Poly Medicure Ltd

Medical Equipment / Supplies / Accessories

Poly Medicure Ltd

Medical Equipment / Supplies / Accessories

Stock Info

Shareholding Pattern

Price performance

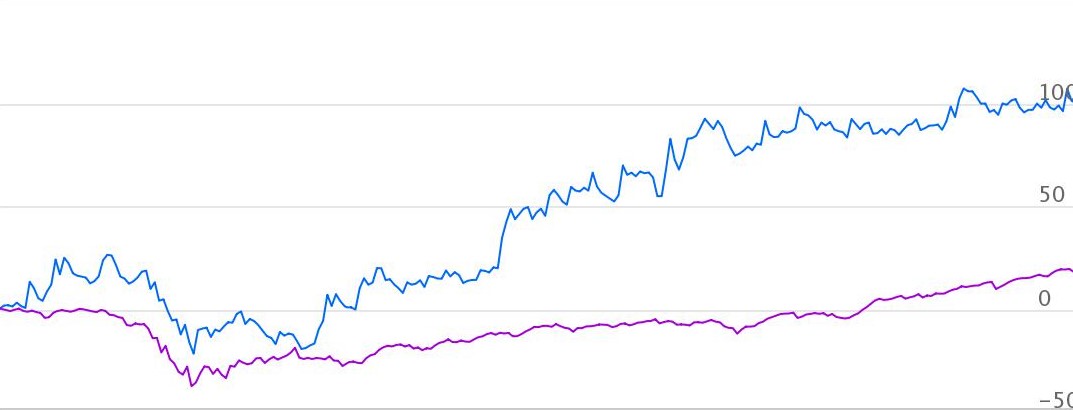

Indexed Stock Performance

Huge opportunity size for this MedTech MNC

Poly Medicure Limited

(Polymed) is one of the leading medical devices manufacturers and exporters in India.

The company holds a dominant position in the medical consumables market with focus

on Innovation, Safety, and Quality.

Polymed is engaged in the development, manufacture and marketing of quality Disposable Medical Devices in the product verticals of Infusion therapy, blood management, gastroenterology, surgery and wound drainage, anesthesia and urology. The company manufactures and supplies in India and internationally. The company has a well-diversified and de-risked business model, comprising a wide range of products with clients across more than 110 countries. The company currently operates five manufacturing units in India and three abroad - China, Egypt (JV) and Italy.

Plan1 Health s.r.l.,

Italy, (a step-down subsidiary) develops, manufactures and sells medical devices

worldwide, in particular vascular access systems and long-term implantable systems

worldwide.

Investment thesis

Beneficiary of ‘Make in India’ Boost

The Indian Government has identified the medical devices as a priority sector for

the flagship 'Make in India' program and is committed to strengthen the

manufacturing ecosystem. India is the fourth largest medical devices market in Asia.

Despite the strong demand for medical devices, India's domestic manufacturing

has remained low. The medical device market continues to be dominated by imported

products, which comprise of around 70%-80% of total sales. ‘Atma Nirbhar’

Bharat mission is providing an impetus to India’s vision of becoming a global

manufacturing hub for medical devices.

Production Linked Incentive (PLI) Scheme for Promoting Domestic Manufacturing

of Medical Devices

The PLI Scheme for Medical Devices manufacturing proposes a financial incentive

of 5% on incremental sales (over base year) of goods manufactured in India, to boost

domestic manufacturing and attract large investment in medical devices segments

such as cancer care devices, radiology and imaging devices, anaesthetics devices,

implants etc. Production Linked incentives of up to Rs. 3,420 crore will be awarded

in the scheme tenure. Polymed has applied for PLI scheme under medical devices manufacturing

and expecting positive outcome from the same.

Implementation of Ayushman Bharat (AB PM-JAY)

Ayushman Bharat Pradhan Mantri Jan Arogya Yojana (AB PM-JAY) launched on 23rd September

2018, is the Government of India ’s program to provide free access to healthcare

for 40% of people in the country. AB PM-JAY is the future of India’s healthcare

ecosystem. By May 2020, the scheme had provided more than 1 crore treatments with

a value of Rs. 13,412 crore. Medical devices industry has benefitted and also contributed

to the success of the scheme in a big way.

Acquisition of Plan1 Health S.R.L.

With the acquisition of Plan1 Health S.R.L., an Italy based manufacturing company;

Polymed now has access to new technology in Oncology and Vascular Access, and opens

more opportunities with the acquired company’s worldwide customer base. Plan1

Health products adhere to the highest quality standards in Europe and are synergetic

with the company’s product portfolio.

Development of new products and capacity expansion to drive robust growth

Polymed is about to complete an expansion plan for FY19-20 and FY20-21 by investing

approximately Rs. 100 crore in last 2 years. The new capacity will cater to additional

demand created through Ayushman Bharat/ PM-JAY over the next few years, and new

customers in developed countries.

Polymed has developed strong in-house capabilities like ability to create moulds, robotized manufacturing, tooling and machine making capabilities. This has helped to commercialize new innovative products faster and expand the company’s product basket in newer therapy areas.

