Polycab India Ltd

Cable

Polycab India Ltd

Cable

Stock Info

Shareholding Pattern

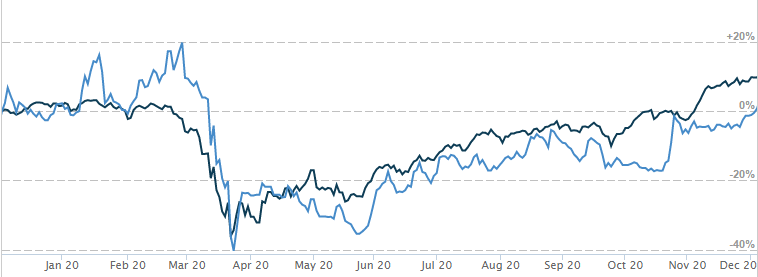

Price performance

Indexed Stock Performance

Strong Leadership in Wires & Cables business along with transforming itself into strong FMEG business makes Company attractive

Polycab India Ltd is a leading player in India’s wires and cables industry with more than 18% and ~12% market share in the organized and total market respectively. The company has retail outlets reach of 1,37,000 and 3,650 authorized dealers/distributors. Project Bandhan connects 147,000 electricians and 57,000 retailers.

Investment Rationale

Strong brand recognition in the electrical industry:

Polycab has evolved itself from a B2B player to a fast-growing B2C brand in the

consumer electrical market, thus expanding its customer base and extending its reach

in the domestic and international markets. The company aims to increase the B2C

mix from 35% to 50% in the medium term.

Transforming itself into a strong FMEG business:

Polycab’s FMEG revenue has grown at the CAGR of 40% from FY16-20. FMEG business

will continue to grow at double digit rate due to launch of the product in the premium

segment, stable pricing, continuous brand building exercise and expansion of distribution

network.

Government initiatives in Power and infrastructure:

The demand for building wire and power cable is expected to increase by government

initiatives such as universal electrification, investment in digital & telecommunication

connectivity, Capacity additions under national solar mission, Housing for all by

2022 targeting 20mn households and smart cities mission envisaging core infrastructure

to 100 cities.

Multiple manufacturing locations and backward integration:

The Company has a strong manufacturing experience of over five decades and has invested

significantly to augment and upgrade its manufacturing capability. To maintain a

smooth supply chain, Polycab has established multiple manufacturing locations in

strategic locations, supported by 30 depots across India. A comprehensive backward

integration of operation remains a key priority for the Company and has helped Polycab

to build manufacturing facilities for all key raw materials, including aluminium

rods, copper rods, and various grades of PVC, rubber, XLPE compounds, GI wire and

strip. The Company recently acquired the remaining 50% stake in Ryker from Trafigura

making Ryker a wholly owned subsidiary of Polycab. Ryker was started as a 50:50

JV with the Singapore-headquartered commodity trading company Trafigura in FY 16,

to set up a copper rod manufacturing facility in Waghodia, Gujarat. However, post

Trafigura’s global strategic decision to exit from value-add manufacturing

businesses in India, Polycab bought out their stake. The plant started commercial

operation in 1QFY20 with an annual capacity of 2,25,000 tonnes. Strategic Backward

integration in manufacturing enables company to maintain full control over quality

and supply chain, lower operational costs, and deliver products at competitive prices.

ZIGZAG FOR UPWARD DIRECTION

Price: POLYCAB is consolidating above all its important moving average, 21SMA & 50SMA on daily and weekly chart. We expect the stock to continue its outperformance in the coming weeks. The stock was trading in range as show on daily chart, before the stock break out from this range on higher side. The stock has bounced from the support level with increased in volume which indicates the strength in the counter. The stock is making higher low on daily chart, which is giving bullish stance. The Parabolic SAR (Stop & Reverse) is also below the trading price, suggesting northward momentum is likely to remain intact in the counter.

Indicator: The stock is trading above keen moving average (21SMA & 50SMA) on daily chart, which indicates bullishness for this stock. The RSI on daily chart is pegged at 70.95, indicating the stock has not been overbought. Bollinger Band (20, 2, S) set up on daily chart has started to expand and currently the stock is trading above the upper band of Bollinger Band indicating the volatility expansion on the higher side. MACD line on daily charts is in buy mode, indicating bullish momentum is likely to continue which supports to our bullish view on the stock. The DMI+ is also pointing in northward direction and is currently placed around 25.88 levels, whereas ADX trading at 35.63 well above 25 mark, which shows overall strength is likely to bring in sustained buying from the current levels

Volume: Price and volume analysis plays an important part in determining overall strength or weakness in the stock. Price and volume pattern are moving in the same direction which reflects the true movements in the stock. POLYCAB stock has seen the profit booking with thin volume, which still shows the movement of this stock, is still on bull side.

Conclusion: Considering all the above data facts, we recommend buying for short to medium term. Trader may go long around current level Rs.979 with keeping the stop loss Rs.850 for target Rs.1225.