Privi Speciality Chemicals Ltd

Chemicals

Privi Speciality Chemicals Ltd

Chemicals

Stock Info

Shareholding Pattern

Price performance

Indexed Stock Performance

Privi Speciality-A niche Play in chemicals

Company Profile:

Privi Speciality Chemicals Ltd. (PSCL - formerly known as Fairchem Speciality Ltd.),

a Fairfax company holding 51% stake, is India’s leading manufacturer, supplier

and exporter of aroma and fragrance chemicals and a globally trusted partner and

a preferred supplier of bulk aroma chemicals. Privi has state-of-the-art integrated

manufacturing facilities both at Mahad in Maharashtra and at Jhagadia in Gujarat

with knowledge, expertise and capacity to perform critical reactions such as; Hydrogenation,

Condensation, Grignard reactions, as well as unit operations like Pyrolysis, Reactive

Distillation, High Vacuum Distillation, Continuous Distillation to deliver consistency

in odour and prescribed key parameters in an industry driven by stringent olfaction

standards.

Privi enjoys a dominant position and economies of scale in its product categories. Privi manufacture over 50 products and has a capacity of over 37,500 tons per annum. Privi also develops and produces custom made aroma chemicals as per the specific requirements of the customer.

Consolidated Financial Statements

| Rs in Cr | Net Sales | EBITDA | EBITDAM | PAT | EPS | ROE | P/E | EV/EBITDA |

|---|---|---|---|---|---|---|---|---|

| FY18 | 1024.30 | 130.20 | 12.70% | 53.40 | 14.10 | 10.90% | 21.20 | 11.00 |

| FY19 | 1341.00 | 212.70 | 15.90% | 94.20 | 24.10 | 16.40% | 15.20 | 8.90 |

| FY20 | 1324.10 | 220.60 | 16.70% | 146.00 | 37.40 | 23.90% | 8.90 | 7.70 |

| FY21 | 1276.60 | 209.80 | 16.40% | 116.90 | 29.90 | 16.20% | 28.50 | 18.30 |

| FY22E | 1480.00 | 290.00 | 19.60% | 145.80 | 37.30 | 17.00% | 50.90 | 27.50 |

| FY23E | 1740.00 | 362.00 | 20.80% | 195.70 | 50.10 | 18.90% | 37.90 | 21.90 |

Investment Rationale

Market leader in a niche industry:

Privi is the leading manufacturer of aroma chemicals such as Amber Fleur and Dihydromyrcenol

(citrus character) which are important ingredients in the manufacture of Fragrances.

It has expanded its product range from 2 products in 1992 to 50+ high performance

chemicals in 2021 based on in-house R&D. Company is the only Asian company to

set up a refinery for processing waste from pulp & paper industry to produce

key building blocks for aroma chemicals. Globally it is the second largest player

in the pine tree fragrance segment, with a market share of 20-25%.

Strong Client Base:

Privi has been supplying to the top 10 global fragrance companies, which controls

2/3rd of the total global fragrance market, for over 10 years and has

direct relationships with global customers like Firmenich, Symrise, Mane, Givaudan,

EFF, P&G, Reckitt Benckiser. In FY19 company has exported its first consignment

of Terpene-4-OL to BASF which would be used in the production of Herbicides and

has a lot of potential to add value to the top line and bottom line of the company.

Strong raw materials sourcing capabilities:

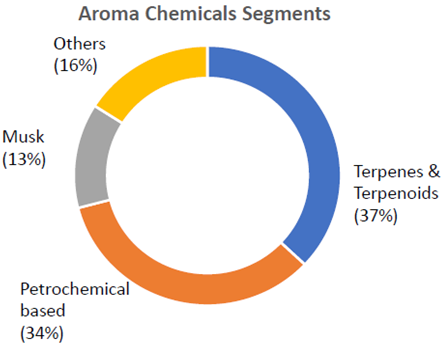

Privi is mainly into manufacturing aroma chemicals from terpene molecules (Pine

based) that serve as building blocks in the Flavours & Fragrance (F&F) industry.

Terpene molecules are procured by i) tapping a pine tree to get Gum Turpentine Oil

(GTO) or ii) using the waste from a Pulp and Paper industry -Crude Sulphate Turpentine

(CST).

China is the leader for GTO and the prices are very volatile. CST is a waste product in making pulp and it can be sourced with six months to one year fixed price contracts. Company has developed the Sulphur separation process (sulphur is an impurity in CST) and has tied up its procurement of CST directly from over 30 mills across Europe and North America. Privi continues to operate single largest CST processing site in Asia, which helps the company to mitigate raw material price volatility.

