Tata Motors Ltd

Automobiles-Trucks / Lcv

Tata Motors Ltd

Automobiles-Trucks / Lcv

Stock Info

Shareholding Pattern

Price performance

Indexed Stock Performance

All three key businesses are poised for a strong turnaround.

Tata Motors Limited (Tata motors), a $45bn organization, is a leading global automobile manufacturer of cars, utility vehicles, pick-ups, trucks and buses. It is a part of the USD 110 billion Tata group, Tata Motors is India’s largest and the only OEM offering extensive range of integrated, smart and e- mobility solutions. It has operations in India, the UK, South Korea, Thailand, South Africa, and Indonesia through a strong global network of 134 subsidiaries, associate companies and joint ventures, including Jaguar Land Rover in the UK and Tata Daewoo in South Korea. With a focus on engineering and tech enabled automotive solutions catering to the future of mobility, Tata Motors is one of the Top 2 players in India’s commercial vehicles market and amongst the top four in the passenger vehicles market. It has state of the art design and R&D centres located in India, UK, US, Italy and South Korea. Internationally, Tata commercial and passenger vehicles are marketed in countries, spread across Africa, the Middle East, South Asia, South East Asia, South America, Australia, CIS, and Russia. Tata Motors also operates in the premium car segment through its subsidiary Jaguar & Land Rover limited. Jaguar Land Rover has been a subsidiary of Tata Motors since 2008.

Consolidated Financial Statements

| Rs in Cr | Net Sales | EBITDA | EBITDAM | PAT | EPS | ROE | P/E | EV/EBITDA |

|---|---|---|---|---|---|---|---|---|

| FY18 | 291550.50 | 28893.80 | 9.90% | 8988.90 | 26.50 | 9.40% | 12.30 | 5.20 |

| FY19 | 301938.40 | 23334.20 | 7.70% | -28826.20 | -84.90 | -47.50% | -2.10 | 5.30 |

| FY20 | 261068.00 | 17689.80 | 6.80% | -12070.90 | -33.10 | -18.90% | -2.10 | 5.70 |

| FY21 | 249794.80 | 30870.20 | 12.40% | -13451.40 | -35.10 | -23.70% | -8.60 | 6.00 |

| FY22E | 293053.00 | 29127.00 | 9.90% | -1909.00 | -5.00 | -3.50% | -104.10 | 10.80 |

| FY23E | 362720.00 | 45757.10 | 12.60% | 12296.10 | 32.10 | 18.50% | 16.20 | 6.90 |

Investment Rationale

Domestic business to act as key catalyst for growth:

The company is aiming to grab higher market share in the domestic PV market as well

as the CV market. As per the management the focus remains to strengthen the core

domestic business. In order to improve its market share, the company has a well

strategy in place to achieve the same.

CV segment: Tata Motors managed to gain market share across all CV segments. CV market share stood at 44.6% in 1HFY22 vs 42.4% in FY21

PV business: Tata Motors’s revamped PV portfolio aided in market share gains (11.3% vs 8.2% in FY21).

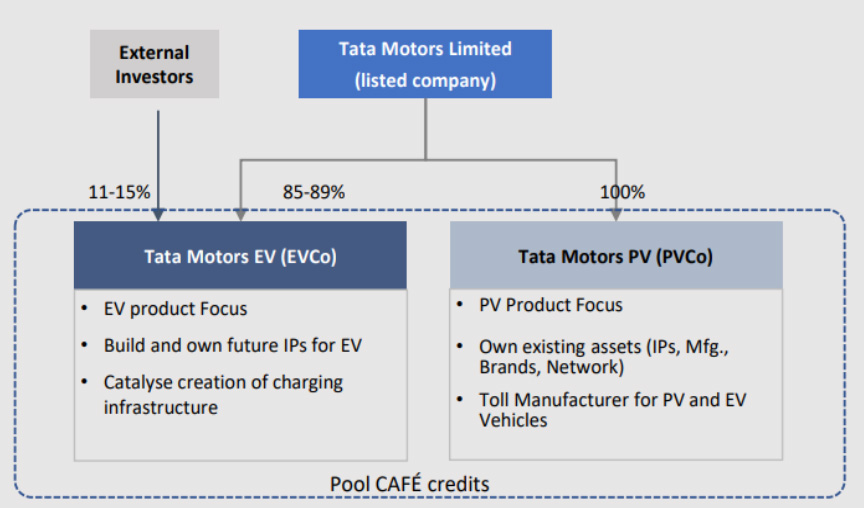

EV stake sale to unlocks value:

TPG Rise Climate along with ADQ will invest Rs 75bn ($1 bn) to secure 11-15% stake

in Tata Motors new wholly-owned EV subsidiary (EVco)- through compulsory convertible

preference shares (CCPS). 50% of the capital infusion by TPG will be completed by

Mar-22 and rest by CY22 end.