Classification of Medical devices as Drugs will ensure consolidation in the industry

The Drugs Technical Advisory Board, in consultation with the government announced

on 11 February 2020 that all medical devices intended for use by humans or animals

are to be classified as drugs and regulated under section 3 of the Drugs and Cosmetics

Act, 1940, from 1 April 2020. This has ensured that all medical devices meet certain

standards of quality and efficacy, and make medical device companies accountable

for the quality and safety of their products.

Focus on R&D and innovation

Polymed has developed the technology to create moulds internally with strong R&D

team comprising of 50+ engineers, 20+ clinical consultants and 30+ engineers in

process engineering. The company operates a research and development centre at Faridabad,

Haryana, which is approved by Department for Scientific & Industrial Research

and by the Ministry of Science & Technology, Government of India. The company’s

focus is on increasing its R&D spend to 5% of revenue and commercializing new

innovative products.

Outlook & Valuation

Polymed is a leading medical technology and innovative solutions company with leadership in infusion therapy and vascular access devices. We see tremendous opportunity in domestic medical devices industry, where 70% of requirements are imported currently. New product launches and capacity expansion will drive incremental growth going forward. We expect robust domestic growth in demand of medical devices through increased government focus on improving healthcare infrastructure. We thus initiate ‘Buy’ with TP of Rs. 670 valuing the company at 30.6x FY23E earnings.

Consolidated Financial Statements

| Rs in Cr | Net Sales | EBITDA | EBITDAM | PAT | EPS | ROE | P/E | EV/EBITDA |

|---|---|---|---|---|---|---|---|---|

| FY18 | 520.42 | 121.96 | 23.40% | 69.35 | 7.99 | 20.90% | 31.38 | 19.02 |

| FY19 | 610.83 | 131.23 | 21.50% | 64.00 | 7.41 | 17.10% | 29.62 | 15.58 |

| FY20 | 687.24 | 166.12 | 24.20% | 93.74 | 10.86 | 22.00% | 21.45 | 13.35 |

| FY21E | 783.45 | 219.37 | 28.00% | 133.58 | 15.36 | 24.50% | 34.50 | 21.57 |

| FY22E | 940.14 | 266.06 | 28.30% | 163.80 | 17.81 | 23.70% | 29.67 | 18.48 |

| FY23E | 1146.97 | 326.89 | 28.50% | 204.08 | 21.92 | 25.80% | 23.81 | 14.69 |

Investment Rationale

Beneficiary of ‘Make in India’ Boost

Despite the strong demand for medical devices, India's domestic manufacturing

has remained low. The medical device market continues to be dominated by imported

products, which comprise of around 70%-80% of total sales. The Government wants

to reduce dependence on imports and boost ‘Make in India’; as a result,

health cess of 5% on imports of medical equipment was imposed on 2nd February 2020

in the Union Budget, a move that is likely to make imported medical devices costlier.

The Indian Government has identified the medical devices as a priority sector for the flagship 'Make in India' program and is committed to strengthen the manufacturing ecosystem. India is the fourth largest medical devices market in Asia. ‘Atma Nirbhar’ Bharat mission is providing an impetus to India’s vision of becoming a global manufacturing hub for medical devices. Recent initiatives for instance, The Production Linked Incentive Scheme (PLI) and Promotion of Medical Devices Parks Scheme are a testimony to this. These schemes have been cogently constructed to incentivize large-scale manufacturing and to build required infrastructure for developing manufacturing clusters within India.

Polymed holds leadership position in disposable medical devices market in India. The company has strong product portfolio of 130+ commercially available products, which are distributed by 275+ sales associates across 5000+ hospitals in India. Polymed is India’s 1st indigenous dialyzer manufacturer, among top 3 I.V. cannula manufacturers in the world and largest exporter of consumable medical devices from India. Polymed has strong focus on manufacturing products which are import substitutes. We believe Polymed is biggest beneficiary of ‘Make in India’ push.

Production Linked Incentive (PLI) Scheme for Promoting Domestic Manufacturing

of Medical Devices

The PLI Scheme for Medical Devices manufacturing proposes a financial incentive

of 5% on incremental sales (over base year) of goods manufactured in India, to boost

domestic manufacturing and attract large investment in medical devices segments

such as cancer care devices, radiology and imaging devices, anaesthetics devices,

implants etc. Production Linked incentives of up to Rs. 3,420 crore will be awarded

in the scheme tenure. The applicant companies will be required to meet minimum thresholds

of investment & production and meet the eligiblity criteria to receive incentives

under the scheme.

Polymed has applied for PLI scheme under medical devices manufacturing and expecting

positive outcome from the same. As a result, QIP is being planned to fulfill high

capex requirement of the scheme. We belive positive outcome on PLI application can

prove to be a huge game changer for polymed.

Implementation of Ayushman Bharat (AB PM-JAY)

Ayushman Bharat Pradhan Mantri Jan Arogya Yojana (AB PM-JAY) launched on 23rd September

2018, is the Government of India’s program to provide free access to healthcare

for 40% of people in the country. AB PM-JAY provides free secondary health care

for those needing specialist treatments and tertiary health care for those requiring

hospitalization. The program is a centrally sponsored and is jointly funded by both

the central government and the states.

AB PM-JAY is the future of India’s healthcare ecosystem. By May 2020, the scheme had provided more than 1 crore treatments with a value of Rs. 13,412 crore. The number of public and private hospitals empanelled nationwide stands at 24,432. It is a path-breaking initiative of the Government of India and is expected to positively impact across all levels of healthcare.