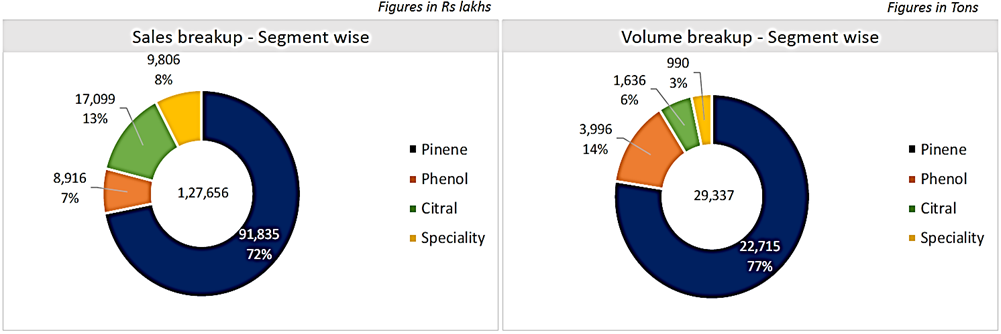

The financial performance in FY21 was largely driven by higher sales volume (up 15.6% YoY), lower sales price realisation and rising input costs in H2FY21. The company undertook several initiatives encompassing cost management, supply chain optimisation, smart procurement and long-term coal linkage which helped in absorbing escalation in input costs. While it depends on over 70% of imported raw materials, it also exports over 70% of its sales. It derives 70% of its sales from Pine segment. The capacity utilisation stood at 79% and leaves enough room for growth in the next couple of years.

Industry

- Global F&F market size is about USD 30.4 Bn. Fragrance accounts for about USD 16.1 Bn (53%) of the total F&F market.

- Within Fragrance, Aroma chemicals market size is about USD 5.5 Bn

- The Aroma chemicals market is expected to grow at a CAGR of 5.8% from 2020 to 2027 (value based).

- Rising importance of personal hygiene and grooming is expected to remain one of the key drivers of growth

- The global perfume market size was valued at USD 32 billion in 2018 and is expected to expand at a CAGR of 3.9% from 2019 to 2025

Outlook & valuation

Going forward, we believe Privi should fetch premium valuations on account of strong industry tailwinds, robust volume growth due to increase in manufacturing capacity and improvement in operating margins. also, the company enjoys cost efficiencies as most of its raw materials are derived from waste products. Further, it is also incurring capex of Rs 4.0 bn to set up capacities for new products viz. Galaxmusk (4,800 tpa at Jhagadia), Camphor (4,800 tpa at Mahad) and Prionyl (120 tpa at Mahad) which are likely to get commissioned in April 2022. Full benefits therefore are likely to be visible by FY24E. Further, the company recently signed a Joint Venture agreement with Givaudan SA, world’s largest Flavour & Fragrance Company.

As per our estimates, the stock is currently trading at 38x FY23 EPS. Furthermore, Management has set its vision of achieving annual revenues of Rs 30.0 bn soon and intends to launch at least five new molecules with a low carbon footprint in the next five years. We Initiate coverage on Privi Speciality

Chemicals Ltd with a ‘Buy’ rating.

