Muthoot Finance Ltd

Finance - Gold NBFC

Muthoot Finance Ltd

Finance - Gold NBFC

Stock Info

Shareholding Pattern

Price performance

Indexed Stock Performance

Well-established Track Record and Strong Brand in Gold Financing Industry

Company Profile

Muthoot Finance Limited (MFL), India's largest and most trusted gold financing

company (by loan portfolio), is registered with the Reserve Bank of India (the RBI)

as a 'Systemically Important Non-Deposit-Taking Non-Banking Financial Company

(NBFC-ND-SI)'. MFL is the flagship company of the Muthoot Group and was founded

in 1997. Today, MFL is India's largest gold loan focused NBFC, with Rs. 54,687.6

crores in total loan assets (standalone) and 4,600+ branches as of December, 2021.

South India accounts for a large amount of the company's business (50% of the overall portfolio as of December, 2021), where gold loans have long been accepted as a form of short-term finance, while MFL has expanded its footprint beyond South India in recent years. MFL reported a standalone net profit of 1,028.9 crores on an asset base of Rs. 66,830.9 crores in Q3FY22 against a net profit of Rs. 991.4 crores on an asset base of Rs. 62,703.2 crore in Q3FY21.

Consolidated Financial Statements

| Particulars (Rs. in Crores) | NII | PPOP | PAT | EPS | Adj. Book Value |

|---|---|---|---|---|---|

| FY20 | 5773.46 | 4153.14 | 3018.30 | 75.31 | 285.94 |

| FY21 | 6636.09 | 5101.49 | 3722.18 | 92.79 | 377.33 |

| FY22E | 7404.20 | 5716.69 | 4070.70 | 101.43 | 456.00 |

| FY23E | 8297.33 | 6349.33 | 4610.24 | 114.87 | 550.47 |

| FY24E | 9503.84 | 7318.83 | 5314.94 | 132.43 | 655.25 |

Investment Rationale

Leadership Position in Gold Finance/Loan Segment

Muthoot Finance has maintained its dominant position in the gold finance industry,

owing to its promoter family's long and successful 80-year track record. The

company has a wide operational base of over 4,600 branches across India, which has

helped it maintain its leadership position among gold lending NBFCs over time. Despite

low volume growth and greater competition from banks as a result of the LTV relaxation

advantage granted to them, the company's gold loan AUM climbed by 27.4% YoY

in FY21. This was due to a rise in gold prices, fresh disbursals at somewhat higher

than normal LTV, and the expansion of the active customer base through the reactivation

of previous inactive clients and the addition of new consumers.

The company's operating efficiency has historically been higher than that of competitors. The average AUM/branch as of December, 2021 was Rs. 11.7 crores, over double what it was in FY13. Muthoot's network of branches and client base, which is geographically more diverse and improving, should help the medium-term development of its competitive position. While the company has begun to diversify into non-gold markets, given the obstacles experienced by other asset classes during the pandemic, its primary concentration will remain on gold loans over the medium term.

Large Market Opportunity and Strong Momentum in Gold Loan…

Because gold is a fairly liquid asset with a low risk of loss, it is one of the

quickest methods for those in financial distress to get cash. The company's

demand for gold loans remained robust in FY21, increasing by 26.5%. The World Gold

Council estimates that Indian consumers own USD 1.5 trillion in gold, largely in

the form of jewellery. According to estimates, total funding penetration against

this is around USD 150 billion (or 10%).

According to some reports, the organised gold loan industry is likely to increase 10% to 15% in the next 4-5 years, owing to innate need for small business loans and market share gains from the unorganised category. Loan growth volatility in gold loans is lesser than the other retail lending divisions like auto finance or microfinance; in good times, loan growth is 25%-30%, while in difficult times, the loan book is flat YoY.

The advent of the Covid-19 pandemic has been beneficial to gold loans, since lenders have shifted their focus from unsecured to secured credit. Small businesspeople and traders will turn to gold loans to fulfil the capital requirements to restart their enterprises, therefore the market is projected to grow at fast pace when COVID instances subside.

…to Benefit Muthoot Finance, which is well-placed to Cater to the Demand

The laborious and crowded nature of a regular bank branch is a hostile set-up for

a gold loan customer, given the social stigma associated with pledging gold. The

door-step concept, which tries to eliminate the social stigma portion, presents

a challenge to the conventional brick-and-mortar paradigm. While there are early

indicators that this strategy is working, however, convincing small-ticket clients

of the transit process's safety will be a key determinant, as Indians are wary

of strangers handling their gold.

