Kajaria Ceramics Ltd

Ceramics / Marble / Granite / Sanitaryware

Kajaria Ceramics Ltd

Ceramics / Marble / Granite / Sanitaryware

Stock Info

Shareholding Pattern

Price performance

Indexed Stock Performance

India’s Largest Ceramic/Vitrified Tiles Manufacturer and the 8th Largest in the World

Company Profile

Incorporated in the year 1985, Kajaria Ceramics Ltd. (Kajaria) is India’s

largest ceramic/vitrified tiles manufacturer and the 8th largest

in the world. It started production in the year 1988, with an annual capacity of

1 million sq. meters (MSM) per annum, today, Kajaria has the annual capacity of

70.4 MSM, distributed across its eight plants located across Uttar Pradesh, Rajasthan,

Andhra Pradesh, and Gujarat.

Apart from tiles, KCL's step-down subsidiary Kajaria Bathware Pvt. Ltd. operates a sanitaryware plant in Morbi, Gujarat, and a faucet manufacturing facility in Gailpur, Rajasthan. The sanitaryware plant has a capacity of 7.5 lakh pieces, while the faucet plant has a capacity of 1 million pieces. Further, it has also entered the plywood business through Kajaria Plywood. It showcases its tiles pan-India, through its extensive network of 1,500 dealers, providing customers with the widest choice in tiles.

Investment Rationale

Market Leadership Position

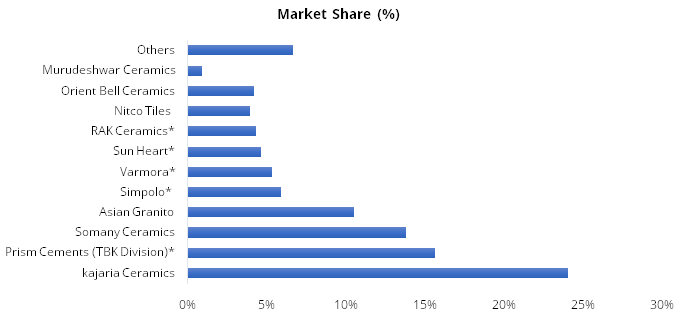

Kajaria is India’s largest ceramic tiles manufacturer and commands a market

share of ~25% in the organised market and 10% of the total market. Its total market

share has doubled over the past decade and had registered the volume growth of ~12%

CAGR vs. the industry’s ~5% CAGR. Manufacturing presence across regions, strong

distribution network, and large and premium portfolio has aided Kajaria in achieving

industry leadership position and most respected tile brand in India. Further, we

believe constant innovation and strategy to differentiate products in terms of design,

pattern and size could help Kajaria to sustain and increase its market share further.

Below chart shows market share of national brands as of March’20. National

brands contribute 45% of the industry and balance of the industry is represented

by other regional brands/unbranded players present in Morbi/Himmatnagar in Gujarat.

*Estimated

Source: Investor Presentation; StockAxis Research

Wide, Pan-India Distribution Network and Strong Brand Presence

Kajaria has strong distribution network spread across India. The company has grown

its distribution network from 900 in FY14 to 1,500 currently, a growth of ~67%.

Despite the headwinds faced by the ceramic tile industry as a result of sluggish

residential real estate activity, Kajaria's revenues were driven by pent-up

retail demand from tier II and III cities where the company had previously expanded

its distribution presence.

Over the last five years (From FY15), the company has accelerated its advertisement and sales promotion expenses. As of FY20, these expense as a % of sales were 3.19% (highest in FY18 of 3.88%). The continuous spending on sales promotion and advertisement had aided the company to create strong brand recall and position itself as a premium brand in the tiles segment, which in turn, has resulted into industry-leading volumes in the past few years. Over 2014-2019, the industry volume has grown at a CAGR of only a per cent, while Kajaraia has been able to post CAGR of ~7% during the same period.

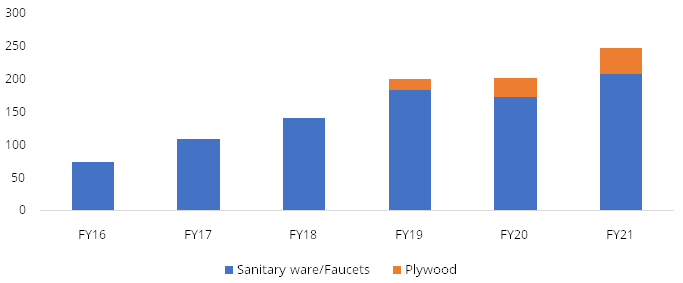

Diversification – Bathware and Plywood

To complete the entire basket of bathroom products, Kajaria expanded its horizons

from tiles into sanitaryware and faucets. Kajaria Bathware is a subsidiary of Kajaria

Ceramics, with 85% stake and remaining 15% stake owned by Aravali Investment Holdings,

Mauritius, a wholly-owned subsidiary of WestBridge Crossover Fund, LLC. The Company

commissioned a 7-lakh piece per annum facility at Morbi, in August 2014; its 1 million

pieces faucet facility at Gailpur (Rajasthan) commenced commercial production in

July 2015. In FY20, it expanded the sanitaryware capacity to 7.50-lakh piece per

annum. It offers premium range of products under the brand name “Kerovit.”