Financial Statement

Profit & Loss statement

| Yr End March (Rs Cr) | 2018 | 2019 | 2020 | 2021 | 2022E | 2023E |

|---|---|---|---|---|---|---|

| Net Sales | 1024.30 | 1341.00 | 1324.10 | 1276.60 | 1480.00 | 1740.00 |

| Growth % | 30.90% | 30.90% | -1.30% | -3.60% | 15.90% | 17.60% |

| Expenditure | ||||||

| Material Cost | 662.60 | 826.90 | 803.10 | 751.10 | 832.00 | 1000.00 |

| Employee Cost | 56.80 | 71.30 | 65.00 | 69.90 | 85.00 | 89.00 |

| Other Expenses | 174.70 | 230.20 | 235.30 | 245.80 | 273.00 | 289.00 |

| EBITDA | 130.20 | 212.70 | 220.60 | 209.80 | 290.00 | 362.00 |

| Growth % | 63.30% | 63.30% | 3.70% | -4.90% | 38.20% | 24.80% |

| EBITDA Margin | 12.70% | 15.90% | 16.70% | 16.40% | 19.60% | 20.80% |

| Depreciation & Amortization | 43.30 | 46.90 | 56.80 | 71.00 | 72.00 | 73.00 |

| EBIT | 86.90 | 165.80 | 163.80 | 138.80 | 218.00 | 289.00 |

| EBIT Margin % | 8.50% | 12.40% | 12.40% | 10.90% | 14.70% | 16.60% |

| Other Income | 16.00 | 5.70 | 26.40 | 20.00 | 20.00 | 19.00 |

| Interest & Finance Charges | 23.90 | 29.00 | 37.60 | 23.70 | 32.90 | 35.50 |

| Profit Before Tax - Before Exceptional | 79.00 | 142.50 | 152.60 | 135.10 | 205.10 | 272.50 |

| Profit Before Tax | 79.00 | 151.60 | 192.60 | 158.20 | 205.10 | 272.50 |

| Tax Expense | 25.60 | 57.30 | 46.60 | 41.30 | 59.30 | 76.80 |

| Effective Tax rate | 32.40% | 37.80% | 24.20% | 26.10% | 28.90% | 28.20% |

| Exceptional Items | - | 9.00 | 40.00 | 23.10 | - | - |

| Net Profit | 53.40 | 94.20 | 146.00 | 116.90 | 145.80 | 195.70 |

| Growth % | 76.60% | 76.60% | 54.90% | -19.90% | 24.70% | 34.20% |

| Net Profit Margin | 5.20% | 7.00% | 11.00% | 9.20% | 9.90% | 11.20% |

| Consolidated Net Profit | 53.40 | 94.20 | 146.00 | 116.90 | 145.80 | 195.70 |

| Growth % | 76.60% | 76.60% | 54.90% | -19.90% | 24.70% | 34.20% |

| Net Profit Margin after MI | 5.20% | 7.00% | 11.00% | 9.20% | 9.90% | 11.20% |

Balance Sheet

| Yr End March (Rs Cr) | 2018 | 2019 | 2020 | 2021 | 2022E | 2023E |

|---|---|---|---|---|---|---|

| Share Capital | 39.10 | 39.10 | 39.10 | 39.10 | 39.10 | 39.10 |

| Total Reserves | 449.30 | 536.60 | 573.00 | 683.50 | 817.50 | 997.80 |

| Shareholders' Funds | 488.40 | 575.70 | 612.10 | 722.50 | 856.50 | 1036.90 |

| Minority Interest | - | - | - | - | - | - |

| Non Current Liabilities | ||||||

| Long Term Burrowing | 76.80 | 180.80 | 225.70 | 331.80 | 400.30 | 454.30 |

| Deferred Tax Assets / Liabilities | 22.10 | 28.70 | 13.40 | 13.30 | 13.30 | 13.30 |

| Long Term Provisions | 8.60 | 10.50 | 12.90 | 14.70 | 14.70 | 14.70 |

| Current Liabilities | ||||||

| Short Term Borrowings | 215.20 | 280.50 | 255.40 | 164.30 | 164.30 | 164.30 |

| Trade Payables | 150.10 | 214.60 | 149.70 | 167.40 | 188.80 | 198.50 |

| Other Current Liabilities | 85.00 | 108.30 | 99.80 | 111.30 | 76.80 | 76.80 |

| Short Term Provisions | 6.80 | 26.70 | 8.40 | 10.60 | 10.60 | 10.60 |

| Total Equity & Liabilities | 1052.90 | 1425.70 | 1383.70 | 1540.20 | 1729.60 | 1973.70 |

| Assets | ||||||

| Net Block | 434.90 | 497.50 | 598.20 | 597.90 | 745.90 | 802.90 |

| Non Current Investments | - | - | - | - | - | - |

| Long Term Loans & Advances | 22.60 | 26.90 | 24.50 | 65.20 | 65.20 | 65.20 |

| Current Assets | ||||||

| Currents Investments | 3.00 | - | 1.10 | - | 4.30 | 4.30 |

| Inventories | 233.90 | 364.20 | 328.70 | 342.50 | 362.50 | 423.50 |

| Sundry Debtors | 230.40 | 330.70 | 228.90 | 239.00 | 253.00 | 295.50 |

| Cash and Bank | 24.10 | 23.10 | 88.30 | 19.70 | 22.90 | 106.50 |

| Short Term Loans and Advances | 34.90 | 66.80 | 30.30 | 27.60 | 27.60 | 27.60 |

