Player in the Steel industry

Company Profile

Tata Steel Ltd is a part of the widely diversified Tata Group and is present across

the entire value chain of steel manufacturing from mining and processing iron ore

and coal to producing and distributing finished products. The Company offers a broad

range of steel products including a portfolio of high value added downstream products

such as hot rolled, cold rolled, coated steel, rebar’s, wire rods, tubes and

wires. Further the product profile of the company comprises both flat and long products.

In addition to different varieties of steel, it is also a large producer of ferro-chrome

products. The company has an annual crude steel capacity of 34 million tons per

annum, of which 19.6 million tons of crude steel capacity is in India, and 12.1

million tons’ capacity is in Europe. In May 2018, it completed acquisition

of Bhushan Steel (BSL) Tata Steel BSL also completed acquisition of Bhushan Energy

in June 2019 to improve cost efficiency. In April 2019, it completed acquisition

of Usha Martin’s steel business through its subsidiary Tata Sponge Iron (now

known as Tata Steel Long Products), thereby expanding its long products portfolio.

Rationale for Investment

Established market position with a wide distribution reach

The company is world’s second-most geographically diversified steel producer

having operations that are fully integrated - from mining to the manufacturing and

marketing of finished products. The company’s operations are spread across

26 countries and commercial presence in over 50 countries. The company has a high

market share in the Eastern and Northern regions of India. Further we believe the

company has been able to operate the steel assets in India at its maximum capacity

due to superior product quality and wide distribution network. The company’s

channel partners and the Sampoorna digital platform is enabling efficient distribution

and enhancing customer experience through better collaboration along the distribution

network.

Diversified product segment with focus on innovative products

The company’s product portfolio spans across the flat and long product categories,

characterised by a high share of value-added and branded products, which support

higher margins and strengthen its operating profile. In FY20 for India operations,

~78% of sales was contributed by flat products and ~22% by long products. The company

has four segments such as i) Automotive & special products ii) Branded products

and retail iii) Industrial products and projects iv) downstream division. The company

has an established position in the domestic automobile flat product segment and

with the acquisition of Bhushan Steel and the alloy steel business of Usha Martin

Limited, we expect the company will further consolidate its leadership position

in the domestic automotive market.

Captive consumption provides cost efficiency

Tata Steel standalone steel business is amongst the lowest cost steel producers

globally, as it procures 100% of its iron ore requirement and around 30% of its

coking coal requirement from its captive mines, thus providing a distinct competitive

advantage over its peers. Due to captive consumption, the company’s domestic

profitability has remained partly insulated from the volatility in raw material

prices. Further we believe, this backward integration benefits the company in getting

significant operating leverage and aids in reporting healthy earnings through the

steel upcycle.

Debt reduction strategy shall lead to leaner and stronger balance sheet

The company reduced gross debt by more than Rs 20,000 crore in Q4FY21 whereas it

pared debt by Rs 28,000 crore in FY21. Net debt stood at Rs 75,389 crore in FY21;

28% lower than the FY20 numbers. The company aims to lower its debt further by $

1 billion every year. We believe aggressive prepayment of debt shall result in a

sharp improvement of capital structure metrics and company remains focussed on debt

reduction and balance sheet repair.

Outlook & Valuation

We believe the company shall capitalize on growth opportunities supported by i) elevated steel prices ii) deleveraging balance sheet and diversified product segments. Further we expect Tata steel BSL and Tata steel long products to continue deliver improvements in operating business which will translate into better profitability and also Tata steel Europe to turnaround its business performance through transformation program. Further we expect the company to focus on conserving cash and ensuring adequate liquidity to face potential disruptions. The stock is currently trading at 4.5x FY23E EBITDA.

Technical

Price: TATA STEEL is in a secular bull run making higher highs and higher lows on weekly charts. The stock is currently placed above all its 21SMA & 50SMA moving averages on daily time frames which indicates positive setup. The stock has seen supportive volume formation on daily charts. We expect the stock to continue it outperforms in the coming weeks. The stock has bounced with increased in volume which indicates the strength in the counter. The Parabolic SAR on weekly chart is trading below the price, indicating upward momentum is likely to continue in the stock.

Indicator: The RSI on daily chart is pegged at sub 55.33 levels, indicating the stock has not yet been over bought. Even the MACD line on weekly charts is in buy mode, indicating bullish momentum is likely to continue. The DMI+ is also in bullish zone and is currently placed around 26.93 levels, whereas ADX trading at 38.11, way above 25 level, which shows overall strength.

Volume: Price and volume analysis plays an important part in determining overall strength or weakness in the stock. Price and volume pattern are moving in the same direction which reflects the true movements in the stock. TATASTEEL stock has seen the increase in delivery volume, which shows the movement of this stock is on bullish side.

Conclusion: Considering all the above data facts, we recommend buying for short term. The stock is in the category of investor friendly stocks and always attracted the market participants. The stock has seen decent deliverable quantity to trade quantity on daily basis, which indicates strong hands are accumulating the stock at currents levels, which enhance the confidence. Investor can go long on the stock around Rs.1093 levels keeping a stop loss below Rs.950 for the target of Rs.1370 levels.