The implied equity valuation for EVco translates to $9.1bn and conversion of CCPS to equity shares will happen by FY27 based on achievement of revenue thresholds.

TPG Rise will have representation on the EVCo board of directors.

Present EVCo revenues are at Rs 500-600 crore. It is aiming for EBITDA breakeven next year and for FCF positive status after three to four years. EVCo contribution margins are similar to India PV business.

Source: Company

Aggressive CAPEX plans for expansion of EV (Electric Vehicle) portfolio:

The company plans to have a portfolio of 10 EVs by FY26, across different price

ranges and segments. It has plans to invest $2.2bn towards product development,

technology, charging infra, network expansion and localisation to consolidate its

presence in emerging segment.

Company has market share of 71% in the EV space In FY21 vs 11% in FY18 with highest number of EV models introduced in the market. It also plans to grow its network as it has a presence across 100+ cities through 255 touchpoints.

The management expects EV industry to grow 2.5-2.7x in FY22 vs 1.5-2x every year between FY17-FY21. Also, EV business currently contributes Rs 5-6bn to the company’s revenues and is expected to breakeven EBITDA by FY23E.

Management reiterated that 20% of their volume will come from EVs as against industry penetration of 10% in FY26.

To benefit from the PLI scheme:

The government recently approved Rs 260bn worth of new PLI effective from FY23 onwards

for a period of 5 years, under which, based on revenues generated through PLI eligible

vehicles/components (eligibility criteria: OEMs with a minimum of Rs 100bn in revenue

& Rs 30bn in fixed assets; 4W OEMs need to invest a minimum of Rs 20bn over

the period), OEMs will get incentives in the range of 13-18%. The manufacturers

of electric vehicles will get a big boost from the PLI scheme for the automotive

sector and the earlier launched PLI for Advanced Chemistry Cell (Rs 181bn) &

the Faster Adoption of Manufacturing of Electric Vehicles (FAME) scheme. The company

is looking at the best way to leverage the PLI opportunity and will likely apply

for the same as Tata Motors standalone entity (both for CV & PV).

Q3FY22 Result Highlights:

JLR Launched a new Range Rover (RR) in 3QFY22, boosting order book growth to 155K

units, up 30K units year on year. According to management, the customer response

to the new RR was significantly stronger than the response to Discovery.

A record order book of more than 150K and historically low inventory would result in a solid sales performance in FY23, as the semiconductor issue appears to be improving progressively in the next quarters.

Moreover, the recently launched Punch in the domestic PV category has been the most successful vehicle in the company's PV portfolio over the last decade, with record-breaking sales volume.

Its recent domestic PV transaction in the EV category is a game changer that will take the company to a completely new horizon in the coming decade.

Outlook & valuation

Tata motors limited enjoys immense financial flexibility by its virtue of being part of Tata Group and strong backing from its promoter Tata Sons. We expect losses of the company to gradually reduce driven by higher volumes, cost cutting initiatives and better operating leverage. Significant developments on these fronts could be a potential trigger for the future growth prospects of Tata motors. The India business is behind its peak capex cycle and an improvement in volumes backed by new model launches will boost India performance. Currently the stock trades at EV/EBITDA of 4x on FY24E basis and we initiate our coverage on Tata motors with Buy rating with a rolled forward TP of Rs. 659 based on SOTP.

Sum of the parts (SOTP) valuation

| Particulars | Parameters | EBITDA | Multiple | Per Share Equity Value |

|---|---|---|---|---|

| Tata Motors Core business | FY24E EV/EBITDA | 7,300 | 13 | 235.0 |

| JLR | FY24E Adj EV/EBITDA | 41,917 | 3.5 | 210.0 |

| India EV business | 11% stake sale @₹7,500 | - | - | 195 |

| Other Investments | 3x P/B on FY21 | 2,369 | 3 | 20 |

| Total value per share | 659.6 |

Financial Statement

Profit & Loss statement

| Yr End March (Rs Cr) | 2018 | 2019 | 2020 | 2021 | 2022E | 2023E |

|---|---|---|---|---|---|---|

| Net Sales | 291550.50 | 301938.40 | 261068.00 | 249794.80 | 293053.00 | 362720.00 |

| Expenditure | ||||||

| Material Cost | 187228.60 | 197566.60 | 167428.30 | 158326.70 | 193415.00 | 238851.10 |

| Employee Cost | 30300.10 | 33243.90 | 30438.60 | 27648.50 | 32080.00 | 32536.00 |