Also, banks mostly cater to the high-ticket size segment, whereas Muthoot caters to relatively small ticket size, which is stickier. While banks have 75% share, Muthoot is the largest player. The branch-centric and operationally intensive nature of gold loans at lower ticket sizes, are believed to be strong entry barriers. Muthoot controls more than 10% of the gold lending market, including agro gold loans.

As the interest among the banks and fintech companies is growing to set the stage in this segment, one may feel that there can be potential loss of market share of the gold financers, however, we expect Muthoot to grow its loan book in-line with the industry on the back of A) strong Pan-India network of 4,600+ branches mostly on the suburban areas, where demand for gold is higher. B) Trust, which the company has gained in its history of existence of almost eight decades and advertisement campaigns over decades, and C) strong customer base; in recent quarters, the company is focused on proving loans to its old and inactive clients.

Comfortable Capitalisation

As of December 2021, MFL had a healthy capitalization profile, with a standalone

gearing of 2.35 times, aided by strong internal capital generation. As of December

2021, MFL's standalone net worth was Rs. 17,412.2 crores (Rs. 15,238.9 crore

as on March, 2021).

On a standalone basis, Tier I and total capital adequacy ratios have also stayed comfortable over 20% in recent years, owing to steady business growth, and stood at 29.9 on December, 2021. Muthoot will be able to properly capitalise its subsidiaries and provide need-based liquidity support, in addition to enhancing its standalone capital position, thanks to strong internal cash generation from the gold loan business.

| Particulars (Rs. in Crores) | Dec-21 | Sep-21 | Jun-21 | Mar-21 | Dec-20 |

|---|---|---|---|---|---|

| Outside Liabilities | 49,418.7 | 51,087.1 | 49,982.7 | 48,226.0 | 48,525.2 |

| Cash & Bank Balances & Investment in MF liquid Funds | 8,565.4 | 7,789.7 | 8,249.2 | 7,130.8 | 9,550.2 |

| Tangible Net worth | 17,408.1 | 16,368.1 | 15,379.1 | 15,233.5 | 14,173.1 |

| Capital Gearing (x) | 2.35 | 2.65 | 2.71 | 2.70 | 2.75 |

Source: Investors’ Presentation

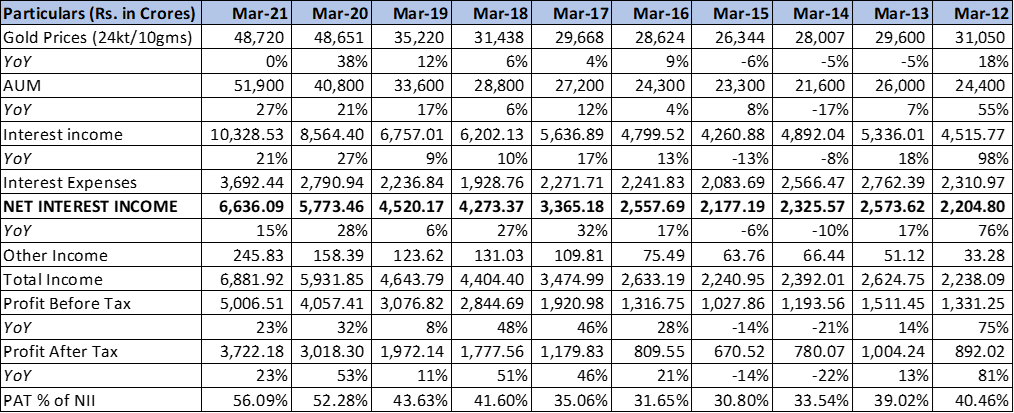

Resilient Performance Despite an Eventful Past Decade for the Gold Loan Industry

In the last 10-15 years, this business has gone through several cycles. Prior to

2012, the business was seeing tremendous development, fuelled by the shift to secured

lending following the global financial crisis and the rapid expansion of branch

networks. The growth took a pause when the Reserve Bank of India (the RBI) capped

LTVs for gold lending NBFCs at 60% vs. no cap earlier.

It also revoked gold loan firms' priority sector lending classification, resulting in a significant increase in their cost of capital. The Reserve Bank of India established regularity parity in 2014, raising LTVs to 75%, in accordance with bank standards. This re-ignited growth for gold lenders, albeit at a slower rate due to the sluggish rise in gold prices. However, loan growth has accelerated in the last two years, owing to a substantial jump in gold prices combined with the pandemic's impact on borrowers' cashflows.