Medical devices industry has benefitted and also contributed to the success of the scheme in a big way. The government under AB PM-JAY has started directly procuring critical medical equipment and devices via Government e-Marketplace (GEM) for hospitals in a bid to reduce the cost of healthcare service. This move has created a new segment of growth for the medical device industry. Government procurement takes place at a negotiated price, which fosters price competitiveness and supports organised sector as quality medical equipment is must.

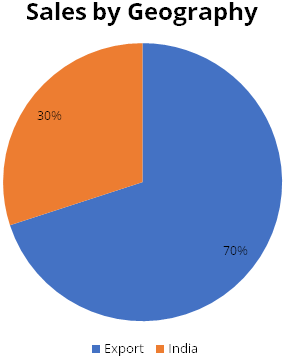

Robust domestic growth

The Covid-19 pandemic has exposed India’s inadequate health infrastructure.

In the fight against Covid-19, the government has increased focus towards improving

India’s healthcare infrastructure and deepening the healthcare sector. Polymed

has been investing heavily in increasing its manufacturing capacity and R&D;

it has also been consistently introducing new products which are import substitutes.

Currently 70% revenue comes from exports. The company has been increasing its distributors

and improving its distribution in tier-2 and tier-3 cities. We see significant scope

for domestic business to grow and improve its share in the company’s total

revenue.

Acquisition of Plan1 Health S.R.L.

With the acquisition of Plan1 Health S.R.L., an Italy based manufacturing company;

Polymed now has access to new technology in Oncology and Vascular Access, and opens

more opportunities with the acquired company’s worldwide customer base. Plan1

Health products adhere to the highest quality standards in Europe and are synergetic

with the company’s product portfolio.

Plan1Health has expanded 3x its clean room area to expand manufacturing capacity and added new warehouse to facilitate increase storage and movement of goods. The company will start exporting its products to Brazil, Russia, and China etc. in 2021

Development of new products and capacity expansion to drive robust growth

The company is about to complete an expansion plan for FY19-20 and FY20-21 by investing

approximately Rs.100 crore in last 2 years. The new capacity will cater to additional

demand created through Ayushman Bharat/ PM-JAY over the next few years, and new

customers in developed countries.

Capacity expansion

Phase II of IMT, Faridabad plant got operational in December 2020 and new manufacturing

plant in Mahindra SEZ, Jaipur will be operational by February 2021. These two expansion

projects will further augment the manufacturing capacities of existing and new products.

New products like Manifolds, Catheters, Tubings, Infusion lines and new sizes of

Dialyzers will be manufactured in these plants.

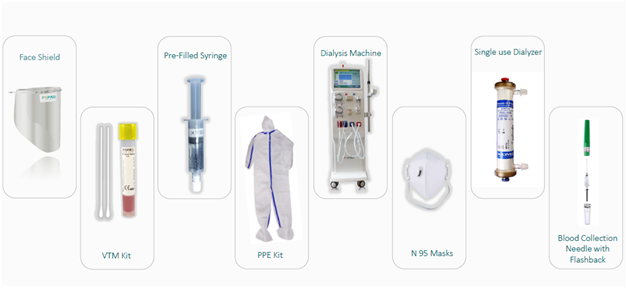

New products developement

Polymed has developed strong in-house capabilities like ability to create moulds,

robotized manufacturing, tooling and machine making capabilities. This has helped

to commercialize new innovative products faster and expand the company’s product

basket in newer therapy areas. Polymed recently ventured into manufacturing of new

products like face shield, VTM Kit, Pre-filled Syringe, PPE Kits, Dialysis Machine,

N 95 Masks, Single use Dialyzer and Blood collection needle with flashback.

Classification of Medical devices as Drugs will ensure consolidation in the industry

In consultation with the Drugs Technical Advisory Board, the government announced

on 11 February 2020 that all medical devices intended for use by humans or animals

are to be classified as drugs and regulated under section 3 of the Drugs and Cosmetics

Act, 1940, from 1 April 2020. This has ensured that all medical devices meet certain

standards of quality and efficacy, and make medical device companies accountable

for the quality and safety of their products.

Lack of regulations and its enforcement was the major reason for low-medium brand image of India’s medical devices in the exports market. We believe these stringent regulations will ensure quality and improve market share of branded and quality focused players like Polymed.

Focus on R&D and innovation

Polymed has developed the technology to create moulds internally with strong R&D

team comprising of 50+ engineers, 20+ clinical consultants and 30+ engineers in

process engineering. The company operates a research and development centre at Faridabad,

Haryana, which is approved by Department for Scientific & Industrial Research

and by the Ministry of Science & Technology, Government of India. R&D is

primarily focused on developing new products within existing as well as new critical

care product verticals, and further improving existing processes and productivity.

The company’s focus is on increasing its R&D spend to 5% of revenue and

commercializing new innovative products. Currently, the company holds 250+ patents

and 190+ pending applications.

Financials

Revenue

Polymed has diversified revenue profile. Diversification is across geography and

product category. The company supplies to over 110 different countries, with strong

presence in Europe. Exports contribute 70% of sales, while India contributes 30%.