On account of Kajaria’s robust, pan-India distribution network and marketing,

sanitaryware/faucets segment has been able to grow at a faster pace. Further, in

FY19, the company entered plywood business through Kajaria Plywood (a subsidary)

and sells the outsourced products under the brand name KajariaPLY, thereby capitalising

on its brand. Though plywood division is currently small, going forward, Kajaria

expects strong market penetration.

Source: AxeEquity; StockAxis Research

Large Scale Operations with Diversified Customer Base

Kajaria has experienced consistent revenue growth over the years, owing to its established

position in the Indian tile industry and strong brand recognition. As a result,

the company's operations have grown to a sizeable scale, with revenues of Rs.

2,808 crores in FY20. Furthermore, Kajaria has a well-diversified customer base

with established presence in both retail and institutional segments, with retail

accounting for ~90% of revenues. Stronger retail demand and penetration in tier

II and III markets supported a sharp rebound in the company's sales during Q2FY21,

despite the pandemic-induced lockdown having a negative impact on sales in Q4FY20

and Q1FY21.

Shift Form Unorganized to Organized

Regulatory developments such as ban by NGT on all industrial units that run on captive

coal gasifier plants in Morbi region and stricter implementation of GST/e-way bill

has resulted into higher compliance costs for unorganized players. Further, the

issue of labour unavailability and liquidity challenges faced by many small players

have resulted in consolidation and augur well for the market position of organised

players. The management believes that in FY22E, the company is likely to witness

a volume growth of 20%-25% followed by ~15% volume CAGR from FY23 – FY24 on

the back of continued demand from Tier – I, II, and III cities.

Buoyancy in Exports to Keep Domestic Tiles Market Robust

India is the second-largest tile manufacturer, after China. Amid Covid-19 pandemic,

there is anti-China sentiment across major countries which has given a boost to

Indian exports. Various anti-dumping duties levied on Chinese tiles by some European

and American counties have shifted the demand to India and due to which Morbi region

is witnessing the strength in exports. The recovery in sales from Morbi region works

favourably for big and organised companies such as Kajaria due to comparatively

lower competitive pressure in domestic market from Morbi region. The Indian exports

are expected to grow double-digit despite anti-dumping duty by GCC on Indian imports

as anti-China sentiment as well as global pent-up demand is likely to offset the

impact.

Outlook and Valuation

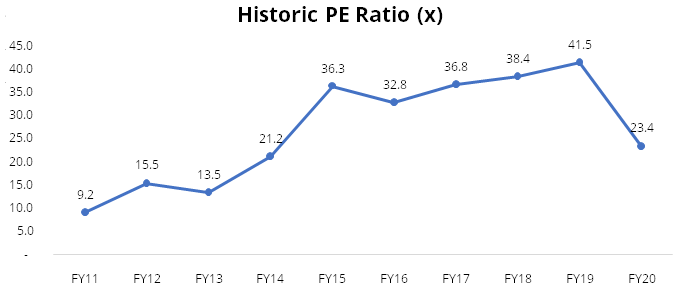

Kajaria is India’s largest ceramic/vitrified tiles manufacturer and the 8th largest in the world. Kajaria is expected to benefit improving demand in the housing sector. Further, increase in exports could also benefit big and organized player like kajaria on the back of lower competitive pressure in domestic market from Morbi region. Kajaria has consistently generated FCF since FY16, owing to a healthy margin, strict management of working capital, and low capex. The management of the company expects to gain market share by achieving 20% - 25% volume growth in the tiles segment in FY22 and ~15% volume CAGR from FY23 – FY24 on the back of continued demand. At the current market price of Rs 951, the stock is trading at 33.9x of FY23E earnings estimates.

Technical

Price: KAJARIA CERAMICS is consolidating above all its important moving averages, 21SMA & 50SMA on daily and weekly charts. We expect the stock to continue its outperformance in the coming weeks. The stock was trading in range as show on daily chart, before the stock break out from this range on higher side. The stock has bounced from the support level with increase in volumes which indicates the strength in the counter. The stock is making higher low on daily chart, which is giving bullish stance. The Parabolic SAR (Stop & Reverse) on daily chart is also below the trading price, suggesting northward momentum is likely to remain intact in the counter.

Indicator: The stock is trading above key moving averages (21SMA & 50SMA) on daily chart, which indicates bullishness for this stock. The RSI on daily chart is pegged at 70.90, indicating the stock has not been overbought. Bollinger Band (20, 2, S) set up on daily chart has started to expand and currently the stock is kissing the upper band of Bollinger Band indicating the volatility expansion on the higher side. MACD line on daily charts is in buy mode, indicating bullish momentum is likely to continue which supports to our bullish view on the stock. The DMI+ on weekly chart, is also pointing in northward direction and is currently placed around 33.07 levels, whereas ADX trading at 46.69 well above 40 mark, which shows overall strength is likely to bring in sustained buying from the current levels.

Volume: Price and volume analysis plays an important part in determining overall strength or weakness in the stock. Price and volume pattern are moving in the same direction which reflects bullishness in the stock. KAJARIA CERAMICS has seen volume buildup, which shows the movement of this stock is on bull side.

Conclusion: Considering all the above data facts, we recommend buying for short to medium term. Investor may go long around current level Rs.951 with stop loss Rs. 847 & target of Rs.1220.