Reliance Industries Ltd

Telecommunication - Service Provider

Reliance Industries Ltd

Telecommunication - Service Provider

Stock Info

Shareholding Pattern

Price performance

Indexed Stock Performance

O2C and retail business to witness growth post relaxation of Covid restrictions while Jio to capitalize on data explosion

Company Profile:

Reliance Industries Limited (RIL) is an Indian multinational conglomerate company,

headquartered in Mumbai, India. RIL's diverse businesses include energy, petrochemicals,

natural gas, retail, telecommunications, mass media, and textiles. RIL enjoys global

leadership in most of its businesses, being the largest polyester yarn and fibre

producer and among the top five to ten producers of major petrochemical products

in the world. It is also among the largest integrated petrochemical producers globally.

Its consumer business (JIO & Retail), which has scaled up in the last 4-5 years,

is expected to contribute ~50% of the company EBITDA by FY25. RJio has brought transformational

changes in the Indian digital services space to enable the vision of Digital India

for 1.3 billion Indians and propel India into global leadership in the digital economy.

It has created an eco-system comprising of network, devices, applications and content,

service experience and affordable tariffs for everyone to live the Jio Digital Life.

Reliance Retail is the largest and the most profitable retailer in India with the

widest reach. It has been listed among the fastest growing retailers in the world

in the Deloitte's Global Powers of Retailing 2021 index.

Consolidated Financial Statements

| Rs in Cr | Net Sales | EBITDA | EBITDAM | PAT | EPS | ROE | P/E | EV/EBITDA |

|---|---|---|---|---|---|---|---|---|

| FY19 | 569209.00 | 84167.00 | 14.80% | 39588.00 | 66.20 | 10.00% | 20.40 | 12.10 |

| FY20 | 597535.00 | 88894.00 | 14.90% | 39354.00 | 61.50 | 8.50% | 17.90 | 10.60 |

| FY21E | 466924.00 | 80635.00 | 17.30% | 49128.00 | 76.10 | 6.10% | 26.30 | 17.00 |

| FY22E | 657288.50 | 121598.40 | 18.50% | 57930.40 | 85.70 | 6.80% | 25.40 | 14.70 |

| FY23E | 716444.50 | 142572.40 | 19.90% | 74076.20 | 109.50 | 8.00% | 20.00 | 12.10 |

Investment Rationale

RJio platforms expected to be the biggest catalyst that will drive growth

The company indicated on five growth drivers for its digital platforms: Mobile broadband,

JioFiber, Enterprise Broadband, Broadband for SMEs and Narrow band Internet-of Things.

The company has high ambitions and aims to connect over 5 crore homes and business

establishments through JioFiber and connect over 100 crore smart sensors through

internet of things. Further Jio platforms will also provide solutions for healthcare,

financial services, education etc. supported by technology such as 4G and 5G, cloud

computing, big data analytics, machine learning, block chain etc.

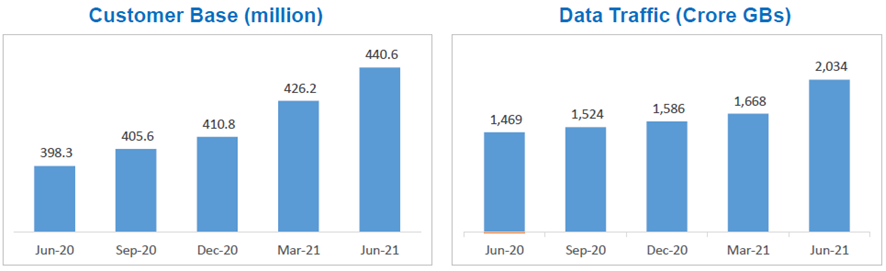

Consequential in-roads achieved in the telecom business

RJio has witnessed healthy addition to its user base since launching its services

in September 2016. Jio is now the digital lifeline of more than 44 crore customers

and has become the world’s fastest growing digital services company. RJio

has not only revolutionized India’s telecommunication industry but also digitized

its hinterlands through its extensive network penetration. RJio's revenue metrics

are expected to improve on the back of strong subscriber additions and tariff increase.

