Tata Elxsi Ltd

IT - Software Services

Tata Elxsi Ltd

IT - Software Services

Stock Info

Shareholding Pattern

Price performance

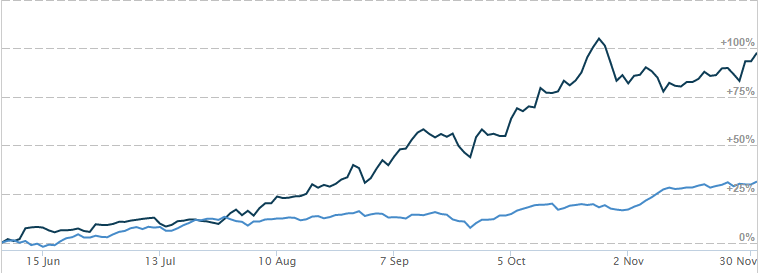

Indexed Stock Performance

Diversified business model, outsourcing of design services by Global OEMs and higher ER&D investments from global majors will continue to boost sales, Debt free status and cash rich position makes it a perfect candidate for re-rating.

Tata Elxsi (TELX) is amongst the world’s leading providers of design and technology services for product engineering and solutions across industries including Broadcast, Communications and Automotive sectors. It provides technology consulting, new product design, development, and testing services. TELX also provides solutions and services for emerging technologies such as IoT (Internet of Things), Big Data Analytics, Cloud, Mobility, Virtual Reality and Artificial Intelligence.

Tata Elxsi is uniquely placed with its integrated design, technology & engineering teams to help enterprises reimaging their products & services, deliver exceptional outcomes for their customers, and drive the growth of their brands and business. In terms of Business mix, automotive sector contributed 60% to revenue in FY19, followed by Broadcasting and Media (30 to 35% of total revenue) and other sectors (5-10% of total revenue). TELX reports its financials under two segments, namely, Software Development and Services (SDS) and Systems Integration and Support (SI).

Tata Elxsi addresses the complete product development lifecycle from R&D, new product development and testing to maintenance engineering for Broadcast, Consumer Electronics, and Communications. With the penetration of high-speed internet, smart devices and content flooding in the market, the borders between entertainment, media, and telecommunications have dissolved. New services such as smart, connected homes & OTT are creating new revenue opportunities for operators & broadcasters. Tata Elxsi works with leading broadcasters & operators to create solutions for smarter living, engaged entertainment and a digital future driven by IoT, analytics and artificial intelligence thereby enabling new revenue streams and enhanced customer experience.

Revival in automotive sector to boost revenues in near term:

Tata Elxsi’s automotive sector contributes around 51% of total revenue. While

in automotive sector its top client JLR comprises around 14.5% of total revenues,

in recent statement from JLR the management indicted that despite of slowdown they

are not looking to reduce their budget for R&D process which is positive for

TELX. We believe in near term auto sector can revive at a faster pace. Globally

auto manufacturers are continuously investing in Technology driven cars and focusing

on Driverless cars, we expect good momentum soon in auto sector. Apart from this,

we expect a key change in Auto sector is a shift from normal vehicles to Electric

vehicles. According to Bloomberg report in 2018 over 2 million Electric vehicles

(EV) were sold which has grown in 10 folds from 10 years back. It expects annual

EV’s to rise by 10 million in 2025. This has a huge untapped opportunity for

Tata Elxsi as it offers services to Electric vehicles in program management, Engine

management software, Battery management etc

New collaborations and exciting ventures to explore new opportunities:

Tata Elxsi has successfully collaborated with top auto sector players to develop

sector specific products and tools for OEM’s and automotive suppliers. TELX

has collaborated with Hyundai mobis, to develop tool to test accelerate testing

of autonomous cars. It recently announced the licensing of their AUTOSAR adaptive

platform to Great wall motors, China’s largest SUV manufacturer. TELX has

also partnered with android and blackberry for IP solutions which is one stop solution

for automotive solution.

Broadcast and communication vertical continues to post robust growth:

During the quarter, the broadcast and communication vertical became the largest

in terms of revenue, taking the total contribution to overall revenue to 45%. There

are three sub-segments in this vertical i.e. (1) operator segment, (2) broadcasters

and (3) devices segment. The top account in this vertical is a large multi-services

operator based out of the US and the company has relationship with that customer

over 12 years. The company is engaged with large operators in Europe, India, and

South Africa. TE is looking to expand its business in Middle East market.

Healthcare and medical device business is the new avenue for growth:

Revenue in healthcare and medical device declined 2.6% q-o-q during the quarter.

Healthcare segment revenue increased 26.5% y-o-y and 5.3% q-o-q during the quarter.

Management believes that the growth trend in this segment would continue in coming

quarters as the company has been investing on delivery capabilities, sales and demand

creation perspective.

Technical Tagline: “MID CAP TECH STAR”

Price: Tata Elxsi has gained 19.20% over last one month after finding bottom at Rs.1161.35 made on 21 September 2020, which also ended short term down trend in the stock. The stock has been significantly outperforming both NIFTY and NIFTY IT over last month. We expect the stock to continue its outperformance in the coming weeks. The stock has high of Rs.1490.90 made on July 2018 and move low from that level till low of Rs.499.95 made on March 2020. Drawing Fibonacci Retracement between this level the stock is trading above 100% retracement, which has a value of Rs.1490.90. The stock has bounced from the support level with increased in volume which indicates the strength in the counter.

Indicator: The stock is trading above important moving average 21SMA & 50SMA on weekly chart. Bollinger Band (20, 2, S) set up on weekly chart has started to expand and currently the stock is trading above the upper band of Bollinger Band indicating the volatility expansion on the higher side. RSI on daily chart is pegged at sub 71.26 levels, indicating the stock has not yet been over bought. Even the MACD line on weekly charts is in buy mode, indicating bullish momentum is likely to continue which supports to our bullish view on the stock.

Volume: Price and volume analysis plays an important part in determining overall strength or weakness in the stock. Price and volume pattern are moving in the same direction which reflects the true movements in the stock. TATA ELXSI stock has seen the profit booking with thin volume, which still shows the movement of this stock, is still on bull side.

Conclusion: Considering all the above data facts, we recommend buying for short to medium term. Traders may go long on the stock around Rs.1543 levels keeping a stop loss below Rs.1350 for the targets of Rs.1925 levels.