Polycab India Ltd

Cable

Polycab India Ltd

Cable

Stock Info

Shareholding Pattern

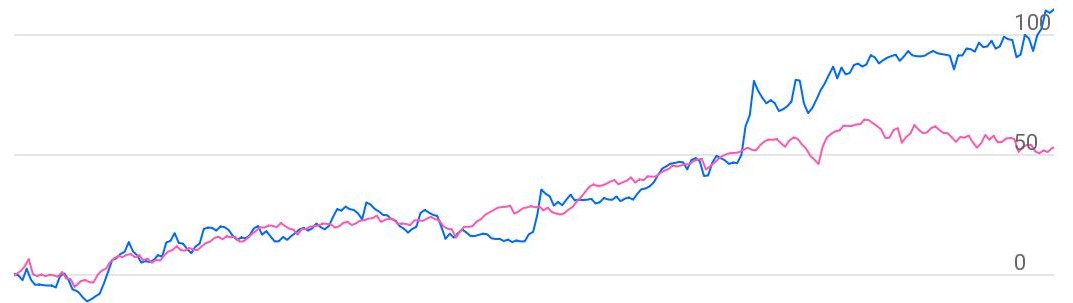

Price performance

Indexed Stock Performance

Strong Leadership in Wires & Cables business along with transforming itself into strong FMEG business makes Company attractive.

Profile

Polycab India Ltd is a leading player in India’s wires and cables industry

with more than 18% and ~12% market share in the organized and total market respectively.

The company has retail outlets reach of 1,51,000 and ~4,000 authorized dealers/distributors.

Project Bandhan connects 1,70,000 electricians and 51,000 retailers.

Consolidated Financial Statements

| Rs in Cr | Net Sales | EBITDA | EBITDAM | PAT | EPS | ROE | P/E | EV/EBITDA |

|---|---|---|---|---|---|---|---|---|

| FY18 | 6770.31 | 728.88 | 10.77% | 358.01 | 25.35 | 15.25% | - | 1.08 |

| FY19 | 7985.55 | 952.76 | 11.93% | 499.70 | 35.20 | 17.55% | - | -0.05 |

| FY20 | 8829.96 | 1135.03 | 12.85% | 759.06 | 50.63 | 19.79% | 14.55 | 9.66 |

| FY21E | 8557.84 | 1121.08 | 13.10% | 775.76 | 51.74 | 17.26% | 28.68 | 19.44 |

| FY22E | 10393.67 | 1247.24 | 12.00% | 879.70 | 58.67 | 16.78% | 25.29 | 17.08 |

| FY23E | 11528.73 | 1389.21 | 12.05% | 989.41 | 65.99 | 17.54% | 22.49 | 15.05 |

Investment Rationale

Strong brand recognition in the electrical industry:

Polycab has evolved itself from a B2B player to a fast-growing B2C brand in the

consumer electrical market, thus expanding its customer base and extending its reach

in the domestic and international markets. The company aims to increase the B2C

mix from ~40% to 50% in the medium term.

Transforming itself into a strong FMEG business:

Polycab’s FMEG revenue has grown at the CAGR of 40% from FY16-20. FMEG business

will continue to grow at double digit rate due to launch of the product in the premium

segment, stable pricing, continuous brand building exercise and expansion of distribution

network.

Government initiatives in Power and infrastructure:

The demand for building wire and power cable is expected to increase by government

initiatives such as universal electrification, investment in digital & telecommunication

connectivity, capacity additions under national solar mission, Housing for all by

2022 targeting 20mn households and smart cities mission envisaging core infrastructure

to 100 cities.

Multiple manufacturing locations and backward integration:

The Company has a strong manufacturing experience of over five decades and has invested

significantly to augment and upgrade its manufacturing capability. To maintain a

smooth supply chain, Polycab has established multiple manufacturing locations in

strategic locations, supported by 30 depots across India. A comprehensive backward

integration of operation remains a key priority for the Company and has helped Polycab

to build manufacturing facilities for all key raw materials, including aluminium

rods, copper rods, and various grades of PVC, rubber, XLPE compounds, GI wire and

strip. The Company recently acquired the remaining 50% stake in Ryker from Trafigura

making Ryker a wholly owned subsidiary of Polycab. Ryker was started as a 50:50

JV with the Singapore-headquartered commodity trading company Trafigura in FY 16,

to set up a copper rod manufacturing facility in Waghodia, Gujarat. However, post

Trafigura’s global strategic decision to exit from value-add manufacturing

businesses in India, Polycab bought out their stake. The plant started commercial

operation in 1QFY20 with an annual capacity of 2,25,000 tonnes. Strategic Backward

integration in manufacturing enables company to maintain full control over quality

and supply chain, lower operational costs, and deliver products at competitive prices.