Collaboration with Google to augment RJio’s customer base

RJio platforms received investments from thirteen investors along with strategic

partnership with Facebook and Google which has helped them in accelerating its deleveraging

initiative and repositioning RJio Platforms as a quasi-technology company. We expect

these investments will aid in developing new products and create an ecosystem of

services along with providing cross selling opportunities. RJio platforms and Google

have already developed an affordable entry level smartphone along with Android-based

operating system and the play store. We believe this will enable the company to

target ~30 crore feature phone users in India and gain market share from incumbents

such as Airtel & Vodafone Idea. This collaboration will further drive smart-phone

penetration in the country and also potentially unlock new opportunities and boost

data consumption in India.

Exponential growth in data consumption

The higher acceptance of digital services is reflected in the 27% growth seen in

RJio’s total data traffic to over 20 Exabytes in Q1FY22. RJio’s network

carries over 5 exabytes of data per month, among the highest globally, with average

per capita data usage per month of over 15.5 GB. Mobile data usage in India is expected

to quadruple to over 35 exabytes per month by 2026, with 1.2b smartphone users.

RIL presentation

RJio targets to connect 50mn homes across 1600+ cities with FTTH; currently connected

to over 3mn homes. Wire-line penetration across homes stands at <10% while Fiber

penetration is even lower, with fixed broadband largely running on a legacy copper-based

infrastructure.

New initiatives in 5G/IOT/AI

Qualcomm and RJio successfully tested 5G solutions in India, achieving the 1Gbps

milestone on Jio 5G solutions. Reliance is working with Microsoft to enhance the

adoption of leading technologies such as data analytics, artificial intelligence

(AI), cognitive services, block-chain, the Internet of Things (IoT), and edge computing

among small and medium enterprises (SMEs). They have already operationlized cloud

data centres and onboarded pilot customers. RJio intends to use Google Cloud technologies

to power its 5G solutions. It also intends to collaborate with Google to launch

a range of 5G computing solutions across gaming, healthcare, education and video

entertainment verticals. RJio has also tied up with Whatsapp and launched recharge

through Whatsapp using Whatsapp Bot framework targeting the JioPhone. These initiatives

are aimed at increasing customer engagement so as to grow customer data case leading

to growing data consumption and revenues.

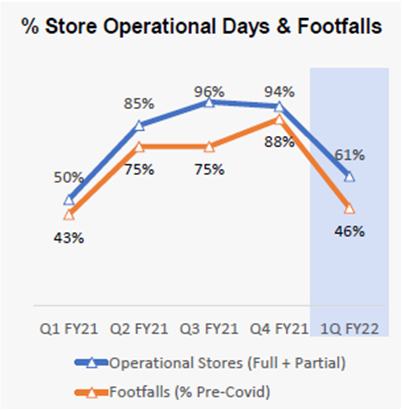

Reliance retail on a high growth trajectory:

Reliance Retail added 123 gross new stores in Q1FY22 vs. 826 in Q4FY21 and 1,456

in FY21. Store additions were low compared to the historical pace of additions due

to the lockdowns. However, the company expects an accelerated store opening pace

from here-on, with 700+ stores in the pipeline to open, as footfalls are expected

to increase post relaxation of covid related restrictions.

Source: RIL presentation

Also, traction in digital channels remained healthy. The contribution of digital/new-commerce channels improved meaningfully to ~20% of revenues in Q1FY22 from 4% in Q1FY21. Strong growth has been led by higher number of assortments, hyper-local delivery and focus on increasing merchant partnerships across business segments. While its online fashion platform ‘Ajio’ saw 4x increase (YoY) in monthly active users/order volumes (20% of retail sales), the Jiomart platform scaled up further with 25% qoq growth and is now present in 218 cities. Hyper-local delivery for fashion is now available in 450+cities and Kirana (merchant) partnerships were up ~33% in Q1FY22. The company highlighted investments in distribution centres/third-party-logistics partners (3PL) and securing of higher inventory from vendors to cater to increased demand from these channels. The company intends to grow new commerce partnerships across businesses and geographies. They will launch and scale-up JioMart Digital, which is foray in the electronics space, Urban Ladder, Zivamme and recently acquired Just Dial.

