Tata Chemicals Ltd

Chemicals

Tata Chemicals Ltd

Chemicals

Stock Info

Shareholding Pattern

Price performance

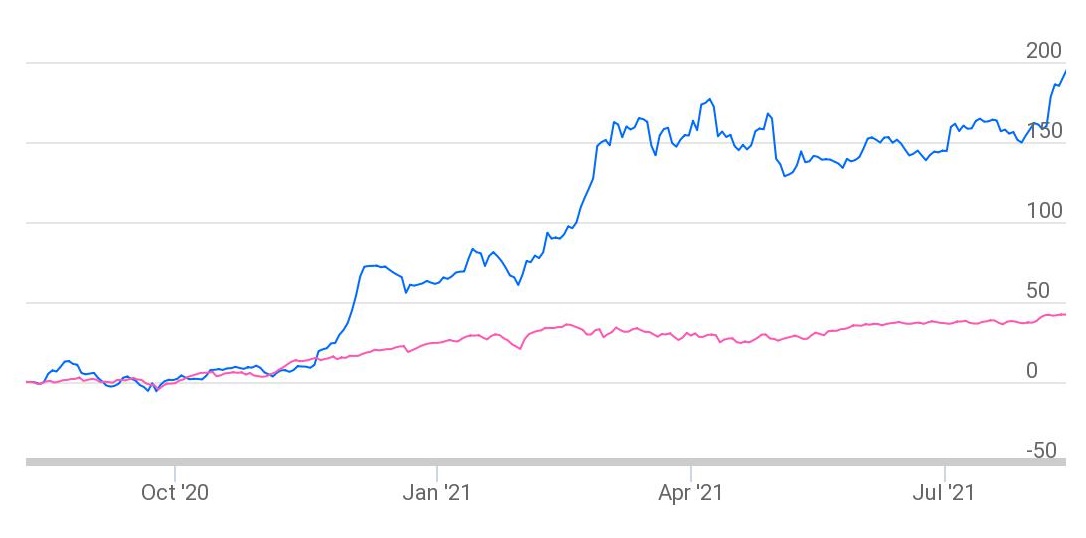

Indexed Stock Performance

World's Leading Manufacturer of Soda Ash and Sodium Bicarbonate, with Market Shares at 3rd and 6th Position, Respectively

Company Profile

Tata Chemicals Ltd. (TCL), a part of ~USD 106 billion Tata Group, is engaged in

manufacturing of basic and specialty chemicals. In basic chemicals, it manufactures

Soda Ash, Sodium Bicarbonate, Salt, and other products. In specialty chemicals,

it develops specialty silica products for industrial applications as well as nutrition

ingredients and formulations for food, feed, and pharma industries. TCL also develops

and manufactures crop protection chemicals, crop nutrition, seeds, and other agricultural

inputs through its subsidiary, Rallis India Ltd. The company is a global major

in soda ash and sodium bicarbonate (market position of 3rd and 6th

respectively).

It has 13 manufacturing units across India, the USA, the UK, and Kenya. In 2006, TCL completed acquisition of the Brunner Mond group and gained access to the soda ash business in Europe and Kenya. It acquired GCIP in North America in March 2008. In December 2010, it acquired British Salt Ltd., the leading manufacturer of pure-dried vacuum salt products with around 50% market share in the UK. Given below is the installed capacity of various products (as of June 2021) –

| Capacity (in TPA) | India | The USA | The UK | Kenya |

|---|---|---|---|---|

| Soda Ash | 9,17,000 | 24,50,000 | 4,00,000 | 3,50,000 |

| Sodium Bicarbonate | 1,05,500 | - | 1,30,000 | - |

| Salt | 11,70,000 | - | 4,30,000 | - |

| Specialty Silica | 10,000 | - | - | - |

| Prebiotic | 5,000 | - | - | - |

Source: Investor Presentation, June 2021

Investment Rationale

Well-established Position in a Soda Ash Industry

Tata Chemicals is the world's leading manufacturer of soda ash and sodium bicarbonate,

with market shares at 3rd and 6th position, respectively,

with a global footprint spanning four continents: Asia, America, Europe, and Africa.