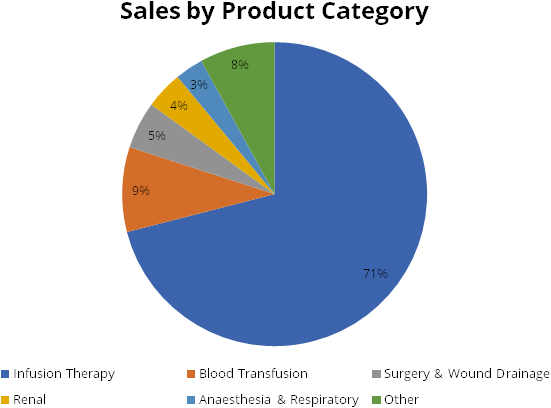

The company has broad portfolio of 130+ commercially available products. Product category wise Infusion therapy contributes 71% of revenue, followed by Blood transfusion at 9%.

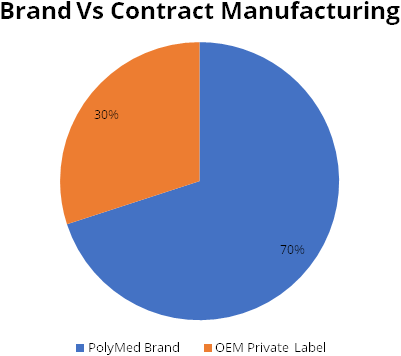

Contract manufacturing is another big opportunity for Polymed. Med Tech companies are looking towards India for new sourcing and supply chains alternatives. Currently, 70% of sales are Polymed branded sales, while rest 30% is private lable.

Strong operating performance

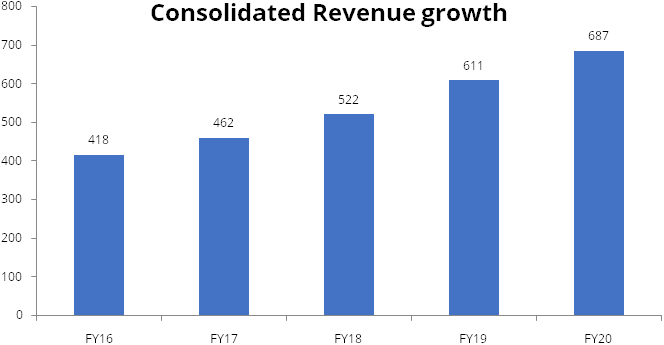

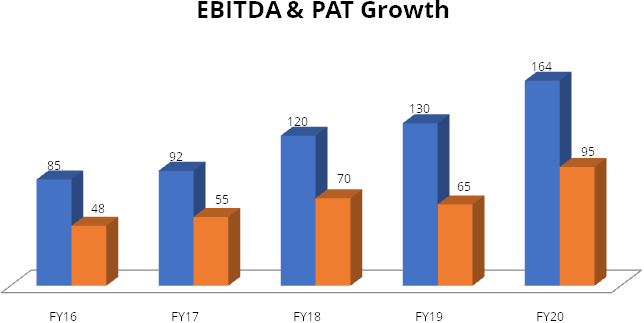

Polymed has shown consistency and sustained growth in top-line, EBITDA and PAT.

Net consolidated revenue has growth at 4-year CAGR of 11%, while EBITDA and PAT

have grown at 4-year CAGR of 14% and 15% respectively.

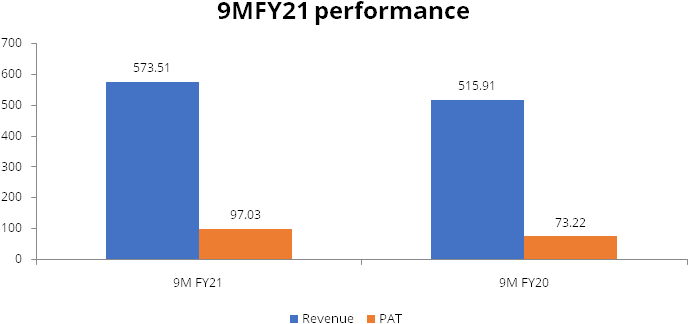

Poly Medicure reported healthy numbers for 9MFY21, strong performance was led by 11.2% growth in Revenues and 32.5% growth in PAT as compared to 9M FY20. Healthy profitability was led by robust margin expansion, due to improvement in gross margins, favorable product mix and operating leverage benefits.

Industry

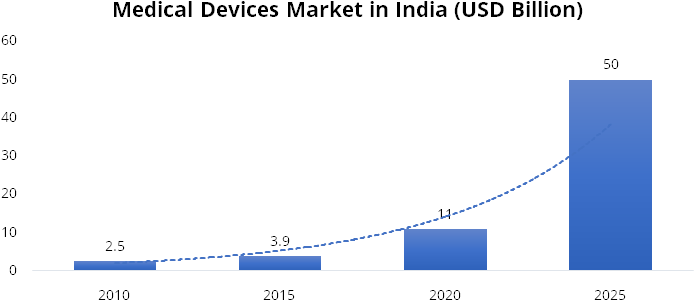

Healthcare Sector

The healthcare industry in India comprises of hospitals, medical devices, clinical

trials, outsourcing, telemedicine, medical tourism, health insurance and medical

equipment & pharma.

