Kajaria Ceramics Ltd

Ceramics / Marble / Granite / Sanitaryware

Stock Info

Shareholding Pattern

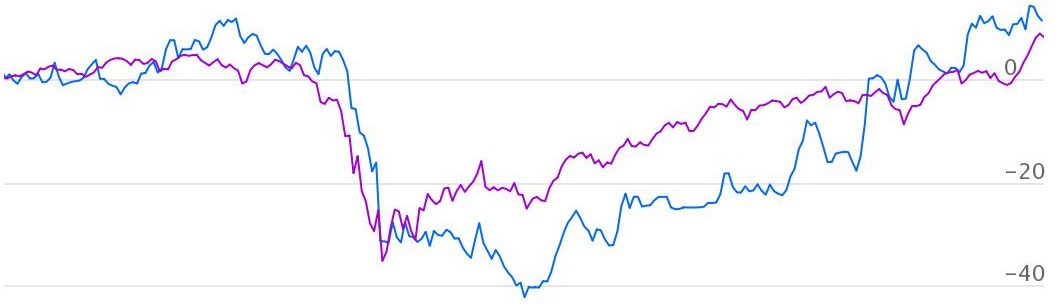

Price performance

Indexed Stock Performance

Muhurat pick

Profile:

Kajaria Ceramics is the largest manufacturer of ceramic/vitrified tiles in India

and the 9th largest in the world. It has present annual capacity of 70.40 mn. sq.

meters presently, distributed across eight plants - one in Sikandrabad in Uttar

Pradesh, one in Gailpur and one in Malootana in Rajasthan, three in Morbi in Gujarat

and one in Vijayawada and one in SriKalahasti in Andhra Pradesh.

Investment Rationale

Market Leader & strong brand recall - Kajaria ceramic ltd has highest market

share in Indian tiles industry - ~25% of the organized segment & ~10% of the

total market. Constant innovation and strategy to differentiate its products in

terms of design, pattern and size have helped Kajaria to increase its market share.

The company has been able to create strong brand recall through massive advertising

on airports, social media, newspapers and magazines as well.

Strong distribution network - Kajaria ceramic has ~1500 strong dealer network, which helps it to have a deep penetration across India. Over the years, Kajaria has invested in various joint ventures and set up manufacturing units at different locations, which has helped it to strengthen its distribution channel and improve the geographic reach of the company.

Shift form unorganized to organized - Regulatory actions like ban by NGT on all industrial units that run on coal gasifiers in Morbi & Wankaner in Gujarat & stricter implementation of GST/e-way bill will increase compliance costs for unorganized players thereby giving a boost to branded and organized players.

Outlook & Valuation

We remain positive on Kajaria ceramic due to strong recovery in housing sector,

stable pricing, robust distribution network, continuous investment in branding,

shift from unorganised to organised sector & strong balance sheet. Currently

kajaria ceramic trades at 28.75x on the basis of FY22E earnings.