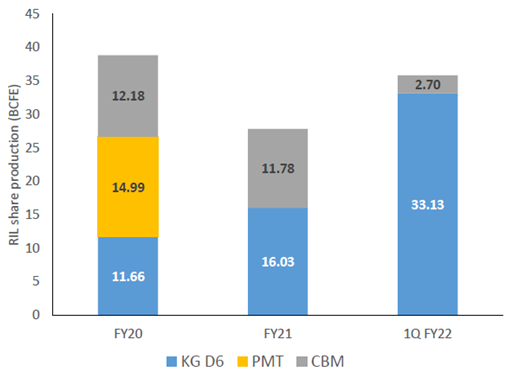

O2C business to witness improvement in margin profile:

RIL expects gas production of +18mmscmd in FY22 (from the already commissioned R-cluster

and Sat-cluster), while the MJ cluster would be commissioned in 3QFY23. The KG basin

is expected to achieve peak production of ~30mmscmd over the next two years. Oil

& gas business witnessed sharp production revival in domestic upstream portfolio

where production in 1Q FY22 was more than FY21 production which resulted in revenues

at 10 quarter high while EBITDA was at 22 quarter high, supported by increased production

from R-cluster, Satellite cluster and improved price realization for CBM and US-Shale.

The management is optimistic about O2C business as demand and margin outlook looks good on the back of strength in global demand supporting prices and margins, improving transportation fuel cracks due to improving trends in road & air mobility and continued strength in downstream chemicals margins. RIL expects demand for PVC, PP, and Polyester to remain firm on account of strong downstream demand.

Outlook & valuation

Launch of Jio smartphone along with new digital app offerings will accelerate Rjio’s growth and hence we assign a multiple of 17x FY23 EV/EBITDA to arrive at a target price of Rs 790/share (for its 67% stake). The higher multiple also captures the digital revenue opportunity, potential tariff hikes, and opportunity in the Feature Phone market. We value Reliance Retail at 34x FY23E EV/EBITDA to arrive at a target price of Rs 963/share (for its 90% stake). The premium valuation captures the company’s aggressive stance to add new stores and to make inroads in the online business through the new JioMart platform. RIL remains constructive on the O2C margin outlook with improving mobility & healthy domestic pet-chem demand, thus we value the O2C business at 10x FY23E EV/EBITDA, arriving at a valuation of INR958/share and add Rs 59/share for the Oil & Gas business, valuing it at 10xFY23 EV/EBITDA. The company is also looking to sell stake in the O2C business to Saudi Aramco, enter into new business verticals such as cloud data centers, solar energy etc, which can act as new triggers going forward. Hence, we initiate our coverage on Reliance Industries with a buy rating and target price of Rs 2770.

SOTP based valuation

| FY23E | Method | Multiple | Equity value/share |

|---|---|---|---|

| Rjio (67% stake) | EV/Ebitda | 17 | 790 |

| Retail (90% stake) | EV/Ebitda | 34 | 963 |

| O2C | EV/Ebitda | 10 | 958 |

| O&G | EV/Ebitda | 10 | 59 |

| Target Price | 2770 | ||

Financial Statement

Profit & Loss statement

| Year End March (Rs Cr) | 2019 | 2020 | 2021 | 2022E | 2023E |

|---|---|---|---|---|---|

| Net Sales | 569209.00 | 597535.00 | 466924.00 | 657288.50 | 716444.50 |

| Growth % | 45.30% | 5.00% | -21.90% | 40.80% | 9.00% |

| Expenditure | |||||

| Material Cost | 394646.00 | 405429.00 | 292942.00 | 427237.50 | 458524.50 |

| Employee Cost | 12488.00 | 14075.00 | 14817.00 | 17089.50 | 17911.10 |

| Other Expenses | 77908.00 | 89137.00 | 78530.00 | 91363.10 | 97436.40 |

| EBITDA | 84167.00 | 88894.00 | 80635.00 | 121598.40 | 142572.40 |

| Growth % | 31.20% | 5.60% | -9.30% | 50.80% | 17.20% |

| EBITDA Margin | 14.80% | 14.90% | 17.30% | 18.50% | 19.90% |

| Depreciation & Amortization | 20934.00 | 22203.00 | 26572.00 | 29047.80 | 31834.70 |

