Sequent Scientific Ltd

Pharmaceuticals & Drugs - Veterinary

Sequent Scientific Ltd

Pharmaceuticals & Drugs - Veterinary

Stock Info

Shareholding Pattern

Price performance

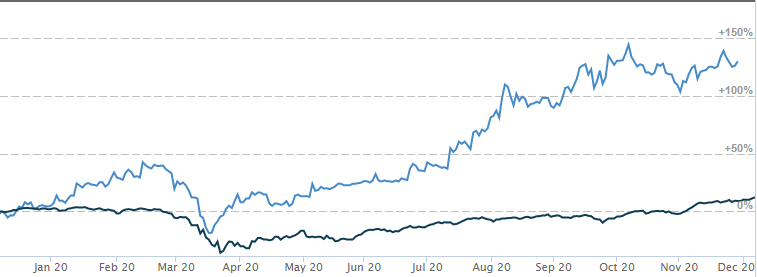

Indexed Stock Performance

Change of guard to provide new exuberance

Sequent Scientific Ltd, headquartered in Mumbai, India with a global footprint, operates in the domains of animal health (Alivira) and analytical services. Sequent has eight manufacturing facilities based in India, Spain, Germany, Brazil and Turkey with approvals from global regulatory bodies, including USFDA, EUGMP, WHO, TGA, among others. Their Vizag facility is India’s first and only USFDA approved facility for veterinary Active Pharmaceutical Ingredients (APIs). They are the largest animal health company from India and amongst the top 20 global animal health companies.

Investment Rationale

New promoter to act as catalysts

Carlyle group’s (one of the world’s largest and most diversified global

investment firms) backing as the new promoter group provides much needed impetus

to place the company on a robust growth trajectory to retain its position as one

of the top global animal healthcare companies. The Carlyle Group will leverage its

global network, industry knowledge and experience in healthcare to guide the company

on its business expansion strategy, improve its skillset and help the company drive

sales and product innovation. This ownership change will also help the company fast-track

its growth strategy in the US market, foray into vaccines business and penetrate

the China market.

Formulation business poised to deliver robust growth

The company has built a diversified portfolio across 12 dosage forms and has a strong

pipeline of 40+ formulation products with 10 pending filings in the US. Within this

pipeline, majority of products fall in the high-margin injectable dosage forms and

veterinary drugs. The company is well positioned to capitalise on opportunities

and maintain the growth momentum in the European region primarily supported by approval

of new injectable.

Strong API pipeline to act as future growth drivers

The company has emerged among the ‘Top 3’ USFDA Veterinary Master File

(VMF) filers with 19 filings. Sequent has a pipeline of 14+ products and the company’s

strategic product selection has enabled it to have 6 products where it is the sole

VMF holder. The company is one of the leading producers of animal health APIs with

a robust portfolio of 27 commercial APIs. The company is focusing more on sticky

and high-margin regulated market players and catering to global leaders in animal

health.

Focus on strengthening its R&D capabilities

Sequent has a robust track record of R&D capabilities and strong product pipeline

in the animal healthcare space. With increasing investments in R&D, the company’s

R&D pipeline shall continue to strengthen and lower business risk profile in

the medium term. Sequent’s API R&D centre at Vizag focuses primarily on

developing new products, improving existing products and expanding product applications.

The company has inaugurated new state-of-the-art R&D centre in Mumbai, and this

unique centre with strong injectable focus has capabilities to develop products

of eight different dosage forms.

HEADING FOR NEW 52 WEEK HIGH

Price: SEQUENT SCIENTIFIC on daily charts, the stock is trading with higher top and higher bottom formation. The accumulation has been seen in the range of Rs.146 to Rs.165 levels where supports has placed, indicating bullish view for the stock. On the daily charts stock has closing above the upper band of Bollinger Band (20, 2) with a positive bias. The Parbolic–Sar is placed below the price on the daily chart, re-iterating our positive stance in the counter. The overall chart structure suggests the stock is expected to extend gains in the short to medium terms for making new 52 week high in coming days.

Indicator: The stock trading above its short-term moving averages like 21SMA at Rs.155.20 and it 50SMA at Rs.152.90. The RSI on daily chart is pegged at 67.22, pointing toward the northward direction. Even the MACD is trading above the signal in buy territory on daily chart, indicating positive momentum in the stock in the near term. The DMI+ is also pointing upwards and is currently placed around 29.95 levels, whereas ADX trading at 21.19 well above 20 mark, which shows overall strength is likely to bring in sustained buying from the current levels.

Volume: Price and volume analysis plays an important part in determining overall strength or weakness in the stock. Price and volume pattern are moving in the same direction which reflects the true movements in the stock. Sequent Scientific stock has seen the profit booking with thin volume, which still shows the movement of this stock, is still on bull side.

Conclusion: Considering all the above data facts, we recommend buying for short to medium term. The stock has seen decent deliverable quantity to trade quantity on daily basis, which indicates strong hands are accumulating the stock at currents levels, which enhance the confidence over the stock. Traders may go long on the stock around Rs.168.50 levels keeping a stop loss below Rs.147 for target of Rs.210.