Outlook & valuation

Polycab Ltd is expected to maintain healthy performance as wire & cable segment is expected to see improvement as infrastructure investments rise, strong housing demand, diversified product portfolio, wide distribution reach, strong brand presence, increasing share of B2C business by scaling up FMEG business, healthy return ratios & robust balance sheet. At the price of 1484, Polycab Ltd trades at PE multiple of 22.5X on the basis of FY23E earnings.

Financial Statement

Profit & Loss statement

| Yr End March (Rs Cr) | 2018 | 2019 | 2020 | 2021E | 2022E | 2023E |

|---|---|---|---|---|---|---|

| Net Sales | 6770.31 | 7985.55 | 8829.96 | 8557.84 | 10393.67 | 11528.73 |

| Growth % | 23.09% | 17.95% | 10.57% | -3.08% | 21.45% | 10.92% |

| Expenditure | ||||||

| Material Cost | 5006.53 | 5711.66 | 6051.17 | 6204.44 | 7431.47 | 8243.04 |

| Employee Cost | 259.26 | 300.25 | 365.75 | 308.08 | 415.75 | 461.15 |

| Other Expenses | 775.64 | 1020.88 | 1278.01 | 924.25 | 1299.21 | 1435.33 |

| EBITDA | 728.88 | 952.76 | 1135.03 | 1121.08 | 1247.24 | 1389.21 |

| Growth % | 51.87% | 30.72% | 19.13% | -1.23% | 11.25% | 11.38% |

| EBITDA Margin | 10.77% | 11.93% | 12.85% | 13.10% | 12.00% | 12.05% |

| Depreciation & Amortization | 132.95 | 141.45 | 160.89 | 175.31 | 198.31 | 218.70 |

| EBIT | 595.93 | 811.32 | 974.14 | 945.77 | 1048.93 | 1170.51 |

| EBIT Margin % | 8.80% | 10.16% | 11.03% | 11.05% | 10.09% | 10.15% |

| Other Income | 64.44 | 63.78 | 92.79 | 134.91 | 170.65 | 195.67 |

| Interest & Finance Charges | 93.68 | 116.71 | 49.54 | 43.98 | 43.98 | 43.98 |

| Profit Before Tax - Before Exceptional | 566.68 | 758.39 | 1017.40 | 1036.70 | 1175.60 | 1322.21 |

| Profit Before Tax | 566.68 | 758.39 | 1017.40 | 1036.70 | 1175.60 | 1322.21 |

| Tax Expense | 208.23 | 255.76 | 244.37 | 260.94 | 295.90 | 332.80 |

| Effective Tax rate | 36.74% | 33.72% | 24.02% | 25.17% | 25.17% | 25.17% |

| Exceptional Items | - | - | - | - | - | - |

| Net Profit | 358.46 | 502.63 | 773.03 | 775.76 | 879.70 | 989.41 |

| Growth % | 53.79% | 40.22% | 53.80% | 0.35% | 13.40% | 12.47% |

| Net Profit Margin | 5.29% | 6.29% | 8.75% | 9.06% | 8.46% | 8.58% |

Balance Sheet

| Yr End March (Rs Cr) | 2018 | 2019 | 2020 | 2021E | 2022E | 2023E |

|---|---|---|---|---|---|---|

| Share Capital | 141.21 | 141.21 | 148.88 | 148.88 | 148.88 | 148.88 |

| Total Reserves | 2206.41 | 2690.80 | 3660.68 | 4320.07 | 5067.82 | 5859.35 |

| Shareholders' Funds | 2347.62 | 2846.96 | 3836.42 | 4495.81 | 5243.56 | 6035.09 |

| Non Current Liabilities | ||||||

| Long Term Burrowing | 158.95 | 88.93 | 10.66 | 45.61 | 45.61 | 45.61 |

| Deferred Tax Assets / Liabilities | 55.34 | 23.10 | 16.48 | -77.66 | -77.66 | -77.66 |

| Long Term Provisions | 9.51 | 16.24 | 25.63 | 25.63 | 25.63 | 25.63 |

| Current Liabilities | ||||||

| Short Term Borrowings | 568.75 | 103.07 | 111.45 | 111.45 | 111.45 | 111.45 |

| Trade Payables | 922.09 | 1520.18 | 1353.68 | 1548.23 | 1687.46 | 1951.99 |

| Other Current Liabilities | 243.58 | 807.63 | 401.01 | 366.06 | 366.06 | 366.06 |

| Short Term Provisions | 120.01 | 188.06 | 142.94 | 142.94 | 142.94 | 142.94 |

| Total Equity & Liabilities | 4448.10 | 5628.30 | 5960.58 | 6705.38 | 7592.36 | 8648.42 |

| Assets | ||||||

| Net Block | 1197.13 | 1275.58 | 1422.01 | 1496.70 | 1623.39 | 1729.69 |

| Non Current Investments | 31.55 | 29.39 | 25.48 | 25.48 | 25.48 | 25.48 |

| Long Term Loans & Advances | 150.72 | 199.25 | 218.65 | 218.65 | 218.65 | 218.65 |