India’s healthcare sector is one of the fastest-growing sectors in the past few years; the high growth rate is due to the availability of modern healthcare services, strengthening coverage, health awareness, increasing expenditure by public and private players and lastly policies introduced by the government. Till some years back it was all about private healthcare in India, but with private participation in public schemes, and the government increasing its spending in healthcare, the public healthcare segment is gaining prominence.

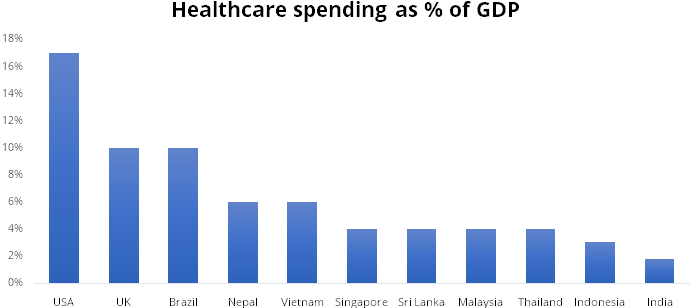

Healthcare in India still has a long way to go to catch up with other advanced nations, the current per capita spend on medical devices in India is at $3 vs $13 in China and $340 in the US. High government spending on healthcare services and infra will help the sector grow at a faster pace and improve the quality of service in the country.

Source: Company Presentation, Stockaxis Research

Source: Company Presentation, Stockaxis Research

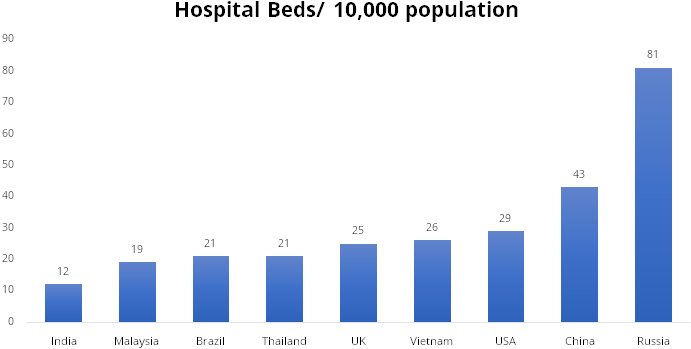

Medical Devices Industry

Medical devices industry plays a vital role in healthcare sector and is an essential

part in healthcare delivery. The industry consists of wide array of tool and equipment

which help medical practitioners deliver quality healthcare effectively and save

crucial lives. Segment-wise, these devices can be bifurcated in diagnostic imaging,

consumables, Intravenous (IV) diagnostics, orthopaedic prosthetics, dental products

and others (which include patient monitor, ECG, oxygenators, etc). The growing use

of technology is driving a new trend in the medical devices sector with the focus

on improving delivery, user experience and bringing down healthcare costs.

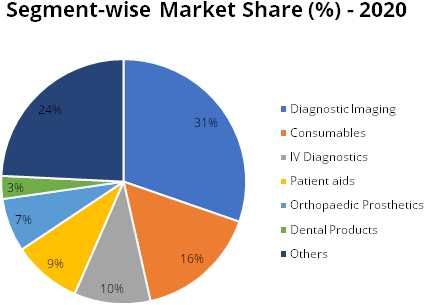

The medical devices industry in India is the 4th largest in Asia and among the top 30 in the world. As per the recent report by IBEF, the current market size of Indian medical device stands at USD 11 billion compared to USD 2.5 in 2010, thereby registering a growth of ~16%. Further, the market size is expected to grow at a CAGR of 35.4% from 2020 – 2025 and reach at USD 50 billion by 2025. This growth will be aided by rising number of medical facilities, rise in home healthcare segment, demographics (ageing population), boost in exports, various government initiatives such as Production Linked Incentives (PLI) and promotion of medical device parks.

Source: IBEF, Stockaxis Research

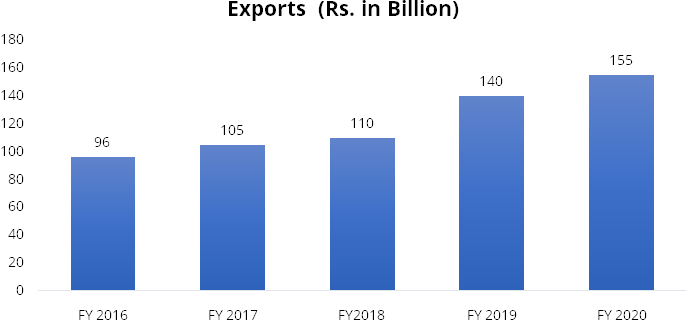

Import and Export Scenario

Due to inverted duty structure and absence of proper regulatory framework for medical

devices, India’s medical devices industry is highly import dependent, importing

70% - 80% of total demand. As of 2020, India imported USD 5.6 billion of medical

devices. On the export front, India has exported medical devices amounting to Rs.

155 billion as of FY2020 compared to Rs. 96 billion in FY2016, thereby registering

a CAGR of 13%. India has outpaced the global market growth of 5%.

Source: Company Presentation, Stockaxis Research

Further, on the back of various government schemes and allowance of 100% FDI in the industry, the exports are expected to grow further in the coming years. The key export countries for India are the USA, France, Germany, Singapore, Brazil, Turkey, the Netherlands, Iran, Belgium and China.