| Other Expenses | 61075.50 | 12567.70 | 21057.70 | 77950.80 | 91467.90 | -271387.10 |

| EBITDA | 28893.80 | 23334.20 | 17689.80 | 30870.20 | 29127.00 | 45757.10 |

| EBITDA Margin | 9.90% | 7.70% | 6.80% | 12.40% | 9.90% | 12.60% |

| Depreciation & Amortization | 21553.60 | 23590.60 | 21425.40 | 23546.70 | 24761.00 | 26347.00 |

| EBIT | 7340.20 | -256.40 | -3735.60 | 7323.50 | 4366.00 | 19410.10 |

| EBIT Margin % | 2.50% | -0.10% | -1.40% | 2.90% | 1.50% | 5.40% |

| Other Income | 6521.50 | 4295.40 | 3270.40 | 4060.40 | 2377.00 | 4163.00 |

| Interest & Finance Charges | 4681.80 | 5758.60 | 7243.30 | 8097.20 | 9223.00 | 7605.00 |

| Profit Before Tax - Before Exceptional | 9179.90 | -1719.60 | -7708.50 | 3286.70 | -2480.00 | 15968.10 |

| Profit Before Tax | 11155.00 | -31371.20 | -10580.00 | -10474.30 | -2480.00 | 15968.10 |

| Tax Expense | 4341.90 | -2437.50 | 395.30 | 2541.90 | -571.00 | 3672.00 |

| Effective Tax rate | 47.30% | 141.70% | -5.10% | 77.30% | 23.00% | 23.00% |

| Exceptional Items | 1975.10 | -29651.60 | -2871.40 | -13761.00 | - | - |

| Net Profit | 6813.10 | -28933.70 | -10975.20 | -13016.10 | -1909.00 | 12296.10 |

| Net Profit Margin | 2.30% | -9.60% | -4.20% | -5.20% | -0.70% | 3.40% |

| Consolidated Net Profit | 8988.90 | -28826.20 | -12070.90 | -13451.40 | -1909.00 | 12296.10 |

| Net Profit Margin after MI | 3.10% | -9.50% | -4.60% | -5.40% | -0.70% | 3.40% |

Balance Sheet

| Yr End March (Rs Cr) | 2018 | 2019 | 2020 | 2021 | 2022E | 2023E |

|---|---|---|---|---|---|---|

| Share Capital | 679.20 | 679.20 | 719.50 | 765.80 | 765.80 | 765.80 |

| Total Reserves | 94748.70 | 59491.90 | 61478.40 | 54458.70 | 52683.40 | 64118.80 |

| Shareholders' Funds | 95953.00 | 60702.60 | 63892.10 | 56820.20 | 55053.40 | 66437.80 |

| Minority Interest | 525.10 | 523.10 | 813.60 | 1573.50 | 1582.00 | 1531.00 |

| Non Current Liabilities | ||||||

| Long Term Burrowing | 61199.50 | 70817.50 | 83315.60 | 93112.80 | 131054.70 | 132815.70 |

| Deferred Tax Assets / Liabilities | 1967.10 | -3660.10 | -3516.00 | -2964.50 | -2964.50 | -2964.50 |

| Long Term Provisions | 10948.40 | 11854.90 | 14736.70 | 13606.80 | 13606.80 | 13606.80 |

| Current Liabilities | ||||||

| Short Term Borrowings | 16794.90 | 20150.30 | 16362.50 | 21662.80 | 21662.80 | 21662.80 |

| Trade Payables | 76939.80 | 71690.70 | 66398.20 | 76040.20 | 72131.80 | 78153.80 |

| Other Current Liabilities | 39972.20 | 42402.10 | 46324.10 | 46111.80 | 24982.80 | 24982.80 |

| Short Term Provisions | 9512.60 | 11214.40 | 11369.20 | 13934.50 | 13934.50 | 13934.50 |

| Total Equity & Liabilities | 327191.80 | 302043.40 | 316663.40 | 338605.50 | 349743.30 | 368910.60 |

| Assets | ||||||

| Net Block | 121413.90 | 111234.50 | 127107.10 | 138707.60 | 143946.60 | 157599.60 |

| Non Current Investments | 5651.70 | 6240.90 | 5446.90 | 5569.10 | 5569.10 | 5569.10 |

| Long Term Loans & Advances | 2730.70 | 2908.30 | 4017.20 | 4102.20 | 4102.20 | 4102.20 |

| Current Assets | ||||||

| Currents Investments | 15161.10 | 9529.80 | 10861.50 | 19051.20 | 19051.20 | 19051.20 |

| Inventories | 42137.60 | 39013.70 | 37456.90 | 36088.60 | 35694.10 | 40424.40 |

| Sundry Debtors | 19893.30 | 18996.20 | 11172.70 | 12679.10 | 12641.70 | 15271.40 |

| Cash and Bank | 34613.90 | 32648.80 | 33727.00 | 46792.50 | 53123.20 | 51277.50 |

| Short Term Loans and Advances | 8665.10 | 8418.10 | 7505.40 | 9091.80 | 9091.80 | 9091.80 |

| Total Assets | 327191.80 | 302043.40 | 316663.40 | 338605.50 | 349743.30 | 368910.60 |