| Current Assets | ||||||

| Currents Investments | - | - | 40.00 | 40.00 | 40.00 | 40.00 |

| Inventories | 1365.70 | 1995.79 | 1924.95 | 2262.80 | 2466.29 | 2852.91 |

| Sundry Debtors | 1290.82 | 1334.32 | 1433.64 | 1429.13 | 1505.74 | 1711.75 |

| Cash and Bank | 10.64 | 316.65 | 281.31 | 618.08 | 1098.28 | 1455.40 |

| Short Term Loans and Advances | 226.38 | 170.86 | 182.98 | 182.98 | 182.98 | 182.98 |

| Total Assets | 4448.10 | 5628.30 | 5960.58 | 6705.38 | 7592.36 | 8648.42 |

Cash Flow Statement

| Yr End March (Rs Cr) | 2018 | 2019 | 2020 | 2021E | 2022E | 2023E |

|---|---|---|---|---|---|---|

| Profit After Tax | 358.46 | 502.63 | 773.03 | 775.76 | 879.70 | 989.41 |

| Depreciation | 132.95 | 141.45 | 160.89 | 175.31 | 198.31 | 218.70 |

| Others | 53.62 | 380.81 | -427.12 | - | - | - |

| Changes in Working Capital | -341.84 | 305.32 | -622.11 | -138.79 | -140.86 | -328.10 |

| Cash From Operating Activities | 362.44 | 1229.96 | 244.64 | 812.29 | 937.15 | 880.01 |

| Purchase of Fixed Assets | -198.84 | -286.07 | -290.13 | -250.00 | -325.00 | -325.00 |

| Free Cash Flows | 163.61 | 943.89 | -45.50 | 562.29 | 612.15 | 555.01 |

| Others | -4.56 | -126.38 | 26.84 | - | - | - |

| Cash Flow from Investing Activities | -187.83 | -407.73 | -262.25 | -250.00 | -325.00 | -325.00 |

| Increase / (Decrease) in Loan Funds | -78.92 | -565.06 | -119.41 | - | - | - |

| Equity Dividend Paid | -16.99 | -2.88 | -179.30 | -116.36 | -131.96 | -197.88 |

| Others | -93.91 | -83.47 | 309.43 | - | - | - |

| Cash from Financing Activities | -189.82 | -651.40 | 10.71 | -116.36 | -131.96 | -197.88 |

| Net Cash Inflow / Outflow | -15.21 | 170.83 | -6.90 | 445.92 | 480.19 | 357.13 |

| Opening Cash & Cash Equivalents | 23.44 | 8.23 | 179.06 | 172.16 | 618.08 | 1098.28 |

| Closing Cash & Cash Equivalent | 8.23 | 179.06 | 172.16 | 618.08 | 1098.28 | 1455.40 |

Key Ratios

| Yr End March | 2018 | 2019 | 2020 | 2021E | 2022E | 2023E |

|---|---|---|---|---|---|---|

| Basic EPS | 25.35 | 35.20 | 50.63 | 51.74 | 58.67 | 65.99 |

| Diluted EPS | 25.35 | 35.20 | 50.63 | 51.74 | 58.67 | 65.99 |

| Cash EPS | 34.77 | 45.17 | 61.36 | 63.44 | 71.90 | 80.58 |

| DPS | - | 3.00 | 7.00 | 7.76 | 8.80 | 13.20 |

| Book value (Rs/share) | 166.25 | 200.56 | 255.88 | 299.86 | 349.74 | 402.53 |

| ROCE (Post Tax) | 14.18% | 18.97% | 23.17% | 18.78% | 18.16% | 17.64% |

| ROE | 15.25% | 17.55% | 19.79% | 17.26% | 16.78% | 17.54% |

| Inventory Days | 77.78 | 76.82 | 81.03 | 95.00 | 95.00 | 95.00 |

| Receivable Days | 66.43 | 59.99 | 57.21 | 60.00 | 58.00 | 57.00 |

| Payable Days | 61.36 | 55.82 | 59.40 | 65.00 | 65.00 | 65.00 |

| PE (x) | - | - | 14.55 | 28.68 | 25.29 | 22.49 |

| P/BV (x) | - | - | 2.90 | 4.95 | 4.24 | 3.69 |

| EV/EBITDA (x) | 1.08 | -0.05 | 9.66 | 19.44 | 17.08 | 15.05 |

| Dividend Yield | 0.94% | 0.52% | 0.59% | 0.89% | ||

| P/Sales (x) | - | - | 1.26 | 2.60 | 2.14 | 1.93 |

| Sales/Net FA (x) | 5.82 | 6.46 | 6.55 | 5.86 | 6.66 | 6.88 |