It has a capacity of 4.1 MMT of soda ash, of which +75% is natural soda ash, resulting

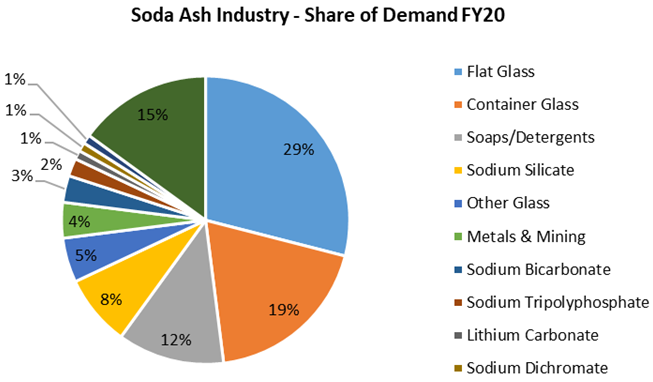

in efficient operations and lower operating costs. Its products are utilized in

a variety of applications, including flat glass, container glass, soaps/detergents,

sodium silicate, metals & mining, sodium bicarbonate, among others. The company

also benefits from adequate exposure to non-discretionary end-user products, which

ensures constant demand for soda ash. TCL is now a wholly chemistry-focused firm,

able to commit resources to scale up its chemical portfolio after de-merging from

the consumer product business (now de-merged to Tata Consumer Products).

Source: Statista

Demand Revival from End User Industries and Better Price Realization to Aid Growth

Due to Covid-19 pandemic, the company’s volume growth in soda ash was impacted

in Q1FY21 across geographies. However, the improvement was seen from Q2FY21, and

company fulfilled all its contractual obligations and agreements. Further, India

business volume was again hit by second wave of Covid-19 but remained steady and

above pre-covid levels. Soda ash demand is increasing globally with spot prices

beginning to move upward. Much of this recovery has been driven by application sectors

driven by sustainability trends like solar glass, lithium carbonate and the move

from plastic to glass containers.

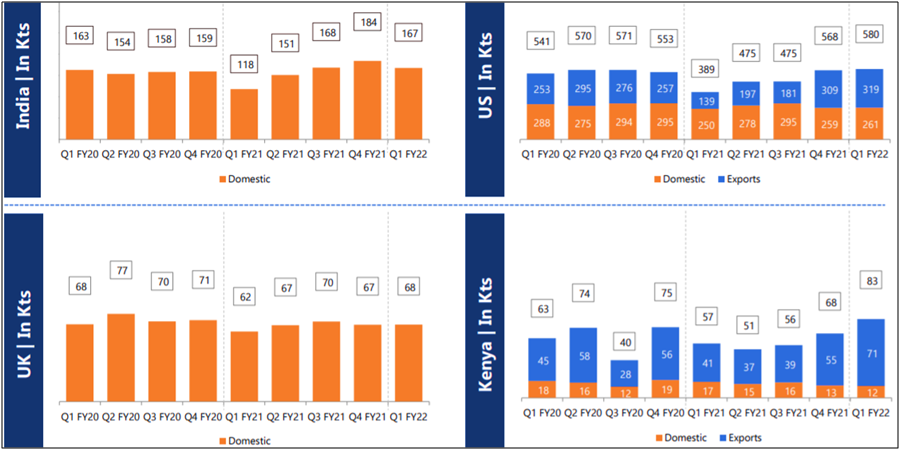

Demand Trends for Soda Ash Across Geographies

In India, demand recovery in soda ash and an anticipated reduction in imports are

likely to bring demand and supply into balance with corresponding easing of pressure

on pricing.

