Multi Commodity Exchange Of India Ltd

Finance - Exchange

Stock Info

Shareholding Pattern

Price performance

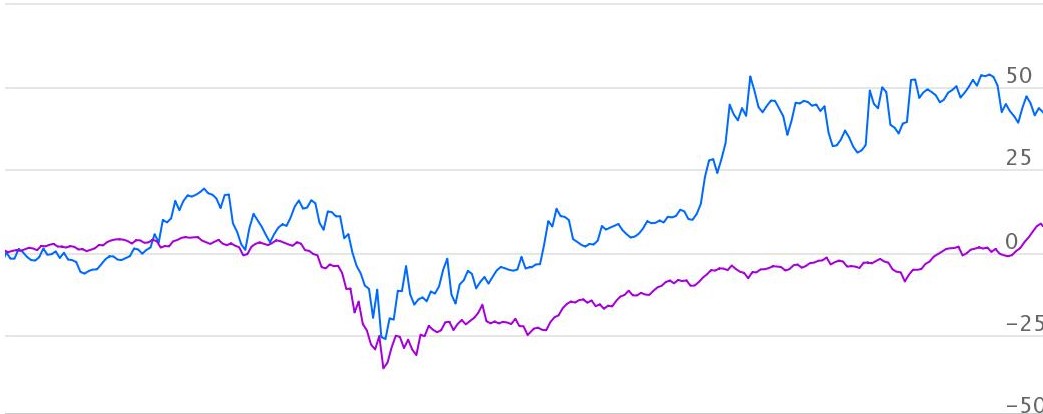

Indexed Stock Performance

Muhurat pick

Profile

Multi Commodity Exchange of India Limited (MCX) is India’s first listed, national-level,

electronic exchange. It is also the first exchange to introduce commodity options

in India. In the financial year 2019-20, the market share of MCX was at a record

high of 94.01%

Investment Rationale

- High Operating Leverage Business Model

Multi Commodity Exchange of India (MCX) reported robust operating performance in Q2FY21 led by EBITDA margin expansion driven by the high operating leverage inherent in the business model. In Q2FY21, MCX’s total commodity futures turnover and revenues grew 12% YoY, but operating cost increased by only 2% YoY. - Market Leadership with Monopolistic position in multiple commodities

MCX was able to enhance its market share to over 95% in the commodity derivatives market. This was despite the launch of commodity derivatives by both BSE and NSE. - Robust volume growth to be driven by bullion

MCX added five more locations to the list of additional delivery centres for gold and gold mini contracts this is aimed at enabling lakhs of jewellers, big and small, to conveniently take physical deliveries of gold through exchange mechanism from their nearest locations. - Introduction of New products and increasing institutional participation

MCX recently launched cash settled index products – ICOMDEX Bullion and ICOMDEX Base. Along with newer products MCX is witnessing increased participation from mutual funds, portfolio managers and AIFs.

Outlook & Valuation

We believe that continued price volatility will lead to strong growth in volumes

and we expect higher volumes in the gold segment to continue amid prevailing global

uncertainty. We are bullish on MCX given undisputed leadership position, healthy

growth in ADTO and launch of new products. Future growth levers includes gradual

traction in option trading and charging of newly launched products with increased

institutional participation. MCX is currently trading at 30x FY22 E earnings.