| EBIT | 63233.00 | 66691.00 | 54063.00 | 92550.60 | 110737.70 |

| EBIT Margin % | 11.10% | 11.20% | 11.60% | 14.10% | 15.50% |

| Other Income | 8386.00 | 13279.00 | 16429.00 | 6285.30 | 7604.50 |

| Interest & Finance Charges | 16495.00 | 22027.00 | 21189.00 | 16133.00 | 13145.10 |

| Profit Before Tax - Before Exceptional | 55124.00 | 57943.00 | 49303.00 | 82702.90 | 105197.10 |

| Profit Before Tax | 55124.00 | 53499.00 | 54945.00 | 82702.90 | 105197.10 |

| Tax Expense | 15390.00 | 13726.00 | 1722.00 | 20816.30 | 26478.10 |

| Effective Tax rate | 27.90% | 23.70% | 3.50% | 25.20% | 25.20% |

| Exceptional Items | - | -4444.00 | 5642.00 | - | - |

| Net Profit | 39734.00 | 39773.00 | 53223.00 | 61886.60 | 78719.00 |

| Growth % | 10.30% | 0.10% | 33.80% | 16.30% | 27.20% |

| Net Profit Margin | 7.00% | 6.70% | 11.40% | 9.40% | 11.00% |

| Consolidated Net Profit | 39588.00 | 39354.00 | 49128.00 | 57930.40 | 74076.20 |

| Growth % | 9.70% | -0.60% | 24.80% | 17.90% | 27.90% |

| Net Profit Margin after MI | 7.00% | 6.60% | 10.50% | 8.80% | 10.30% |

Balance Sheet

| Year End March (Rs Cr) | 2019 | 2020 | 2021 | 2022E | 2023E |

|---|---|---|---|---|---|

| Share Capital | 5926.00 | 6339.00 | 6445.00 | 6762.00 | 6762.00 |

| Total Reserves | 381177.00 | 442808.00 | 692990.00 | 749662.80 | 821715.00 |

| Shareholders' Funds | 395392.00 | 461347.00 | 799432.00 | 856421.80 | 928474.00 |

| Minority Interest | 8280.00 | 12181.00 | 99260.00 | 99260.00 | 99260.00 |

| Non Current Liabilities | |||||

| Long Term Burrowing | 207506.00 | 197631.00 | 163683.00 | 153661.00 | 105661.00 |

| Deferred Tax Assets / Liabilities | 45147.00 | 51223.00 | 35854.00 | 36500.00 | 36952.00 |

| Long Term Provisions | 2856.00 | 1790.00 | 2625.00 | 2500.00 | 2535.00 |

| Current Liabilities | |||||

| Short Term Borrowings | 64436.00 | 93786.00 | 60081.00 | 62150.00 | 65150.00 |

| Trade Payables | 108309.00 | 96799.00 | 108897.00 | 118581.30 | 144900.60 |

| Other Current Liabilities | 143251.00 | 220441.00 | 106086.00 | 78039.00 | 78039.00 |

| Short Term Provisions | 1326.00 | 1890.00 | 2504.00 | 1745.00 | 1739.00 |

| Total Equity & Liabilities | 997630.00 | 1163015.00 | 1320065.00 | 1353900.10 | 1407752.60 |

| Assets | |||||

| Net Block | 398374.00 | 532658.00 | 541258.00 | 620461.20 | 639626.50 |

| Non Current Investments | 164612.00 | 203852.00 | 212382.00 | 202350.00 | 202650.00 |

| Long Term Loans & Advances | 14946.00 | 36597.00 | 31569.00 | 19500.00 | 18352.00 |

| Current Assets | |||||

| Currents Investments | 71023.00 | 72915.00 | 152446.00 | 155450.00 | 156779.00 |