Source: Company, AceEquity, StockAxis Research

It can be observed from the above table that, in-line with the industry headwinds along with lower gold prices, the company’s performance inFY14 was also impacted. Its AUM de-grew by 17% YoY. NII declined 10% YoY and ultimately this Impacted the bottom line, which was negatively impacted by 22% YoY. Between FY15-FY19, growth moderated and in last two financial years, FY20 and FY21, the growth picked up sharply due to the reasons mentioned above. Over the last decade, the AUM grew at a CAGR of 12.7% and we believe this growth will sustain and the company to post a growth of 13.3% in AUM between FY21-FY24E. We estimate NII and NPAT to grow at a CAGR of 12.7% and 12.6% respectively, between FY21-FY24E.

Profitability is Among the Best in the Sector, and Muthoot is likely to Continue

to Grow

The company's earnings profile has always been strong, and it has increased

even more in recent fiscal years, outperforming NBFCs and banks. The consolidated

Return on Managed Assets (RoMA) for FY21 and 9MFY22 was 6.1% and 5.7% (annualised),

respectively, which is higher than practically other lending companies in India.

The company's capacity to earn high interest margins while keeping operating

expenditures and provisioning requirements low is the main reason for its outstanding

profitability. Increased focus on collection and revisions in interest rates on

various schemes have helped maintain margins over the last 2-3 fiscal years. Except

for a one-time deviation in the fourth quarter of FY18, when NPAs rose due to a

shift in NPA recognition standards from account-wise to borrower-wise, asset quality

has remained under control.

Due to the overhang of pandemic-related issues, Stage III assets, which had previously remained below 3% on a steady-state basis, climbed to 3.8% as of December, 2021. However, because of the minimal asset-side risk, ultimate credit costs in the gold finance business have remained within 1%. Despite slight increase in non-gold credit losses owing to Covid-19 related interruption in FY21 and 9MFY22, consolidated profitability has remained stable. Asset quality and profitability of the non-gold businesses will remain monitorable as the organisation diversifies into other divisions in the long run.

Decent PAT Performance in Q3FY22

Profit in gold finance is less affected by changes in spreads owing to yields/cost

of funds as compared to home or auto finance. This increases the appeal of this

firm, particularly in interest-rate-volatile scenarios. In Q3FY22, PAT increased

by 3.5% QoQ to Rs. 1,030 crores, despite a 1% reduction in AUM growth. The annualised

yield on AUM was 20.7% in Q2FY22, which was the same as in Q2FY21. Annualised NIMs

increased to 13.7% in Q3FY22 from 13.5% in Q2FY22 due to flat yields and decreased

cost of funding during the quarter.

The cost to income/Opex to AUM ratio remained unchanged in Q3FY22, at 23.6%/ 3.3% (annualised) from 23.7%/ 3.3% in Q2FY22. Although credit costs increased by 20% QoQ, it remained relatively modest as a percentage of AUM, at 0.65% against 0.55% in Q2FY22. This is attributed to a 3.82% increase in GS-3 from 1.85%. As a result, standalone RoA/RoE in Q3FY22 was 6.1%/24.4%, compared to 6.0%/25.0% in Q2FY22.

Risks & Concerns

Gold Prices – A sudden and sustained decline in gold prices and adverse changes in regulations related to lending rates for gold loan NBFCs could impact the business.

Concentration – South India accounts for more than half of MFL's gold loan portfolio as well as its branches. Any negative developments in the larger southern states put the business in risk from a social and political standpoint.

Competition – Increasing competition from other banks, NBFCs, and fintech companies entering in the gold loan segment is a concern. The higher competition could drive gradual yield reduction in medium term.

Outlook & valuation

We believe the company, as the market leader in gold loans, is well-positioned to profit from strong momentum in the sector. On the strength of its Pan-India network, trust, and strong client base, we expect Muthoot to grow its loan book in line with the industry. Muthoot's strong brand value, experienced promoters and senior management team, and effective internal controls and audit systems are expected to help the company flourish in the future. The company is currently trading at 2.04x of P/ABV for FY24E.