Cash Flow Statement

| Yr End March (Rs Cr) | 2018 | 2019 | 2020 | 2021 | 2022E | 2023E |

|---|---|---|---|---|---|---|

| Profit After Tax | 6813.10 | -28933.70 | -10975.20 | -13016.10 | -1909.00 | 12296.10 |

| Depreciation | 21553.60 | 23590.60 | 21425.40 | 23546.70 | 24761.00 | 26347.00 |

| Changes in Working Capital | -6433.70 | -7220.70 | 5065.40 | -92.60 | -3476.40 | -1338.10 |

| Cash From Operating Activities | 23857.40 | 18890.80 | 26632.90 | 29000.50 | 19375.60 | 37305.00 |

| Purchase of Fixed Assets | -35078.90 | -35303.50 | -29702.00 | -20205.40 | -30000.00 | -40000.00 |

| Free Cash Flows | -11221.50 | -16412.80 | -3069.10 | 8795.10 | -10624.40 | -2695.00 |

| Cash Flow from Investing Activities | -26201.60 | -19711.10 | -34170.20 | -26126.30 | -30000.00 | -40000.00 |

| Increase / (Decrease) in Loan Funds | 7518.30 | 15930.20 | 8198.80 | 16231.20 | 16813.00 | 1761.00 |

| Equity Dividend Paid | -96.00 | -94.70 | -56.80 | -30.30 | 133.60 | -860.70 |

| Cash from Financing Activities | 2011.70 | 8830.40 | 3389.60 | 9904.20 | 16946.60 | 900.30 |

| Net Cash Inflow / Outflow | -332.50 | 8010.00 | -4147.70 | 12778.50 | 6322.30 | -1794.70 |

| Opening Cash & Cash Equivalents | 13986.80 | 14716.80 | 21559.80 | 18467.80 | 31700.00 | 38022.30 |

| Closing Cash & Cash Equivalent | 14716.80 | 21559.80 | 18467.80 | 31700.00 | 38022.30 | 36227.60 |

Key Ratios

| Yr End March | 2018 | 2019 | 2020 | 2021 | 2022E | 2023E |

|---|---|---|---|---|---|---|

| Basic EPS | 26.50 | -84.90 | -33.10 | -35.10 | -5.00 | 32.10 |

| Diluted EPS | 26.50 | -84.90 | -33.10 | -35.10 | -5.00 | 32.10 |

| Cash EPS (Rs) | -15.40 | 25.60 | 26.40 | 59.70 | 100.90 | - |

| DPS | - | - | - | - | -0.30 | 2.20 |

| Book value (Rs/share) | 282.60 | 178.70 | 175.10 | 148.30 | 143.70 | 173.50 |

| ROCE (%) Post Tax | 4.80% | -1.00% | -0.30% | 1.50% | 2.70% | 8.50% |

| ROE (%) | 9.40% | -47.50% | -18.90% | -23.70% | -3.50% | 18.50% |

| Inventory Days | 48.30 | 49.10 | 53.50 | 53.70 | 48.00 | 45.00 |

| Receivable Days | 21.30 | 23.50 | 21.10 | 17.40 | 17.00 | 17.00 |

| Payable Days | 87.30 | 89.80 | 96.50 | 104.10 | 97.00 | 87.00 |

| PE | 12.30 | -2.10 | -2.10 | -8.60 | -104.10 | 16.20 |

| P/BV | 1.20 | 1.00 | 0.40 | 2.00 | 3.60 | 3.00 |

| EV/EBITDA | 5.20 | 5.30 | 5.70 | 6.00 | 10.80 | 6.90 |

| Dividend Yield (%) | 0.00% | 0.00% | 0.00% | -0.10% | 0.40% | 0.00% |

| P/Sales | 0.40 | 0.20 | 0.10 | 0.50 | 0.70 | 0.50 |

| Net debt/Equity | 0.40 | 1.10 | 1.20 | 1.20 | 2.10 | 1.80 |

| Net Debt/ EBITDA | 1.40 | 2.70 | 4.20 | 2.30 | 3.90 | 2.60 |

| Sales/Net FA (x) | 2.70 | 2.60 | 2.20 | 1.90 | 2.10 | 2.40 |