| Inventories | 67561.00 | 73903.00 | 81672.00 | 80080.90 | 99736.80 |

| Sundry Debtors | 30089.00 | 19656.00 | 19014.00 | 23100.30 | 28227.40 |

| Cash and Bank | 11081.00 | 30920.00 | 17397.00 | 4700.80 | 14123.90 |

| Short Term Loans and Advances | 26347.00 | 33953.00 | 40194.00 | 40194.00 | 40194.00 |

| Total Assets | 997630.00 | 1163015.00 | 1320065.00 | 1353900.10 | 1407752.60 |

Cash Flow Statement

| Year End March (Rs Cr) | 2019 | 2020 | 2021 | 2022E | 2023E |

|---|---|---|---|---|---|

| Profit After Tax | 39734.00 | 39773.00 | 53223.00 | 61886.60 | 78719.00 |

| Depreciation | 20934.00 | 22203.00 | 26572.00 | 29047.80 | 31834.70 |

| Changes in Working Capital | -28782.00 | 17916.00 | -50731.00 | 7189.20 | 1536.30 |

| Cash From Operating Activities | 42346.00 | 94877.00 | 26185.00 | 98123.50 | 112090.00 |

| Purchase of Fixed Assets | -93626.00 | -76517.00 | -105837.00 | -108251.00 | -51000.00 |

| Free Cash Flows | -51280.00 | 18360.00 | -79652.00 | -10127.50 | 61090.00 |

| Cash Flow from Investing Activities | -95128.00 | -72520.00 | -141634.00 | -108251.00 | -51000.00 |

| Increase / (Decrease) in Loan Funds | 86456.00 | 35581.00 | -83710.00 | -36000.00 | -45000.00 |

| Equity Dividend Paid | -3554.00 | -3860.00 | -3921.00 | -5213.70 | -6666.90 |

| Cash from Financing Activities | 55906.00 | -2541.00 | 101902.00 | -2568.70 | -51666.90 |

| Net Cash Inflow / Outflow | 3124.00 | 19816.00 | -13547.00 | -12696.20 | 9423.10 |

| Opening Cash & Cash Equivalents | 7336.00 | 11081.00 | 30920.00 | 17397.00 | 4700.80 |

| Closing Cash & Cash Equivalent | 11081.00 | 30920.00 | 17397.00 | 4700.80 | 14123.90 |

Key Ratios

| Year End March | 2019 | 2020 | 2021 | 2022E | 2023E |

|---|---|---|---|---|---|

| Basic EPS | 66.20 | 61.50 | 76.10 | 85.70 | 109.50 |

| Diluted EPS | 66.20 | 61.50 | 76.10 | 85.70 | 109.50 |

| Cash EPS (Rs) | 101.20 | 96.20 | 117.30 | 128.60 | 156.60 |

| DPS | 6.50 | 6.50 | 7.00 | 7.70 | 9.90 |

| Book value (Rs/share) | 660.90 | 720.90 | 1239.10 | 1266.50 | 1373.10 |

| ROCE (%) Post Tax | 9.00% | 8.60% | 7.70% | 7.10% | 8.20% |

| ROE (%) | 10.00% | 8.50% | 6.10% | 6.80% | 8.00% |

| Inventory Days | 41.20 | 43.20 | 60.80 | 52.00 | 53.00 |

| Receivable Days | 15.30 | 15.20 | 15.10 | 15.00 | 15.00 |

| Payable Days | 69.00 | 62.60 | 80.40 | 77.00 | 77.00 |

| PE | 20.40 | 17.90 | 26.30 | 25.40 | 20.00 |

| P/BV | 2.00 | 1.50 | 1.60 | 1.80 | 1.70 |

| Dividend Yield (%) | 0.50% | 0.60% | 0.30% | 0.30% | 0.40% |

| P/Sales | 1.40 | 1.20 | 2.80 | 2.40 | 2.20 |

| Net debt/Equity | 0.50 | 0.50 | 0.10 | 0.20 | 0.20 |

| Net Debt/ EBITDA | 2.50 | 2.60 | 1.00 | 1.70 | 1.10 |

| Sales/Net FA (x) | 1.40 | 1.30 | 0.90 | 1.10 | 1.10 |