Laurus Labs Ltd

Pharmaceuticals & Drugs - API

Laurus Labs Ltd

Pharmaceuticals & Drugs - API

Stock Info

Shareholding Pattern

Price performance

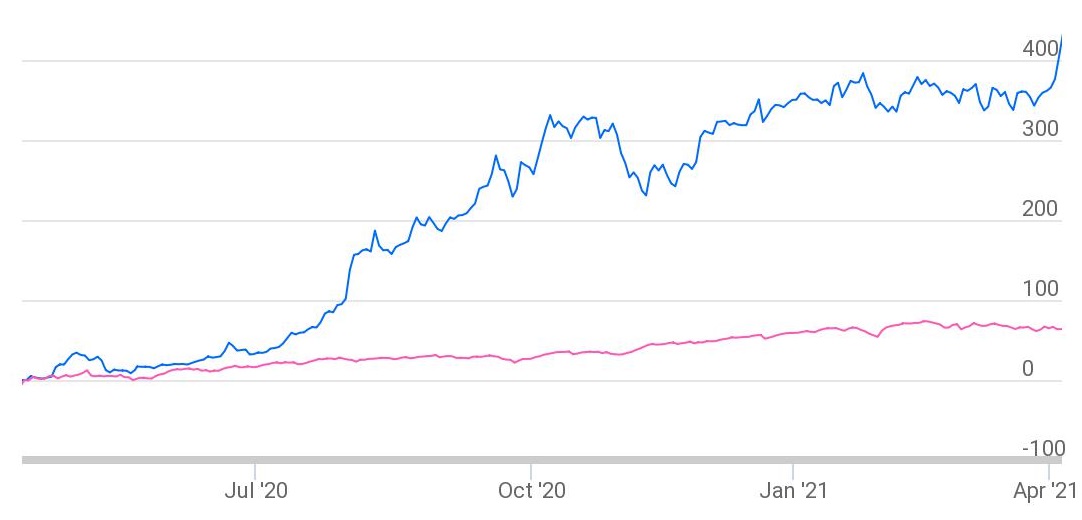

Indexed Stock Performance

Formulations business - a key driver for growth

Profile:

Laurus Labs (Laurus) is a Hyderabad-based leading research and development driven

pharmaceutical company, with a leadership position in generic active pharmaceutical

ingredients (APIs) for select, high-growth therapeutic areas of anti-retrovirals

(ARVs). The company also manufactures APIs in oncology and other therapeutic areas.

Its strategic and early investments in R&D and manufacturing infrastructure

enabled it to be one of the leading suppliers of APIs in the ARV therapeutic area

to multinational pharmaceutical formulation companies, which cater to the large

and fast-growing 'donor-funded access-to-medicines markets' of Sub-Saharan

Africa, South-East Asia and Latin America. Laurus also has growing Synthesis and

Nutraceutical/Cosmeceutical ingredients businesses. Further, it is increasingly

focused on growing its integrated generics finished dosage forms (FDFs) business,

in which it has made significant investments. Laurus operates in four business lines:

Generics - APIs, Generics - FDFs, Synthesis and Ingredients.

The company’s Generics-API business comprises the development, manufacture and sale of APIs and advanced intermediates. Generics-FDF business comprises the development and manufacture of oral solid formulations, while its Synthesis business includes contract development and manufacturing services for global pharmaceutical companies. Laurus’ Ingredients business comprises the manufacture and sale of specialty ingredients for use in Nutraceutical and Cosmeceutical sectors.

Source: Company, Stockaxis Research

Larger share in the tender-driven HIV market: The Company’s drug ‘TLD’ is the most prescribed drug for HIV in low and middle income Countries (LMIC) region. This was instrumental in growing the company’s finished dosages formulations revenues from a mere 2% in FY19 to 29% in FY20. While the business of TLD is likely to sustain over the next couple of years, the recent approval of the company’s drugs TLE400 and TLE600 further enhances its scope to get a better pie in the tender-driven HIV market. We expect double-digit revenue growth from the tender-based ARV formulations.