Government Stimulus to Medical Device Industry

The medical device industry in India suffers from considerable cost of manufacturing

via-a-vis competing economies on account of factors such as lack of infrastructure,

supply chain & logistics, high finance cost, limited design capabilities, and

low focus on R&D and skill development. With the changing economic and regulatory

environment, the medical devices industry is expected to grow significantly. The

Government of India, in recent past, has taken several initiatives to boost this

emerging industry in India such as:

Production Linked Incentive (PLI) Scheme:

To compensate for the manufacturing disability in the selected segment of the medical

devices, the GoI has come up with PLI scheme. In July 2020, GoI released the PLI

Scheme for Medical Devices 2020, in which, an incentive at 5% of incremental sales

over the base year 2019-2020 will be provided to segments of medical devices such

as: i) cancer care /radiotherapy medical devices ii) radiology and imaging medical

devices iii) anaesthetics and cardio-respiratory medical devices (including catheters

of cardiorespiratory category & renal care medical devices and iv) implants

including implantable electronic devices.

Promotion of Medical Device Parks:

It aims to support ‘Make in India’, reduce import dependence, strengthen

the infrastructure base, reduce the cost of production for affordability and value

addition in the domestic medical device industry. Financial assistance up to Rs.

400 crores will be provided for the creation of common infrastructure facilities

in four medical device parks proposed by State Governments.The first such park is

to come up in Andhra Pradesh; Andhra Pradesh MedTech Zone (AMTZ), a company established

under the Government of Andhra Pradesh.

National Health Protection Scheme: Ayushman Bharat – Growing Opportunities

in Affordable Healthcare

Medical devices industry in the country is likely to make the most among other segments

of the healthcare market in the next three years, suggests a whitepaper by SKP.

The whitepaper titled ‘National Health Protection Scheme: Ayushman Bharat

– Growing Opportunities in Affordable Healthcare’ has examined the impact

of Ayushman Bharat- Pradhan Mantri Jan Aarogya Yojana (PMJAY) since its launch on

September 23 last year.

The paper says that among the different segment of the healthcare industry, the medical equipment segment will emerge as the biggest beneficiary with additional revenues of USD 2 billion (approx Rs 14,351 crore at the present rate of exchange). The medical consumables and disposables will constitute 20 per cent of this revenue. Currently, the whitepaper notes that “Medical Devices industry in India is at a very nascent stage.” It is “significantly smaller” than other emerging and developing economies.

“With NHPS and the resultant expansion in the patient pool and bed capacity, this industry is expected to benefit substantially, particularly categories like equipment and instruments, and consumables and disposables,” the whitepaper said. “With the shifting disease burden, some medical device product categories will witness a greater impact than others. These include diagnostic equipment (replacement or new purchases), syringes and needles, stents, etc. In its first 100 days, NHPS attracted a greater ratio of patients from therapies like cardiology and oncology, indicating a future trend,” it added.

The international consulting firm further said, “Effective implementation of the scheme could result in an anticipated CAGR of 30%-35% over the next three years in Medical Devices industry, across Medical Equipment and Furniture.”

Infusion Therapy Device Market

Infusion therapy involves the administration of intravenous fluids, medication or

parenteral nutrition through a needle/catheter. It is prescribed when a patient’s

condition is so severe that it cannot be treated effectively by oral medications,

the medications are introduced to the vein through a catheter. In 2020, the global

catheters market stood at ~USD 16 billion and is expected to grow at a CAGR of 8.7%

from 2020-25 and reach USD 24 billion by 2025. Product category wise Infusion therapy

contributes 71% of Polymed’s sales.

A cannula is a tube that can be inserted into the body, often for the delivery or removal of fluid or for the gathering of data. IV Cannula is amongst the most extensively used medical disposables as it is used in medical situations such as nutrition, surgery, blood transfusion, chemotherapy, etc. Polymed is amongst the top 3 I.V. Cannula manufacturer in the world.

Consumables and disposable medical devices segment includes disposables plastic syringes, blood bags, IV fluid set, wound management, medical apparels, etc. Key players catering to this segment are Poly Medicure, Hindustran syringes, Lotus surgical, BBraun, and Beckton Dickson.

Peer comparison

Phillips India and Siemens are top 2 medical devices players in India by revenue,

followed by Poly Medicure and Trivitron. Phillips India and Siemens are 8x and 4.5x

bigger than Poly Medicure in terms of revenue, as they deal into diagnostic imaging

segment. What we can analyse from below table is Poly Medicure’s revenue is

1.5x of nearest competitor, while operating margins and return ratio are best among

peer set.

| Particulars | Poly Medicure | Trivitron | Sahajanand | Allengers |

|---|---|---|---|---|

| Sales (Rs. in cr.) (FY19) | 611 | 407 | 328 | 293 |

| Sales 3Y CAGR | 14% | 2% | 48% | 1% |

| OPBIT Margin (%) | 23% | 6% | 19% | 12% |

| RoCE (%) | 23% | 1% | 17% | 24% |

Source: Company Presentation, Stockaxis Research

Risks & Concerns

Foreign currency Risk

The Company operates significantly in international markets through imports and

exports and therefore is exposed to foreign exchange risk arising from foreign currency

transactions primarily with respect to USD/Euro/GBP/JPY.