| Total Assets | 1052.90 | 1425.70 | 1383.70 | 1540.20 | 1729.60 | 1973.70 |

Cash Flow Statement

| Yr End March (Rs Cr) | 2018 | 2019 | 2020 | 2021 | 2022E | 2023E |

|---|---|---|---|---|---|---|

| Profit After Tax | 53.40 | 94.20 | 146.00 | 116.90 | 145.80 | 195.70 |

| Depreciation | 43.30 | 46.90 | 56.80 | 71.00 | 72.00 | 73.00 |

| Others | -4.00 | -14.30 | -61.30 | -45.30 | - | - |

| Changes in Working Capital | -18.50 | -180.50 | 11.10 | -51.50 | -12.50 | -93.80 |

| Cash From Operating Activities | 106.60 | 21.00 | 216.10 | 172.10 | 205.30 | 174.90 |

| Purchase of Fixed Assets | -92.50 | -169.10 | -180.30 | -242.80 | -220.00 | -130.00 |

| Free Cash Flows | 14.10 | -148.20 | 35.70 | -70.70 | -14.70 | 44.90 |

| Others | 11.10 | 5.40 | 4.80 | 1.30 | - | - |

| Cash Flow from Investing Activities | -81.30 | -138.50 | -175.60 | -241.50 | -220.00 | -130.00 |

| Increase / (Decrease) in Loan Funds | 8.80 | 161.70 | 71.50 | 30.30 | 34.00 | 54.00 |

| Equity Dividend Paid | -4.50 | -6.80 | - | -5.90 | -11.80 | -15.30 |

| Others | -24.30 | -33.20 | -43.50 | -24.30 | - | - |

| Cash from Financing Activities | -20.10 | 121.70 | 28.00 | 0.20 | 22.20 | 38.70 |

| Net Cash Inflow / Outflow | 5.30 | 4.10 | 68.50 | -69.30 | 7.50 | 83.60 |

| Opening Cash & Cash Equivalents | - | 12.10 | 16.20 | 84.70 | 15.50 | 22.90 |

| Closing Cash & Cash Equivalent | 12.10 | 16.30 | 84.70 | 15.50 | 22.90 | 106.50 |

Key Ratios

| Yr End March | 2018 | 2019 | 2020 | 2021 | 2022E | 2023E |

|---|---|---|---|---|---|---|

| Basic EPS | 14.10 | 24.10 | 37.40 | 29.90 | 37.30 | 50.10 |

| Diluted EPS | 14.10 | 24.10 | 37.40 | 29.90 | 37.30 | 50.10 |

| Cash EPS (Rs) | 25.60 | 36.10 | 51.90 | 48.10 | 61.70 | 74.70 |

| DPS | 1.50 | 2.50 | 1.50 | 2.00 | 3.00 | 3.90 |

| Book value (Rs/share) | 129.50 | 147.40 | 156.70 | 185.00 | 219.30 | 265.40 |

| ROCE (%) Post Tax | 9.20% | 11.70% | 13.50% | 10.20% | 12.80% | 14.40% |

| ROE (%) | 10.90% | 16.40% | 23.90% | 16.20% | 17.00% | 18.90% |

| Inventory Days | 85.50 | 81.40 | 95.50 | 96.00 | 96.00 | 96.00 |

| Receivable Days | 72.00 | 76.40 | 77.10 | 66.90 | 67.00 | 67.00 |

| Payable Days | 48.20 | 49.60 | 50.20 | 45.30 | 50.00 | 45.00 |

| PE | 21.20 | 15.20 | 8.90 | 28.50 | 50.90 | 37.90 |

| P/BV | 2.30 | 2.50 | 2.10 | 4.60 | 8.70 | 7.20 |

| EV/EBITDA | 11.00 | 8.90 | 7.70 | 18.30 | 27.50 | 21.90 |

| Dividend Yield (%) | 0.50% | 0.70% | 0.50% | 0.20% | 0.20% | 0.20% |

| P/Sales | 1.10 | 1.10 | 1.00 | 2.60 | 5.00 | 4.30 |

| Net debt/Equity | 0.60 | 0.80 | 0.70 | 0.70 | 0.60 | 0.50 |

| Net Debt/ EBITDA | 2.30 | 2.20 | 1.90 | 2.40 | 1.90 | 1.40 |

| Sales/Net FA (x) | 2.50 | 2.90 | 2.40 | 2.10 | 2.20 | 2.20 |