Schaeffler India Ltd

Bearings

Schaeffler India Ltd

Bearings

Stock Info

Shareholding Pattern

Price performance

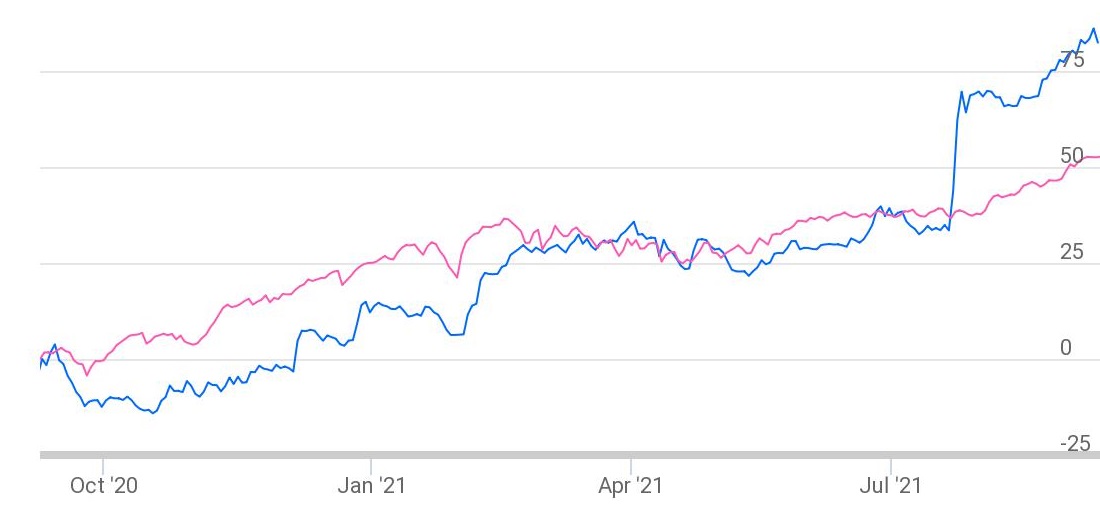

Indexed Stock Performance

Volume recovery to aid growth

Company Profile

Schaeffler with four plants and 11 sales offices has significant presence in India

with three major widely known product brands - FAG, INA and LuK. SIL manufactures

a vast range of ball bearings, cylindrical roller bearings, and spherical roller

bearing and wheel bearings and sold under the brand name of FAG. The company produces

next generation deep groove ball bearings and large size roller bearings also sold

under the name of FAG. Schaeffler manufactures engine and transmission components

for front accessory drive system, chain drive systems, valve train, shift systems

and a range of needle roller bearings and elements, under the brand INA. SIL also

produces clutch systems and dual mass flywheels for passenger cars, light commercial

vehicles, heavy commercial vehicles and tractors which are sold under the brand

of LuK. In addition to this, Schaeffler also has dedicated engineering, research

and development support based in India to augment the product teams. SIL has among

the largest after-market networks serving the industrial and automotive markets.

Investment Rationale

Volumes to bounce back in FY22:

The company expects volumes to bounce back as consumer sentiments improve especially

in the industrial and automobile aftermarket segments. The management has guided

for strong growth in export markets, and better prospects for the bearings business.

In the industrial OEM segment, the company expects to witness strong growth in the

railways segment with the introduction of new products and supplies to Metro Rail

projects. Also, shift towards Linke Hofmann Busch (LHB) coaches for passenger trains

and dedicated freight corridor (DFC) for goods train is expected to boost growth.

New initiatives to increase market share:

The company is focusing on introducing new products in the industrial and automotive

aftermarkets by bringing in localization and boosting its market share. SIL is focusing

on increasing its market share through new product launches and expansion of product

range. The company launched FAG universal joint cross and new range push type clutch

for commercial vehicles. SIL has launched the lubricant business under True Value

brand, which is receiving positive feedback. The company intends to launch more

products in the segment. Moreover, SIL’s parent has identified it as a manufacturing

base for supply to Asia-Pacific region. This provides a huge growth potential for

the company in the long run. With access to e-mobility technology through its parent

company, SIL is developing technology for two-wheelers, working jointly with the

parent company.

Industry tailwinds to drive growth:

Post the implementation of BS-VI emission norms SIL is witnessing increased content

per vehicle in the petrol PV segment while in the industrial OEM segment, the company

is witnessing strong growth from the railways segment and wind-power division. The

railway division’s business is driven by introduction of new products and

supplies to metro railways, while the wind-power business is aided by new client

acquisitions. Besides the OEM segment, aftermarket is also poised for healthy growth,

driven by new product introductions.

Margins to remain sustainable despite sharp rise in steel prices:

The company expects margins (Q2FY22 EBITDA Margin: 16.9%) to remain firm going forward

as it intends to pass on the rise in steel prices to its customers along with increasing

the level of localization by bringing down dependency on imports. The company has

already laid out a strategy to invest Rs 1000 cr in the next three years towards

localization of capacity so as to reduce dependence on imports.

Outlook & valuation

SIL has managed to improve its performance in the last few quarters aided by recovery in automotive and industrial segment. With revival in economic activity, improvement in content per vehicle in auto OEMs, strong growth in the wind power and railways businesses, and launch of new products in the aftermarket segment, we expect SIL to deliver high growth with sustainable margins in the near term. The stock is currently trading at 44x trailing 12 months EPS and we initiate our coverage on Schaeffler India Limited with a Buy Rating.

Technical

Price: SCHAEFFLER INDIA closed on positive note on September 03, 2021 with gains of 2.09% up on daily basis. On the daily charts stock is trading above the upper boundary of Bollinger Band (20, 2) with a positive bias. The stock has bounced from the recent swing low of Rs.6426, with increase in volume, which show the bullishness in the stock. The overall chart structure suggests formation of higher top and higher bottom on the daily charts, indicating that the stock is expected to extend gains in the short terms.

Indicator: The stock is trading above key moving averages 21SMA & 50SMA on daily chart. The RSI on daily chart is pegged at 81.21 and has given a positive crossover with the 9-day signal line on daily and weekly chart, reaffirming the bullish bias in the counter. The DMI+ is also pointing in northward direction and is currently placed at around 27.58 levels, whereas ADX is placed at 41.45, well above 40 level, which shows overall strength & likely sustained buying from the current levels.

Volume: Price and volume analysis plays an important part in determining overall strength or weakness in the stock. Price and volume pattern are moving in the same direction which reflects the true movements in the stock.

Conclusion: The recent price action suggests that the positive momentum in the stock is likely to continue in the coming trading session(s). Thus, we recommend buying the stock for the target of Rs.8700. Investors can add further on any dip towards Rs.7275 levels with stop loss placed at Rs.6300.