Price Risk

The main raw materials for manufacturing of Medical devices are various types of

Plastic Granules. The prices of raw materials are mainly dependent on the price

of Crude Oil and the majority of raw materials are being imported by the company.

Regulatory Risk

Medical Devices is among one of the highly regulated industries across the world,

rightly so as it deals with saving human lives. The regulations impact manufacturing,

quality, marketing and distribution of products globally and bring new compliance

challenges year on year.

Outlook & valuation

Polymed is a leading medical technology and innovative solutions company with leadership in infusion therapy and vascular access devices. Polymed is the first medical devices company from India to have overseas plants.

We see tremendous opportunity in domestic medical devices industry, where 70% of requirements are imported currently. New product launches and capacity expansion will drive incremental growth going forward. We expect robust domestic growth in demand of medical devices through increased government focus on improving healthcare infrastructure and implementation of Ayushman Bharat, where as PLI scheme will provide much needed boost to domestic manufacturing. With acquisition of Plan1 Health S.R.L. (Italy), exports are also expected to improve. We thus initiate ‘Buy’ with TP of Rs. 670 valuing the company at 30.6x FY23E earnings. The stock is curretly trading at 29x / 23x FY22E / FY23 E earnings respectively.

Financial Statement

Profit & Loss statement

| Yr End March (Rs M) | 2018 | 2019 | 2020 | 2021E | 2022E | 2023E |

|---|---|---|---|---|---|---|

| Net Sales | 520.42 | 610.83 | 687.24 | 783.45 | 940.14 | 1146.97 |

| Growth % | 17.40% | 12.50% | 14.00% | 20.00% | 22.00% | |

| Expenditure | ||||||

| Material Cost | 165.05 | 208.66 | 217.05 | 242.87 | 296.15 | 367.03 |

| Employee Cost | 99.13 | 116.61 | 138.76 | 144.94 | 169.23 | 200.72 |

| Other Expenses | 134.28 | 154.32 | 165.31 | 176.28 | 208.71 | 252.33 |

| EBITDA | 121.96 | 131.23 | 166.12 | 219.37 | 266.06 | 326.89 |

| Growth % | 7.60% | 26.60% | 32.00% | 21.30% | 22.90% | |

| EBITDA Margin | 23.40% | 21.50% | 24.20% | 28.00% | 28.30% | 28.50% |

| Depreciation & Amortization | 29.24 | 37.29 | 40.53 | 44.86 | 51.16 | 58.16 |

| EBIT | 92.71 | 93.94 | 125.60 | 174.51 | 214.90 | 268.73 |

| EBIT Margin % | 17.80% | 15.40% | 18.30% | 22.30% | 22.90% | 23.40% |

| Other Income | 14.38 | 18.48 | 18.46 | 18.00 | 18.00 | 18.00 |

| Interest & Finance Charges | 11.58 | 13.75 | 20.48 | 14.00 | 14.00 | 14.00 |

| Profit Before Tax | 95.51 | 98.68 | 123.58 | 178.51 | 218.90 | 272.73 |

| Tax Expense | 26.16 | 34.68 | 29.85 | 44.93 | 55.10 | 68.65 |

| Effective Tax rate | 27.40% | 35.10% | 24.20% | 25.20% | 25.20% | 25.20% |

| Net Profit | 69.35 | 64.00 | 93.74 | 133.58 | 163.80 | 204.08 |

| Growth % | -7.70% | 46.50% | 42.50% | 22.60% | 24.60% | |

| Net Profit Margin | 13.30% | 10.50% | 13.60% | 17.00% | 17.40% | 17.80% |

| EPS | 7.99 | 7.41 | 10.86 | 15.36 | 17.81 | 21.92 |

Balance Sheet

| Yr End March (Rs M) | 2018 | 2019 | 2020 | 2021E | 2022E | 2023E |

|---|---|---|---|---|---|---|

| Share Capital | 44.11 | 44.12 | 44.12 | 46.52 | 46.52 | 46.52 |

| Total Reserves | 293.77 | 336.95 | 390.56 | 506.48 | 651.67 | 837.13 |

| Shareholders' Funds | 338.30 | 381.37 | 434.82 | 553.15 | 698.33 | 883.79 |

| Non Current Liabilities | ||||||

| Long Term Borrowings | 79.12 | 91.38 | 110.57 | 95.28 | 45.28 | 0.28 |

| Deferred Tax Assets / Liabilities | 15.72 | 18.66 | 14.49 | 14.49 | 14.49 | 14.49 |

| Long Term Provisions | 2.10 | 3.13 | 3.80 | 3.80 | 3.80 | 3.80 |

| Current Liabilities | ||||||

| Short Term Borrowings | 32.24 | 45.47 | 57.01 | 57.01 | 57.01 | 57.01 |

| Trade Payables | 43.62 | 55.54 | 66.36 | 62.45 | 73.19 | 88.63 |

| Other Current Liabilities | 46.39 | 48.99 | 72.25 | 37.54 | 37.54 | 37.54 |

| Short Term Provisions | 0.33 | 31.24 | 33.71 | 33.71 | 33.71 | 33.71 |

| Total Equity & Liabilities | 564.83 | 681.60 | 799.54 | 863.96 | 969.88 | 1125.78 |