Key abbreviations:

- TLD: Combination of Tenofovir/Lamivudine/Dolutegravir (300/300/50mg)

- TLE400: Combination of Tenofovir/ Lamivudine/ Efavirenz – (300/300/400mg)

- TLE600: Combination of Tenofovir/ Lamivudine/ Efavirenz – (300/300/600mg)

Leadership in ARV APIs:

Laurus is present in most of the preferred regimens for the treatment of HIV. Its

ARV portfolio consists of ~12 APIs out of ~ 30 molecules in the market to treat

HIV patients. Having established a solid presence in first-line treatment regimen

like Efavirenz (EFV), Tenofovir disoproxil fumarate (TDF), Emtricitabine (FTC) and

Dolutegravir (DTG), it has recently enhanced capacities in Lamivudine (3TC) and

has secured DMF filings for newer regimens like Lopinavir (LPV), Ritonavir (/r)

and Tenofovir alafenamide fumarate (TAF), which are preferred molecules for second-line

treatments. While maintaining leadership in first-line treatment drugs, Laurus has

swiftly moved up to second-line treatments (Lopinavir, Ritonavir & Darunavir)

of HIV-AIDS patients and progressing towards third-line treatments. It has set up

a large capacity for two first-line products – Lamivudine & Dolutegravir.

API business will continue to post steady growth:

Most Pharma companies in India source about 70% of the raw material for manufacture

of APIs from China. While pharma companies are struggling with scarcity of raw material

due to geo-political tensions with China, Laurus is in a comfortable position since

it manufactures raw material for its formulations. As a result, it posted good growth

in FY20 in its FDF business.

The global Covid-19 pandemic has resulted in Laurus receiving enquiries for some of its key APIs from overseas customers. This is the result of pharma companies across the globe looking for sustainable supply chain management. Laurus is well-positioned to become a key supplier of APIs world-wide.

New capacities to fuel growth in formulations business:

Laurus labs has done capex of Rs. 4.2 billion towards commissioning of the new FDF

facility at Vishakhapatnam, currently it has capacity of 5 billion tablets per year.

The company is also tapping emerging markets by participating in tenders. Laurus

has leveraged its API chemistry skills, forward-integrating into formulations. Company

has planned further brownfield expansion for its formulations business, company

is going to incur additional capex in the range Rs.300-400 crores to expand its

current capacity of 5 billion tablet per year to 9 billion tablets per year. The

capex is expected to be completed in next 15-18 months. We believe newer capacities

will enhance its formulations business.

Technical

Price: LAURUS LAB has taken support from its previous swing low and closed in green zone. The stock has seen supportive volume formation on daily charts. The stock has been in consolidation range before the breakout. The stock is in uptrend and making higher tops and higher bottom formation on weekly charts. The historical price action in the stock reflects that any meaningful dip in the stock attract market participants. The stock has seen its profit booking from high of Rs.380 – Rs.385.85 levels, which has placed the stock near its support of Rs. 330 – Rs.335 levels. The stock has bounced from the support level with increased in volume which indicates the strength in the counter.

Indicator: The stock is trading above key moving average 21SMA & 50SMA on daily chart. The RSI 14 on daily chart is pegged at 74.58 trading with higher lows on daily chart; positive crossover with signal line on daily chart shows the strength in the counter. The Parabolic SAR on daily chart is trading below the price, indicating upward momentum is likely to continue in the stock. The MACD is also in buy mode on daily charts indicating bullish bias. ADX is trading at 40.49 that is well above 40, which shows overall strength & sustained buying from the current levels can continue. We expect the stock to outperform in near term.

Volume: Price and volume analysis plays an important part in determining overall strength or weakness in the stock. Price and volume pattern are moving in the same direction which reflects the true movements in the stock.

Conclusion: Considering all the above data facts, we recommend buying for short to medium term. Investors may go long on the stock around Rs.419 levels keeping a stop loss below Rs.370 for target of Rs.510 level.