Financial Statement

Profit & Loss statement

| Particulars (Rs. in Crores) | FY20 | FY21 | FY22E | FY23E | FY24E |

|---|---|---|---|---|---|

| Interest Income | 8564.40 | 10328.53 | 11318.18 | 12661.43 | 14522.55 |

| Interest Expenses | 2790.94 | 3692.44 | 3913.99 | 4364.10 | 5018.71 |

| Net Interest Income (NII) | 5773.46 | 6636.09 | 7404.20 | 8297.33 | 9503.84 |

| Other Income | 158.39 | 245.83 | 147.50 | 162.25 | 178.47 |

| Total Income | 5931.85 | 6881.92 | 7551.69 | 8459.58 | 9682.31 |

| Operating Expense | 1778.71 | 1780.43 | 1835.00 | 2110.25 | 2363.48 |

| Pre-Provisioning Operating Profit (PPOP) | 4153.14 | 5101.49 | 5716.69 | 6349.33 | 7318.83 |

| Provisions | 95.73 | 94.98 | 252.67 | 161.09 | 184.68 |

| Profit Before Tax | 4057.41 | 5006.51 | 5464.03 | 6188.24 | 7134.15 |

| Tax Expenses | 1039.11 | 1284.34 | 1393.33 | 1578.00 | 1819.21 |

| Profit After Tax | 3018.30 | 3722.18 | 4070.70 | 4610.24 | 5314.94 |

| Earnings Per Share (Rs.) | 75.31 | 92.79 | 101.43 | 114.87 | 132.43 |

Balance Sheet

| As of March (Rs. in Crores) | FY20 | FY21 | FY22E | FY23E | FY24E |

|---|---|---|---|---|---|

| Share Capital | 401.04 | 401.20 | 401.35 | 401.35 | 401.35 |

| Share Warrants & Outstandings | 13.23 | 10.50 | 10.50 | 10.50 | 10.50 |

| Total Reserves | 11157.55 | 14827.20 | 18141.98 | 21842.13 | 26070.79 |

| Net Worth | 11571.81 | 15238.89 | 18553.83 | 22253.98 | 26482.64 |

| Borrowings | 37130.05 | 45946.28 | 47694.49 | 52667.93 | 58329.47 |

| Other Liabilities | 1757.79 | 2251.11 | 2332.95 | 2344.26 | 2394.25 |

| Total Liabilities | 50459.65 | 63436.28 | 68581.27 | 77266.17 | 87206.36 |

| Loans | 42604.84 | 54064.06 | 56147.99 | 64437.06 | 73872.96 |

| Investments | 1031.64 | 1067.19 | 1217.19 | 1397.19 | 1587.19 |

| Net Fixed Assets | 227.78 | 246.94 | 265.42 | 293.90 | 313.90 |

| Other Assets | 6595.39 | 8058.09 | 12086.04 | 13355.85 | 14933.76 |

| Total Assets | 50459.65 | 63436.28 | 69716.64 | 79484.00 | 90707.81 |

Key Ratios

| Particulars | FY20 | FY21 | FY22E | FY23E | FY24E |

|---|---|---|---|---|---|

| Earnings Per Share (Rs.) | 75.31 | 92.79 | 101.43 | 114.87 | 132.43 |

| Price/Earnings | 17.73 | 14.39 | 13.16 | 11.62 | 10.08 |

| Book Value (BV) (Rs) | 288.33 | 379.70 | 462.29 | 554.49 | 659.85 |

| Price / BV | 4.63 | 3.52 | 2.89 | 2.41 | 2.02 |

| Adjusted Book Value (Rs.) | 285.94 | 377.33 | 456.00 | 550.47 | 655.25 |

| Price / ABV | 4.67 | 3.54 | 2.93 | 2.43 | 2.04 |

| Avg. Yield on Loans | 22.09% | 21.37% | 20.50% | 21.00% | 21.00% |

| Spreads on Loans | 9.77% | 8.81% | 8.63% | 9.24% | 9.25% |

| NIIM (%) | 14.85% | 13.69% | 13.45% | 13.95% | 13.95% |

| ROA (%) | 5.98% | 5.87% | 5.84% | 5.80% | 5.86% |

| Cost to Income Ratio (%) | 29.99% | 25.87% | 24.30% | 24.95% | 24.41% |

| Debt/Equity (x) | 3.21 | 3.02 | 2.57 | 2.37 | 2.20 |

| GNPA (%) | 2.10 | 0.90 | 2.40 | 1.90 | 1.80 |