| Assets | ||||||

| Net Block | 261.79 | 302.74 | 359.49 | 394.63 | 443.47 | 485.31 |

| Non Current Investments | 10.28 | 10.79 | 12.92 | 12.92 | 12.92 | 12.92 |

| Long Term Loans & Advances | 13.70 | 8.82 | 19.54 | 19.54 | 19.54 | 19.54 |

| Current Assets | ||||||

| Currents Investments | 10.62 | 0.27 | 15.92 | 15.92 | 15.92 | 15.92 |

| Inventories | 72.99 | 83.79 | 112.09 | 98.72 | 115.69 | 140.09 |

| Sundry Debtors | 112.54 | 128.38 | 127.12 | 143.04 | 167.64 | 202.99 |

| Cash and Bank | 20.39 | 54.59 | 25.36 | 29.19 | 44.70 | 99.00 |

| Short Term Loans and Advances | 16.65 | 40.83 | 56.20 | 56.20 | 56.20 | 56.20 |

| Total Assets | 564.82 | 681.60 | 799.54 | 863.96 | 969.88 | 1125.78 |

Cash Flow Statement

| Yr End March (Rs M) | 2018 | 2019 | 2020 | 2021E | 2022E | 2023E |

|---|---|---|---|---|---|---|

| Profit After Tax | 69.35 | 64.00 | 93.74 | 133.58 | 163.80 | 204.08 |

| Depreciation | 29.24 | 37.29 | 40.53 | 44.86 | 51.16 | 58.16 |

| Others | -11.07 | 6.03 | 4.14 | - | - | - |

| Changes in Working Capital | -37.35 | -8.69 | -12.07 | -6.45 | -30.83 | -44.32 |

| Cash From Operating Activities | 74.96 | 106.48 | 130.51 | 171.98 | 184.13 | 217.92 |

| Purchase of Fixed Assets | -82.46 | -78.00 | -106.02 | -80.00 | -100.00 | -100.00 |

| Free Cash Flows | -7.50 | 28.49 | 24.48 | 91.98 | 84.13 | 117.92 |

| Others | -5.82 | -25.15 | -3.78 | - | - | - |

| Cash Flow from Investing Activities | -88.03 | -100.74 | -109.46 | -80.00 | -100.00 | -100.00 |

| Increase / (Decrease) in Loan Funds | 30.93 | 28.24 | 33.29 | -50.00 | -50.00 | -45.00 |

| Equity Dividend Paid | -5.31 | -21.19 | -42.47 | -17.66 | -18.62 | -18.62 |

| Others | -9.91 | -12.18 | -11.33 | - | - | - |

| Cash from Financing Activities | 15.71 | -5.13 | -20.51 | -67.66 | -68.62 | -63.62 |

| Net Cash Inflow / Outflow | 2.64 | 0.62 | 0.54 | 24.33 | 15.51 | 54.30 |

| Opening Cash & Cash Equivalents | 1.06 | 3.70 | 4.32 | 4.86 | 29.19 | 44.70 |

| Closing Cash & Cash Equivalent | 3.70 | 4.32 | 4.86 | 29.19 | 44.70 | 99.00 |

Key Ratios

| Yr End March | 2018 | 2019 | 2020 | 2021E | 2022E | 2023E |

|---|---|---|---|---|---|---|

| Basic EPS | 7.99 | 7.41 | 10.86 | 15.36 | 17.81 | 21.92 |

| Diluted EPS | 7.99 | 7.41 | 10.86 | 15.36 | 17.81 | 21.92 |

| Cash EPS (Rs) | 11.30 | 11.63 | 15.45 | 20.44 | 23.31 | 28.17 |

| DPS | 2.00 | 2.00 | 2.00 | 2.00 | 2.00 | 2.00 |

| Book value (Rs/share) | 38.30 | 43.19 | 49.26 | 62.66 | 75.01 | 94.93 |

| ROE (%) | 20.90% | 17.10% | 22.00% | 24.50% | 23.70% | 25.80% |

| ROCE (%) Post Tax | 19.40% | 15.10% | 19.50% | 22.00% | 23.10% | 24.60% |

| Inventory Days | 47.00 | 47.00 | 52.00 | 49.00 | 42.00 | 41.00 |

| Receivable Days | 73.00 | 72.00 | 68.00 | 63.00 | 60.00 | 59.00 |

| Payable Days | 30.00 | 30.00 | 32.00 | 30.00 | 26.00 | 26.00 |

| PE | 31.38 | 29.62 | 21.45 | 34.50 | 29.67 | 23.81 |

| P/BV | 6.56 | 5.08 | 4.73 | 8.33 | 6.96 | 5.50 |

| EV/EBITDA | 19.02 | 15.58 | 13.35 | 21.57 | 18.48 | 14.69 |

| P/Sales | 4.26 | 3.17 | 2.99 | 5.88 | 5.17 | 4.24 |

| Net debt/Equity | 0.30 | 0.28 | 0.37 | 0.22 | 0.08 | - |

| Net Debt/EBITDA | 0.84 | 0.81 | 0.97 | 0.56 | 0.22 | -0.18 |