The management’s outlook for its US subsidiary remains positive with soda ash rates moving up close to normal levels primarily driven by recovery in export markets.

In UK, demand continues to remain firm. However, pricing which is primarily contractual has come under pressure from January 2021 and will persist at these levels till at least CY21 end as per the management.

In Kenya, demand recovery in export markets and a consequent revival in pricing together with a focus on the domestic East African market to maximise overall price realisation.

Given below the volume trend of TCL for soda ash –

Source: Investor Presentation, June 2021

Capex Program to Drive Growth

The company is investing ~Rs. 2,700 crores to increase capacities of soda ash, sodium

bicarbonate, and salt at its Mithapur site. The capex program is on schedule and

the company is targeting additional capacity of 2.3 lakh MT of soda ash from current

levels of 9.17 lakh MT. Further, it is also expanding capacities of sodium bicarbonate

and salt by 0.70 lakh MT and 3.30 lakh MT from current capacities of 1.05 lakh MT

and 11.70 lakh MT, respectively. Till June 2021, the company has spent Rs. 950 crores

and is targeting completion of all on-going projects by FY24. Salt capacity is expected

to be completed during H1FY23 and Sodium Bicarbonate by H2FY23. The management expects

increased capacities of soda ash and salt will be the drivers of volume, revenue,

and bottom-line growth.

Strong Financial Risk Profile

The company’s liquidity position is high, with Rs. 3,293 crores in cash and

cash equivalents as of June 2021 due to easy access to low-cost finance. In FY21,

the debt-to-equity ratio improved to 0.49x from 0.6x in FY20. The net debt as of

June 2021 is Rs. 3,991 crores, up Rs. 248 crores from March 2021, primarily due

to small short-term borrowing in Singapore to fund working capital. The company

continues to be debt-free on a standalone basis. Gearing should remain below 1x,

indicating a sound capital structure.

Outlook & valuation

The company’s volume has improved considerably over last one year and sequentially, despite some headwinds in domestic market due to second wave of Covid-19. In the spot market, the prices are already up and management expects the price improvement will continue going forward. The outlook for domestic chemical industry remains positive and the company is also expected to perform better in its specialty chemicals segment. The on-going capex programme is also expected to aid volume, revenue, and profit growth over long term. At the current market price of Rs. 883, the stock is valued at 9x of EV/EBITDA of FY23E consensus estimates.

Technical

Price: TATA CHEMICAL is consolidating above all its important moving average, 21SMA & 50SMA on daily and weekly charts. We expect the stock to continue its outperformance in the coming weeks. The stock was trading in range as show on daily chart, before the stock break out from this range on higher side. The stock has bounced from the support level with increased volumes which indicates the strength in the counter. The stock is making higher low on daily chart, which also is giving bullish signal. The Parabolic SAR (Stop & Reverse) on daily chart is also below the trading price, suggesting northward momentum is likely to remain intact in the counter.

Indicator: The stock is trading above key moving average (21SMA & 50SMA) on daily chart, which indicates bullishness for this stock. The RSI on daily chart is pegged at 78.33, indicating the stock has not been overbought. Bollinger Band (20, 2, S) set up on daily chart has started to expand and currently the stock is trading above the upper band of Bollinger Band indicating the volatility expansion on the higher side. MACD line on daily charts is in buy mode, indicating bullish momentum to continue. The DMI+ is also pointing in northward direction and is currently placed around 36.95 levels, ADX is trading at 28.94 well above 25 mark, which shows overall strength.

Volume: Price and volume analysis plays an important part in determining overall strength or weakness in the stock. Price and volume pattern are moving in the same direction which reflects the true movements in the stock. TATACHEM stock has seen the increase in delivery volume, which shows the movement of this stock is on bullish side.

Conclusion: Considering all the above data facts, we recommend buying for short to medium term. Investors may go long around current level of Rs.883 with stop loss at Rs.760 for target Rs.1105.